adaask

Realty Income (NYSE:O) and W.P. Carey (NYSE:WPC) are both triple net lease REITs with very stable cash-flowing business models. While WPC’s yield is higher than O’s, O boasts a higher credit rating, implying a lower risk profile.

In this article, we will compare the business models, balance sheets, growth potential, and valuation of these two REITs side-by-side to determine which is the better buy today.

W.P. Carey vs. Realty Income: Business Models

Both businesses have very recession resistant business models thanks to deriving virtually all of their revenue from broadly diversified real estate portfolios with triple net leases.

O’s advantages stem from its superior scale and more attractive cost of capital. With a portfolio of over 11,400 properties that service 1,125 counterparties across 72 industries, O has both scale and diversification that combine with its conservative lease structures to produce a low risk profile for the business. 94% of its rent is considered resilient to economic downturns and/or threats from e-commerce. On top of that, 43% of its rent is paid by investment grade tenants.

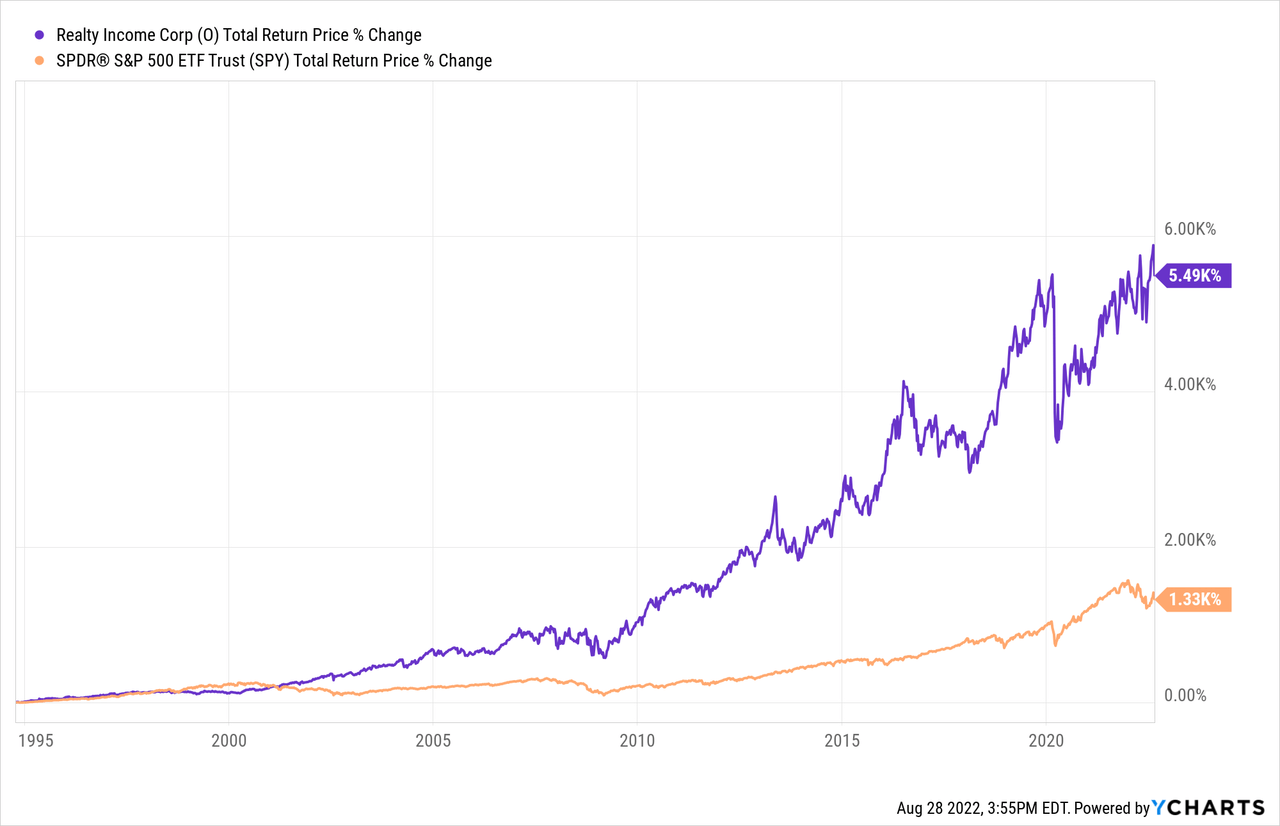

All of this has enabled O to generate 27 years of consecutive annual dividend growth. On top of that, it has delivered phenomenal total returns for shareholders that have crushed the S&P 500 (SPY) over the public history of the REIT:

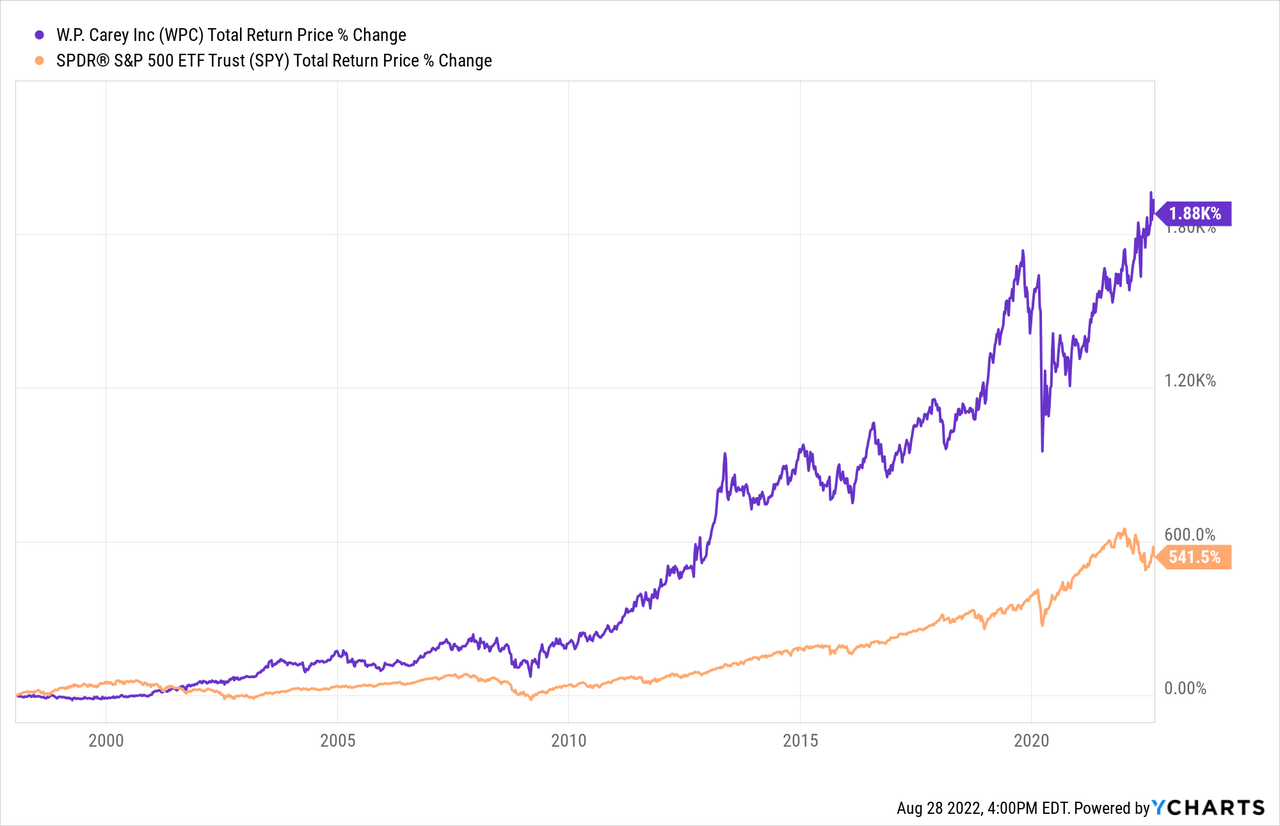

WPC has also generated an impressive dividend growth streak, raising its dividend every year since going public in 1998. Over that time frame, it has also significantly outperformed the market:

It has been able to generate such strong total returns and consistent dividend growth thanks to its focus on high quality properties and tenants in a manner somewhat similar to O. 31.4% of its rent comes from investment grade tenants. However, while it does have somewhat lesser exposure to investment grade tenants relative to O, it makes up for this with its high concentration of investments in industrial and logistics properties, which enjoy stronger economic tailwinds than the retail properties that O focuses so heavily on.

Furthermore, WPC also distinguishes itself with its 33% exposure to Europe and 3% exposure to other international geographies in contrast to O’s much heavier exposure to U.S. real estate, though O does have a very large U.K. portfolio. Last, but not least, WPC also enjoys much greater protection against inflation than O does, with 57% of its contractual rent escalators being linked to CPI, a number that is roughly double O’s.

Overall, it is tough to bet against O’s sheer scale, high percentage of investment grade counterparties, and impressive track record. On the other hand, WPC’s track record is also impressive and its much greater exposure to inflation-linked rent escalators and industrial/logistics/private storage real estate makes it hard to pick against in the current stagflationary environment. Overall, we rate this category a draw between these two.

W.P. Carey vs. Realty Income: Balance Sheets

Both businesses’ balance sheets are strong, with WPC’s achieving a BBB (positive outlook) credit rating and O getting an A- (stable outlook) credit rating from S&P.

O has a 7.6 year weighted average debt maturity term for its notes and bonds, has a 94% unsecured debt to total debt ratio, its debt is 93% fixed rate, and has a 5.5x fixed charge coverage ratio. Its debt maturity profile is also well staggered, with its liquidity easily covering its debt maturities through 2024. Its high credit rating and low leverage ratio enable it to take out debt at very attractive terms, even in the current rising rate environment. For example, this past quarter O took out a £600 million note at a weighted average fixed interest rate of just 3.22% with a blended tenure of 10.5 years.

Meanwhile, WPC’s liquidity also positions it to easily handle debt maturities through 2024. Another positive is that much of its higher cost debt matures over the next few years while its low-cost debt is locked in for years, meaning that it should not see its weighted average interest rate increase much in the coming years despite interest rates being elevated at the moment. Its overall weighted average interest rate is 2.6% and its weighted average debt maturity is 4.9 years as it has quite a bit (51.3%) of debt due in 2024 through 2026. WPC’s fixed charge coverage is 6.8x, giving it plenty of security for meeting its financial obligations and a low risk of financial distress.

W.P. Carey vs. Realty Income: Growth Potential

Both WPC and O continue to invest in opportunistic acquisitions which combines with solid organic growth due to built-in contractual rent escalators to drive mid-single digit annualized AFFO per share growth.

O and WPC both have low costs of capital, as O’s superior credit rating gives it access to cheap debt, but WPC’s greater exposure to Europe enables it to take more advantage of Europe’s lower interest rates. Furthermore, both businesses’ stocks currently trade at similar premiums to net asset value, so issuing equity is similarly accretive.

One of WPC’s biggest advantages is that it is set to benefit significantly more from high inflation rates as it will push its rent escalations higher. On the other hand, it also still has some minor headwinds over the next year from its final major asset management fund rolling off the books and it also has some significant leases expiring in 2024. As a result, analysts are more bullish on O’s growth potential than WPC’s, with an expected AFFO per share CAGR of 5% through 2025 for O compared to a 2.7% CAGR through 2025 for WPC.

That said, these estimates are made under the assumption that inflation will be tamped down in the near future. If inflation remains persistently high, then WPC will likely see its growth rate move significantly higher in the coming years. Overall, we assign a tie between these two REITs as we expect WPC’s growth rate to accelerate once it gets past the lease maturities of 2024 and it also enjoys upside potential if inflation rates remain elevated for the foreseeable future.

W.P. Carey vs. Realty Income: Stock Valuation

When comparing these REITs side-by-side, we see that WPC is slightly cheaper than O across every metric:

| Metric | P/AFFO | Dividend Yield | EV/EBITDA | P/NAV |

| WPC | 16.21x | 5.0% | 16.92x | 1.17x |

| O | 18.58x | 4.3% | 18.58x | 1.20x |

Investor Takeaway

Both WPC and O look like very solid, conservative dividend growth plays that also pay out attractive current yields. We think both are equally conservative when it comes to guarding against the downside as O has a higher credit rating, far greater scale, and more investment grade tenants, but WPC has more industrial/logistics/storage exposure and a superior fixed charge coverage ratio.

If inflation remains higher, we prefer WPC given its superior exposure to CPI-linked rent escalators, but if it retreats meaningfully lower in the near future, O may end up posting better growth rates, at least in the near term.

WPC does have a slightly cheaper share price, however, so ultimately that gives it the edge here. As a result, we rate WPC a Buy and O a Hold at their current prices.

Be the first to comment