Andrei Akushevich/iStock via Getty Images

The modern era is incredibly complex. There are many working parts, ranging from large pieces of machinery to small gadgets, that all require some form of power in order to function. One company that’s dedicated to helping address the power needs for certain market segments is Ballard Power Systems (NASDAQ:BLDP). For years, this enterprise has struggled to gain traction from a revenue perspective. This comes even as management has embarked on a number of transactions aimed at achieving growth in some way or another. To make matters worse, profitability for the company has gotten really bad in recent years, making the years leading up to this look good by comparison. The good news for investors is that the firm does have a significant amount of cash on hand, leaving it with a great deal of time that it can burn through that capital prior to facing any real risk of failure. But given the way that things are going, shares may not be the best to consider at this time.

A niche power play

According to the management team at Ballard Power Systems, the company’s primary aim is to design, develop, produce, and sell and service its proton exchange membrane fuel cell and related products. For context, a fuel cell is a device that combines hydrogen fuel with oxygen that is extracted from the air in order to produce electricity. The hydrogen fuel in question can be obtained from a number of resources, such as natural gas, kerosene, methanol, or hydrogen carbon fuels. It can even be taken from water through the electrolysis process. The end goal here is to create a fuel cell that can deliver relatively clean and more or less infinite energy for the foreseeable future.

The management team at Ballard Power Systems claims that they are fuel cell products feature high fuel efficiency, low operating temperature, low noise, and low vibration. They are generally compact in size and can be flexible when there are rapid changes in electrical demand and modular size. The company’s secret sauce is a stack of unit cells that are designed by its own proprietary technology that, in turn, includes membrane electrode assemblies, catalysts, plates, and other related components. Over the years, Ballard Power Systems has focused on making a number of transactions aimed at improving its chance of success. Most recently, for instance, back in November of last year, it announced the acquisition of Arcola Energy, a UK-based systems engineering company that specializes in hydrogen fuel cell powertrain and vehicle systems integration. Total consideration there could be up to $40 million over the next few years. Just one month prior to that, the company announced the signing of a memorandum of understanding for a strategic partnership with Forsee Power with the end goal of developing a fully integrated fuel cell and battery solution that’s focused on heavy-duty hydrogen mobility applications. A search of the company’s financial statements will also reveal a number of similar deals and transactions in recent years.

Although the company seems to have its hands in a number of things, including some operations that are located overseas, its primary focus is what management calls its Fuel Cell Products and Services segment. This unit consists of the sale and service of its proton exchange membrane fuel cell products for the heavy-duty motive, and material handling and stationary power generation Power products markets. The heavy-duty motive space consists of bus, truck, rail, and marine applications. Meanwhile, the material handling and stationary power generation category is more centered around industrial vehicles like forklifts, automated guided vehicles, and ground support equipment, as well as offering backup power products for organizations like data centers. The company also has a Technology Solutions unit that provides customized, bundled technology solutions, largely centered around managing difficult technical and business challenges in a customer’s proton exchange membrane fuel cell program.

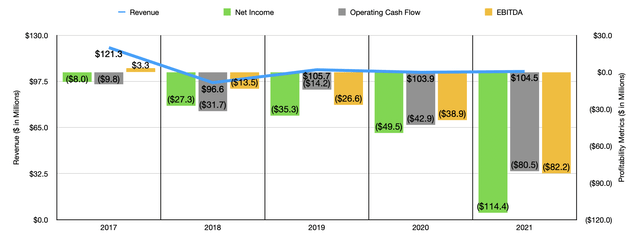

You would expect a company that is on the cutting edge of technology to be growing at a nice pace. But that has not been the case here. Between 2017 and 2021, revenue has remained in a fairly narrow range of between $96.6 million and $121.3 million. No clear trend is visible here. This alone might be fine if it weren’t for the fact that profitability is getting worse by the year. The company went from generating a net loss of $8 million in 2017 to a loss of $114.4 million in 2021. Other profitability metrics have performed similarly. Operating cash flow went from a negative $9.8 million to a negative $80.5 million. Meanwhile, EBITDA worsened as well, turning from a positive $3.3 million to a negative $82.2 million.

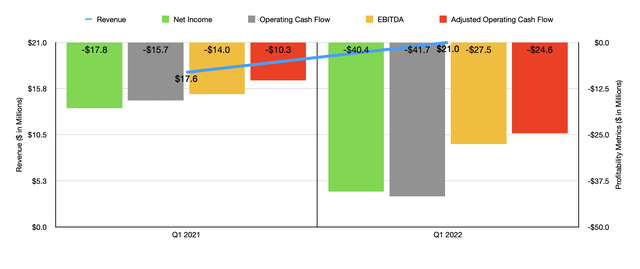

When it comes to the current fiscal year, things are not looking much better. Revenue rose in the latest quarter, coming in at $21 million. That compares to the $17.6 million generated in the first quarter of 2021. However, the company’s net loss has widened from $17.8 million to $40.4 million. This took the loss per share from $0.06 to $0.14. The operating cash flow of the company went from negative $15.7 million to negative $41.7 million. Meanwhile, the EBITDA for the firm turned from negative $14 million to negative $27.5 million. The company does have a chance to finally prove the skeptics wrong when the business reports financial results for the second quarter. But if analysts are correct, things aren’t likely to get much better. The current expectation is for the company to generate revenue of around $24.2 million. That would actually be down from the $25 million reported one year earlier. Meanwhile, the company’s net loss should be around $0.12 per share. That stacks up against the $0.07 per share loss, totaling $21.9 million, scene in the second quarter of 2021. It’s also likely that other profitability metrics will worsen. After all, the operating cash flow for the company was negative by $33.5 million in the second quarter of last year, while its EBITDA is negative by $19.7 million.

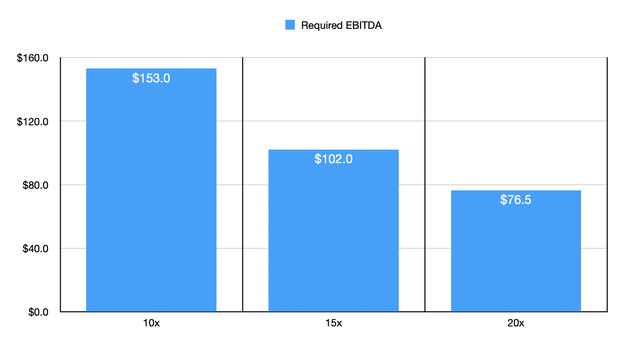

Given the profitability situation of the company, we cannot really value it per se. What we can do, however, if see what kind of profitability would be needed to justify a certain trading multiple. Given that the business has $1.07 billion in cash on hand and no debt, the metric we should probably use is the EV to EBITDA. If we were to assume that an appropriate value for the company is a multiple of 10 over its EBITDA, this would require EBITDA of $153 million. This is most certainly greater than the revenue the company is generating for the year. If we change the multiple to 15, EBITDA would still need to come in at $102 million, while a multiple of 20 would push us down to $76.5 million. But that’s still an astronomical amount for a company like Ballard Power Systems today.

Takeaway

Moving forward, I will say I am not looking at Ballard Power Systems in a very positive light. The near-term risk for shareholders is certainly low because of the excess cash the business has. However, if the passage is any indication of the future, things are looking pretty bleak. With revenue not really growing and profitability worsening, I have no choice but to rate the business a ‘sell’ for now.

Be the first to comment