Darren415

This article was first released to Systematic Income subscribers and free trials on Sep. 24.

Welcome to another installment of our BDC Market Weekly Review, where we discuss market activity in the Business Development Company (“BDC”) sector from both the bottom-up – highlighting individual news and events – as well as the top-down – providing an overview of the broader market.

We also try to add some historical context as well as relevant themes that look to be driving the market or that investors ought to be mindful of. This update covers the period through the fourth week of September.

Be sure to check out our other Weeklies – covering the Closed-End Fund (“CEF”) as well as the preferreds/baby bond markets for perspectives across the broader income space. Also, have a look at our primer of the BDC sector, with a focus on how it compares to credit CEFs.

Market Action

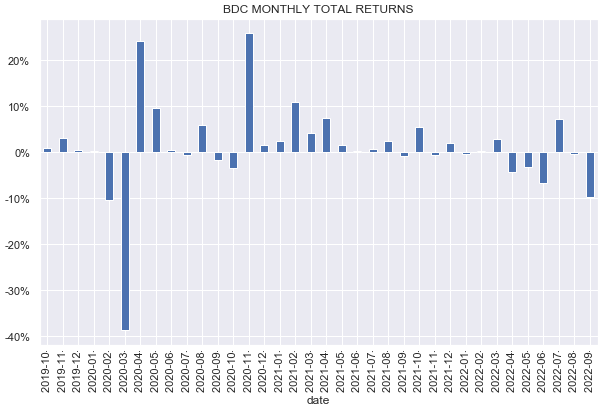

It was a rare underperformance week for the BDC sector this year. The clear anxiety around a “higher for longer” monetary policy environment caused higher-beta sectors like BDCs, MLPs, REITs and others to underperform sharply. This is despite the fact that quickly rising short-term rates have continued to deliver dividend hikes for BDCs.

The sector was down around 7% this week. Only BXSL is up over the month of September which is shaping up to be the worst month for the sector since Mar-2020.

Systematic Income

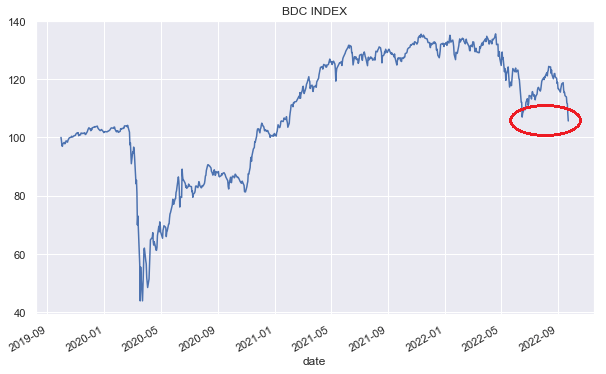

The BDC index below shows that the sector has now fallen below its June trough and stands roughly where it was in early 2021.

Systematic Income

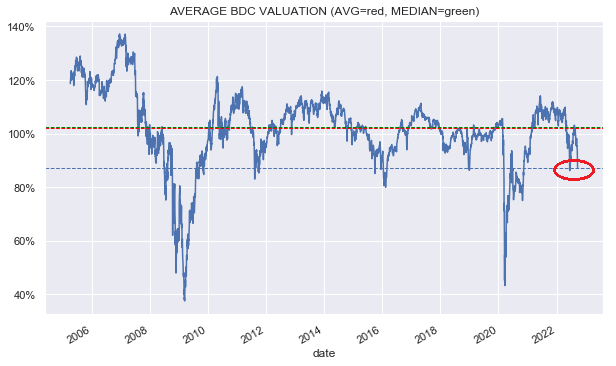

The sector valuation is at its June trough levels and not far off the previous troughs in 2018 (Fed auto-pilot tantrum), 2016 (Energy crash) and 2012 (Euro crisis). Periods where the sector saw significantly lower valuations are those of the “world-ending” kind such as the GFC and the COVID crash. While we are likely to enter a recession in our view a better comparison set is the former rather than the letter which suggests that current valuation looks quite attractive in aggregate.

Systematic Income

Market Themes

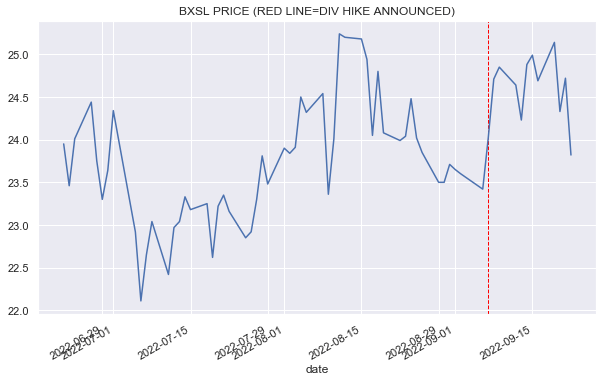

The sharp rise in short-term rates amid a low default environment has allowed many BDCs to hike their dividends in the last few months. One clear pattern that has emerged which will not surprise many income investors is that those BDCs that hiked their dividends have enjoyed a price boost as well.

We can see this for BXSL where the stock’s price jumped on the dividend hike announcement.

Systematic Income

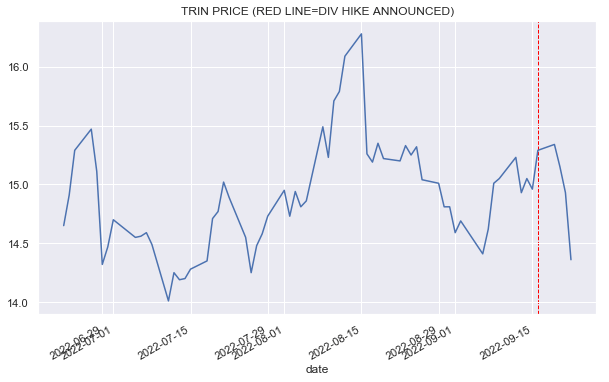

We see it for TRIN.

Systematic Income

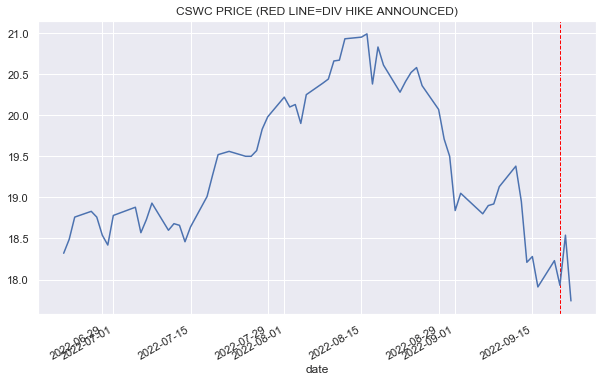

And for CSWC.

Systematic Income

This all makes sense, however, it also highlights that the sector is far from efficient. For instance, if the sector were totally efficient it would trade on a net income yield rather than a dividend yield. In other words, outside of the daily market volatility, investors would see most of the price adjustment on quarterly earnings days when net income numbers are announced. Ultimately, it’s net income which is the right metric of BDC earning power, not their dividends.

The price jumps on dividend hike days also highlights a market inefficiency because the price jumps reveal that the hike was a surprise, at least to some investors. In our recent BXSL and TRIN coverage, we explicitly highlighted a strong chance of dividend hikes (we haven’t provided detailed coverage of CSWC). This didn’t require any kind of specialized or insider knowledge – it was a simple reflection of just a handful of key metrics.

What this market dynamic suggests is that investors who can be just a step ahead can benefit not only with potential capital gains but also with a higher level of yield due to their lower cost basis over investors who chase the hike at higher prices.

Market Commentary

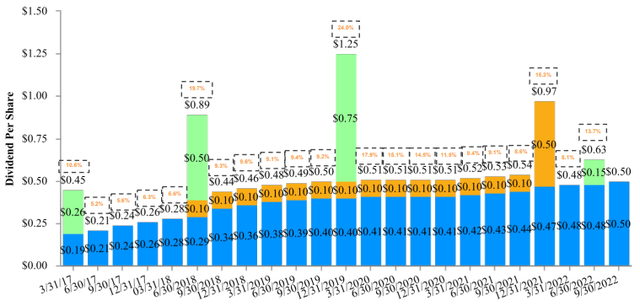

As indicated above, the Capital Southwest Corporation (CSWC) hiked its dividend to $0.52. The company has been regularly increasing its dividend as the chart below shows. Part of this is due to the NAV accretion of new shares offerings given the stock’s premium valuation.

The CEO of Carlyle Secured Lending (CGBD) Linda Pace will step down but continue to serve as the Chair of the Board. Pace will be replaced with Aren LeeKong in January who is currently the company director. We don’t see this as having a material impact on our outlook for the company which remains Buy rated.

Stance And Takeaways

This week we upgrade the Fidus Investment (FDUS) as well as the Oaktree Specialty Lending Corp (OCSL) from Hold to Buy.

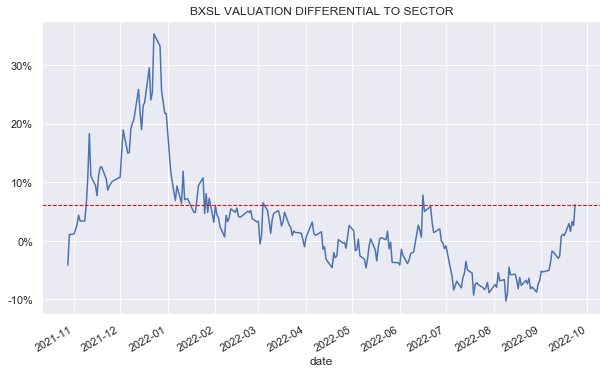

Two of our other holdings have risen to valuations that look a tad expensive though not exceedingly so. They are the Blackstone Secured Lending Fund (BXSL)…

Systematic Income

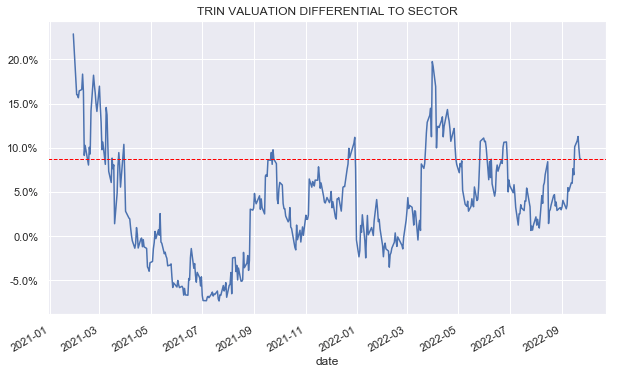

… and Trinity Capital (TRIN). We continue to maintain positions in these stocks in our High Income Portfolio with a Hold rating.

Systematic Income

Be the first to comment