sankai/E+ via Getty Images

Bicycle Therapeutics (NASDAQ:BCYC) has been on my radar since it was IPO’d back in 2019, but I always found a way to not pay it much attention… until recently. The company reported interim data from their lead cancer program, BT8009. The preliminary data indicates BT8009 is effective against solid tumors, however, it looks as if the data might have created some doubt that BT8009 is not as compelling as expected. The market has turned on BCYC, and the ticker has become a “Falling Knife”. I am considering an attempt to “catch the falling knife” for a quick trade and keep a small “house money” position for a potential long-term investment in anticipation the company will get a pipeline program across the finish line.

I intend to provide a brief background on the company and their platform tech. In addition, I take a look at the recent data and will point out why I think the market has turned on BCYC. Finally, I explain what a “Falling Knife” is and what I look for in these trades.

Background On BCYC

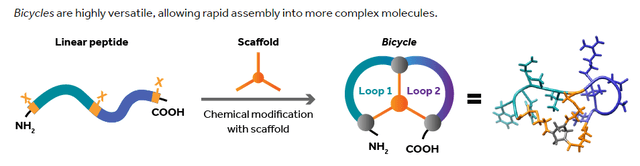

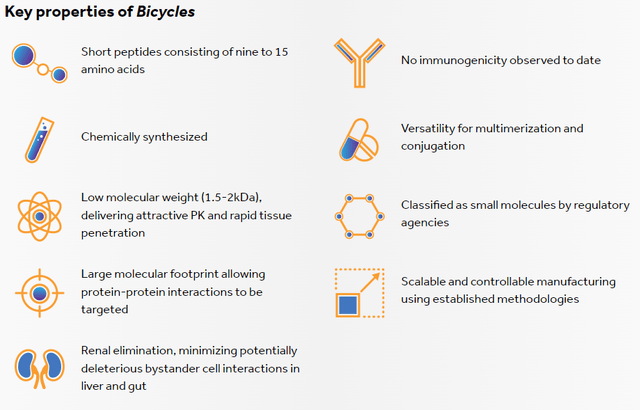

Bicycle Therapeutics is a clinical-stage biotech company attempting to transform how we treat cancer. The company’s technology is bicyclic peptide technology that they have branded as a “bicycle.” The company’s Bicycles are synthetic short peptides that are formed into two loops with the use of a “scaffold”, which stabilizes their structure.

Bicycle Structure (Bicycle Therapeutics)

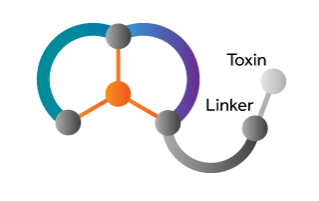

The Company’s Bicycle Toxin Conjugates “BTC” deliver a small molecule payload into the tumor microenvironment with limited spillage to healthy tissues.

Bicycle Toxin Conjugate (Bicycle Therapeutics)

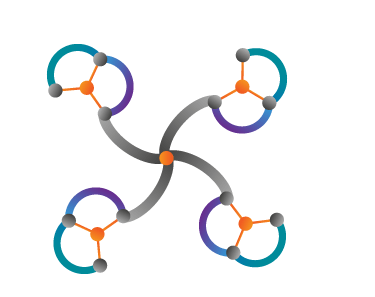

Furthermore, Bicycles can be combined to create more complex molecules to allow them to bind to two or more protein targets.

Tetramer Molecule (4 Bicycles) (Bicycle Therapeutics)

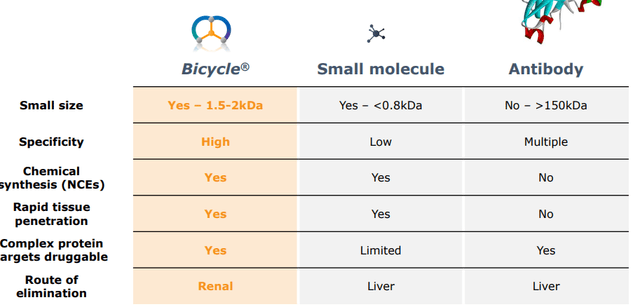

These Bicycles are unique and characterize a new category that chains the therapeutic benefits of a biologic but with the manufacturing and pharmacokinetic advantages of a small molecule. It is professed that the Bicycle’s small size and tumor targeting abilities will allow rapid tumor infiltration and retention, yet, they will reduce exposure of healthy tissues. Essentially, Bicycles are expected to create potent efficacy while abating unwanted effects compared to small molecules and antibodies.

Bicycle vs. Small Molecules and Antibodies (Bicycle Therapeutics)

Bicycle vs. Small Molecules and Antibodies

This method is envisioned to be superior to antibody-drug conjugates “ADCs”, which are potent but are often incredibly toxic.

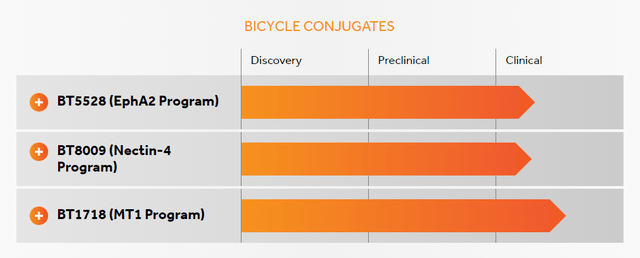

Bicycle Therapeutics BTC Programs (Bicycle Therapeutics)

The company’s BTC candidates in the clinical stage are BT5528, which is a second-gen BTC targetingEphA2 and is in a Phase I/II clinical trial as a monotherapy and in combination with Bristol-Myers Squibb’s (BMY) Opdivo (nivolumab). BT8009 is a second-gen BTC targeting Nectin-4 that is in a Phase I/II clinical trial. BT1718 is in a Phase I/IIa trial targeting tumors MT1-MMP.

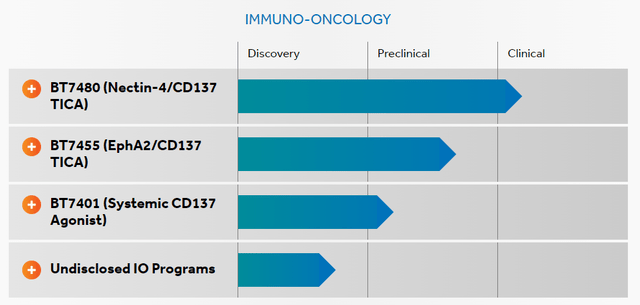

The company also has their bicycle-based systemic immune cell agonists and bicycle tumor-targeted immune cell agonists “TICAs”, to elicit NK and T-cell responses.

Bicycle Therapeutics immuno-oncology programs (Bicycle Therapeutics)

At this point, the company’s TICA programs are in the IND-enabling stage. BT7480 is a Nectin-4/CD137 TICA bicycle; BT7455 is an EphA2/CD137 TICA bicycle; and, BT7401 is a multivalent CD137 bicycle-based systemic immune cell agonist. The company also has undisclosed immuno-oncology programs.

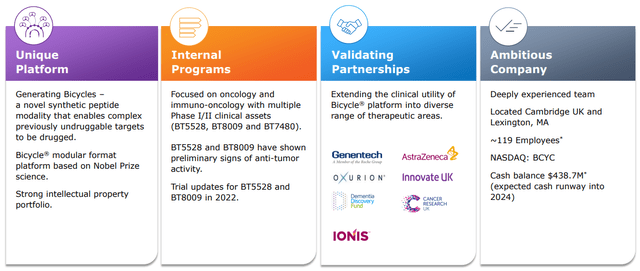

Bicycle has strategic partnerships that can deliver substantial revenue in the coming years. The Roche (OTCQX:RHHBY) partnership was signed back in February of 2020. Roche paid Bicycle Therapeutics $30M upfront with the total earning potential to be around $1.7B. In addition, Roche is adding a secondary product development deal, which paid Bicycle an additional $10M upfront payment. The company also has a partnership with Ionis Pharmaceuticals (IONS) to develop targeted oligonucleotide therapeutics. Ionis paid Bicycle a $45M upfront and $11M in equity. Bicycle is also collaborating with AstraZeneca (AZN) for inhaled bicycles for respiratory indications and anti-infectives with Innovate.

BT8009 Data

BT8009 is one of Bicycle’s BTCs that is being tested against solid tumor cancers. The company believes that it can be a groundbreaking treatment that has a high affinity and selectivity for Nectin-4 on MDA-MB-468 cells. Nectin-4 is present across the cell surface of tumors allowing BT8009 to be a “hit and run” delivery of toxin to the tumors, while minimalizing toxic exposure to the system. BT8009 has shown very promising results in preclinical and phase I clinical trials. In head-to-head preclinical studies against Padcev (enfortumab vedotin), BT8009 displayed comparable or superior activity.

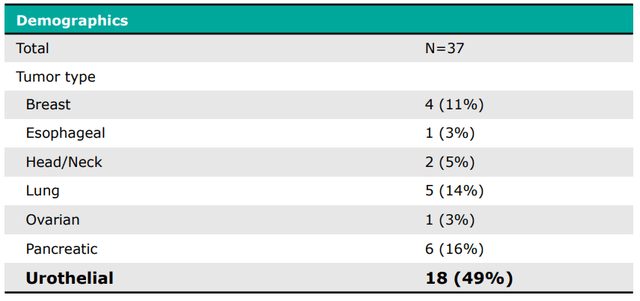

On April 11th, the company publicized interim data from their Phase I/II trial of BT8009, which was presented at the 2022 AACR annual meeting. This trial is testing BT8009 in a variety of tumor types in patients that had a median of 3 prior lines of therapy.

Study Patient Demographics (Bicycle Therapeutics)

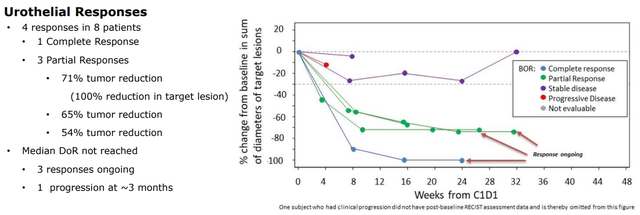

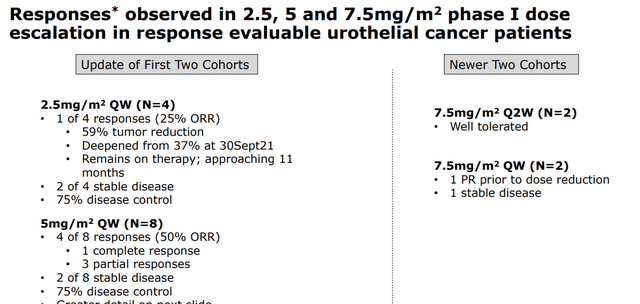

The data revealed a 50% confirmed ORR in the 5.0mg/m2 weekly cohort, with one complete response in eight urothelial cancer patients. The 2.5mg/m2 and 5.0mg/m2 weekly cohorts did not reach their median duration of response at the cutoff. However, the data they did report from these cohorts revealed that four out of five responders remain on therapy after at least 24 weeks

5.0mg/m2 Weekly Cohort Responses (Bicycle Therapeutics)

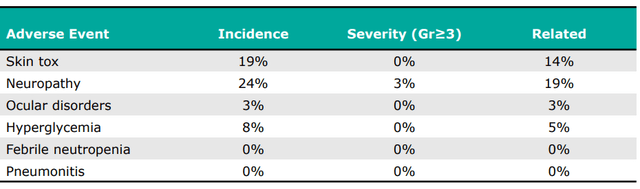

The company also reported that tolerability was maintained, with a low occurrence of skin, ocular, and neurological toxicities that demonstrates BT8009’s distinction from antibody products, including Padcev.

BT8009 Adverse Event Data (Bicycle Therapeutics)

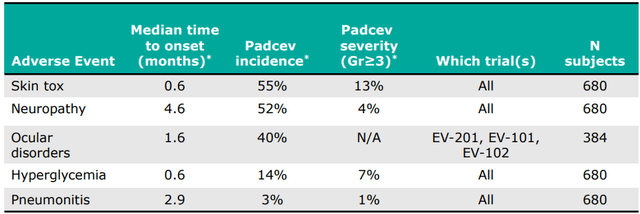

Looking at these figures, we can see that BT8009’s adverse event data is noticeably superior to Padcev’s data.

Comparable Padcev Adverse Event Data (Bicycle Therapeutics)

The 7.5mg/m2 weekly cohort revealed a non-tolerated dose, with dose-limiting toxicity that led to GI and fatigue being detected. The company is looking for alternative dosing frequencies to determine a recommended Phase II dose. It looks as if that is going to be around the 5mg/m2 dose, but the company anticipates to “provide further updates on clinical progress later in 2022.”

The market’s initial response to the data was positive, however, the stock experienced intense selling pressure in the subsequent trading days. Some have speculated that the dose-limiting toxicity in the newer 7.5mg/m2 cohorts was a concern because it revealed that BT8009 is not as mild as originally assumed.

Responses In Different Cohorts (Bicycle Therapeutics)

In fact, one analyst believes the company’s BTCs might not dislodge ADCs and might not have a path to accelerated approval. This might be true considering the company found that 7.5mg/m2 cohorts had some tolerability issues, which puts a ceiling on how much a patient can be dosed. Obviously, we would like to see higher tolerability to allow a doctor to up the dosage to elicit a stronger response. It appears that the possibility is now gone, so patients will be most likely limited to the 5.0mg/m2 dose. Although the data from the 5.0mg/m2 patients are encouraging, it is not knockout numbers that make it a shoo-in for approval and commercial success. I believe the narrative that Bicycle was bringing forth a new age of oncology treatments has been damaged and was the primary cause for the share price implosion.

A Bullish Take On The Data

Although the recent data has planted a seed of doubt about Bicycle’s platform, I believe investors should still have a bullish outlook for the company going forward. First of all, the BT8009 data was not a failure and the company is looking forward to declaring a Phase II dose. In fact, BT8009 still has to be fully explored in other tumors and in combination therapies, so the company is not going to throw the asset in the trash and neither should investors. There is also the possibility the company will pit BT8009 against Padcev, or perhaps run a study with patients who have already failed Padcev to show a potential superiority.

High Nectin-4 Expressing Tumor Types (Bicycle Therapeutics)

Beyond BT8009, the company has several additional programs that are in play, both wholly-owned and partnered that could deliver significant revenue if approved.

Bicycle Therapeutics Investment Highlights (Bicycle Therapeutics)

What is more, Bicycle currently has an impressive cash balance of roughly $438.7M, which is expected to fund the company into 2024. Considering the market cap is roughly $711.55M, we can say the market is almost completely discounting Bicycle’s potential to push its pipeline forward and possibly develop a blockbuster product that could have numerous benefits over the contemporary products.

Bicycle Properties and Advantage (Bicycle Therapeutics)

Accepting The Risks

Like all biopharma companies, Bicycle has numerous risks including regulatory and financial. As the company moves their programs deeper into development, they will have to run a larger study to cultivate stronger data to prove their programs are worthy of approval. Of course, these late-stage studies will be expensive to run, which could force the company to execute another round of funding, and ultimately dilute the shareholders. Again, these issues are not specific to Bicycle, however, they will be exasperated if the company will have to run an additional study for BT8009 or they fail to secure accelerated approval. Consequently, BCYC would be put into Compounding Healthcare’s speculative “Bio Boom” portfolio.

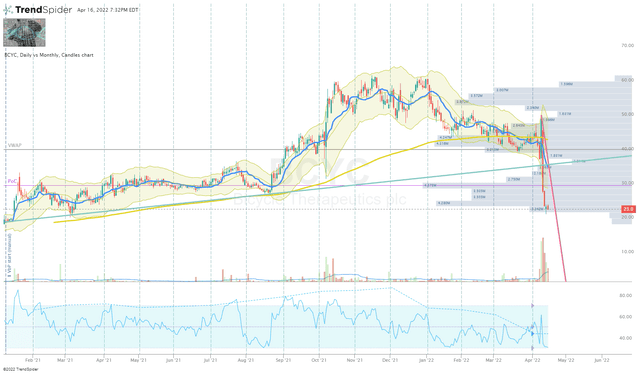

Falling Knife

The market’s response to the BT8009 data has turned BCYC into a “Falling Knife”. A falling knife is a trading slang term for a stock that has gone into a freefall drop in the share price. Many investors attempt to catch the falling knife at a “false support”, which is a brief period of support before making another leg lower. Identifying the difference between false support and true support can be tricky because a false support might occur at previous levels of support, which can lure investors into thinking the share price is ready to rapidly reverse. To prevent this mistake, traders often use the term in phrases like, “don’t try to catch a falling knife,” which is essentially a policy to wait for the share price to bottom out and base before clicking the buy button.

Personally, I rely on several technical tactics to help identify false support and not avoid catching the falling knife. Employing these tactics into your playbook can be difficult because it requires experience to become proficient at orchestrating them in a high-risk situation. If I had to whittle it down to one critical skill, it would be identifying a reversal pattern following “a dead cat bounce”. The lower-risk strategy would be waiting for the share price to base in the coming weeks and months in order to define a clear level of support and reveal a high probability reversal pattern. Of course, this runs the risk of missing out on a potential “whipsaw” or “V bottom reversal” and a missed opportunity. Another potentially useful strategy is to use a dollar-cost average “DCA” approach, where an investor accumulates a position over a long period of time through periodic Investments. This strategy all but guarantees the investor will get the best price. On the other hand, using DCA reduces the risk by not committing to going all-in at one specific price that might not be the bottom.

For Bicycle, I think I will likely use both of these strategies. I will attempt to find a potential reversal for a quick trade but will change my strategy to a DCA approach if I miss the mark on the reversal.

Bicycle Daily Chart (Trendpsider)

The goal of this potential position would be to generate some cash through a short-term position trade to generate a “house money” position that will be held for a long-term investment funded by the market.

Long term, I expect to maintain an undersized position until we get some clarity on the company’s pipeline programs and the success of their partner programs. If the company can get one of their wholly owned or partnered programs into a pivotal trial, I will look to start accumulating a sizable position in anticipation that the data will validate their platform, thus improving the company’s long-term outlook.

Be the first to comment