Scott Olson/Getty Images News

Fears of a recession have seen our major indices decline precipitously in recent weeks, even after we’d seen one of the worst starts to a year ever. While it’s certainly possible we get a recession given we have spiking interest rates, far too much demand for too little supply in many areas of the economy, and the need to work off the excesses of the COVID stimulus programs, I think prices of many stocks have already properly taken these factors into account. In other words, unless the recession ends up being harsh and/or protracted, shares of companies in several sectors are likely too cheap.

One of those sectors is retail, which has been rocked by iffy consumer spending, wage inflation, supply chain challenges, and rising cost of goods. That’s a perfect storm for retail, so it’s no wonder many specialty retailer stocks have been destroyed this year. However, if you’ve got a longer time frame, I think bargains exist today, including tech retailing giant Best Buy (NYSE:BBY).

Signs of a bottom?

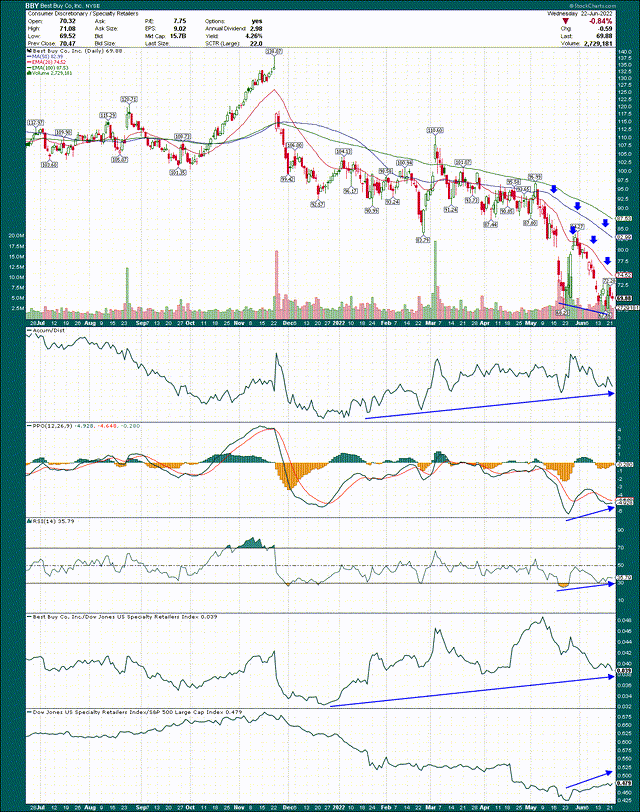

We’ll begin with the chart, as always, to get a perspective on price action and momentum. At first glance, it’s not good, given the stock has given back roughly two-thirds of the COVID rally since its high last November. However, I see signs of life.

First, one thing I look for with a bottoming stock is a positive divergence. This occurs when price makes a new low, but the momentum indicators make a higher low. Essentially what that means is that selling pressure is abating, which is the first critical step towards a sustainable bottom. We have a positive divergence in Best Buy, as notated above. That doesn’t guarantee us anything, but it’s a great first step.

Second, the accumulation/distribution line is well off its lows, although I’d like to see some more upward movement there. The A/D line plots whether a stock is finishing the period higher than it began, which shows whether big money is flowing in during dips, or flowing out. A higher A/D line means Wall Street is buying dips (rather than selling rips) and that’s what we want to see.

Third, relative strength is improving pretty rapidly, which makes me think this bottom is more than likely sustainable. I’ve plotted the specialty retailers in the bottom panel, and we can see that bottom was actually made about a month ago. In other words, specialty retailers are outperforming the market right now, even with massive fears of a recession coming. That’s telling to me.

Best Buy’s own relative strength against the group of specialty retailers is decent as well, so we have a stock that looks like it’s trying to make a bottom, improving relative strength in its peer group, and a peer group that is improving against the market. What more could you ask for?

What we need to see for a sustainable bottom is for all the things we just looked at to continue improving, but also a series of higher lows. There will be pullbacks, and that’s fine. The key is that those pullbacks do not violate prior lows. If they do, this setup is invalidated, so place your stop loss orders accordingly.

Let’s now turn our attention to the fundamental case for Best Buy, even in the face of a consumer spending recession.

Fears priced in

Before we get to the fundamentals of the business, I’ll acknowledge that if we get a really harsh recession, all of this goes out the window. The recession of 2008 took years for Best Buy to recover from, and if we get a really terrible recession, that’s likely to be the case again. However, I don’t think that will occur, and if it does, you’ll get plenty of warning because share prices will break down long before it actually happens. That’s why we use technical analysis, and why we respect price levels.

Now that’s out the way, let’s take a look at the case for Best Buy.

While Best Buy was struggling years ago to compete with online retailers of the very products it sells, it has spent the past few years reinventing itself, and to my eye, it has worked beautifully. I was one that wrote off Best Buy as a relic of the past years ago, but it’s clear that was wrong.

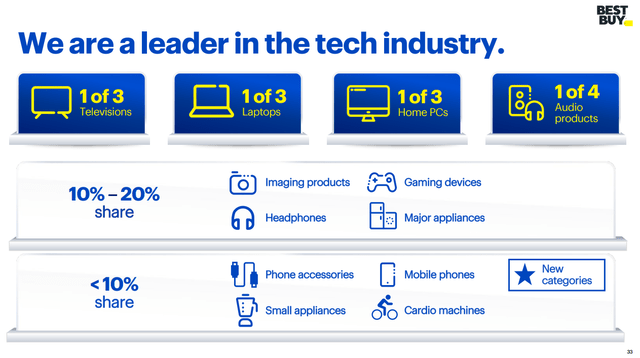

The company sells a third of the major technology products that are sold in the US, selling from a huge slate of brands, price points, etc. Even so, its share is still quite low, so it isn’t like Best Buy has taken over electronics and there’s nowhere to go. In a highly fragmented electronics retail space, Best Buy offers meaningful scale and brand recognition.

In addition to that, the company’s focus on services and other margin builders has worked wonders. Best Buy can differentiate from online retailers with its physical footprint, and its ability to use that physical footprint to offer services that require human interaction, such as Geek Squad, and more recently Totaltech. This focus has unequivocally worked to help stave off competitive threats from online electronics retailers, and I have no reason to think that won’t continue to be the case.

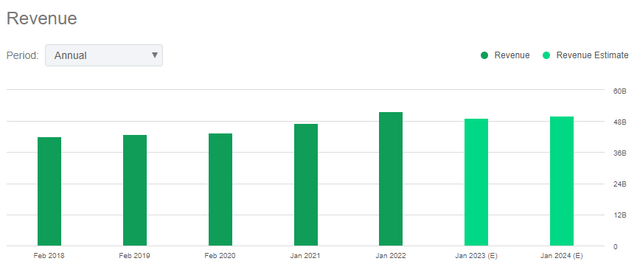

Now, let’s take a look at some numbers to see what Best Buy has done with this transformation. We’ll begin with revenue for the past few years, as well as estimates for this year and next.

Revenue ramped into the COVID surge of calendar 2021 (FY2022), but we can see that’s expected to fall off this year. Best Buy is certainly not alone in this, and it makes sense given unprecedented stimulus measures put into place that helped contribute to the situation we’re in today with inflation. By historical standards, even the declining revenue base of fiscal year 2023 is quite strong, so I think we need to use some perspective.

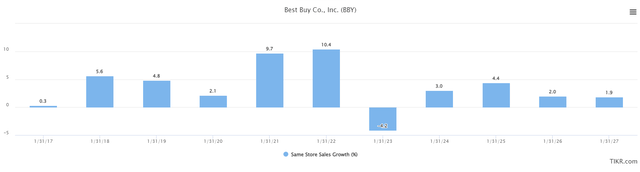

We can see that estimates for this year’s comparable sales are fairly deep into negative territory, but again, we must consider where Best Buy came from. Comparable sales for the past two years were in excess of 20% combined, so a small retracement is to be expected, particularly given unsustainable stimulus tailwinds. The important thing to focus on is that all other future years of comparable sales estimates are positive, so I have a hard time thinking Best Buy’s model is suddenly broken.

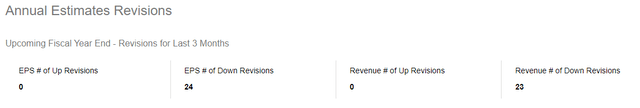

Now, one thing that has already occurred for Best Buy is that analyst estimates have been decimated in recent months. In fact, just have a look at the below.

We’ve seen 24 EPS revisions, and 23 revenue revisions in the past three months, and 100% of them were down. Anyone that reads my work knows I love to have upward revisions in revenue and EPS supporting a rally but we just don’t have that with Best Buy. Sentiment is about as bad as it can get right now, and I don’t have a positive spin on this. The only silver lining is that further downward revisions are less likely given what’s already occurred, but this is a risk for sure.

On the margin front, Best Buy has said Totaltech is a headwind for now, but should drive “meaningful” improvement in spending among members, and therefore margins, over time. The company is investing in Totaltech now in terms of promotion and adding features, both of which cost money. But management is confident that as it scales, it should drive incremental top and bottom line gains.

In addition, Best Buy sees declining consumer spending in the near-term – which I’d argue looks priced in – as well as promotional costs, supply chain costs, and higher capex. On the plus side, management sees drivers as cost efficiencies, lower incentive compensation, and growth in the ads business. It’s important to note the company has already exceeded 2025 goals that were set in 2019, so again, some perspective on declines this year in top and bottom line figures would go a long way.

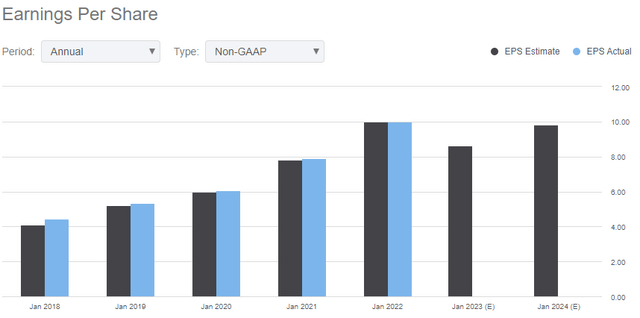

All of these factors combine for a fairly sizable decline in earnings expectations for this year.

The company’s fiscal 2022 was a dream where stimulus fueled outsized spending from consumers, and that needs to be unwound this year, to an extent. Management said the back half of this year should be better than the first half, so we’ll see, but for now, we’re looking at a ~14% decline in EPS estimates.

Pricing in the bad news

There’s a lot of bad news floating around stocks in general, but particularly with consumer discretionary categories like electronics. I’ll reiterate that if there’s a recession, and it’s a bad one, Best Buy is likely to see its share price crater, even from current levels. However, price action at the moment tells me Wall Street thinks the current discount to historical valuations is enough to account for that risk, which we looked at above. Just how big is the current discount? It’s sizable to say the least.

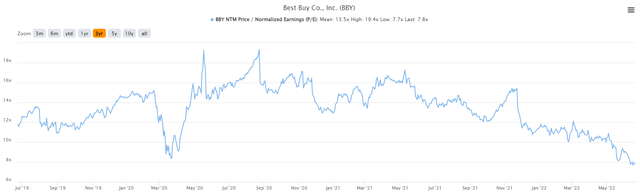

Let’s start with the forward P/E going back to 2007, which gives us a lot of perspective on how cheap or expensive the stock can get long-term.

Shares go for 7.8X forward earnings today, which is lower than the COVID panic low set in 2020, but not as low as the post-recession low set in 2012. The stock went for just 4.9X forward earnings very briefly, before rebounding significantly. But if we get a harsh recession, I wouldn’t be surprised to see something like that. I’ll be clear again that I do not think that will happen, but it’s a risk.

However, on the upside, bull periods put in values in the mid-teens, which is double where we are today. So yes, there is some downside risk you must acknowledge. However, there’s a lot more upside risk given how much the stock has already fallen.

Let’s now zoom in to the past three years for some more recent perspective.

As noted, the stock is now actually cheaper than it was in March of 2020 when everyone thought the world was falling apart due to COVID. That’s very telling to me, because either earnings estimates have massive downside from here, or the stock is too cheap. Given we’ve already seen dozens of downgrades in earnings expectations recently, I have to lean towards the stock simply being too cheap.

Finally, let’s not forget the fact that the stock is yielding around 5% today, which is a massive bonus not only in the cash one can receive, but also in that income investors are likely to support the stock with that kind of yield.

The yield is screaming that the stock is cheap, as it is sporting its highest yield in a decade right now. I don’t primarily choose stocks based upon dividend yield, but in this case it’s hard to ignore the added bonus of a big yield.

Best Buy, then, has a lot to offer if you believe a recession is already priced in. We have a company that has a well-founded strategy that it has been executing upon for years. Revenue and margins have long-term tailwinds, although this year is slated to see reversion to the mean off of stratospheric levels last year. The valuation is undoubtedly pricing in a recession, and the yield is telling you the stock is cheap as well. With retailers starting to outperform the S&P 500, I think now is the time to take a risk on Best Buy.

Be the first to comment