pinstock

Thesis

Barings Participation Investors (NYSE:MPV) is a closed end fund from the Barings platform. The fund IPOed in 1988 and provides a retail investor with access to the privately placed middle market loans space. The CEF’s primary objective is current yield, and its long-term performance is reflective of that. On a 10-year basis, the fund’s annualized total return comes quite close to its current dividend yield. As per the fund’s literature:

The Trust’s principal investments are privately placed, below investment grade, long-term debt obligations including bank loans and mezzanine debt instruments. Such private placement securities may, in some cases, be accompanied by equity features such as common stock, preferred stock, warrants, conversion rights, or other equity features. The Trust typically purchases these investments, which are not publicly tradable, directly from their issuers in private placement transactions. These investments are typically made to small or middle market companies. In addition, the Trust may invest, subject to certain limitations, in marketable debt securities (including high yield and/or investment grade securities) and marketable common stock. Below investment grade or high yield securities have predominantly speculative characteristics with respect to the capacity of the issuer to pay interest and repay capital.

Private placements are a type of capital raising that involves using pre-determined buyers rather than going through a public registration of the securities. Private placements are very common in the middle market loan space due to the heavy negotiations that usually go into establishing debt covenants, capital structures and liens in order to get the best yield possible on the raised debt.

The fund is well-run with an extremely low 5-year standard deviation of only 6.86 and a Sharpe ratio above 1 (the current 5-year Sharpe is 1.03). The fund has been only disbursing interest income in the past two years and runs a low leverage ratio of 11.6%. Privately placed loans are a bit on the expensive side when financed due to their illiquidity, hence we like the fact that the fund is not trying to pump up its dividend via excessive leverage. The fund is a bit of a “steady Eddy” in the space, although it is outshined performance-wise by its bigger brother Barings Corporate Investors (MCI).

While we are of the general opinion that a mild recession is in the cards for late 2022/early 2023, we do not think it will be credit driven. We feel the Fed is set to increase rates to fight inflation, although the supply side of oil and commodities is not controlled by the Fed. This will result in the tightening of financial conditions and a deceleration of the economy. Yes, some highly leveraged unprofitable companies will go bust, but it will generally not be a credit Armageddon.

We like MPV and we feel it is worth a look by retail investors who want to hold a low volatility fund long-term (3 years plus timeframe) and would like to diversify their asset class holdings via the middle market exposure. In a rising rates environment, MPV is able to pass higher rates to holders via its floating collateral, which it has been doing. We expect the large discount to NAV to persist as we enter another recessionary environment. Investors who are already in the fund can Hold here while new money looking for exposure to the middle market space should buy on dips.

Analytics

AUM: $0.135 billion

Sharpe Ratio (5Y): 1.03

St Deviation (5Y): 6.86

Yield: 6.25%

Expense Ratio: 2.66%

Premium/Discount to NAV: -14.72%

Z-Stat: -0.78

Leverage Ratio: 11.6%

Annualized Total Return (5Y lookback): 3.98%

Risk Factor: Leveraged Loans (Middle Market)

Holdings

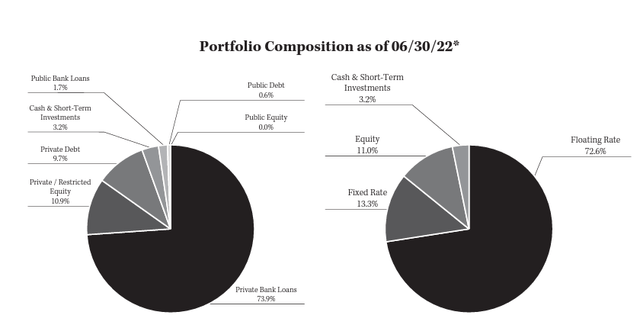

The fund is overweight privately placed bank loans:

We can see that the majority of the portfolio is floating rate, which keeps the portfolio duration down.

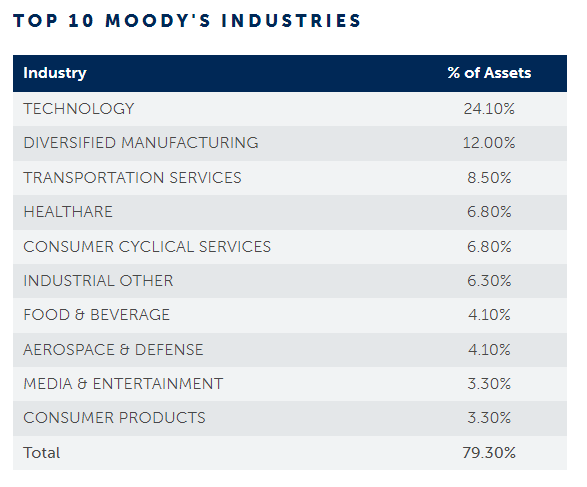

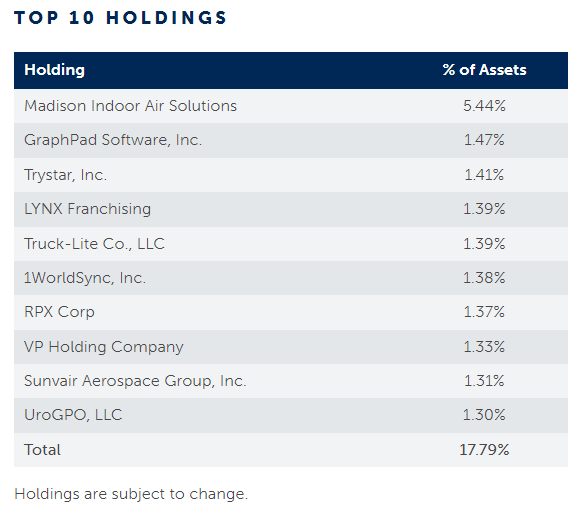

Technology was the top sector in the CEF’s portfolio from a sectoral standpoint:

Top Industries (Fund Fact Sheet)

We can see that by far Technology is the top sector, followed by Diversified Manufacturing. The top 2 sectors account for over a third of the vehicle’s portfolio. The other Industries are much more granular, with weightings coming in below 10% for each sector. The top names in the portfolio were as follows:

Top Holdings (Fund Fact Sheet)

Outside of Madison Indoor Air Solutions which represents more than 5% of the portfolio, no other name breaches a 3% threshold, making the portfolio very granular.

Performance

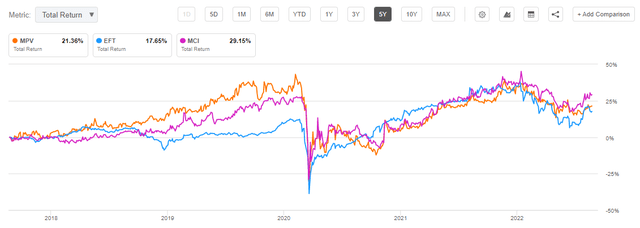

The fund is down approximately -10% year to date:

YTD Total Return (Seeking Alpha)

We can see that MPV slightly underperforms its sister fund Barings Corporate Investors (MCI) but is well ahead of a competitor in Eaton Vance Floating Rate Income Trust (EFT). The picture is similar on a 5-year basis:

5Y Total Return (Seeking Alpha)

We can see that up to 2020, MPV was actually outperforming the much better known MCI fund from Barings.

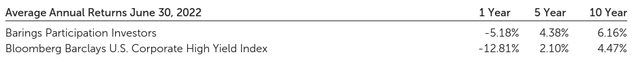

While the fund is well-run and a “steady-Eddy” that outperforms the index long term, do not expect outsized returns here:

Average Annual Returns (Semi-Annual Report)

We can see from the figures posted in the vehicle’s Semi-Annual report as of June 2022 that long-term the fund posts an average annual total return close to its dividend yield of 6.25%.

Premium / Discount to NAV

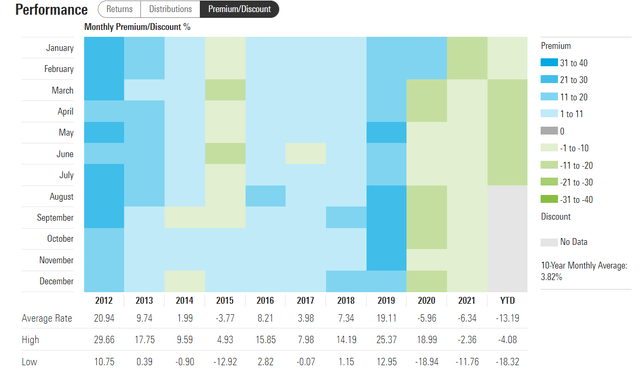

The fund has historically traded at a premium to net asset value:

Premium/Discount to NAV (Morningstar)

We can see from the above table that up to the COVID crisis the fund had been trading at a premium to net asset value. From 2012 up to 2019, the premium averaged 3% to 7%. The COVID meltdown changed everything, with bankruptcy questions swirling for a large swath of the fund’s portfolio – small and middle sized companies had a tougher time to access liquidity during the pandemic, hence the higher probability they would default. The fund never recovered and it is currently trading at a very high discount of -14.72% to net asset value.

Distributions

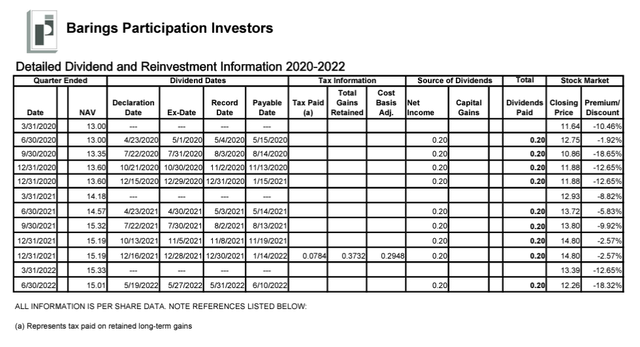

The fund does not play any games and it is run as a pure passthrough vehicle:

Dividend Information (Fund Website)

We can see from the distributions table that all received cash in the past 2 years has been from investment income. This correlates well with the dividend yield that the fund exposes which is consistent with the net cash margin produced by the underlying loans.

Conclusion

Barings Participation Investors is a closed end fund from the Barings platform that exhibits a long-term track record having IPOed in 1988. The vehicle provides investors with access to the privately placed middle market loans space and runs a low leverage ratio of only 11.6%. The fund displays a low standard deviation of 6.86 and a Sharpe ratio above 1 (both measured on a 5-year basis). On a long-term time horizon, the CEF’s annualized total returns tend to equate its current dividend yield of 6.25%, consistent with its primary objective. The fund is a well-run vehicle in the space that is currently trading with a large discount to NAV due to the illiquidity of the underlying collateral and a potential upcoming recession. Investors who are already in the fund can Hold here while new money looking for exposure to the middle market space should buy on dips.

Be the first to comment