Felipe Brayner

Quality is never an accident. – John Ruskin

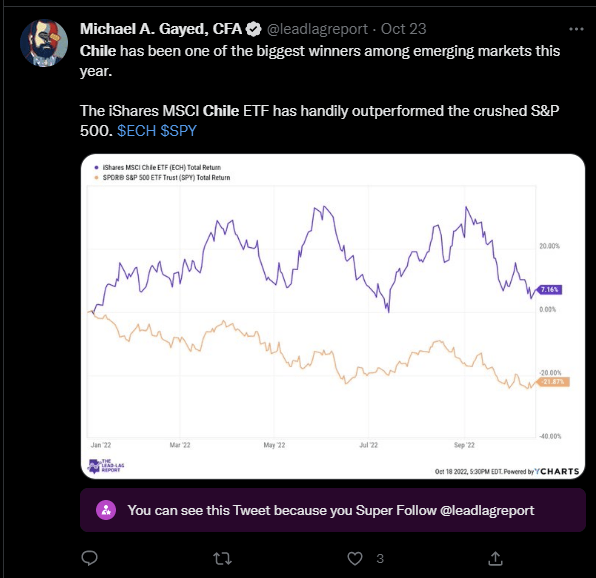

In 2022, emerging markets performance has been a mixed bag, and rarely has there been a period when all the EM sub-segments have come together. One of the regions that have held up pretty well – in what has been a difficult environment for risk assets – is the Chilean equity space; as noted in some content shared with the Super followers of The Lead-Lag Report, Chilean equities have proven to be a very handsome source of returns for those rotating away from American equities.

Twitter

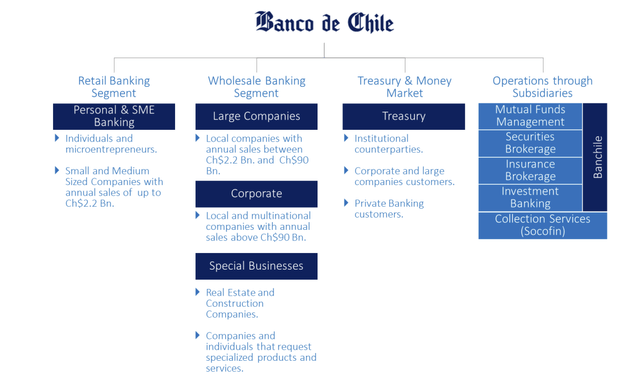

The stock I’m about to cover today – Banco de Chile (NYSE:BCH), is an integral component of the iShares MSCI Chile Capped ETF (ECH), accounting for 11% of the total portfolio (the second-largest weight). Banco de Chile is a diversified full-service institution that offers a range of lending and non-lending products to different segments of the Chilean market. The traditional operations of banking are carried out by BCH whilst non-banking specialized services such as mutual fund management, securities brokerage, investment banking, insurance brokerage, and collection services are carried out by BCH’s subsidiaries and affiliates.

Given that the BCH stock has already delivered relatively handsome returns this year (+21% YTD), it is questionable if you’ll see further outsized gains. Nonetheless, rather than speculating over that, here are a few narratives that could help prospective investors better understand this business.

Important narratives

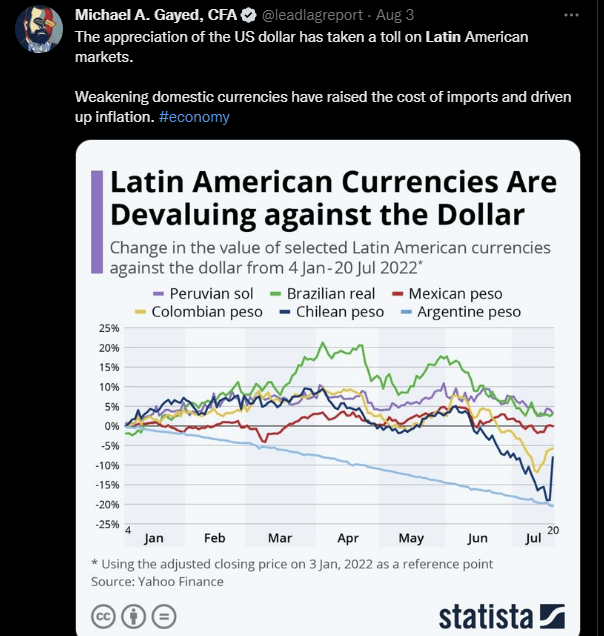

Inflation has been an omnipresent phenomenon for most regions across the globe, and Chile is no exception to this. Annual inflation is currently at a whopping 14% and this has prompted the central bank to lift rates to levels of 11.25%. What investors need to note is that a lot of this inflation in Chile is trade-related; as noted in The Lead-Lag Report, the Chilean Peso amongst other Latam-based currencies has lost its vigor against the dollar, and this has only raised the import bill for Chile even further. The weakness has persisted despite the Chilean central bank making a $25bn intervention in the market at the start of H2.

Twitter

Regardless of that, for BCH so far, this heightened inflation phenomenon has worked relatively well. It’s important to note that there’s a great deal of inflation indexing in the Chilean economy, where financial institutions typically match their UF-indexed liabilities with UF-indexed assets. This has translated into pretty robust NIMs for BCH. All in all, by the end of FY22, BCH management thinks that NIMs for the bank could hover around an elevated level of 5.3%.

In addition to strong NIMs, also note the impact of the depreciating peso on BCH’s commercial loan portfolio, which is the largest loan segment, contributing 56% of the total loan book (the other two segments are residential mortgages and consumer loans). The weaker Peso has emboldened Chilean exporters’ competitive position, and they have been taking on a greater share of trade finance loans (which were up by a whopping 46% in Q3). The greater volume of trade finance loans has also boosted the volume of fee income associated with this.

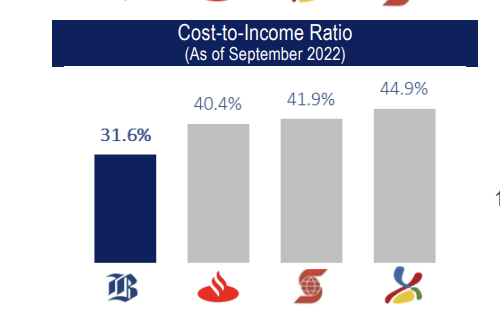

To run a successful bank, catering to more than 2 million customers, it is also important to get your cost base right, and I believe BCH has done a great job here in the face of steep inflation. To get a sense of BCH’s efficiency in managing costs, we can consider the cost-to-income ratio of the bank (this measures the level of OPEX as a function of both net interest income and non-interest income; the lower, the better). Compared to its largest peers, BCH’s cost-to-income ratio of 31.6% is at a much lower level, than its closest competitors including Banco Santander-Chile (BSAC) which is the other major Chilean bank that American-based investors can pursue.

BCH

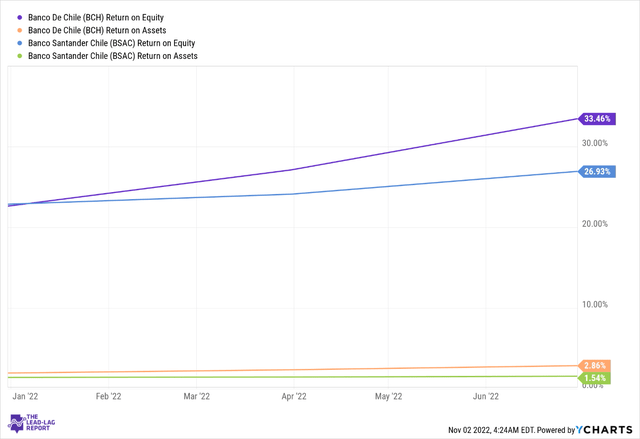

Investors should also be mindful of the relatively strong return differentials between these two banks. BCH’s ROE is a good 650bps higher than BSAC, but some of you may argue that ROEs can often be bloated if the bank decides to aggressively lever-up on a low equity base (which does not reflect well on the risk management of the bank). To counter this, I’d urge you to also consider the ROA metric, which gives you a sense of the quality of returns on the asset book per se. Note that, in this case, BCH’s figure is almost twice as much as BSAC.

Conclusion

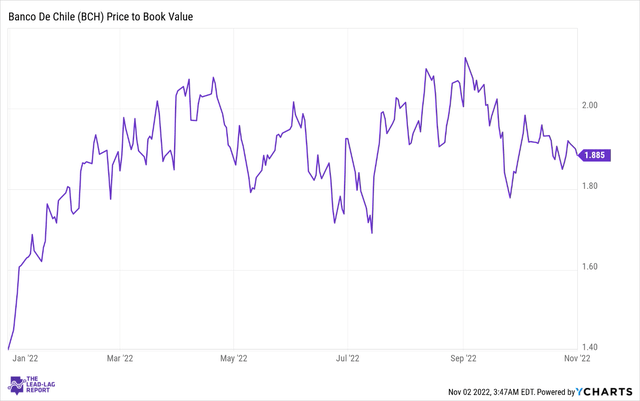

Despite the rise in the stock price this year, BCH still appears to offer decent value at current levels. In the previous section, I touched upon the high quality of BCH’s assets, as captured by the superior ROA metric. Well, that high-quality book can still be picked up at a discount to its long-term average. The stock currently trades at a P/BV of 1.89x, which is still 20% lower than the long-term average of 2.37x.

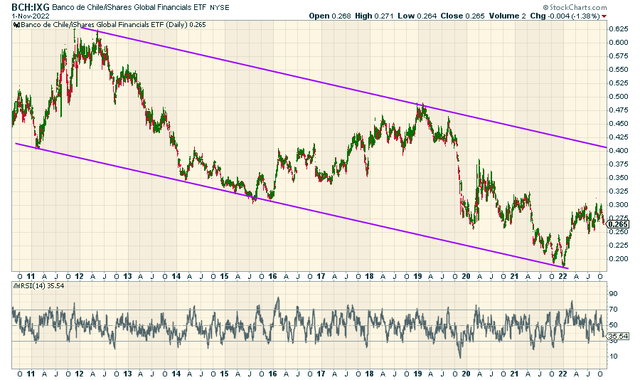

In addition to that, a chart capturing the strength of BCH and its financial peers from across the globe also shows that the stock is well-positioned to see further upside.

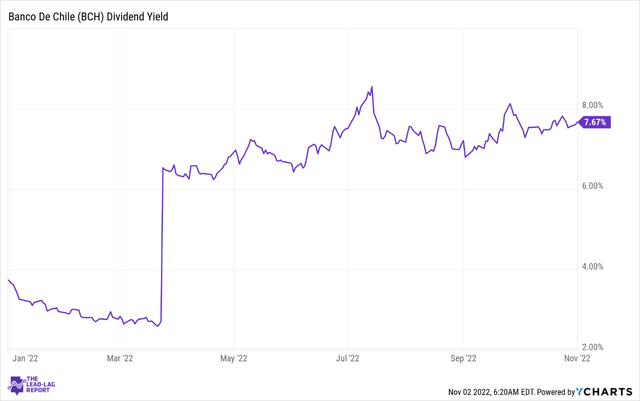

Even if you remain skeptical about the prospect of further outsized gains at these levels, I think there’s something to be said about a near 8% dividend yield, which is almost twice as much as you’d typically get from BCH. The elevated yield could help assuage the impact of any drastic drawdowns when sentiment towards risk assets shifts again.

Twitter

As noted in my paywalled research, volatility in the bond market has dissipated in recent weeks, and the growing appetite for long-dated bonds may signal that risk-off conditions aren’t too far away.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Be the first to comment