sshaw75

The big Canadian banks are different in their own ways. What makes Bank of Nova Scotia (NYSE:BNS)(TSX:BNS:CA), the third-largest by market cap, different?

[Bank of Nova Scotia reports in Canadian dollars, so the figures below are also in C$ unless otherwise noted.]

Other than generating core earnings from Canada, it has also chosen to focus on other geographies, including the United States and the Pacific Alliance region — namely, Mexico, Peru, Chile, and Colombia. While the latter group could experience higher growth, they are also riskier, particularly in today’s high inflation and rising interest rate environment.

That said, the business is solid as its net impaired loans was still low at only 0.36% of loans and acceptances in fiscal Q3. Even when the COVID-19 pandemic was widespread and there were economic shutdowns in 2020, this percentage only averaged 0.52% for fiscal 2020.

In fiscal 2021, Scotiabank generated 68% of its adjusted earnings in Canada, 18% in the Pacific Alliance region, and 7% in the United States. By business segment, it generated 43% of adjusted earnings from Canadian Banking, 21% from Global Banking and Markets, 19% from International Banking, and 17% from Wealth Management.

Profitable and stable growth

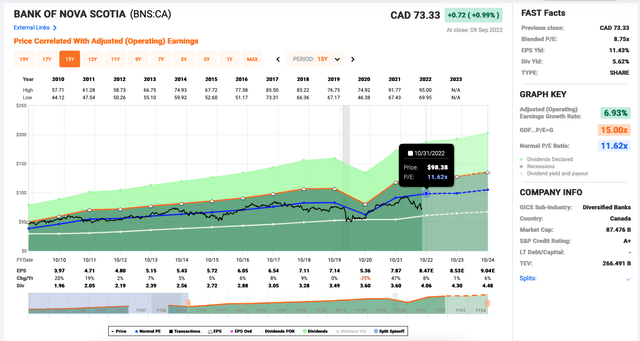

The bank notes that its medium-term objective is for earnings-per-share (“EPS”) growth to be at least 7% and return on equity (“ROE”) to be at least 14%.

Its three-, five-, and 10-year EPS growth rates are 3.4%, 5.4%, and 5.3%, respectively. No period hit the 7% target. Perhaps it’s because the bank has been quite acquisitive, which complicates the business and requires integration costs. Here are its recent acquisitions, listed in its 2021 annual report:

-

Banco Cencosud, Peru (closed 2019)

-

Banco Dominicano del Progreso, Dominican Republic (closed 2019)

-

MD Financial Management, Canada (closed 2018)

-

Jarislowsky, Fraser Limited, Canada (closed 2018)

-

Citibank consumer and small and medium enterprise operations, Colombia (closed 2018)

-

BBVA, Chile (closed 2018)

Similarly, it also costs Scotiabank to close businesses should it find better places to allocate capital. Here are its recent divestitures:

-

Operations in British Virgin Islands (closed 2020)

-

Equity-accounted investment in Thanachart Bank, Thailand (closed 2020)

-

Colfondos AFP, Colombia (closed 2020)

-

Operations in Puerto Rico and USVI (closed 2020)

-

Insurance and banking operations in El Salvador (closed 2020)

-

Banking operations in the Caribbean: Anguilla, Dominica, Grenada, St. Kitts & Nevis, St. Lucia, St. Maarten, St. Vincent & the Grenadines (closed 2019)

-

Insurance and pension operations in the Dominican Republic (closed 2019)

Its divestitures in fiscal 2020 brought in a net gain of C$354 million.

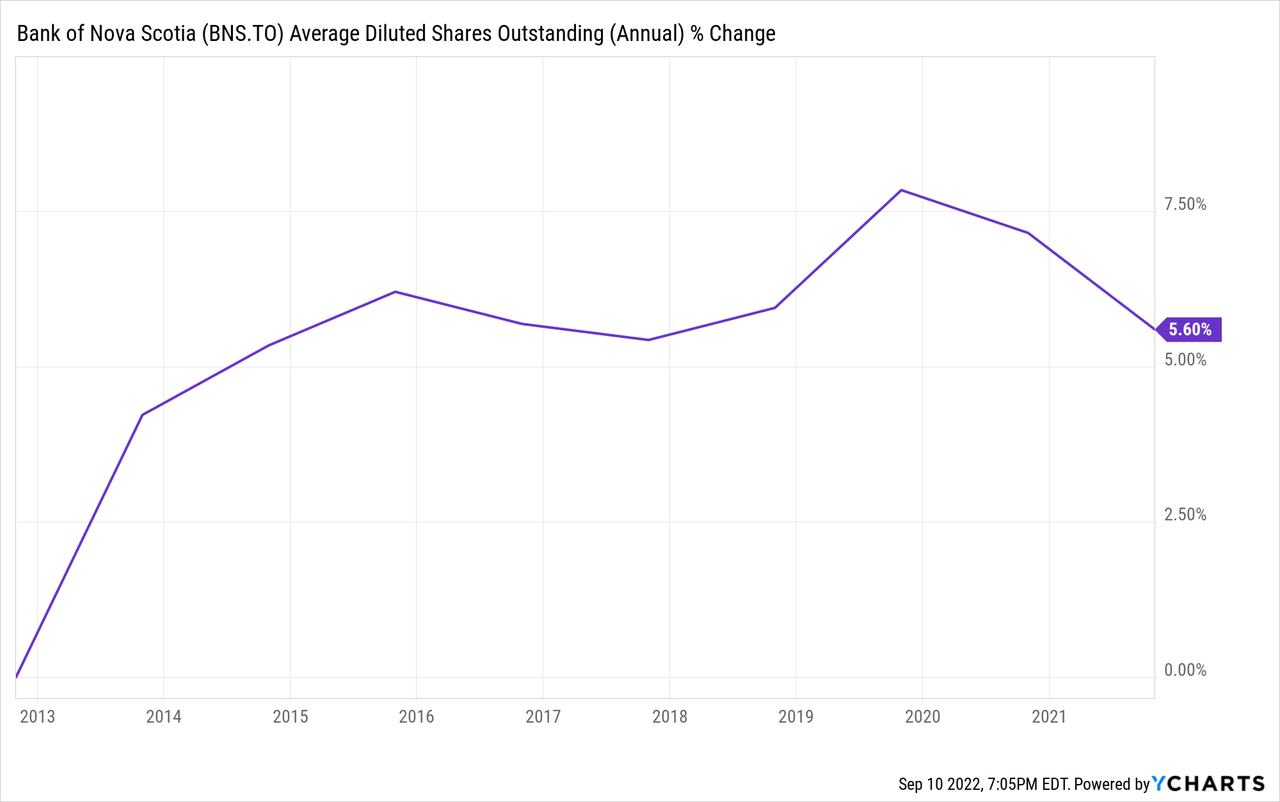

At times, the bank used equity offerings to help make acquisitions, which might have dampened its EPS growth. Even though the bank does repurchase shares, it’s hard to say whether it bought shares at good valuations. Usually businesses buy back shares when they have an abundance of capital, not necessarily when the stock is a good value.

Its three-, five-, and 10-year ROE are 13.1%, 13.5%, and 14.7%, respectively. Its five-year ROE almost reached its target of at least 14%. It did overachieve over the period of a decade.

Although the bank’s EPS growth wasn’t as high as intended and underperformed the Big Five Canadian banks which had an average five-year and 10-year EPS growth rates of approximately 8.9% and 8.0%, respectively, ultimately, BNS stock was still able to deliver stable earnings and dividend growth in the long run, making it a reasonable dividend stock for investment out of a large market of stocks.

BNS Stock for Passive Income

Bank of Nova Scotia has paid a dividend every single year since 1833. It at least maintained its dividend through thick and thin, including around the global financial crisis in 2008 and the COVID-19 pandemic around 2020.

The bank’s trailing-12-month payout ratio of approximately 49% remains healthy. BNS stock could make sense for income investors or retirees who need passive income. At the recent quotation of C$73.33 per share, it offers the highest yield of 5.6% among the big Canadian banks.

The idea for passive income suggests no work needs to be done. Indeed, little work is required of investors to get passive income from the stable bank stock. You only need to purchase and sit on BNS shares to start collecting passive income. For a little more work, investors could aim to buy it for a higher yield when it’s undervalued.

Currently, BNS stock trades at a decent discount of about 25% from its long-term normal valuation of about 11.6. We don’t doubt that it could eventually trade at 11.6 times earnings again when economic conditions become favourable.

Conclusion

All told, Bank of Nova Scotia stock compensates investors with a higher yield than its other big Canadian bank peers for its underperformance in recent years.

With a focus on the core markets of Canada, the U.S., Mexico, Peru, Chile, and Colombia now, it’s a good mix of stability and growth, which could lead to higher earnings growth potentially at its target rate of 7% over the next 10 years.

Particularly, income investors, including retirees, who eye passive income may be interested in the stable bank stock that pays out a safe yield of 5.6% — a dividend that’s set to grow.

Notably, U.S. investors may get a 15% withholding tax on the Canadian dividend unless shares are held in their retirement account.

Be the first to comment