Leonid Ikan

Despite the continued effects of cost inflation and wider heavy oil differentials, Baytex Energy (OTCPK:BTEGF) still looks capable of generating around US$575 million in positive cash flow over the next five quarters at current strip prices. Based on its shareholder return framework, this would allow it to put a bit over US$200 million towards share repurchases over this period, while the rest goes towards debt reduction.

Due to the impact of wider differentials and slightly weaker benchmark commodity prices (at strip), Baytex’s projected near-term cash flow is a bit lower than what I expected before, thus pushing the transition to Phase 3 of its shareholder return framework (50% to share repurchases) to around mid-2023. I believe that Baytex is worth approximately CAD$8 or US$6 in a long-term (after 2023) $75 WTI oil environment.

This report uses US dollars unless otherwise mentioned, along with an exchange rate of US$1.00 to CAD$1.33.

Q4 2022 Outlook

Baytex may end up averaging close to 88,000 BOEPD in production during Q4 2022. It noted that October production was over 87,000 BOEPD and it expects 2022 exit rate production to be in the 87,000 BOEPD to 88,000 BOEPD range.

This is being driven by Clearwater production growth. Baytex noted that current Clearwater production was 10,000 barrels per day, up from an average of 8,191 barrels per day in Q3 2022.

At the current Q4 2022 strip of mid-$80s WTI oil, this leads to a projection that Baytex will generate $430 million in revenues after hedges for the quarter.

The WCS differential has widened considerably, but the impact of wider differentials in Q4 2022 are partially offset by Baytex’s basis hedges. It has 17,000 barrels per day hedged at a WCS differential of negative US$12.28 to WTI for the quarter.

|

Units |

$ Per Unit |

$ Million USD |

|

|

Heavy Oil |

2,990,000 |

$54.00 |

$161 |

|

Light Oil and Condensate |

3,128,000 |

$81.50 |

$255 |

|

NGLs |

736,000 |

$32.00 |

$24 |

|

Natural Gas |

7,360,000 |

$4.00 |

$29 |

|

Hedge Value |

-$39 |

||

|

Total |

$430 |

Baytex is now projected to generate US$125 million in positive cash flow in Q4 2022 at current strip prices. Baytex had approximately US$829 million in net debt at the end of Q3 2022. Based on its current capital return framework, it would put US$94 million towards debt reduction, leaving it with US$735 million in net debt at the end of 2022. Baytex would also be able to spend US$31 million on share repurchases.

|

$ Million USD |

|

|

Royalties |

$100 |

|

Operating Expenses |

$87 |

|

Transportation |

$10 |

|

Cash General And Admin |

$10 |

|

Cash Interest |

$15 |

|

Capital Expenditures |

$75 |

|

Leasing Expenditures |

$1 |

|

Asset Retirement Obligations |

$7 |

|

Total Expenses |

$305 |

Projected 2023 Outlook

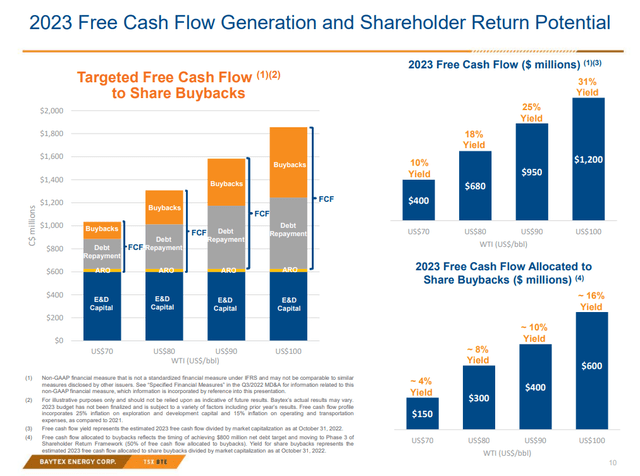

Baytex currently expects approximately US$490 million in free cash flow in 2023 at the current high-$70s WTI strip. This calculation includes 25% inflation for exploration and development capital and 15% inflation for operating and transportation expenses compared to 2021 levels. Those cost inflation levels appear to be a reasonable assumptions.

There may be some downside with WCS differentials, as Baytex’s calculations use a negative US$17.50 differential for 2023, while current strip is around US$4 to US$5 worse than that. Using current strip differentials instead results in a projection of roughly US$450 million in free cash flow for Baytex in 2023.

Baytex Free Cash Flow (baytexenergy.com)

Based on its shareholder return framework, this suggests that Baytex will put approximately US$180 million towards share repurchases in 2023 and the rest towards debt reduction, allowing it to reduce its net debt to US$465 million by the end of 2023.

Baytex’s Clearwater economics are still strong with wider differentials. It estimates that its Clearwater wells will pay back in around seven months with WCS at US$52.50 in the first year of the well’s life. The current WCS strip for 2023 is in the mid-$50s (US dollars).

Notes On Valuation

I now estimate Baytex’s value at approximately CAD$8 or US$6 per share in a long-term (after 2023) $75 WTI oil environment. That share price would result in a roughly 13% annual free cash flow yield for 2024 to 2026 at that oil price.

While this may seem to be a fairly high free cash flow yield for valuation purposes, this reflects the volatility inherent with oil and gas prices as well as the depletion of inventory. The free cash flow calculations above do not include costs for replenishing inventory, although Baytex estimates it has 10+ years of drilling inventory in each of its core areas.

Conclusion

Baytex is now projected to generate approximately US$575 million in free cash flow over the next five quarters at current strip prices. This would allow it to reduce its net debt to approximately US$465 million by the end of 2023 while also spending over US$200 million on share repurchases.

Baytex’s Clearwater wells still look quite good despite weaker oil prices (including wider heavy oil differentials). At current 2023 strip, Baytex’s Clearwater wells should still pay back in under seven months.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment