JHVEPhoto

Dear readers,

I’ve written about Bank of Montreal (NYSE:BMO) a few times over the past years since I’ve been an active contributor on SA. I’ve held positions in the bank a few times during that time as well, though I’ve often favored other Canadian banks above BMO.

However, with the situation the way it currently is, I now believe we have an upside to consider for Bank of Montreal – and that upside is pretty decent, especially compared to historical upsides.

Let me show you what I mean.

Bank of Montreal – updating on this bank

In my last article, I made it clear that it was time to “BUY” more BMO. Now, since that time, the bank is down 4.5%, including dividends, but this is only a marginal change which only puts the bank, as I see it, at a greater upside.

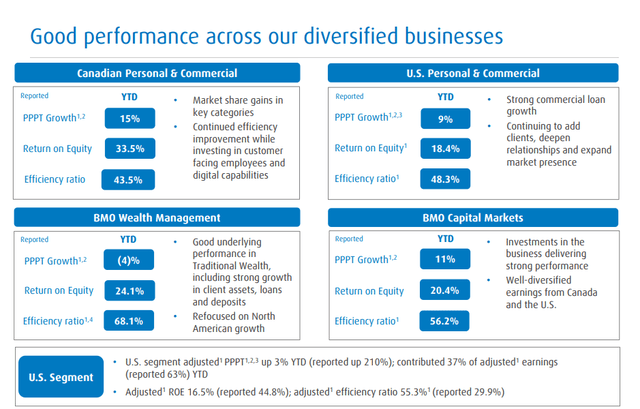

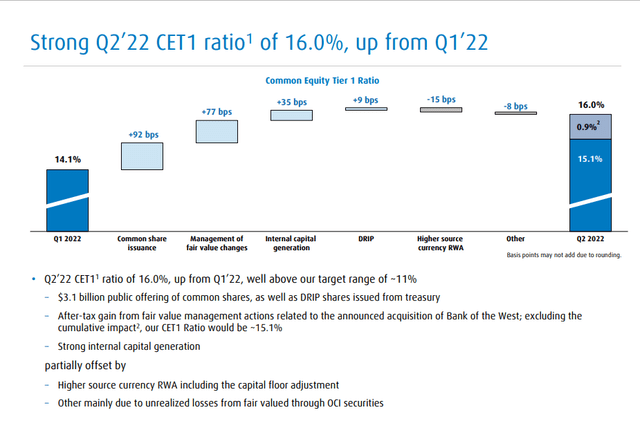

Ending 2021 well, the company has since reported the initial period of 2022 as well as 2Q22. This period, like 1Q22, came in at appealing levels, seeing good income, EPS, efficiency, RoE, and fundamentals, including retaining a 14%+ CET1 ratio.

Like in 1Q22, the 2Q22 results saw improvements, with adjusted EPS of $3.23 and pretax earnings growth on a YoY basis of 6%. This comes to a 12% YTD increase, driven not only by a good backdrop but strong revenue growth coupled with expert expense management. That’s also why the bank felt comfortable increasing the dividend 5% QoQ, and 31% YoY, driving the current yield up.

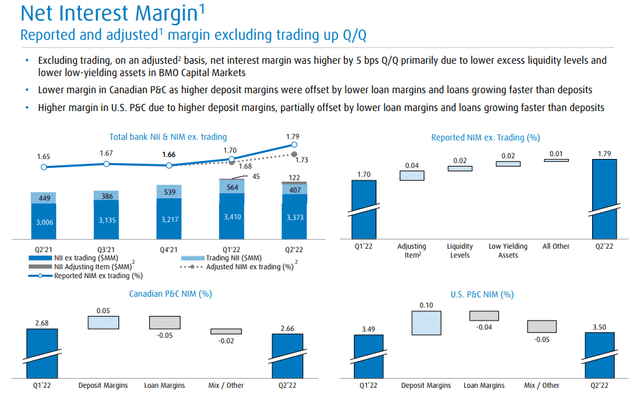

BMO is a bank – which means that technically speaking, impacts to its NII and overall interest rate adjustments in the upward direction are actually positive for BMO. Banks and financial companies, unlike some other companies, tend to do very well in rising interest rate environments, provided that they’re well-structured and conservatively managed.

BMO certainly is that – and its continued YTD RoE of 17.2% up from a YoY number continues to show the bank becoming more and more positive as an investment.

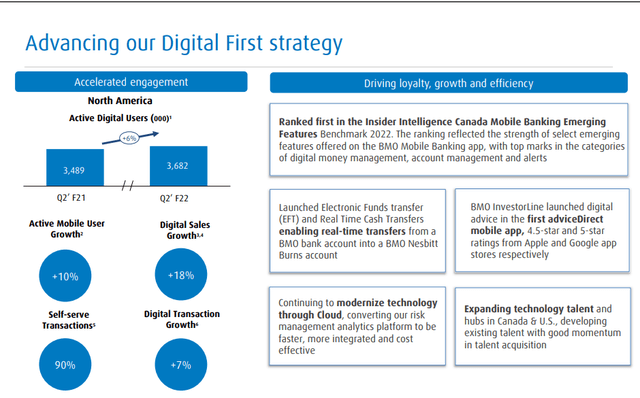

With Canadian pandemic restrictions lifted, the economy is back to growth, and BMO’s customers and businesses continue to adapt. BMO saw double-digit commercial loan growth in both US and Canada, and it’s also getting an advantage from its already-broad commercial presents, attracting new clients.

BMO has strong operations in the US – stronger than some American banks, with operations across the Midwest, the western coast, Texas, Florida, and others. These segments posted very promising results, and the bank is now #11 in commercial lending with a #3 deposit market share in core footprints, such as Chicago and Milwaukee. Growth is also strong here, and over 50% of the company’s revenue comes from areas that are outside of the overall core footprint of the company’s businesses.

The M&A will accelerate NA growth, and the bank has already filed for regulatory approval, with expectations of $670M worth of cost synergies on a pre-tax basis.

The company’s fundamentals remain extremely strong. An over 200-year history started back in 1817, and the 8th-largest bank in NA in terms of assets, serving 12 million customers on an annual basis means that this is one of the more significant Canadian banks to invest in. My stance towards the banks – BMO, Scotiabank (BNS), and CIBC (CM) as well as others is positive. I own shares in all of them, and I buy more when valuation allows for this.

Again, like with my last article, very little fundamentally has changed for the bank. With recent M&As and consistently positive results, it’s easy to see that BMO will be moving upward here, even if there are things to keep in mind.

The M&A of BoTW adds an FV impact to the company’s balance sheet but calculating these can be somewhat tricky given their relative sensitivity to overall interest rates. This will also impact the amount of goodwill, and therefore, company capital. Higher interest rates mean higher goodwill due to lower fair value of the fixed-rate assets, which will increase BMO’s capital requirements. However, this is then balanced with ongoing customer deposit increase and commercial growth, which is solid and ongoing.

As mentioned, impaired loans are back to near pre-pandemic levels. This is unchanged as well, with the overall bank loan portfolio being very high quality, and one of the best in the Canadian banking industry, with 45% consumer loans spread between mortgages, cards, and personal loans, and 55% government/business loans, with only very marginal (1%) exposures to Oil & Gas. The highest exposures here are financials, service industries, real estate, manufacturing, and other relatively conservative sectors.

BMO has some interest rate sensitivity, meaning that a 100 bps interest rate increase results in a total $635M worth of Pre-Tax earnings (Canadian dollars). Term rates are already up, and reinvestment rates are up at the highest level in several years.

The company’s non-interest-related revenue rate is at the very least close to stable, and non-interest expenses are only up slightly, with the bank’s efficiency ratio continuing to see very strong numbers despite the overall impacts. This is, among other things, related to lower employee costs.

The company has yet further improved its CET-1 ratio, an important factor going into the current macro.

The aforementioned M&A is moving forward, and BMO will have to work more with regulators and community organizations to make sure that closing readiness is there, as well as finalize the integration plan. BMO currently expects the M&A to be finished by the end of 2022.

All in all, 2Q22 was yet another positive milestone for BMO, and another quarter of positive growth, as evidenced by yet further dividend growth and continued positive expectations for the next few quarters.

Let’s look at how this impacts the valuation.

Bank of Montreal Valuation

We’re moving into an environment where valuations for quality banks like BMO are falling. This provides us with buying opportunities of the highest order, both during and following a potential crash. We’ve seen plenty of decline thus far, and we might see more going forward.

We’re going to be using the Canadian ticker for BMO here, as it provides a bit more accuracy in terms of yield and historicals. All dollar amounts in the valuation segments are CAD.

The bank is currently trading at a valuation below 9.6x. For a business that typically trades at 9.5-11x, that marks a decent amount of undervaluation, especially when considering that this bank is A+ rated.

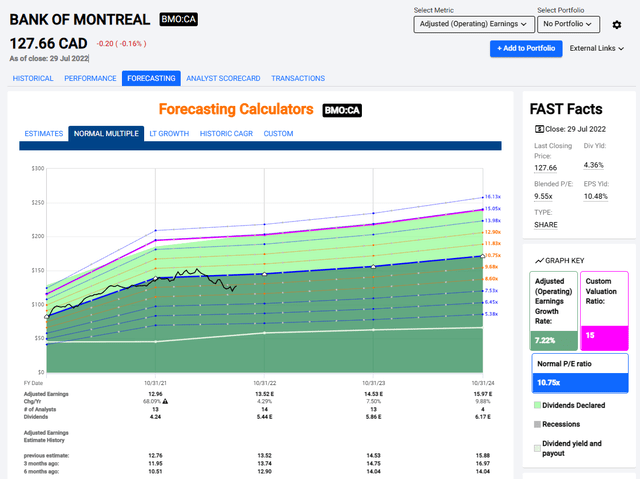

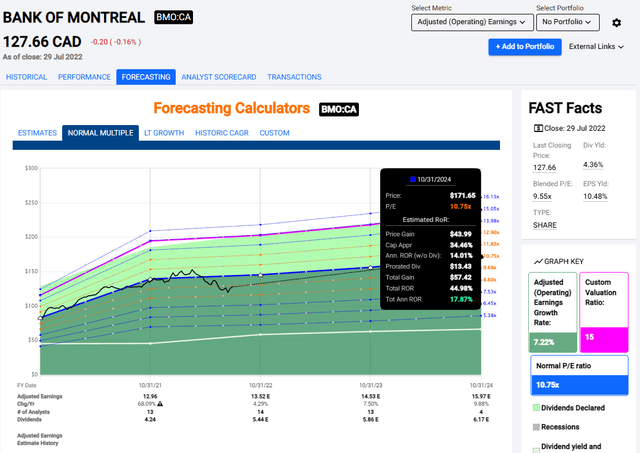

BMO Valuation (F.A.S.T Graphs)

BMO is certainly attractive here. The company typically trades at average valuations of between 9.5-11X P/E, with a current P/E of 9.55x.

Based on the exact 5-year average of 10.75X, this implies a slight upside to 2022E, and a larger upside to 2024E of close to 18% annualized, based on significant forecasted EPS growth on the back of the increased business volume and positive rate trends.

As you can see, the upside is significantly higher than just 7-9% annually at this point in time. This is an A+ rated bank with a 4.3%+ yield. It is one of the lower yields in the Canadian banking sector, but it’s also one of the safer banks in terms of portfolio diversification, US market exposure, and expected earnings growth during the next few years, as well as the historical accuracy of these growth numbers.

S&P Global gives BMO a good upside here, based on this expected growth. The current target averages for BMO range from a low of $142, significantly above the current price. The high is $160, with the PT average coming in at $154 based on 15 analysts, 12 of which have a “BUY” or an “outperform” rating, coming to an overall upside of 20% at this time.

BMO isn’t going anywhere. This is a safe, covered yield, backed by an essential banking oligopoly in one of the safest nations on earth.

To my mind, BMO will perform more or less as expected.

The resulting upside should cause your portfolio to at least perform in line with market expectations, growing 10-16% annually. It also has the capacity to outperform more, coming to 20-22% annually, if things go to historical highs.

But it usually doesn’t go far beyond this – not historically.

So, BMO is a safe bet. These are the sort of safe bets that we currently need and want. Because, as I’m watching the market go up and down, this is a pretty scary market we’re currently in.

I consider BMO a “BUY” with a $140/share price for the NYSE-listed ticker BMO on the basis of a 2024E forecast, and a $155 native CAD target for the TSX ticker BMO.

Thesis

My thesis for BMO is as follows:

- The bank is a great, class-leading bank in a national oligopoly (essentially) with fundamental safeties that have performed extremely well during the pandemic and has incredible recovery tailwinds, which are currently playing out and are likely to continue to do so.

- Investors in BMO can count on long-term safety for their invested capital, coupled with fair returns with a yield above 4.3% today.

- The upside inclusive of capital appreciation is now more than 15% on a conservative basis. I consider this company to be a “BUY” with a $155/share PT for the native Canadian ticker.

The bank also fulfills every last one of my investment criteria.

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has realistic upside based on earnings growth or multiple expansion/reversion.

Based on such trends, current earnings, and forecasted EPS growth of 55% in 2022, I consider BMO a “BUY” with an upside of at least 10-18% this year, potentially more in a 3-year period.

Thank you for reading.

Be the first to comment