daboost/iStock via Getty Images

Introduction

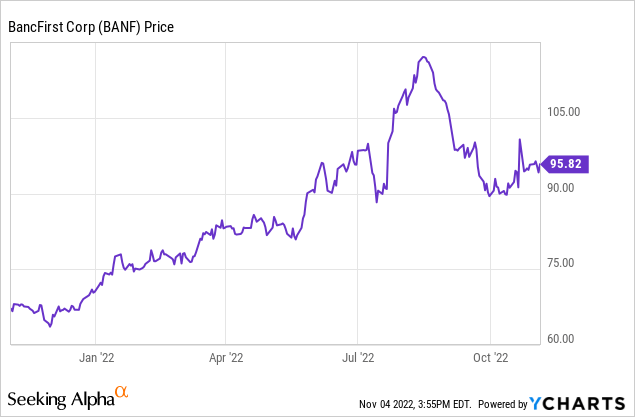

BancFirst (NASDAQ:BANF) is a bank operating in Oklahoma (108 locations) and Texas (three locations). Although its share price has come down since this summer, the stock is still trading at a very large premium to the book value and tangible book value so I wanted to dig into the financial results to see if such a large premium is warranted. I also had a look at the preferred securities which are backed by subordinated debt.

A solid set of results in Q3

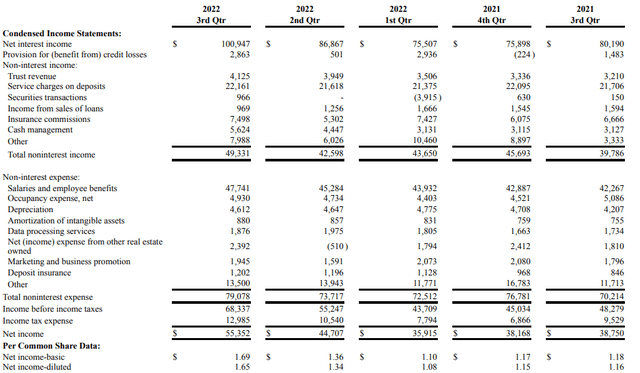

BancFirst saw its net interest income expand in the third quarter of this year to the highest level in several years thanks to a net interest margin expansion. And as the net non-interest expenses came in at approximately $30M and the provision for credit losses was just under $3M, the pre-tax income for the quarter was a very respectable $68.3M.

BancFirst Investor Relations

The net income came in at $55.4M which represents approximately $1.69 per share. This brings the 9M 2022 earnings to $4.15 per share and the full-year EPS will likely come in close to $5.5-5.75 per share. This could and should pave the way to generate north of $6/share in earnings in 2023. That seems to be realistic, as long as the quarterly loan loss provisions remain below $10M per quarter.

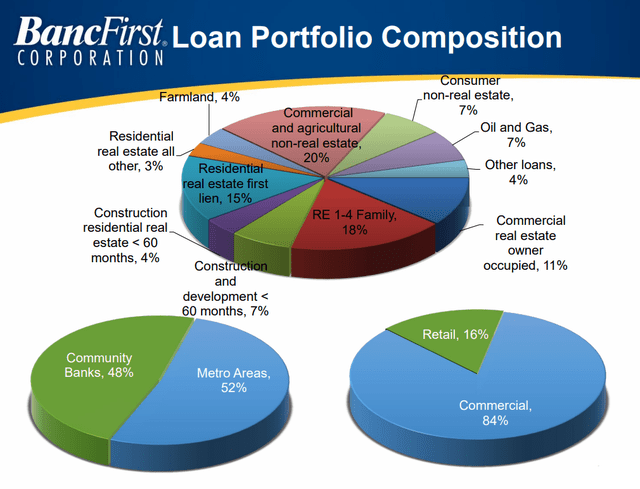

That shouldn’t be a hard task considering the total amount of non-performing and restructured loans stood at $17.4M as of the end of September. Not only is this just a fraction of the $12.45B in total assets, the bank also has a total loan loss provision of almost $90M (and increasing). This means that even if all the non-performing and non-accrual loans are a total write-off (which is unlikely as there will always be some collateral that could be collected), the total amount of provisions can easily and immediately absorb those losses. Of course, now the economic situation is getting a bit trickier we can likely expect more loans to fall behind on payments, but BancFirst can easily increase its quarterly loan loss provisions without having a major impact on the bottom line.

BancFirst Investor Relations

As of the end of September, BancFirst had $992M in tangible equity and divided over the 32.9M share, the tangible book value per share is approximately $30.20. While that’s the highest it has been since the end of last year (the TBV per share in the previous two quarters was just $29.51 in Q1 and $29.90 in Q2), this means the bank is still trading at in excess of three times the tangible book value, and that’s just too high for me.

The preferred securities are not a risk I’m willing to take

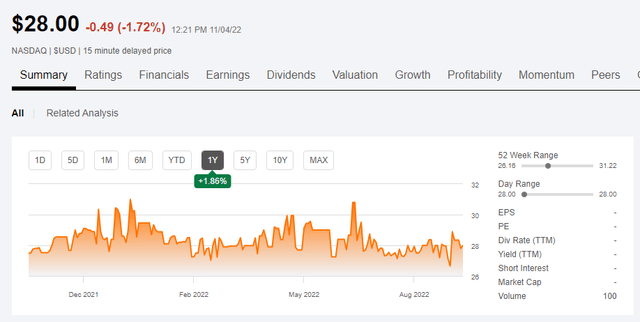

BancFirst also has a series of preferred securities outstanding. We shouldn’t really say these are preferred ‘shares’ as these securities, trading as (NASDAQ:BANFP) are backed by a subordinated note, maturing in 2034. The note and the preferred securities have the same yield: 7.2%. The principal value of the preferred security is $25 and the $1.80 in annual distributions are paid in four equal quarterly tranches of $0.45.

Seeking Alpha

The interesting element about these securities is that 1) they have an end date: the securities will be redeemed on March 31, 2034, and 2) they are callable at any given moment for $25/security. They have been callable since March 2009 and the simple fact they haven’t been called yet during the past decade may further reinforce the belief these securities remain outstanding until they are redeemed in 2034, but that’s quite an aggressive assumption.

Any earlier redemption date before 2034 will hurt the total return. Assuming the securities will be redeemed upon maturity in 2034, the yield to maturity is just 5.76%. A YTM of 5.76% on what essentially are subordinated debt just isn’t appealing enough for me. And it gets worse if the securities are called before the 2034 maturity date. Should they be called in March 2030 for instance, the yield to call drops to approximately 5.24%. That’s for instance less than the debentures of Crown Holdings which are currently yielding approximately 6.8%.

Investment thesis

While BancFirst’s financial results are satisfying, I’m not sure why I would pay almost three times the tangible book value for the bank’s shares. I also had a look at the preferred shares to see if those could perhaps be more interesting from an income perspective but a yield to maturity of 5.76% for a period of 12 years just isn’t interesting enough for me. I’d rather own the First Internet Bancorp 6% debt which could be called in 2024 for a YTC of in excess of 10%. Should the security not be called, the interest rate will increase to in excess of 8% (based on the SOFR rate) in which case the YTM in 2029 would exceed 8%.

While I appreciate BancFirst’s financial performance, I’m currently not interested in either the common shares of the preferred securities as I don’t want to pay 15 times earnings and three times the tangible book value for the common shares, while I can get better yields on the bond market compared to the yield offered by the preferred securities.

Be the first to comment