anusorn nakdee

Every blade has two edges; he who wounds with one wounds himself with the other.”― Victor Hugo

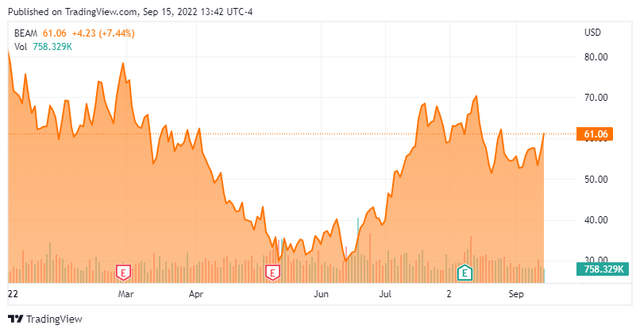

Today, we take our first look at Beam Therapeutics Inc. (NASDAQ:BEAM). The stock of this early stage developmental firm have been on a nice run since early June. However, there some signs that this strength may not last. An analysis follows below.

Company Overview:

Beam Therapeutics is a multi-program clinical-stage company based in Cambridge, MA, right outside Boston. The company is developing precision genetic medicines through base editing and has a broad-based pipeline of drug candidates. The stock currently trades around $60.00 a share and has a market cap just south of $4 billion.

Company Website

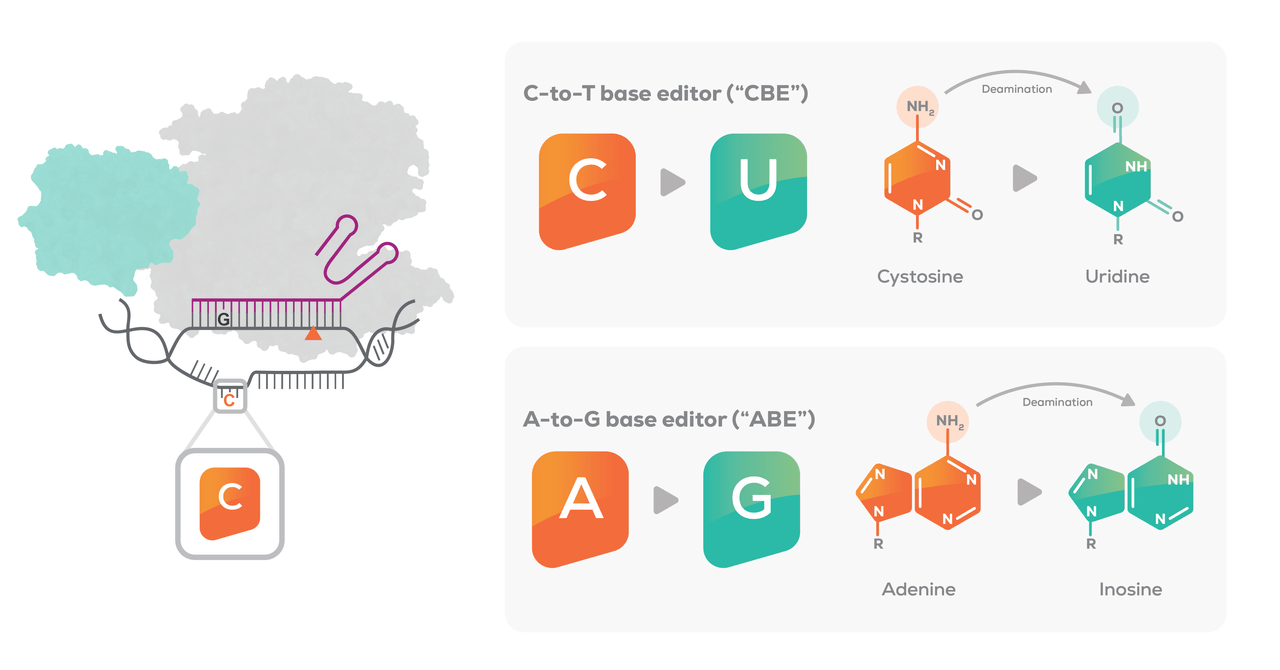

The company has a growing portfolio of proprietary gene editing technologies. These include base editing, prime editing, nuclease editing, and RNA editing. Their current base editor technology includes a cytosine base editor and an adenine base editor.

Company Website

Base editors are made up of two key components. First there is a CRISPR protein. This is bound to a guide RNA, which then leverages the established DNA-targeting ability of CRISPR. However, it is modified to not cause a double-stranded break. The second component is a base editing enzyme, such as a deaminase. This carries out the desired chemical modification of the target DNA base.

Company Website

The company designed this proprietary combination to enable the precise targeting and editing of a single base pair of DNA or multiple bases at the same time. Beam’s management believes that the modular and individual components of these base editors can be customized for specific diseases and create new therapeutic programs.

Company Website

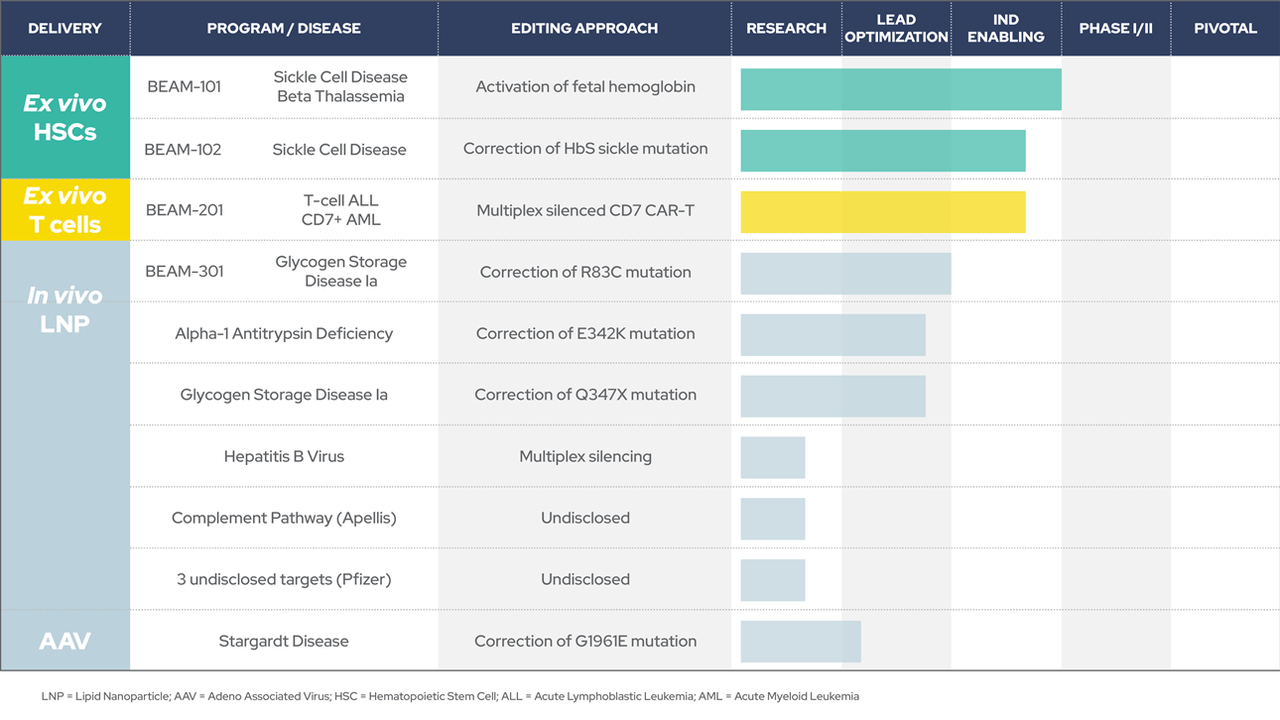

As can be seen above, the company has numerous candidates in development. Most of these are very early stage. For the purpose of this analysis, we will look at a few of the efforts that are the farthest along.

Beam Therapeutics is advancing two ex vivo base editing programs which are dubbed Beam-101 and Beam-102. As part of these studies, cells are collected from the patient. They are then edited, and then infused back into the individual. To create space for the edited cells to take hold in the bone marrow, patients must undergo a conditioning regimen. This usually involves treatment with busulfan, which is the current standard of care in hematopoietic stem cell or HSC transplantation

BEAM-101 is an investigational therapy that produces base edits designed to potentially alleviate the effects of sickle cell disease {SCD} and beta-thalassemia. It does so by mimicking genetic variants seen in individuals who have hereditary persistence of fetal hemoglobin. The company expects to enroll the first patient in a Phase 1/2 clinical trial “BEACON-101” targeting SCD sometime before the end of 2022.

BEAM-102 looks to directly correct the hemoglobin mutation for SCD by base-editing to mimic a naturally-occurring hemoglobin variant. At the beginning of August, the FDA placed Beam’s Investigational New Drug or IND application on clinical hold. The company hopes to have this resolved by the end of the year at the latest.

The company is also advancing a candidate called BEAM-201. This is a multiplex base edited anti-CD7 CAR-T cell investigational therapy for relapsed and refractory T-cell acute lymphoblastic leukemia and T-cell lymphoblastic lymphoma. Submission of an IND application is anticipated in the second half of 2022

The company plans to initiate IND-enabling studies for BEAM-301 sometime by the end of this year. This candidate is a base editing therapy using liver-targeted LNPs which aims to correct the R83C mutation in patients with glycogen storage disorder Ia (GSDIa).

Finally, in mid-July, Verve Therapeutics (VERV) disclosed that the company dosed its first patient in an early-stage trial for its lead asset, the in vivo base editing candidate VERVE-101. This effort involves an adenine base editor messenger RNA that was licensed from Beam Therapeutics.

Analyst Commentary & Balance Sheet:

The analyst community is not currently sanguine on the company’s prospects. Over the past five weeks, BMO Capital ($61 price target), Barclays ($60 price target) and RBC Capital ($76 price target) have all reissued Hold ratings while SVB Securities ($113 price target) and William Blair have maintained Buy ratings on the stock.

So far in the third quarter, insiders and beneficial owners have sold approximately $4.5 million worth of stock in aggregate. In addition, over one out of every five shares of the outstanding float is currently held short. Beam’s balance sheet is in good shape. At the end of the second quarter, the company held $1.2 billion in cash and marketable securities, after posting a net loss of $72 million for the quarter.

A good chunk of this cash came from a four-year research collaboration deal that Beam inked with Pfizer (PFE) early this year which included a substantial $300 million upfront payment from the drug giant. This collaboration will be focused on in vivo base editing programs for three targets for rare genetic diseases of the liver, muscle and central nervous system. These were not part of Beam’s existing programs at the time of agreement. As part of this deal with Pfizer, Beam can also garner potential milestone payments of up to $1.35 billion as well as royalties on any eventual global net sales for each licensed program.

Verdict:

There are some positive attributes about Beam. The company is quite funded at the moment and appears to be pioneering some potentially intriguing technology which has led to a diverse set of product candidates. The collaboration deal with Pfizer helped validate Beam’s approach and provided a big infusion of cash. However, all of the company’s developmental efforts are early stage and many, many years away from potential commercialization.

The analyst community, in general, does not have a positive view on BEAM stock after its recent runup, and some insiders are engaged in a decent amount of profit taking. Most importantly, the economy looks headed for a recession, both here and in Europe. Interest rates have seen a sharp spike in 2022 and inflation levels are at four-decade highs.

In short, this is becoming more and more a “risk off” market environment with the NASDAQ down over 25% in 2022 to date. This is not the kind of environment that shares of high beta, early stage development companies typically do well in. Outside an unforeseen event (for example, a buyout by Pfizer), the stock is most likely dead money at best until overall market dynamics improve. Therefore, for the present moment, BEAM goes down as an AVOID for now.

Revolutions always appear impossible in prospect and inevitable in retrospect.”― David Sinclair

Be the first to comment