Tanarch

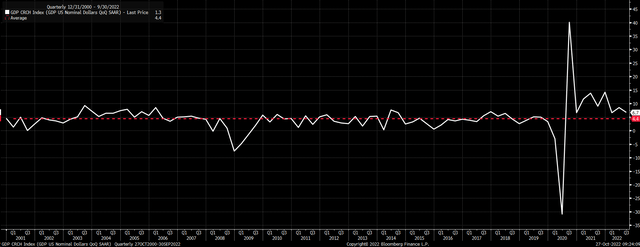

The US economy remains robust, with a 2.6% real GDP growth rate. The real GDP growth swung back to positive, as the GDP price index was lower than expected, coming in at 4.1%. However, it’s worth noting that nominal economic growth also has remained very healthy, with nominal GDP growing by 6.7% on a seasonal-adjusted annualized rate basis. That growth rate is still slightly faster than the first quarter’s nominal growth rate of 6.6%.

Tough to say at this point that the Fed has made much headway in pushing economic growth below trend. Yes, there’s a six- to nine-month lag for monetary policy changes to hit the economy. However, at this point, nominal GDP growth is rising at a rate higher than the historical average since 2001 of 4.4% nominal growth.

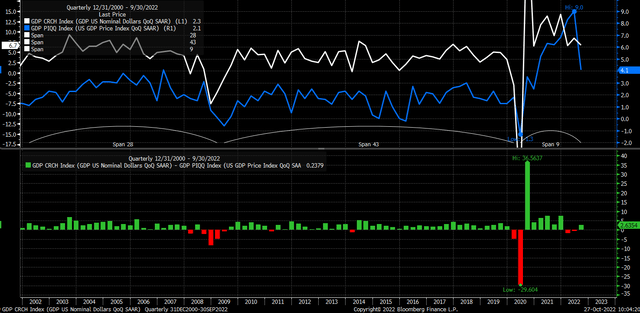

Prices Rise With Nominal Growth

The chart below shows that the GDP price index tends to rise during periods of rising nominal growth, and when the nominal growth falls, the GDP price index falls. Even though the price index fell in the third quarter, it’s likely to be revised, and that revision could be higher because it was so far below expectations of 5.3%. Additionally, nominal growth will need to continue to decline for that price index to fall.

The Fed will not be able to pivot or pause rate hikes anytime soon. A lot of nominal growth still needs to be removed from the economy, which will likely take higher interest rates.

Dollar Worries

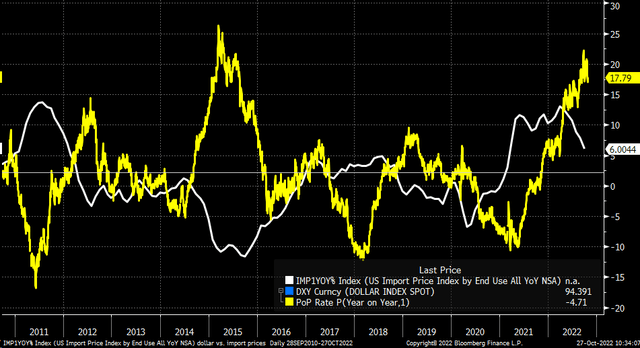

Additionally, the dollar is a significant factor here for the Fed as a strong dollar helps to lower costs not only vs. commodities but also imports. The dollar has strengthened materially against the yen, euro, and Chinese yuan. The yuan has devalued vs. the dollar materially just in the third quarter, rising from 6.71 to 7.23. The rising value is an indication of the devaluation of the Chinese currency.

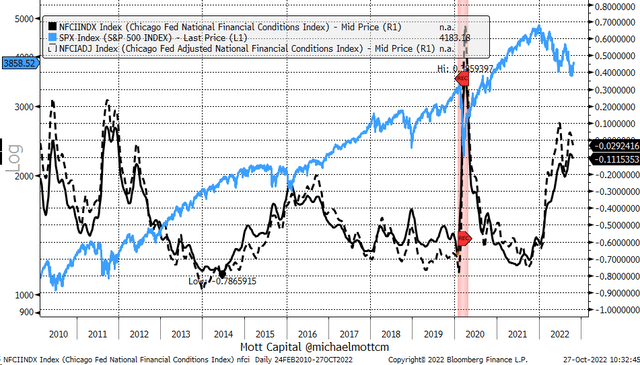

It seems likely that once the market believes the Fed will start backing off hikes or there is a pause coming, the dollar will move materially lower, helping to push commodity and import prices higher. It would not be helpful to the Fed.

A weaker dollar also would work to ease financial conditions, and easing financial conditions help to inflate asset prices. Rising asset prices, such as stocks, would once again create a wealth effect and would not be helpful to the Fed’s mission if it hopes to achieve its 2% target.

Tomorrow’s PCE

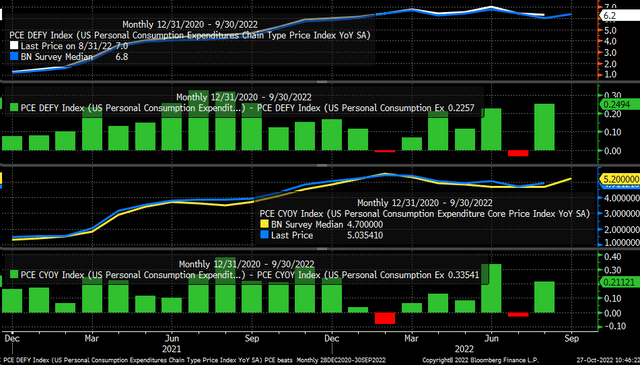

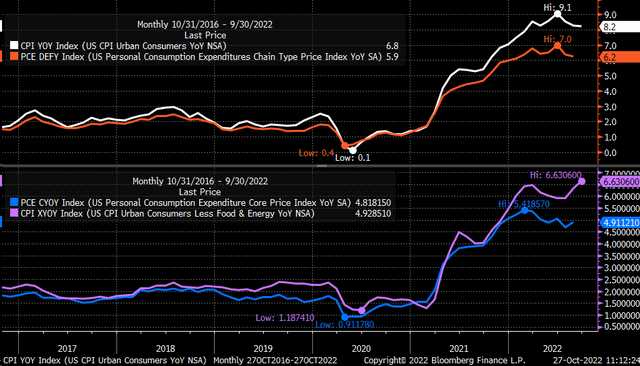

Of course, as more data comes, this could change, and tomorrow could be one such day. Tomorrow there will be a PCE inflation data point, which tends to be the Fed’s preferred measure of inflation. Estimates are for PCE to rise to 6.3% year-over-year vs. last month’s reading of 6.2%, and core PCE is expected to rise by 5.2% vs. last month’s reading of 4.9%.

However, it’s worth noting that PCE and CORE PCE have a history of coming in hotter than expected. In fact, since December 2020, PCE and Core PCE have come in hotter than anticipated 19 of the last 21 times.

Of course, this doesn’t mean that PCE and Core PCE have to come in hotter than expected, but it suggests that markets could grow worried about more rate hikes if it comes in hotter than expected. The biggest problem is that PCE would be rising, which would be a divergence from the CPI, which has been flattening out. A hotter-than-expected number could worry the Fed that its preferred inflation metric is trending in the wrong direction.

I know it’s easy to get wrapped up in articles that talk about the potential for the Fed and the future pace of rate hikes, and that could be a sign the Fed is thinking about pausing sometime soon. But the data doesn’t suggest the Fed is likely to change paths anytime soon.

It’s especially tough when the market runs higher and the fear of missing out takes over. But sometimes, being patient does pay off.

Be the first to comment