marchmeena29/iStock via Getty Images

“The most critical time in any battle is not when I’m fatigued, it’s when I no longer care.” – Craig D. Lounsbrough

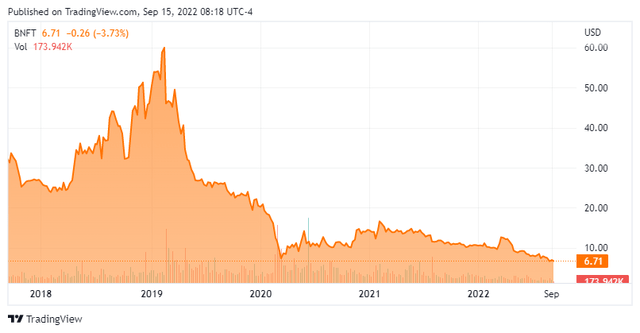

I got an inquiry on Benefitfocus, Inc. (NASDAQ:BNFT) this week from a Seeking Alpha follower. The last piece I put on this cloud-based benefits management provider in the summer of 2018. We took profits in this name within the model portfolio of the Busted IPO Forum a few quarters later. This turned out to be fortuitous timing, as the stock and company have fallen on very hard times since. I have not really looked at it since. Is this equity now oversold? An analysis follows below.

Company Overview:

Benefitfocus, Inc. is headquartered in Charleston, SC. The company provides cloud-based benefits management technology solutions for employers and health plans throughout the United States. The stock currently trades just south of $7.00 a share for an approximate market cap of $240 million.

August Company Presentation

Second Quarter Results:

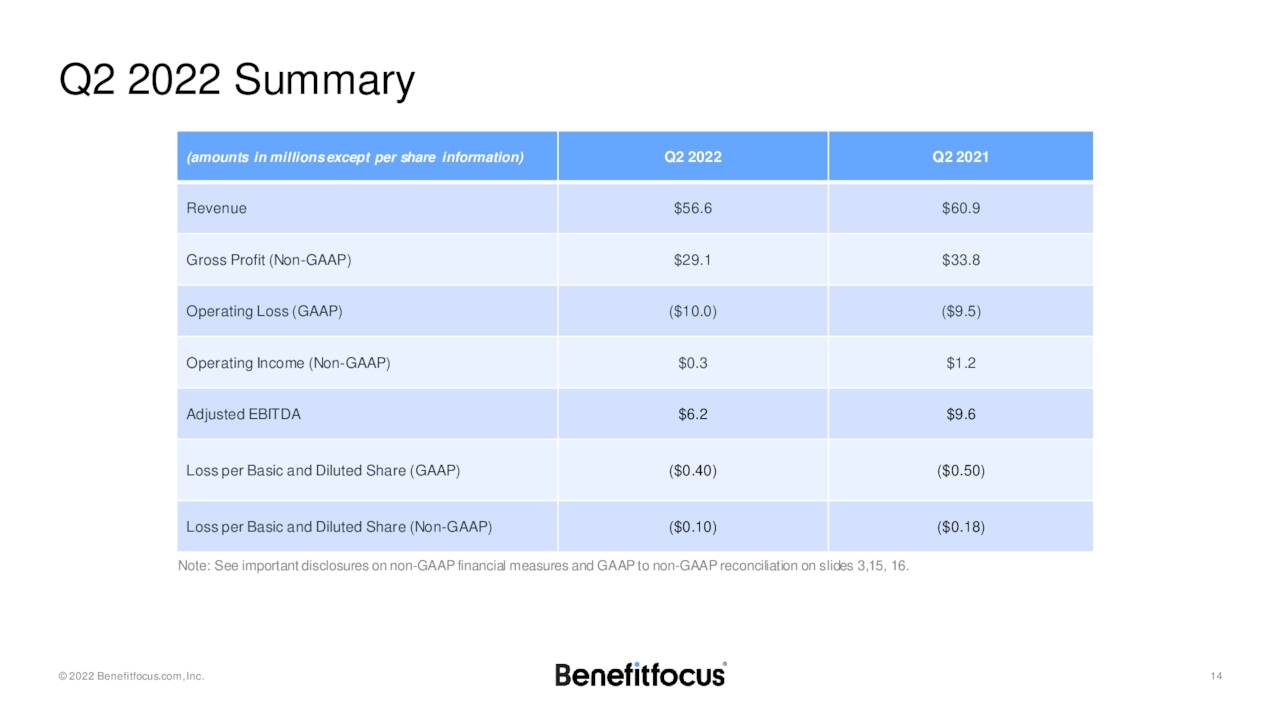

On August 3rd, the company posted second quarter numbers. Benefitfocus had a GAAP quarterly net loss of 40 cents a share, more than a dime below the consensus. Revenues fell seven percent on a year-over-year basis to $56.6 million, roughly in line with expectations.

August Company Presentation

Here is the breakdown of the core revenue flows during the quarter.

- Subscription revenue was $42.0 million, down 5% compared to the second quarter of 2021.

- Platform revenue was $6.6 million, up 12% compared to the second quarter of 2021.

- Professional services revenue was $8.0 million, down 25% compared to the second quarter of 2021.

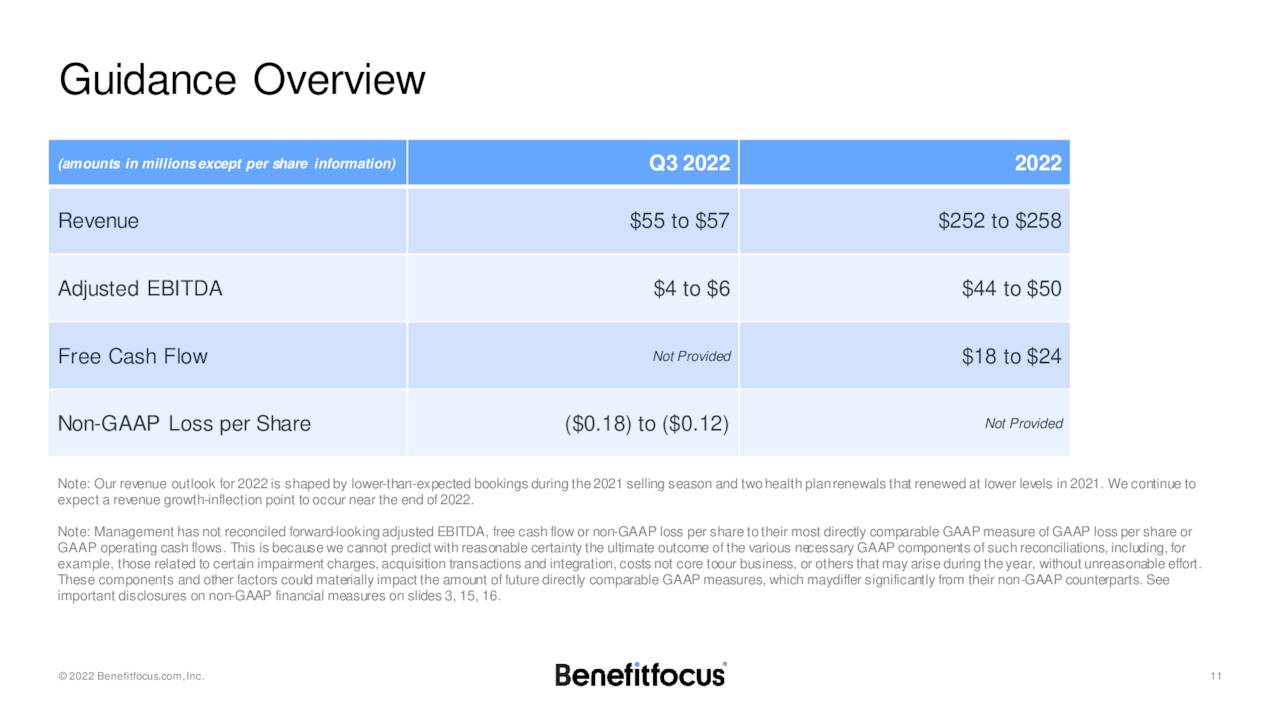

Management also provided the following forward guidance.

August Company Overview

Analyst Commentary & Balance Sheet:

The company gets little attention from Wall Street. JPMorgan assumed coverage with a Neutral rating on BNFT late in May, with an $11 price target. Piper Sandler maintained its Hold rating on September 6th and cut its price target from $9 to $6 a share. The analyst at Sandler said her price target cut:

Reflects the company’s Q2 results and guidance while also noting its lack of revenue growth, margin erosion and heavily Q4-weighted guidance. Benefitfocus also offers few actual data points to back up its assertion that FY23 growth will accelerate.”

Those are the only two analyst firm ratings I can find on the stock so far in 2022.

Just over three percent of the outstanding float in the stock is currently held short. A beneficial owner purchased just over $5 million of shares in the stock in March of this year. Since then, the CFO has disposed of nearly $600,000 worth of his holdings in BNFT.

August Company Presentation

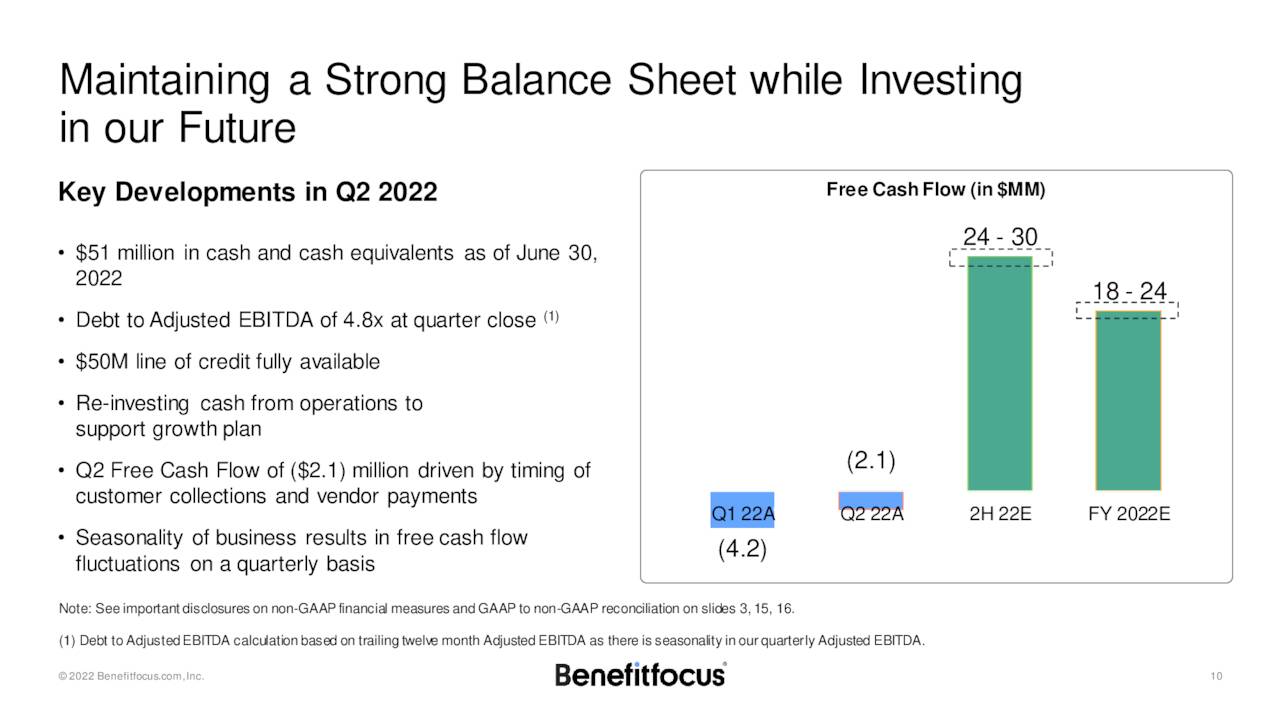

The company ended the second quarter with just over $50 million in cash and marketable securities on its balance after posting a GAAP net loss of $13.8 million for the quarter. The company also has access to an unused $50 million line of credit. Benefitfocus had negative cash flow of $2.1 million in the quarter compared with positive cash flow of $6.6 million in the same period a year ago. Management stated this was due to seasonality and expects free cash flow to be positive ($18 million to $24 million) for the year. Long-term debt stood at approximately $120 million at the end of the second quarter.

Verdict:

The current analyst consensus has the company making a slight profit of 7 cents a share in FY2022, even as revenues fall some four percent this year to $253 million. Next year, they expect sales to tick up three percent as the company breaks even for the fiscal year.

Back when we last looked at the company, it was consistently beating earnings expectations and delivering sales growth in the high-single digits. Price targets from analyst firms were generally in the high $50s. That started to change in the first half of 2019 as quarterly earnings reports began to miss the consensus and the company lost its third CFO in as many years. That is when I bailed on this name. The company announced significant layoffs in early 2020 which was a direct result of the start of the pandemic and the accompanied lockdowns that soon followed.

Things don’t seem to have gotten much better over the past three years although the company is at least at breakeven states. However, given little profits and no sales growth to speak of, it is hard to see much of a reason to own the equity here.

August Company Presentation

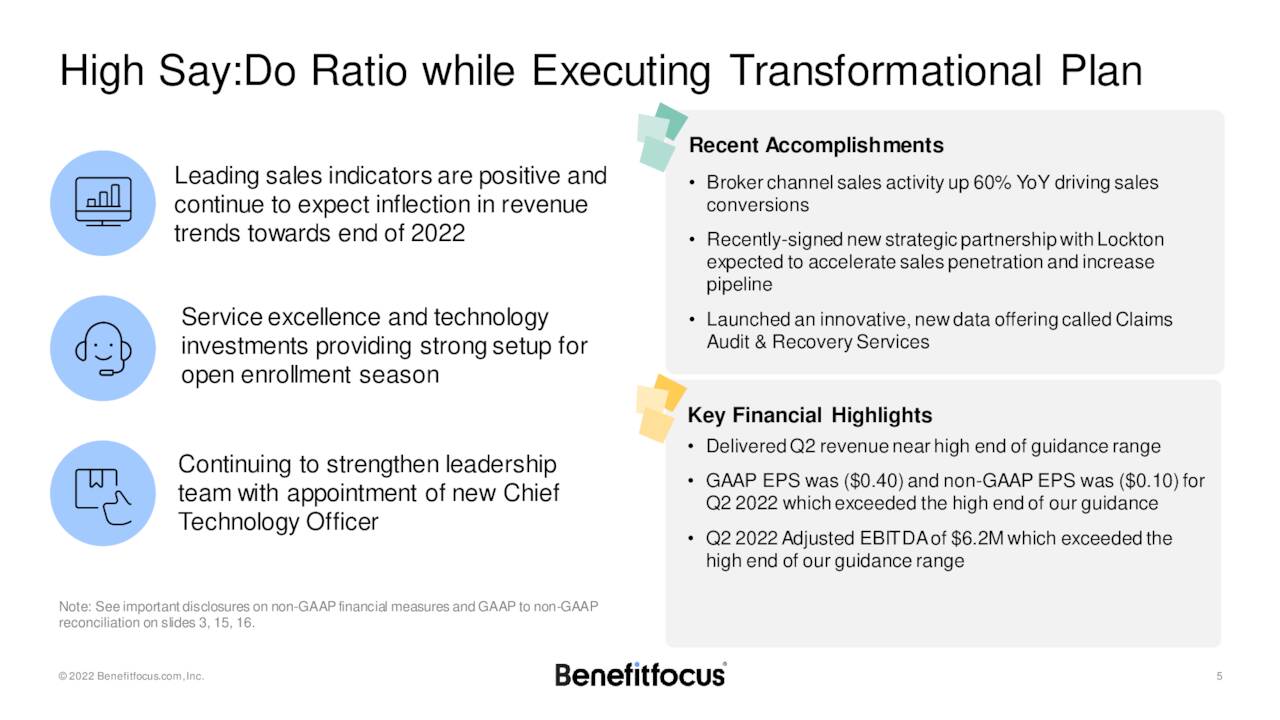

The company is in the process of making ongoing investments in further automation and other process improvements. These are being undertaken in an effort to achieve sustainable efficiencies starting with this year’s enrollment season. It is too early to reliably predict the impact of this ‘transformational plan‘ at this time, however. Given all that, I am aligned with Piper Sandler’s analyst in the view that Benefitfocus is a ‘wait and see‘ story at the moment.

“We draw our strength from the very despair in which we have been forced to live. We shall endure.” – César Chávez

Be the first to comment