adaask

MPLX (NYSE:MPLX) and Enterprise Products Partners (NYSE:EPD) are both K1-issuing midstream MLPs with very stable cash-flowing business models. While MPLX’s yield is ~190 basis points greater than EPD’s, EPD boasts a higher credit rating, implying a lower risk profile.

In this article, we will compare the business models, balance sheets, growth potential, and valuation of these two companies side-by-side to determine which is the better buy today.

MPLX vs. Enterprise Products: Business Models

MPLX owns a diversified and fully-integrated midstream business that consists of pipelines, gathering and processing, and storage assets. One of the unique aspects of MPLX’s business model is that its primary client and shareholder is Marathon Petroleum (MPC). As a result, there is a symbiotic relationship between them, where MPLX exists to serve the interests of MPC, but at the same time, MPC has a vested interest in maximizing the cash flow it receives from MPLX’s distributions given that it owns such a large stake in the partnership. As a result, while in the past MPC has forced MPLX to make less-than-stellar deals such as the acquisition of the Andeavor Logistics business in order to serve its own interests, at the same time MPLX unitholders have benefited tremendously from an extremely generous distribution payout policy.

EPD, meanwhile, does not have any such relationship with another firm and management is unquestionably aligned with unitholders given that the partnership is ~1/3 owned by insiders. It also has a tremendous set of assets which are well-diversified and have proven to deliver stellar results over the long term.

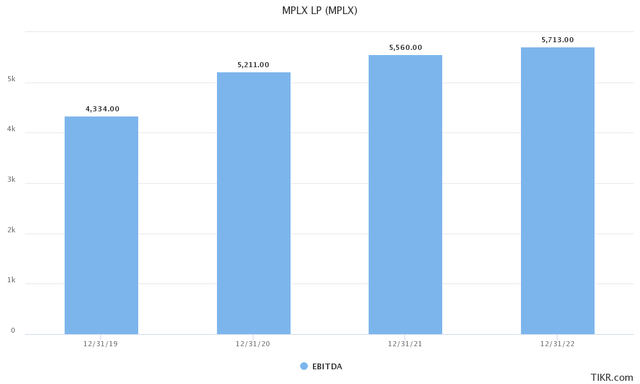

Both MPLX’s and EPD’s businesses are quite resistant to commodity price and economic volatility as they each posted very resilient numbers and continued growing distributions through the worst energy market conditions in modern history during the 2020 COVID-19 lockdowns and energy market crash. MPLX actually saw its EBITDA continue to grow at a robust pace through 2020:

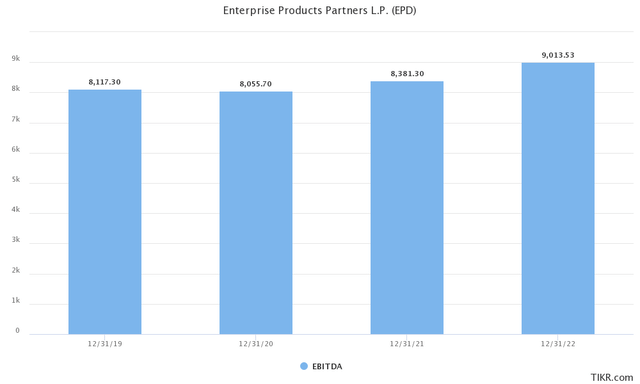

Meanwhile, EPD did suffer a slight dip, but still saw remarkably stable performance and also bounced back well in 2021 and is seeing quite strong growth in 2022:

While both business models are solid, EPD’s greater size, diversification, and more certain insider alignment make it the winner here.

MPLX vs. Enterprise Products: Balance Sheets

Both businesses’ balance sheets are quite solid, with MPLX’s achieving a BBB rating from S&P and EPD’s earnings a BBB+ rating from S&P.

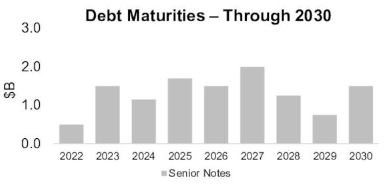

MPLX has a conservative 3.7x leverage ratio which is lower than it has been since 2017 and its debt maturity schedule is well spread out over the next decade with no singly year facing much greater than $2 billion in debt maturities and 2022 only dealing with about $0.5 billion in maturities:

MPLX Debt (Investor Presentation)

Given that their free cash flow was $4.4 billion in 2021 and expected to come in between $3.8 billion and $4 billion through 2026, MPLX should have little trouble handling each of these debt maturities, even if refinancing markets become unfavorable.

EPD’s balance sheet looks even more favorable in our view with a 3.4x leverage ratio on top of having a more diversified asset portfolio than MPLX has. On top of that, it is retaining more distributable cash flow after distributions than MPLX is, has nearly $4 billion in total liquidity with about 95% of its debt at fixed interest rates, and a stunning weighted average maturity of 20.7 years on its debt. The company has no debt maturities this year and only between $875 million and $1.25 billion per year between now and 2026 against expected annual free cash flow generation of between $5.1 billion and $6.1 billion over that span. As a result, EPD’s balance sheet is about as bulletproof as it gets in this sector.

Once again, while MPLX is very solid on this metric, EPD is the clear winner here.

MPLX vs. Enterprise Products: Growth Potential

Both MPLX and EPD continue to invest in opportunistic growth projects and EPD just recently announced a major acquisition that is expected to be both immediately accretive and open up numerous high return low risk incremental growth investment opportunities.

MPLX is expected to grow its distributable cash flow per unit at a 4.1% CAGR through 2026 whereas EPD is expected to post a 4.6% DCF per unit CAGR over that same time span. Thus, this would appear to be a slight advantage for EPD, though MPLX is a very close second.

MPLX vs. Enterprise Products: Stock Valuation

MPLX’s main advantage over EPD is that its distribution yield is significantly higher and its P/DCF multiple is meaningfully lower. However, when we look at the EV/EBITDA multiples, we see a much tighter spread in valuations.

| Metric | P/DCF | Distribution Yield | EV/EBITDA |

| MPLX | 6.6x | 9.3% | 9.31x |

| EPD | 7.7x | 7.4% | 9.62x |

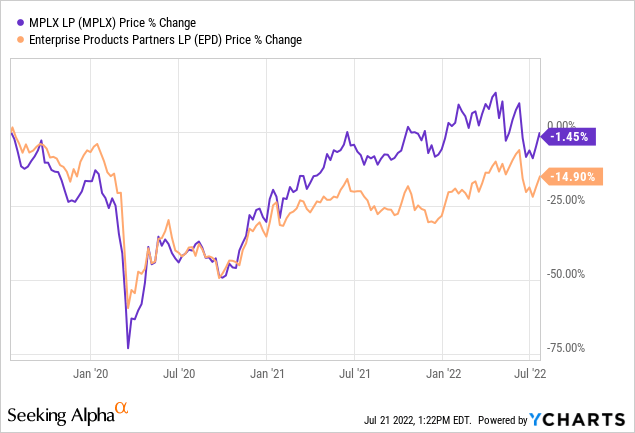

On top of that, MPLX is not trading at any meaningful discount to its pre-COVID levels whereas EPD still is:

This is particularly noteworthy given that MPLX’s DCF per unit was $4.52 in 2019 and is expected to be $4.61 in 2022 whereas EPD’s DCF per unit was $3.01 in 2019 and is expected to be $3.32 in 2022. This means that EPD’s intrinsic value based on DCF has increased by 10.3% over that span and yet is trading at a 14.9% discount to its 2019 level whereas MPLX’s DCF intrinsic value has only increased by 2% over that span and is only trading at a 1.45% discount to its 2019 level.

Last, but not least, EPD’s distribution coverage ratio is expected to be 1.76x this year whereas MPLX’s distribution coverage ratio is expected to be 1.62x. When combined with its lower risk profile, EPD’s distribution is clearly much safer than MPLX’s, though both look quite safe at the moment.

Investor Takeaway

Overall, both businesses look attractively priced here. However, we prefer EPD given that its EV/EBITDA multiple is not much higher than MPLX’s and its balance sheet and business model quality are meaningfully superior. We rate both a BUY here, but feel better about owning EPD over the long term.

Be the first to comment