Scott Olson

Introduction

2022 has been an enervating year for investors as interest rates keep going up and P/E ratios continue falling. Some folks use models like the Buffett Indicator in an effort to time the market. Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) bought a substantial amount of stock in the first quarter of the year and they have continued to be a net buyer since that time. My thesis is that Berkshire Hathaway is not panicking during this environment of rising interest rates.

The Numbers

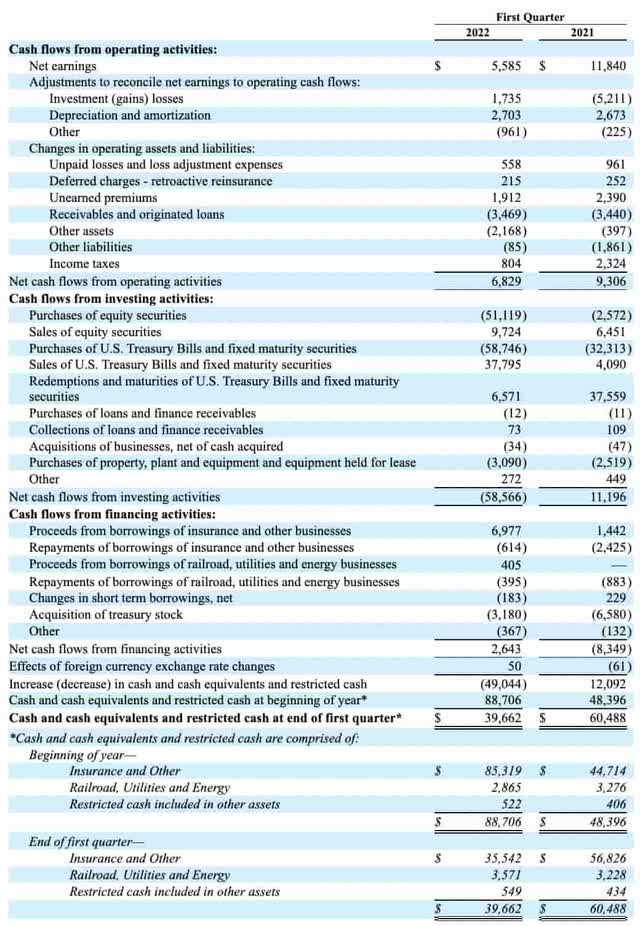

Looking at 1Q22 10-Q cash flow statement, Berkshire spent $51,119 million buying equities and they sold $9,724 million worth of equities such that they were a net buyer of $41,395 million in the first quarter:

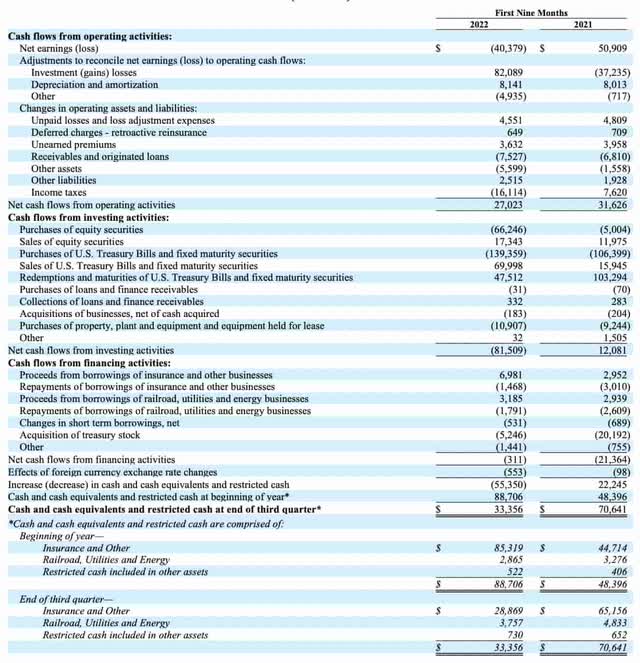

Things slowed down in the second and third quarter but the 3Q22 10-Q shows that Berkshire has continued to be a net buyer of stocks since the first quarter. Looking at the first nine months of the year, they have bought $66,246 million worth of stock and sold $17,343 million worth such that they are a net buyer of $48,903 million:

It is remarkable that Berkshire has been a net stock buyer of $48,903 million for 9M22 seeing as their free cash flow (“FCF”) during this time has only been $16,116 million or $27,023 million – $10,907 million. On top of this, they have spent $5,246 million buying back their own stock during the 9M22 period.

Another way to think about the 9M22 stock purchases is to compare them with 9M21 when Berkshire was a net seller. During 9M22, Berkshire bought $5,004 million worth of stock and they sold $11,975 million worth such that they were a net seller of $6,971 million. Again, this is separate from buying back their own stock because they spent $20,192 million doing that in 9M22.

We see the impact of the 2022 stock purchases at the bottom of the 3Q22 cash flow statement. Cash and equivalents were $88.7 billion at the start of 2022 but after net stock purchases of $48.9 billion along with some other cash flow considerations, the cash and equivalents balance was down to $33.4 billion by 3Q22.

Valuation

We are now in a different interest rate environment compared to February 2022 when I put together valuation thoughts based on the 2021 financials. At that time, I figured the upper end of the valuation range was around $850 billion.

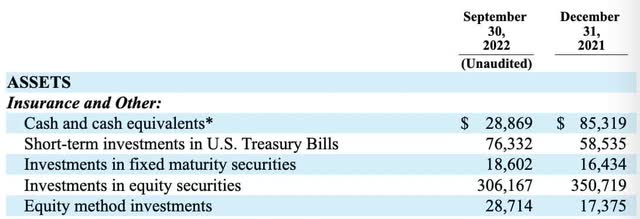

As always, the first five lines of the balance sheet are important valuation considerations. Cumulatively they fell from $528,382 million at the end of 2021 down to $458,684 million at the end of the 9M22 period. Much of the difference is due to the fact that cash and equivalents are down due to net stock purchases and the equity securities portfolio is down because 2022 has been a tough year:

3Q22 balance sheet (3Q22 10-Q)

The above balance sheet decline of approximately $70 billion is considerable on the investment side of Berkshire and I’m sure there has been a decline across operating businesses at Berkshire in 2022 as well. Capex is always higher than depreciation for railroads like BNSF and this gap tends to widen as interest rates rise. Were other subsidiaries traded publicly then their P/E ratios would be falling. I think these operating considerations mean there could be a decline of about $50 billion on that side of Berkshire since the start of the year. Partially offsetting these declines is the fact that insurance float is more beneficial during times of higher interest rates. Combining all these considerations, I now think the high end of the valuation is about $100 billion less than my February 2022 figure, meaning the high end of the valuation range is now closer to $750 billion than $850 billion.

Per the 3Q22 10-Q, there were 1,466,045 Class A share equivalents as of September 30th. Class B shares are 1/1,500th of this so we multiply this by 1,500 and the November 7th Class B share price of $290.19 to get a market cap of $638 billion.

The market cap is less than my valuation range and I think the stock is attractive for long-term investors.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Be the first to comment