BernardaSv/iStock via Getty Images

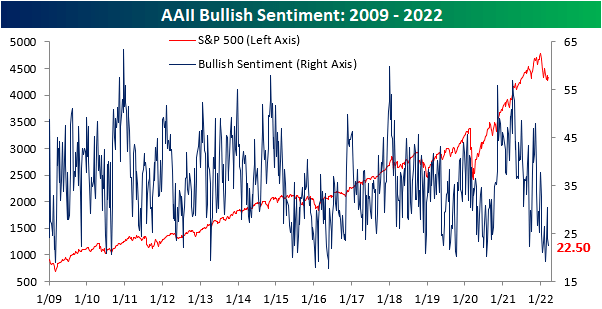

In spite of the S&P 500 gaining back some ground in the past week, sentiment has continued to shift in an increasingly pessimistic direction. For the second week in a row, less than a quarter of respondents to the AAII sentiment survey reported bullish. At 22.5%, however, current levels are still slightly above the low of 19.2% from one month ago.

AAII Bullish Sentiment 2009-2022 (Author)

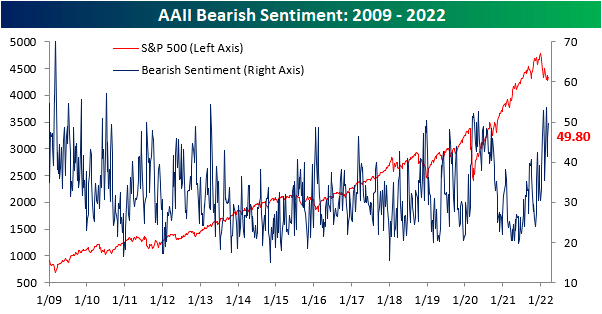

Bearish sentiment meanwhile climbed another 4 percentage points, with just under half of respondents reporting as such. Albeit elevated, bearish sentiment is not as high as the 50%+ readings reached in January and February. As for another reading on bearish sentiment from the Investors Intelligence survey, bearish sentiment is at the highest level since the March 2020 COVID low.

AAII Bearish Sentiment 2009-2022 (Author)

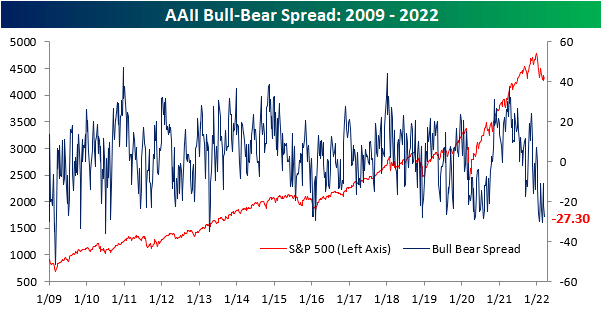

The bull-bear spread is extremely low at -27.3, but that is not quite as low as those past couple of weeks when over half of respondents reported as being bearish.

AAII Bull-Bear Spread 2009-2022 (Author)

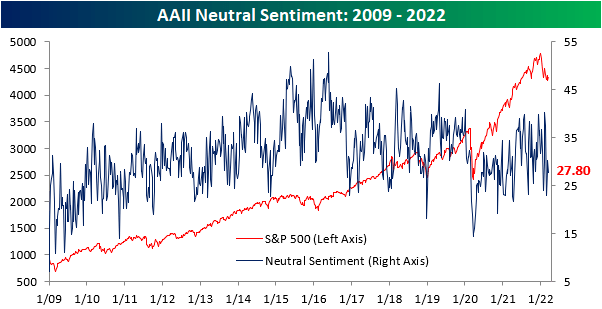

Not all of the increase to bears came from bulls. As shown below, neutral sentiment fell from 30.2% down to 27.8%. That is only the lowest level since the end of February. While bullish and bearish sentiment are both over a full standard deviation away from their historical averages, neutral sentiment is much more in line with its own historical average. Whereas all weeks since the start of the survey have seen neutral sentiment average a reading of 31.4%, this week’s reading was only a few percentage points away.

AAII Neutral Sentiment 2009-2022 (Author)

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment