ridvan_celik/E+ via Getty Images

Thesis

By this time, plenty of SA writers have detailed the Q2 earning releases (“ER”) for both Berkshire Hathaway Inc. (BRK.A, NYSE:BRK.B) (“BRK”) and Apple Inc. (NASDAQ:AAPL). And it is no secret that both continued to report substantial share repurchases of their own stocks.

This article, therefore, wants to examine an aspect that has been largely neglected thus far to my knowledge – the effects of their double buybacks. Existing articles tend to look at their buybacks separately (including my own past articles). And the thesis of this article is that such separate analyses underestimate the potency of their buybacks given BRK’s enormous AAPL position.

You will see that the double buybacks are more overpowering than on the surface. Simple math will show that the combined impacts are larger than 20% if each of them buys back 10% of their own shares. It is a classical example of 1+1>2, which can work to the advantage of BRK shareholders or investors who want to own Apple shares indirectly from Berkshire.

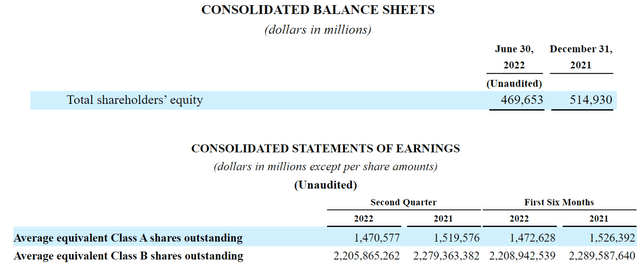

Before we dive in, let me clarify that all the subsequent analyses are made based on Berkshire Hathaway B share (BRK.B), not Berkshire Hathaway A share (BRK.A). As you can see from its most recent 10-Q, the repurchases were largely made for B shares. And there are certainly differences between the A and B shares (like voting power, et al.). But the focus of this article is on the economics side, and the use of equivalents B shares should be fine.

Berkshire share repurchases

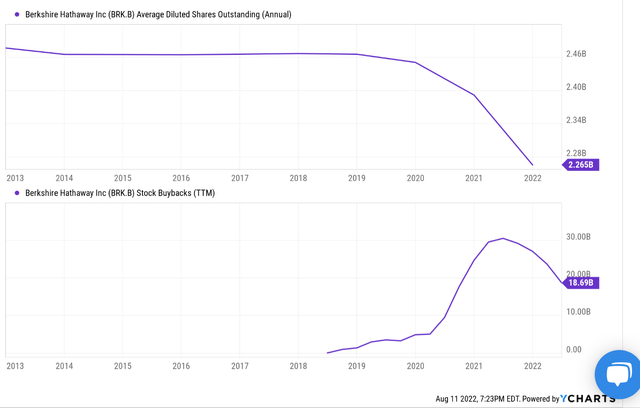

BRK started aggressively buying its own share after 2018, as you can see from the following chart. Even though Warren Buffett frequently applauded the beauty of share repurchases, he actually has not bought his own company’s shares in the past 3 or 4 decades till 2018. We can stipulate the reasons. And my view is that before that, there were plenty of other good (or better) opportunities for Buffett to deploy his cash due to a combination of two factors: the overall market; and the size of the BRK portfolio.

After a long bull run since the 2008 crash, the whole equity market had become quite expensive by 2018. Buffett’s portfolio had also grown tremendously, further narrowing the pool of candidates for him. Under this context, repurchasing his own stocks became a more attractive option. And once he started in 2018, he did it in earnest. All told, as you can see from the following charts, the repurchase peaked near $30B during the past year. And the share counts (equivalent B shares) decreased sharply, from about 2.46B to the current 2.20B as disclosed in its latest 10-Q, a whopping 11% reduction in a couple of years.

During the past quarter, the pace slowed a bit, and approximately $1.0 billion was used on share repurchases. But the six-month total spent on repurchases still reached $4.2 billion. Note that it has made a few sizable equity investments in the past six months (including Occidental Petroleum, HP Inc., et al.) and also acquired Alleghany Corporation. My view is that the past six months are more of an anomaly and steady share repurchase will remain the norm going forward.

AAPL share repurchases

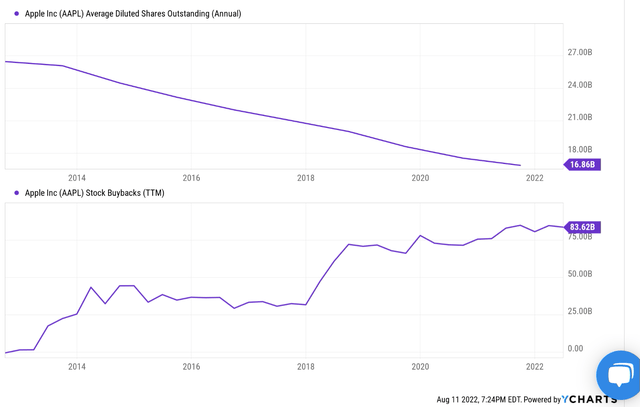

AAPL aggressively repurchases its stock, too, probably even more so than BRK.

As you can see from the following chart, Apple’s share count stood close to 27B (split adjusted) at the beginning of the decade. And after a whole decade of consistent repurchases, now it has only 16.8B shares outstanding. This translates into a whopping 38% reduction of its shares, i.e., more than 1/3. Going forward, I see no signs of the pace slowing down, as CFO Luca Maestri commented on its Q2 ER (or FY Q3 ER). The comments were abridged, and the emphases were added by me.

We ended the quarter with $179 billion in cash and marketable securities… leaving us with total debt of $120 billion. As a result, net cash was nearly $60 billion at the end of the quarter. We returned over $28 billion to shareholders during the June quarter. This included $3.8 billion in dividends and equivalents and $21.7 billion through open market repurchases of 143 million Apple shares. We continue to believe there is great value in our stock and maintain our target of reaching a net cash neutral position over time.

I understand the “net cash neutral position” as net cash position equals total debt. Based on this understanding, its net cash of $60 billion alone gives it another $60 billion of purchasing power for its own shares.

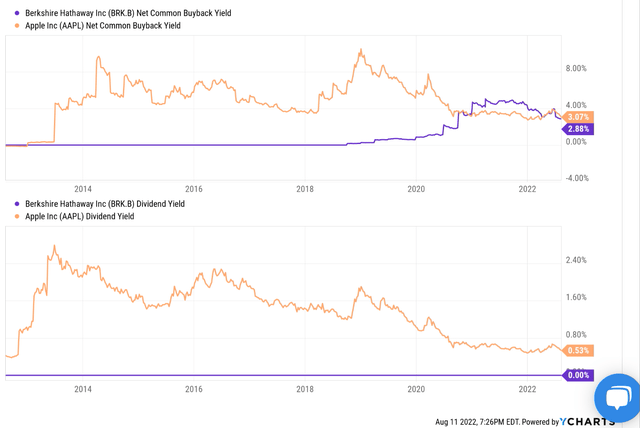

Berkshire and Apple total shareholder yield

Before we move on to discuss the potency of their double buybacks, let me address a common comment I’ve received from readers on BRK. The comment, or rather a complaint, involves the lack of a dividend from BRK and/or the low yield from AAPL. Given the magnitude of their share repurchases, most of the shareholder returns came from, and will continue to come from, repurchases, not dividends.

Warren Buffett has long argued that he could better increase shareholder value through investments than through buybacks or dividends. The same could be said for AAPL. And whether you believe in his argument or not, the fact is that buybacks are much more substantial for both firms as you can see from the charts below.

The top panel of the chart shows their net common buyback yield. It is defined as the amount spent on repurchases divided by the market cap of a company (just like dividend yield is the total amount of dividends paid divided by the market cap). As you can see, BRK’s buyback yield has been close to 4% over the past few years and currently is at 2.88%. AAPL’s buyback yield has been consistently above 4% over the years and currently is at 3.07%. Such buyback yield has far exceeded its dividends (shown in the bottom panel), which was on average 2% in the past year and dropped to only ~0.5% since 2021.

BRK and AAPL double buybacks

Now, let’s look at the overpowering potency of the double buybacks from BRK and AAPL. Buffett already commented on the power of such dark magic in his 2021 shareholder letter (abridged and emphases added by me):

Apple – our runner-up Giant as measured by its yearend market value – is a different sort of holding. Here, our ownership is a mere 5.55%, up from 5.39% a year earlier. That increase sounds like small potatoes. But consider that each 0.1% of Apple’s 2021 earnings amounted to $100 million. We spent no Berkshire funds to gain our accretion. Apple’s repurchases did the job. It’s important to understand that only dividends from Apple are counted in the GAAP earnings Berkshire reports – and last year, Apple paid us $785 million of those. Yet our “share” of Apple’s earnings amounted to a staggering $5.6 billion. Much of what the company retained was used to repurchase Apple shares, an act we applaud.

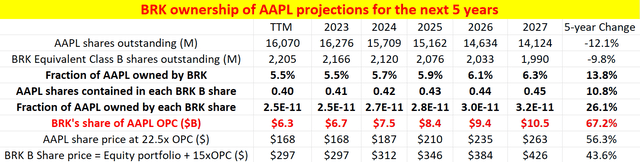

Buffet of course had good reasons to applaud AAPL’s continued share repurchases. And the table below projects what would happen if both continue to repurchase their share in the next 5 years. The table below was made under a few simple assumptions. For AAPL, these assumptions were detailed in an earlier article and summarized below:

- AAPL uses a constant percentage of its operating cash flow on repurchases, and the percentage is taken to be 78%, the average in recent years.

- AAPL profits grow at an 8% CAGR according to consensus estimates.

- An average repurchase price of 22.5x of its operating cash.

For BRK, the assumptions are the same in essence except for three small differences. First, the percentage of operating income spent on repurchase was assumed to be 68%, the average from 2019 to 2022 thus far. Second, it assumes the repurchases were made at a price that equals the worth of its equity portfolio plus 15x of its operating cash, a model detailed in my earlier analysis. Third, it assumes BKR’s AAPL holdings remain fixed at its current level of 890.9M shares.

Under these assumptions, you can see that AAPL shares outstanding would decrease by another 12.1% in the next five years, and BRK share account (equivalent B class shares) would decrease by another 9.8%. The fraction of AAPL owned by BRK would increase from 5.5% currently to about 6.3% in five years, an increase of 0.8%. The number of AAPL shares contained in each BRK B share would increase from 0.40 at the current level to 0.45 in five years. And finally, just for fun, each BRK B share now owns 25 billionths of AAPL (i.e., 25 billionths of the entire Apple Inc). In five years, each BRK B share would own 32 billionths of it.

In Buffett’s language, all of these sound like small potatoes.

However, if you keep reading the next lines of the table, you would see that they are not. As Buffet commented above, BRK’s share of Apple’s earnings amounted to a staggering $5.6 billion in 2021 already. And this year, that amount is projected to be $6.3B thanks to the double repurchases and earnings growth. In five years, BRK’s share of Apple’s earnings would grow to a spectacular $10.5B! To put things under perspective, BRK’s current operating cash is on the order of $20B.

Final thoughts and risks

Finally, note that BRK’s share of Apple’s earnings would grow by 67% in five years under the above projection. A number much larger than the impacts from share repurchases by each of them (12.1% and 9.8% respectively) thanks to the organic growth (of course) but also to the basic arithmetic of double buybacks. Simple math dictates that the combined impacts will be larger than 20% if each of them buys back 10% of their own shares.

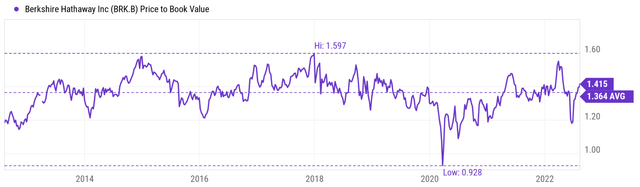

Finally, a few words about risks. Specific risks associated with AAPL or BRK have been eloquently argued in other SA articles already. So here I will just focus on the risks of the approach used in this article. First, the valuation of BRK’s equity portfolio obviously is a moving target. Its latest 10-Q filed on June 30, 2022, shows a book value of $212.9 per share. However, the overall market has changed quite a bit since then and its book value would have changed also. Secondly, since we are on the topic of buybacks, BRK’s current valuation is a bit higher than the target price indicated by Buffett’s early comments. Buffett has commented in interviews and in writings that he would be an enthusiastic buyer of BRK shares at a price near 1.2x book value. Currently, as you can see from the chart below, the price is at 1.42x book value, not only higher than 1.2x (by about 18%) but also higher than its long-term historical average of 1.36x.

Be the first to comment