Richard Drury

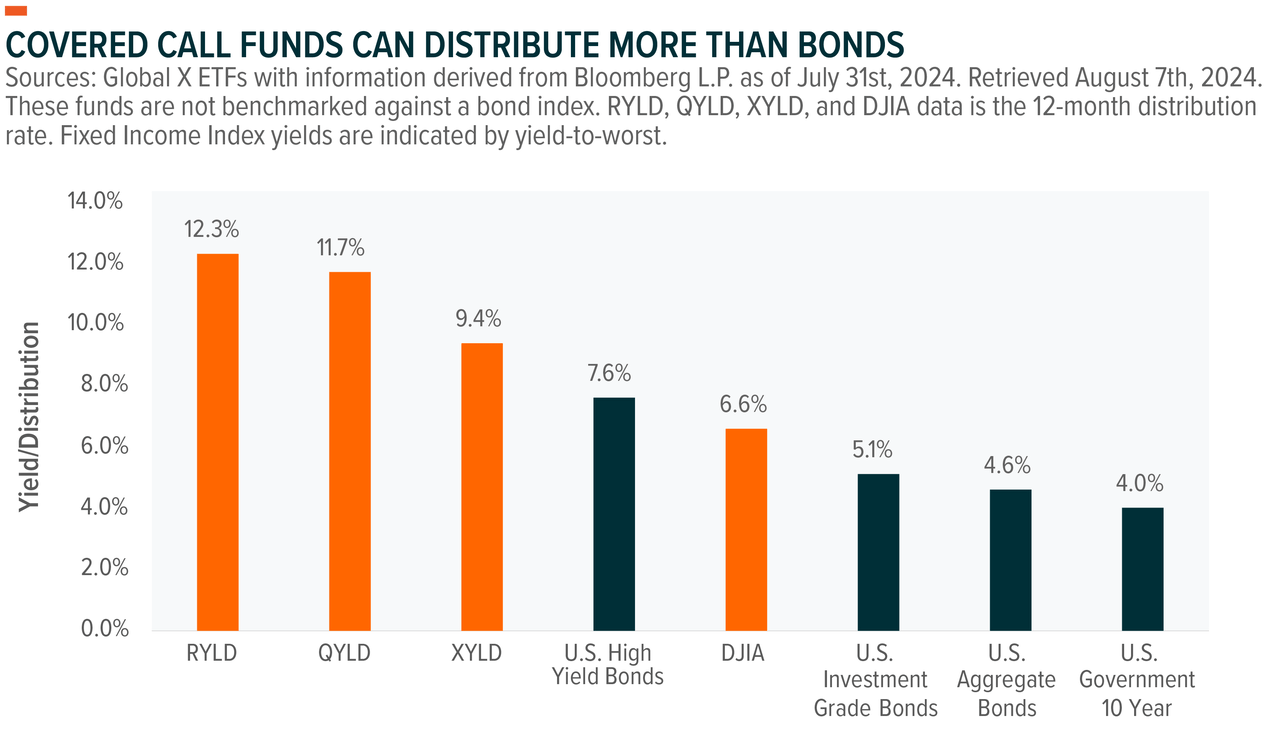

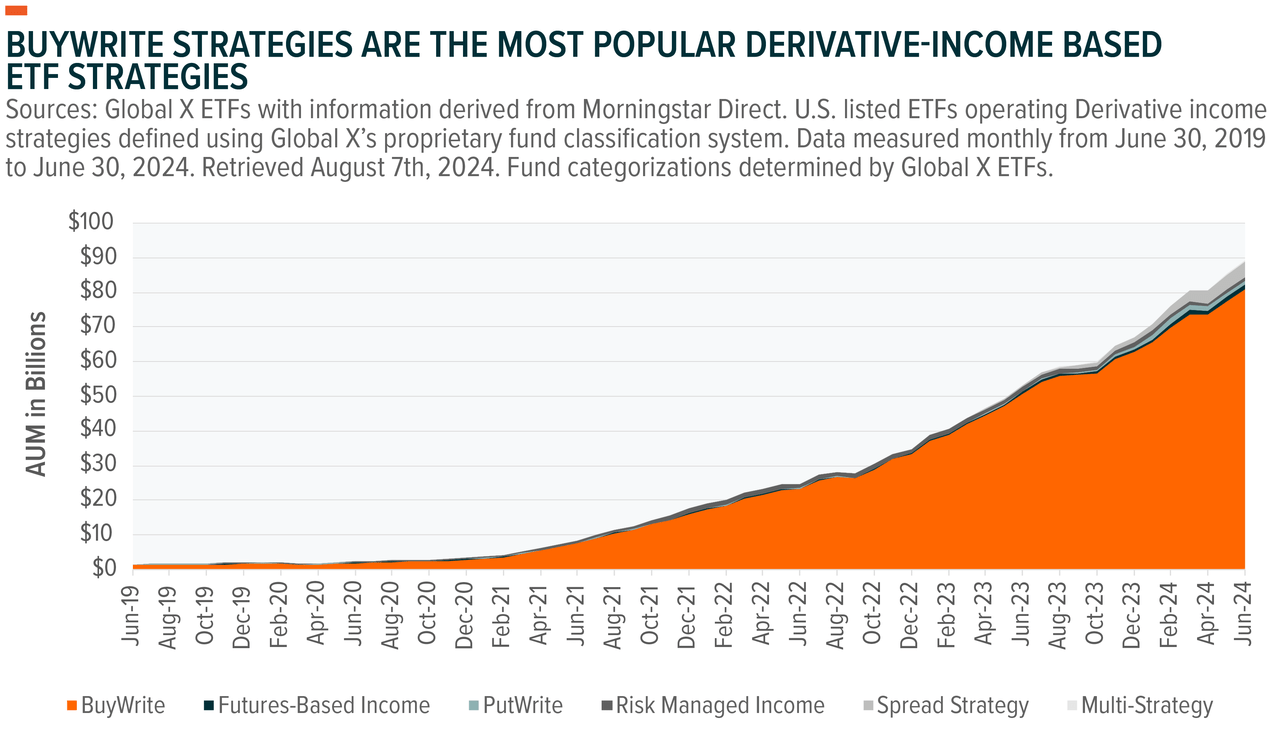

Income opportunities are in the limelight with the first half of 2024 bringing about a series of new all-time highs for the major U.S. equity indices. Indeed, tumultuous markets in recent years are one reason for solid flows into bond funds, and market dynamics seemingly position these instruments to gain value over the near term. It’s important, however, to examine this growth narrative. In many cases, writing covered calls can be a suitable alternative to fixed income, as these strategies seek to produce current income while potentially helping to mitigate the impact of downside movements across an equity portfolio.

Key Takeaways

- The long-dormant bond market has seemingly reawakened, but even with the support of elevated interest rates, the yield potential offered by bond strategies may be surpassed by writing covered calls.

- The path to coupon income and bond price appreciation by way of interest rate cuts may not be as clear-cut as some investors anticipate.

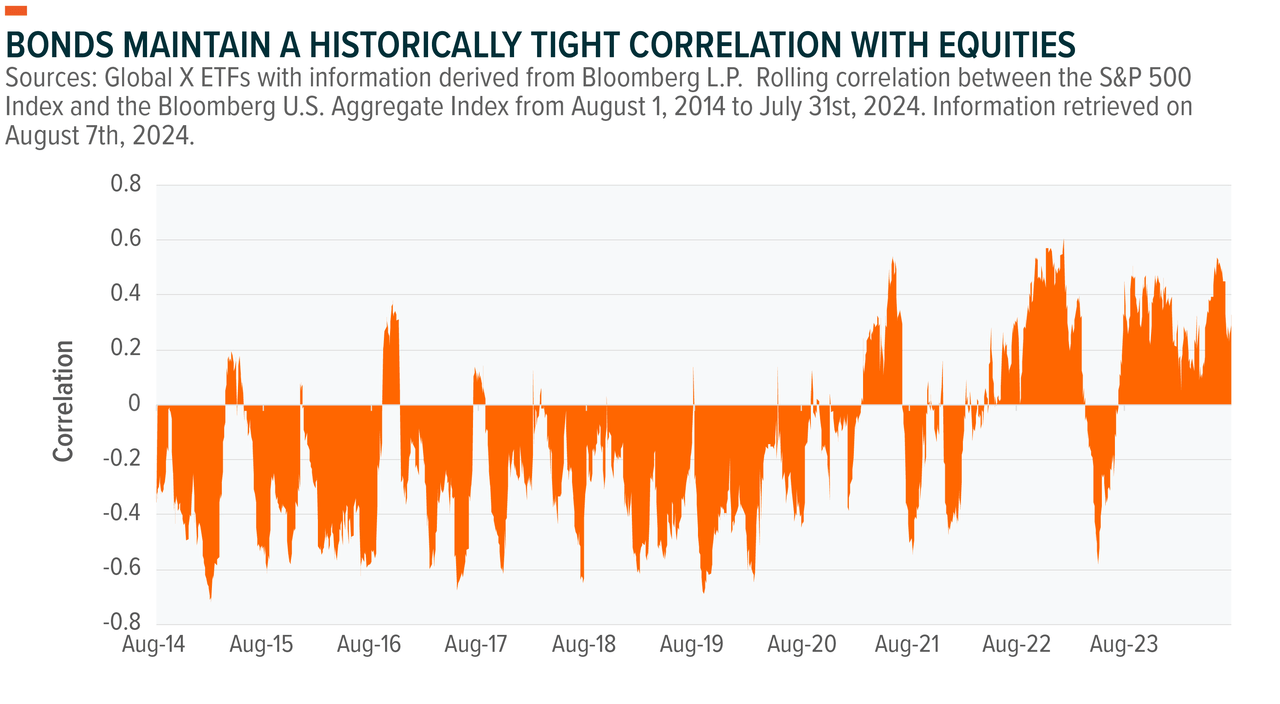

- Historically, a loose correlation between bonds and equities has made debt instruments adequate portfolio diversifiers. In the current environment, however, monetizing volatility may be the more effective means by which to pursue diversification.

Bond Yields Are Back, but They May Not Be as Competitive as They Seem

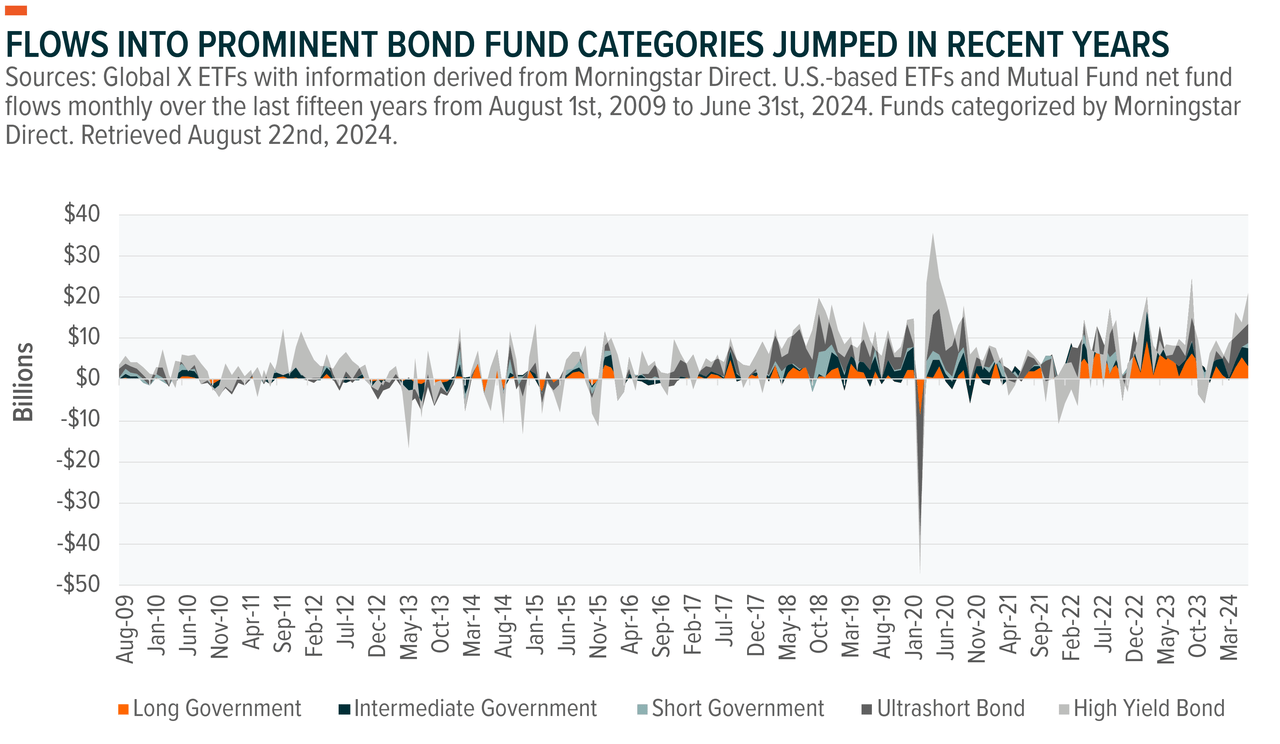

Before the Federal Reserve (Fed) embarked on its year-and-a-half-long rate hiking cycle to combat post-pandemic inflation, 10-year U.S. government bond issues failed to consistently yield beyond 2% dating all the way back to 2009.1 Returns were particularly underwhelming when considering the lack of price appreciation by many of these instruments. The argument for “risk-free” fixed income became much more compelling in recent years, as the federal funds rate was boosted to levels not seen since 2007.2 Factor in markets rising to record highs in 2024 and investors likely reaping significant returns from their equity positions, and bond fund flow catalysts mounted rather quickly. Strong flows are evident across bond categories, and investors experienced improved Investment Grade and junk bond yields.3

Even with income opportunities from bonds looking more appealing, the distribution rate offered by our 100% covered call strategies can potentially prove more appealing. The table below highlights the most recent yield-to-worst on four prominent bond indexes and compares them to the trailing 12-month distribution rates of our family of Global X ETFs that operate covered call strategies on the Russell 2000, Nasdaq 100, S&P 500, and Dow Jones Industrial Average. Purely from a distribution perspective, a covered call strategy could be a better opportunity, as it can help add balance to the equity sleeve of a portfolio. A covered call strategy can also help alleviate concerns over managing bond duration and the potential for credit defaults.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Performance current to the most recent month- and quarter-end and 30-day SEC yields is available at RYLD, QYLD, XYLD, and DJIA.

A portion of the funds’ distribution rates is estimated to include return of capital. For a breakdown of the distributions, please see the Tax Supplements. These do not imply rates for any future distributions.

Asset class representations are as follows: U.S. High Yield Bonds, Bloomberg U.S. Corporate High Yield Total Return Index; U.S. Investment Grade Bonds, Bloomberg U.S. Corporate Total Return Index; U.S. Aggregate Bonds, Bloomberg U.S. Aggregate Index; U.S. Government 10 Year, US Generic Govt 10 Year.

The Bond Growth Story May Prove to Be More of a Saga

The Fed’s rate hiking cycle appears to be over, with inflation on a downward path. Following the release of a higher-than-expected July unemployment rate, the market is now pricing in a 100% chance of the Fed cutting the federal funds rate at its September 2024 meeting.4 Meanwhile, the investment case for bonds suggests adequate coupon rates and bond value appreciation. Still, investors subscribing to this base case may not want to hold their breath until it comes to fruition.

The path to the Fed’s first rate cut is one that has been playing out for the better part of the last year. When the Federal Open Market Committee (FOMC) last raised the rate in July 2023, markets were expecting the first cut in March 2024.5 At the start of 2024, the market had priced in as many as six additional rate cuts for the year.6 However, inflation proved stubborn, and the market proceeded to gradually take rate cuts off the table.

A healthy U.S. economy supported by increasing corporate investment, earnings, and consumer spending argued against a Fed pivot to lower rates and quantitative easing measures. Many of these underlying factors remain evident, and the concern that the Fed’s initial rate cut reignites inflation remains top of mind. Given that risk, the Fed may be inclined to test the waters by lowering the rate by 25 basis points to 5.00–5.25%, and sporadically thereafter, keeping rates elevated for a prolonged period.

Rate cuts can be a double-edged sword. While bonds values may benefit, yields may become less impactful for income-seeking investors, potentially bringing reinvestment risk into play. The rate cut impact will also vary across the bond investment scape, with longer-duration instruments typically receiving the biggest boost. That said, investors using bonds as a source of income would likely be less exposed to these instruments, as the yields on short-term investments have been more generous of late.7

Covered Call Writing May Be a Better Hedge Than Traditional Bonds in This Environment

The recent narrative surrounding bond flows stretches beyond the interest rate story and the opportunity for price appreciation. With equity markets continually eclipsing all-time highs in the first half of 2024, bonds’ traditional role as a portfolio diversifier is more than likely playing a part in portfolio hedging, as well. But in a potential equity market contraction, bonds may fail to offer as much risk mitigation as they have in the past. For one, the correlation between bond and equity performance remains relatively high, signaling that any selloff may be somewhat commensurate.

Although past performance is not a guarantee of future results, historical bond performance should also be taken into consideration regardless of the interest rate backdrop. After all, lower borrowing rates can present a more advantageous environment for companies to reinvest in their businesses. If this scenario were to stoke risk-on sentiment, it could cause bond flows to slow should rate cuts boost equities. If the correlation remains intact but secular drivers continue to promote positive market sentiment, other means of portfolio diversification may be more prudent to seek to curtail downside risk. Covered call writing can act as a downside hedge for underlying equity positions by seeking to harvest call option premia.

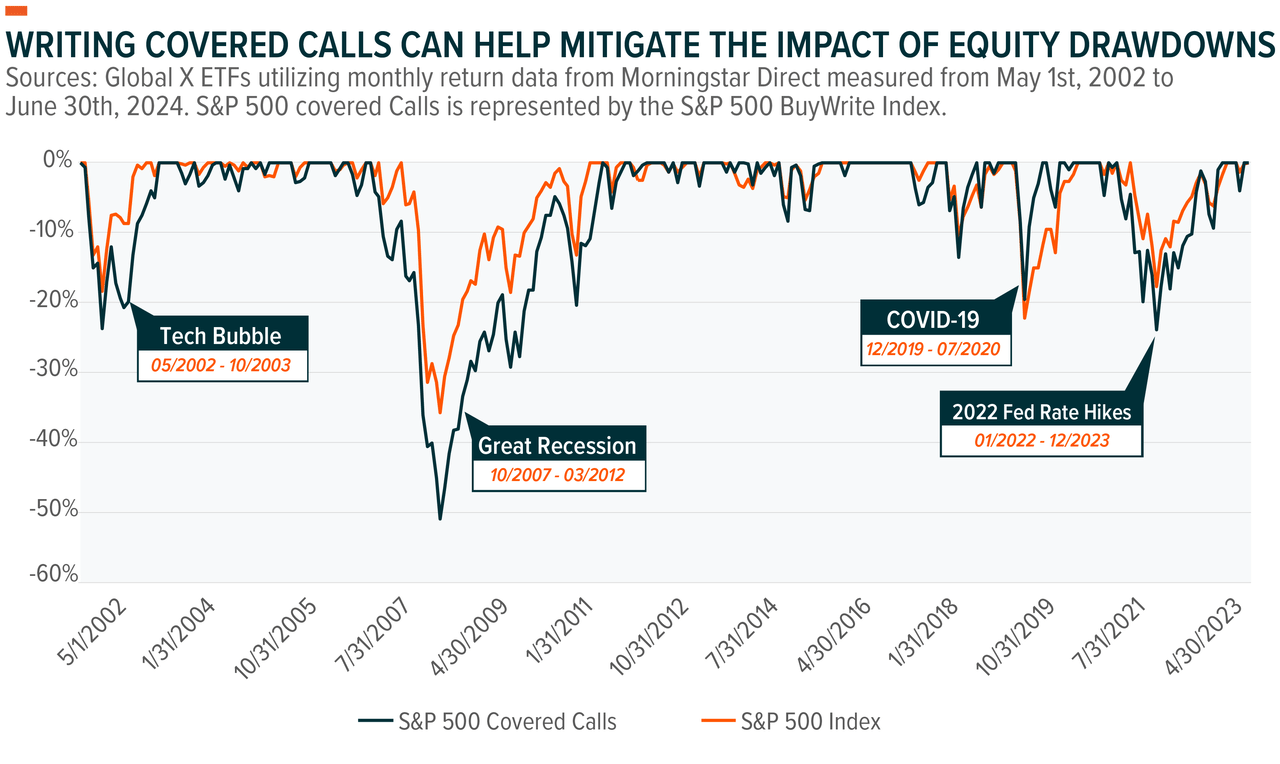

Factoring into covered call writing’s popularity is the potential buffer to the downside, based on the premium value that is collected by selling the call option. The premium receive can offset some of the fall in the underlying asset(s). Fixed income instruments, on the other hand, theoretically can fall to zero value, so the degree to which they can act as a hedge is somewhat unknown.

By aiming to monetize volatility and pursue the premiums that are attainable by writing calls, investors may be able to maintain some equity exposure and still outperform major indices during a contraction. This characteristic has been particularly notable when analyzing the performance of a systematic covered call writing strategy like that of the Cboe S&P 500 BuyWrite Index during broader S&P 500 downturns.

Past performance is not a guarantee of future results. Index returns are for illustrative purposes only and do not represent actual Fund performance. Index returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index.

Conclusion: A Fluid Rate Situation May Make Covered Call Writing an Appealing Bond Alternative

The economic backdrop appears to be shaping up well for bond investments, but it’s early in fixed income’s growth story. As it plays out, the economy can turn down any number of avenues that benefit or hurt fixed income’s potential to act as a hedge. We believe that investors may be better served allocating funds to covered call instruments, which may offer a higher yield and better hedge, should recession, geopolitical, or other risks bring tumult to the markets.

Related ETFs

XYLD – Global X S&P 500 Covered Call ETF

QYLD – Global X Nasdaq 100 Covered Call ETF

RYLD – Global X Russell 2000 Covered Call ETF

DJIA – Global X Dow 30 Covered Call ETF

Click the fund name above to view current performance and holdings. Holdings are subject to change. Current and future holdings are subject to risk.

Footnotes

1. Federal Reserve Bank of St. Louis. Market yield on U.S. Treasury Securities at 10-year Constant Maturity. Retrieved June 28th, 2024.

2. Federal Reserve Bank of New York. Effective federal funds rate chart. Data retrieved August 13th, 2024.

3. Bloomberg L.P. Yield-to-Worst on U.S. Corporate High Yield Total Return Index and Bloomberg U.S. Corporate Total Return Index.

4. CME FedWatch. Target rate probabilities for September 18th, 2024 meeting. Retrieved August 7th, 2024.

5. CME FedWatch. Target rate probabilities for March 20th, 2024 meeting. Retrieved June 28th, 2024.

6. Cox, J. (2024, April 10). Hot inflation data pushes market’s rate cut expectations to September. CNBC. Retrieved June 28th, 2024.

7. U.S. Department of the Treasury. Interest rate statistics accessed August 13, 2024.

Glossary

S&P 500 Index: S&P 500 Index tracks the performance of 500 leading U.S. stocks and captures approximately 80% coverage of available U.S. market capitalization. It is widely regarded as the best single gauge of large-cap U.S. equities.

Nasdaq 100 Index: The Nasdaq-100 Index includes 100 of the largest domestic and international non-financial companies listed on The Nasdaq Stock Market based on market capitalization. The Index reflects companies across major industry groups including computer hardware and software, telecommunications, retail/wholesale trade and biotechnology. It does not contain securities of financial companies including investment companies.

12-Month Distribution Rate: The distribution rate an investor would have received if they had held the fund over the last twelve months, assuming the most recent NAV. The 12-Month distribution rate is calculated by summing any income, capital gains and return of capital distributions over the past twelve months and dividing the sum of the most recent NAV and any capital gain distributions made over the same period.

Yield to Worst: Measurement of the lowest possible yield that can be received on a bond with an early retirement provision.

Russell 2000: The small-cap market index that consists of the smallest 2,000 markets in the Russell 3000 Index.

Dow Jones Industrial Average: Price-weighted index measuring 30 U.S. blue-chip companies. The index includes all industries except transportation and utilities.

Correlation: Statistic that measures the degree to which two securities move in relation to one another, with a value of 1 implying that the securities will move strictly in conjunction, 0 implying no relationship, and -1 implying they will move in equal opposite directions.

BuyWrite Strategy: Option strategy that consists of purchasing an asset and proceeding to write (or sell) covered call options against that same asset.

Cboe S&P 500 BuyWrite Index: An index designed to show the hypothetical performance of a portfolio that engages in a buy-write strategy on the S&P 500 Index.

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information is not intended to be individual or personalized investment or tax advice and should not be used for trading purposes. Please consult a financial advisor or tax professional for more information regarding your investment and/or tax situation.

Investing involves risk, including the possible loss of principal. Diversification does not ensure a profit nor guarantee against a loss. Concentration in a particular industry or sector will subject the Funds to loss due to adverse occurrences that may affect that industry or sector. Investors in the Funds should be willing to accept a high degree of volatility in the price of the fund’s shares and the possibility of significant losses.

These Funds engages in options trading. An option is a contract sold by one party to another that gives the buyer the right, but not the obligation, to buy (call) or sell (put) a stock at an agreed upon price within a certain period or on a specific date. A covered call option involves holding a long position in a particular asset and writing a call option on that same asset with the goal of realizing additional income from the option premium. By selling covered call options, the funds limit their opportunity to profit from an increase in the price of the underlying index above the exercise price, but continues to bear the risk of a decline in the index. A liquid market may not exist for options held by the funds. While the funds receive premiums for writing the call options, the price they realize from the exercise of an option could be substantially below the respective index’s current market price.

Shares of ETFs are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Brokerage commissions will reduce returns.

This material must be preceded or accompanied by the fund’s prospectus. Please read it carefully before investing.

Global X Management Company LLC serves as an advisor to Global X Funds. The Funds are distributed by SEI Investments Distribution Co. (SIDCO), which is not affiliated with Global X Management Company LLC or Mirae Asset Global Investments. Global X Funds are not sponsored, endorsed, issued, sold or promoted by S&P or Cboe, nor do these entities make any representations regarding the advisability of investing in the Global X Funds. Neither SIDCO, Global X nor Mirae Asset Global Investments are affiliated with these entities.

The Global X Derivative Strategy Classification System is based on the expertise, views, and opinions of the Global X Derivative Strategy Classification Committee and are subject to change. Global X defines thematic investing as the process of identifying powerful disruptive macro-level trends and the underlying investments that stand to benefit from the materialization of those trends. By nature, thematic investing is a long term, growth-oriented strategy, that is typically unconstrained geographically or by traditional sector/industry classifications, has low correlation to other growth strategies, and invests in relatable concepts.

The process to identify a derivative-based strategy incorporates three main principles:

- The product must utilize derivatives as a core component of its investment strategy. This does not necessarily mean that derivatives must make up the majority of the ETF’s portfolio. However, derivatives must serve a key purpose in achieving the investment objective stated in the ETF’s prospectus.

- The derivative-based strategy can be utilized over a long-term period from the standpoint that it is able to be used tactically, for temporary exposure to express a market view, or within a strategic allocation. Strategies whose core objective is to be a daily trading tool will most likely not be considered for inclusion.

- The strategy must use derivatives as a means to achieve 1 or more of the 3 main use cases of derivatives by either buying or selling short a specific type of derivative:

- Risk Management – These are strategies with an objective of achieving higher risk-adjusted returns by lowering overall portfolio volatility with the usage of derivatives.

- Income – Strategies that utilize derivatives as a core investment to potentially achieve high income for its investors.

- Performance Enhancement – Strategies that use derivatives to enhance the upside potential for capital appreciation, typically increasing the economic leverage used within a portfolio.

Taking the above principles into account, it should be noted that the derivative-based classification system does not consist of leveraged/inverse ETFs whose core objective is to track an index that rebalances daily. This goes against the 2nd principle stated above regarding the strategy being a long-term investment. Based on the definitions and principles described above, the derivative-based classification system is organized into multiple layers for a more refined understanding as to the objective of each strategy. Note that some options strategies can be utilized for multiple purposes, whether that be for Income, Risk Management, or Performance Enhancement, resulting in some categories appearing more than one time. The system consists of four layers of classification: (1) Derivative Objective (2) Derivative Strategy (3) Derivative Overlay and; (4) Derivative Tactic.

‘Derivative Objective’ is the broadest layer and this gives an understanding as to the core objective of the fund, utilizing the 3 derivative use cases defined in the Principles section: (1) Risk Management, (2) Derivative Income, and (3) Performance Enhancement. One layer down is ‘Derivative Strategy,’ which will provide investors the means by which the investment objective is being pursued. For example, an ETF that utilizes derivatives with a Risk Management objective can be generated using either a Tail Risk Strategy to provide a level of downside protection or a Collar Strategy to provide a range-bound return outcome. Although slightly different, the commonality between these two overlays are the fact that their core purpose is to provide Risk Management.

Further down, we identify ‘Derivative Overlay’ as a layer describes the specific derivatives being used and the manner in which they are being used (Long or Short, Bull or Bear). For example, a Tail Risk overlay can obtain a level of downside protection using many kinds of derivatives. Some overlays include either “going-long” with put options via a Protective Put or harnessing VIX Futures as an overlay on an existing stock portfolio. Lastly, ‘Derivative Tactic’ help to communicate to investors any unique considerations regarding the options overlay being used. For example, a strategy offering a Synthetic Exposure are primarily meant to be exposure vehicles to. Another example is a Defined-Outcome ETF, which utilizes put spread collars to offer a specific level of downside protection with capped upside potential if held over the course of the stated “outcome-period”, making each iteration different from one another.

The number of derivative objectives, derivative strategies, derivative overlays, and derivative tactics are expected to change as new derivative-based strategies come to market. These updates will be made by the Global X Derivative Strategy Classification Committee (“the committee”) and take into account official fund prospectus filings as well as fund company materials.

The ETF industry is continually innovating to provide unique derivative exposures to investors. The Global X Derivative Strategy Classification Committee evaluates these innovations by first investigating if a fund aligns with the core three principles of what it believes a derivative strategy to be. Then, once a fund is deemed a “Derivative Strategy”, the committee identifies what the core objective is, how this objective is being achieved, and what types of derivative positions are being utilized within the strategy by reviewing prospectuses, index methodologies (if applicable), stated objectives by the fund company, as well as underlying holdings. Once per month, the committee will review all new U.S.-Listed ETF launches to determine if the fund should be added and how it should be classified. In addition, the committee will also review any strategy changes that have occurred amongst existing ETFs within the Classification System that might merit reporting in the next monthly Derivative Strategy ETF Report.

While an ETF may engage in multiple objectives or strategies utilizing derivatives, the committee will determine the classification based on the true nature of the ETF.

While an ETF may be classified within a certain objective, strategy, overlay, or tactic, Global X does not give any assurances that the ETF provides good and accurate exposure to the specific exposure it is targeting. For example, an ETF may convey or market itself in a specific manner but still utilize a specific derivative trading strategy that has its own nomenclature.

The derivative classification system is reviewed monthly by the Global X Derivative Strategy Classification Committee to consider new changes and/or additions to the layers (categories) stated above. In addition, the committee will also seek to add newly launched, U.S.-listed ETFs that fit the 3 main principles of a derivative-based strategy.

In the event that an ETF changes its investment objective to another one that goes against the 3 principles of a derivative-based strategy, the strategy will be removed from the classification system and its historical assets under management data will be maintained within the monthly report. On the other hand, if an ETF changes it investment objective to something that fits within the parameters of the 3 principles, it will be considered for inclusion in the classification system where its AUM will start to be reflected in the report.

Global X accepts requests for reviews or appeals for any ETFs. Please contact Global X at research@globalxetfs.com, and the appeal will be considered in a timely manner. There are no guarantees that an appeal will result in a change in the ETF’s classification.

The Derivative-based ETF Report, including the classification system, falls under the supervision of the Global X Derivative-Based Strategy Classification Committee. The Committee consists of members from Global X’s research and product teams who have extensive knowledge of the strategies themselves and the ETF industry. The goal of the committee is to properly identify and classify ETFs that fit the 3 principles. The Committee meets at least monthly to review the classification system, as well as on an ad-hoc basis to review new ETF launches or ETFs that change their strategy.

No content contained in these materials or any part thereof (“Content”) may be modified, reverse engineered, reproduced or distributed in any form or by any means, or stored in a database or retrieval system, without the prior written permission of Global X. The Content shall not be used for any unlawful or unauthorized purposes. Global X does not guarantee the accuracy, completeness, timeliness or availability of the Content and is not responsible for any errors or omissions, regardless of the cause, for the results obtained from the use of the Content.

THE CONTENT IS PROVIDED ON AN “AS IS” BASIS. GLOBAL X AND ITS AFFILIATES DISCLAIM ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE OF THE CONTENT.

In no event shall Global X or its affiliates be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs) in connection with any use of the Content even if advised of the possibility of such damages.”

For more information on Global X, please contact research@globalxetfs.com. For access to Global X Derivative Strategy Classification System – Methodology please click here.

Carefully consider the funds’ investment objectives, risks, and charges and expenses before investing. This and other information can be found in the funds’ full or summary prospectuses, which may be obtained by calling 1-888-GX-FUND-1 (1.888.493.8631), or by visiting globalxfunds.com. Read the prospectus carefully before investing.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment