adaask

Both Realty Income (NYSE:O) and W. P. Carey (NYSE:WPC) are high yield triple net lease REITs with investment grade credit ratings. O has a superior track record while WPC is cheaper.

In this article, we will compare them side by side and offer our take on which one is a better buy right now.

Realty Income Vs. W. P. Carey: Business Model

Both businesses employ the triple net lease real estate model, meaning that they primarily own single tenant free-standing retail real estate. The business model has proven to be low risk, with stable performance and high occupancy rates through various economic cycles, including the Great Recession and the COVID-19 lockdowns. This is largely due to the fact that the tenant bears all responsibility for operating expenses, insurance, and property maintenance, the leases are lengthy in terms and have seniority on the balance sheet, and management teams at storied businesses like O and WPC generally do an excellent job of underwriting the properties.

O is the largest triple net lease REIT with a consistently growing portfolio of 11,733 properties that service 1,147 clients across 79 industries. On top of that, 43% of its rent comes from investment grade clients and 92% of its rent recession and/or e-commerce resistant.

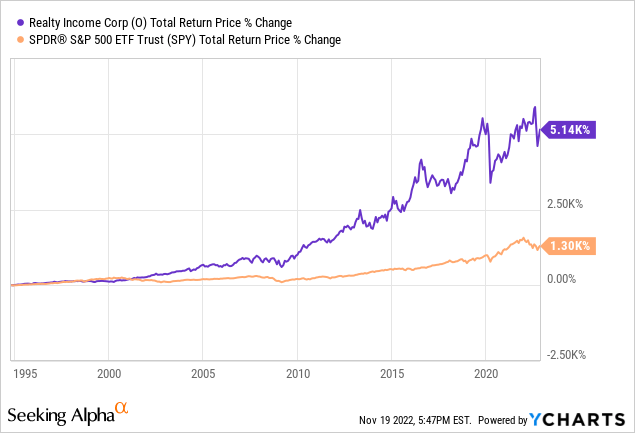

Its stellar low-risk portfolio has combined with its skilled management team to generate per share growth in 25 out of the past 26 years, dividend growth for over a quarter of a century (making it a Dividend Aristocrat), and total returns that have crushed the S&P 500 (SPY) since the REIT went public back in the early 1990s:

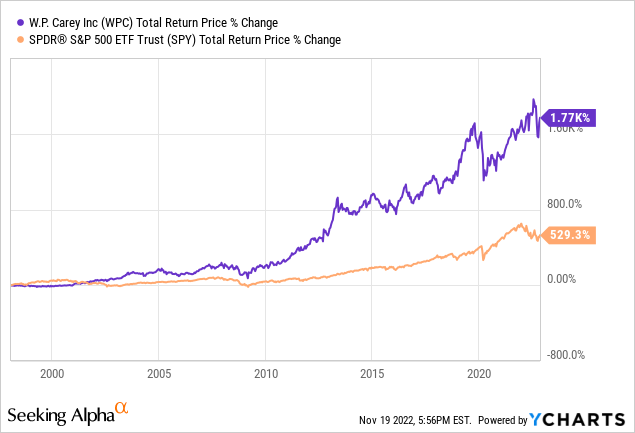

WPC’s portfolio size and total return track record are not quite as impressive as O’s, but they are still quite good in their own right. WPC owns 1,428 properties that service 391 different tenants, which still gives it plenty of diversification. Furthermore, nearly a third of its rent (~31.5%) comes from investment grade tenants and even its non investment grade occupied properties are underwritten carefully to ensure that the assets themselves are in great locations and often mission-critical and/or recession/e-commerce resistant.

Another key distinguishing factor for WPC is that – in contrast to O – the majority (55%) of its rent escalations are linked to CPI, making it arguably the most inflation-resistant triple net lease REIT. Some other key distinguishers for WPC are that it has much greater exposure to industrial and storage properties than O does and it also has significantly greater European exposure than O. In fact, 50% of its ABR comes from industrial and warehouse properties whereas only 16% of its ABR comes from retail. In contrast, O generates a whopping 84.6% of its ABR from retail properties and only 13.9% from industrial properties.

WPC has been able to grow its dividend per share every year since 1998 and as a result is close to becoming a Dividend Aristocrat in its own right. It has also generated tremendous long-term total returns for shareholders:

Overall, we consider this to be a toss-up. O generates more of its rent from investment grade tenants and benefits from superior scale and a longer track record. However, WPC still has plenty of scale and a lengthy and strong track record of its own. Moreover, it has better inflation protection and also has more exposure to industrial and storage properties, which generally have better macro dynamics facing them right now than retail properties. Ultimately, it comes down to whether or not investors want greater inflation protection and industrial exposure in their portfolios or not in deciding between these two options.

Realty Income Vs. W. P. Carey: Balance Sheet

O’s A- credit rating is probably the greatest single distinguishing factor about it relative to its peers in the sector. Its debt maturities are well-staggered with a 6.3 year weighted average term to maturity for its notes and bonds and 88% of its debt is at fixed interest rates. On top of that, 95% of its debt is unsecured, giving it a large unencumbered portfolio of assets to work with and its fixed charge coverage ratio is 5.5x while its net debt to annualized pro forma adjusted EBITDA is 5.2x. Last, but not least, its liquidity totals over $2.5 billion, giving it plenty of flexibility to invest opportunistically and/or address maturities if debt markets are unfavorable for refinancing.

WPC, meanwhile, has BBB (positive outlook) credit rating from S&P which – while not as strong as O’s – still reflects a healthy financial position and gives it access to plenty of debt on attractive terms. Its leverage ratio is 5.6x, which is 0.4 turns higher than O’s, but still reasonable given the conservative nature of the business model. Its debt maturities are also pretty well laddered with a 4.6 year weighted average term to maturity. Its $2.2 billion in liquidity is particularly impressive given that its enterprise value is less than half the size of O’s.

Both balance sheets are also clearly strong, but O gets the edge here by virtue of its superior credit rating.

Realty Income Vs. W. P. Carey: Dividend Outlook

Moving forward, O’s dividend growth outlook remains pretty consistent with what it has been in recent years. It continues to find ways to raise and deploy capital in an accretive manner despite its immense size and has recently expanded its presence into Europe where it continues to invest billions of dollars on new acquisitions. Through 2025, analysts expect O’s AFFO per share to grow at a 4.2% CAGR and its dividend per share to grow at a 4.4% CAGR.

Meanwhile, WPC continues to aggressively pursue industrial properties and European essential retail assets as it believes these are its best opportunities at the moment. Now that it finally has its asset management business exit largely behind it, headwinds on per share growth should be subsiding while inflation linked rental bumps are beginning to flow through, providing a strong tailwind for the bottom line.

That said, it still needs to navigate the upcoming U-Haul lease maturity and likely buyback by the tenant, which will meaningfully dilute AFFO per share. On top of that, WPC’s leverage ratio is towards the high end of its target range and the payout ratio is not particularly low either. As a result, it will likely be a few years before WPC’s dividend per share growth rate kicks up meaningfully. As a result, analysts expect a 2.8% AFFO per share and 2.9% dividend per share CAGR through 2024 at least.

We expect both businesses will continue to grow their dividends each year for many years to come, but believe that – at least for the next few years – O’s dividend growth rate will likely continue to outpace WPC’s by a few hundred basis points.

Realty Income Vs. W. P. Carey: Valuation

When comparing these REITs side-by-side, we see that WPC and O are essentially selling for the same price on a P/NAV and EV/EBITDA basis:

| Metric | P/AFFO | FWD Dividend Yield | EV/EBITDA | P/NAV |

| WPC | 15.06x | 5.37% | 17.41x | 1.15x |

| O | 16.30x | 4.70% | 17.33x | 1.15x |

Meanwhile, WPC does offer a higher dividend yield and trade at a lower P/AFFO ratio. However, the cheaper P/AFFO ratio is purely the product of the REIT having higher leverage and the higher dividend yield is also partly a product of having a higher payout ratio, which O compensates for by having a higher dividend growth rate.

Investor Takeaway

Neither REIT looks particularly cheap at the moment, though neither looks particularly expensive either. We think – assuming that interest rates peak in 2023 sometime and settle at around or slightly below their current level – thank both REITs are poised to deliver ~10% annualized total returns moving forward, which makes them both a Buy, especially considering their low risk profiles.

The main differentiators between the two are:

- WPC pays out a slightly higher current yield, is more focused on industrial, and has stronger inflation protection

- O has a slightly higher expected growth rate, is more focused on retail, and has weaker inflation protection

As a result, investors should favor one over the other based on their outlook/preference for the above factors. Otherwise, holding some of both does not hurt either. At High Yield Investor, since we bought it while it was trading at a clear discount to O, we hold some WPC along with our top pick in the triple net lease space.

Be the first to comment