martin-dm

Investment Thesis

In my previous article on BBQ Holdings, Inc. (NASDAQ:BBQ), I came to the conclusion that the company was pursuing a successful turnaround strategy focused on cheap acquisitions as the main growth source. You can read about it here. Since then, BBQ lost ~33% vs. a loss of ~14% for the S&P 500 and has outperformed the market.

In the short term, I believe investors are concerned that deteriorating consumer sentiment will harm the company. However, I believe the long-term picture remains intact as illustrated by the recent results. Based on my estimates, BBQ could offer a 100% upside if management maintains the current momentum. As a result, I think the stock offers an attractive risk-reward scenario which makes it a buy. That said, investors shouldn’t go all in just yet as I suspect that volatility will remain elevated in the markets in the months ahead and BBQ is likely to see lower prices.

Recent Developments

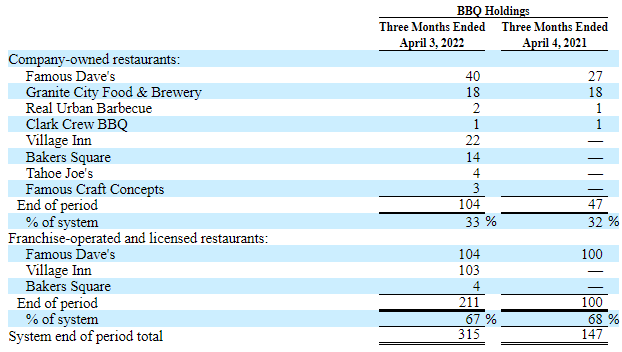

On May 10th, 2022, the company reported results for Q1 FY22. Overall, the results were solid and BBQ managed to beat both revenue and EPS estimates. Sales reached ~$64.18 million in the last quarter, representing a ~72% YoY increase. The results were boosted by the Village Inn and Tahoe Joe’s Steakhouse acquisitions made in July and October 2021, respectively. More on that in my previous article on BBQ. On top of that, management remains committed to the same growth model going forward. The company acquired three bar-centric locations in March 2022, collectively referred to as Famous Craft Concepts, bringing the total cash spent on M&A deals for Q1 FY22 to $4.43 million. The company used less than $0.5 million in new debt to finance these acquisitions and mostly relied on cash from operating activities and accumulated cash reserves on its balance sheet. Another acquisition took place on April 11 2022 when BBQ closed the purchase of Barrio Queen, a chain of seven authentic Mexican fine dining restaurants in Phoenix, Arizona, for $28.5 million.

BBQ 10-Q

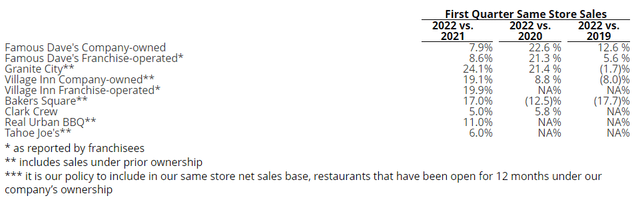

BBQ’s numerous concepts continue to enjoy high comparable sales figures relative to 2019 and 2021, with a few exceptions. Famous Dave’s company-owned restaurants are up 12.6%, whereas Village Inn and Bakers Square are down vs 2019. The next quarters will be very important to watch as they will give investors a good idea if management is successful in turning around these two lagging concepts. Given how high inflation is at the moment, I expect same-store sales to remain high over the next year on a company-wide level.

BBQ Investor Relations Website

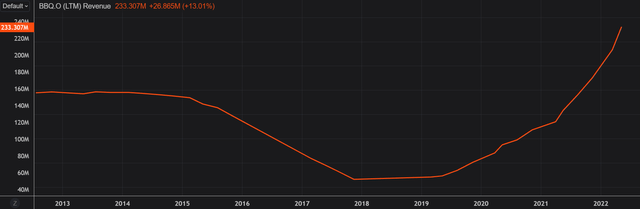

TTM sales have now reached ~$233 million, and are at a multi-decade high. The turnaround is in full swing and management was successful in transforming this failing restaurant chain into a thriving M&A growth machine, while keeping the amount of leverage limited. BBQ finished the last quarter with less than $15 million in total debt, which is relatively low compared to the total amount spent on acquisitions in the previous 24 months. Management now expects revenue of $290 to $310 million for FY22, which is ~9% higher compared to the previous guidance from March 2022.

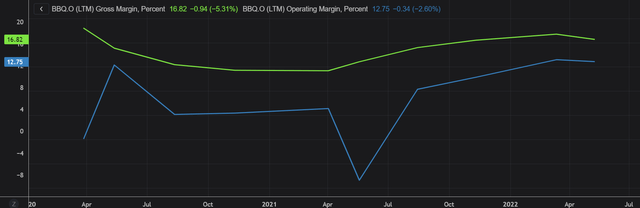

What’s good to see is that operations have benefited from this growth model. The TTM gross profit has now exceeded the 2015 high of ~$35 million and TTM cash from operating activities came close to $23.5 million. According to management, FY22 free cash flow is expected to range from $13.5 to $15.5 million, unchanged from what was communicated in March 2022.

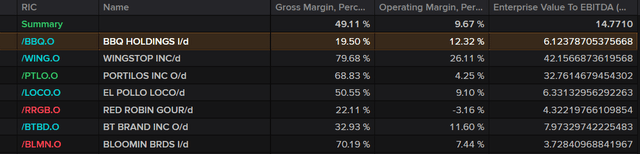

The company has a ~17% TTM gross margin, which remains below the 20% average between 2010 and 2015. It is of course very hard to compare today’s situation with the last decade since BBQ has completely changed its strategy and is now focused on growing through acquisitions. This business model will impact the gross margin with every new acquisition. The operating margin is also stable at around ~13%, which is in line with other competitors.

Refinitiv Eikon Refinitiv Eikon

Valuation

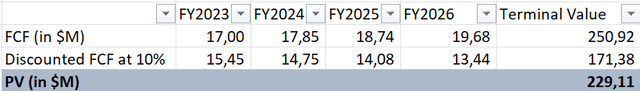

In my previous article on BBQ, I argued that the business was fairly priced at ~9.4x EV/EBITDA. Based on 10.6 million shares outstanding, the company has a market cap of approximately $117.6 million. In this part, I have used a DCF model to value the business. The following assumptions have been made in the model:

- Estimated free cash flow for FY23 of $17 million, slightly below Wall Street estimates of $19 million to provide a conservative intrinsic value figure.

- A growth rate of 5% until FY26.

- A 2% terminal growth rate.

- A 10% discount rate, in line with BBQ’s WACC.

Based on my updated model, the fair value of the stock is around $22 per share, which means the stock could double if the market takes a second look at it or the company becomes a target for an M&A deal. In the short term, I think that investors are afraid that collapsing consumer sentiment will negatively impact the company. However, I believe the long-term picture remains intact and the stock is now cheap enough to offer an interesting risk-reward situation.

Key Takeaways

BBQ is down more than 30% since my previous article which means it is a good time to revisit the investment thesis. In the short term, I believe investors are concerned that the company will suffer as consumer sentiment deteriorates across the economy. However, as evidenced by the recent results, I believe the long-term picture remains intact and the growth model based on cheap M&A deals has so far proved to be successful. According to my estimates and if management maintains the current momentum, BBQ could offer a 100% upside. As a result, I believe the stock offers an appealing risk-reward scenario, making it a buy. However, investors shouldn’t get too excited just yet since market volatility will remain high in the coming months and there is a high probability that BBQ will trade at lower levels in the near future.

Be the first to comment