Darren415

This article was first released to Systematic Income subscribers and free trials on Dec. 10.

Welcome to another installment of our BDC Market Weekly Review, where we discuss market activity in the Business Development Company (“BDC”) sector from both the bottom-up – highlighting individual news and events – as well as the top-down – providing an overview of the broader market.

We also try to add some historical context as well as relevant themes that look to be driving the market or that investors ought to be mindful of. This update covers the period through the second week of December.

Be sure to check out our other Weeklies – covering the Closed-End Fund (“CEF”) as well as the preferreds/baby bond markets for perspectives across the broader income space. Also, have a look at our primer of the BDC sector, with a focus on how it compares to credit CEFs.

Market Action

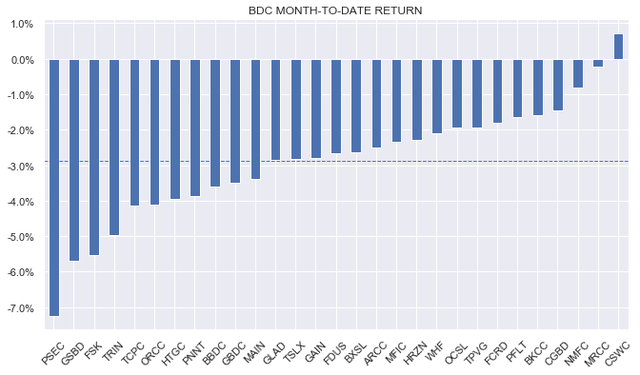

BDCs underperformed for the second week, delivering a drop of around 2%. Month-to-date only one BDC remains in the green while the sector is down around 3%.

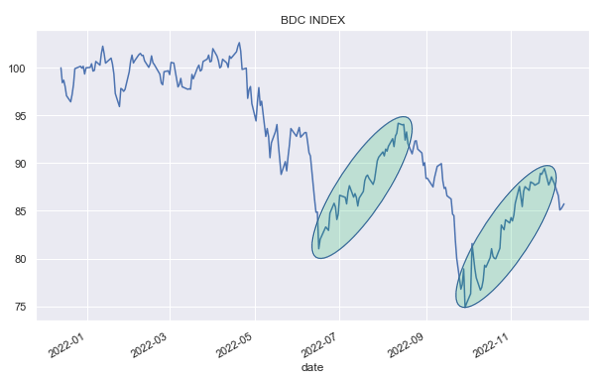

In our recent commentary, we made two points about the sector. First, that the latest rally over October and November (second green oval in the chart below) looks very similar to the rally the sector enjoyed over the summer (first green oval). And two, the recent average sector valuation being very close to par (the sector peaked around 98% recently) did not leave much of a margin of safety for further potential macro weakness. And so the recent rolling over of the sector over the last two weeks has not come as a surprise. Although we don’t expect to revisit the lows of the year, our base case is that price action remains range-bound at best.

Systematic Income

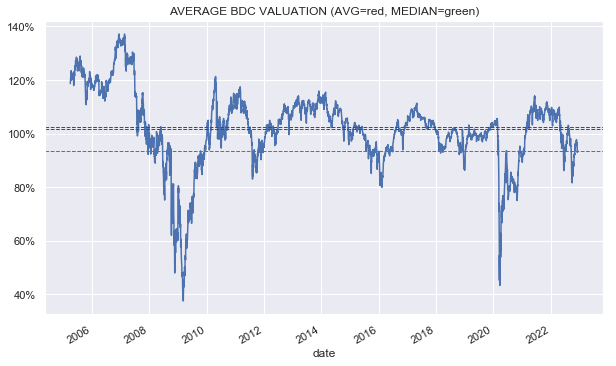

With the average valuation of 94%, the sector remains at a slightly expensive level in our view, though a couple of pockets of value remain.

Systematic Income

Stance And Takeaways

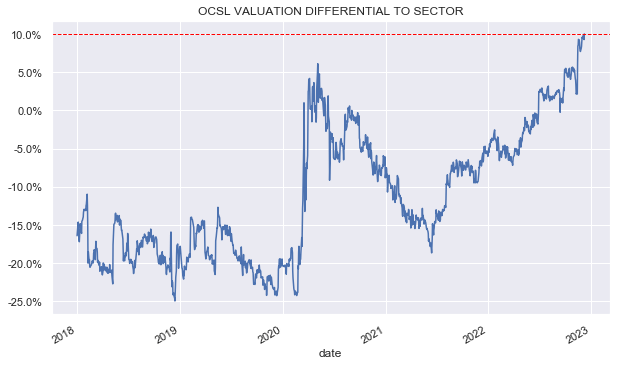

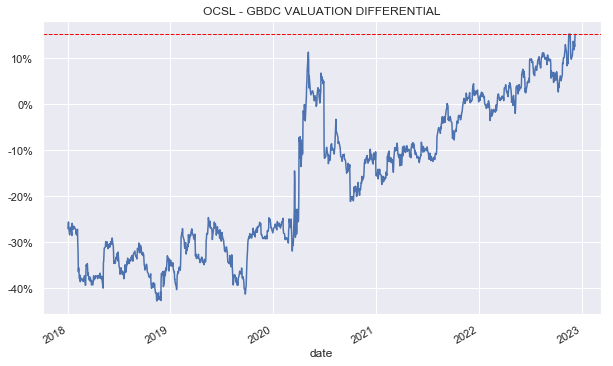

This week we rotated away from Oaktree Specialty Lending (OCSL) in Core and High Income Portfolios. The stock closed this week at a 104% valuation or 10% above the sector average which looks to be a historic record and is excessive in our view.

Systematic Income

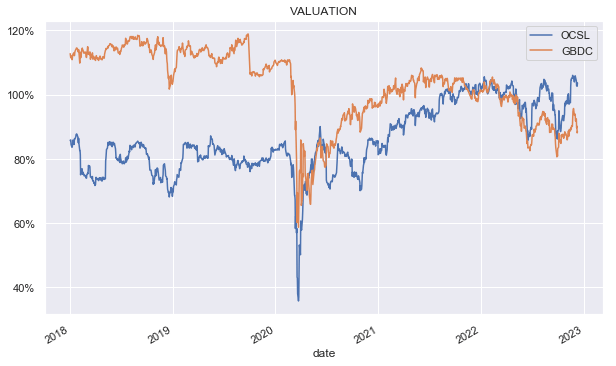

We took advantage of this high level of valuation to rotate to a number of other income securities, including the Golub Capital BDC (GBDC) which closed this week at a 88.5% valuation.

The relative valuation of the two BDCs has flipped with OCSL moving out to a significantly higher level versus GBDC.

Systematic Income

Although a small premium for OCSL would not be unfounded, a 15% valuation gap between the two BDCs seems overly high. The chart below shows how the valuation differential between these two BDCs has traded over time. A 15% valuation premium of OCSL relative to GBDC looks too high and recent performance does not justify it. For instance, GBDC has outperformed OCSL by around 4% over the past year in total NAV terms.

Systematic Income

We also upgraded GBDC to a Buy in our Income Portfolios. Recall that we recently downrated the stock to Hold after its valuation moved north of 95% and nearly converged with the sector average. Now, with a valuation of 88.5% and a 5% discount to the sector average, it’s worth a shift to Buy once again.

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the BDC, CEF, OEF, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis – sign up for a 2-week free trial!

Be the first to comment