artiemedvedev

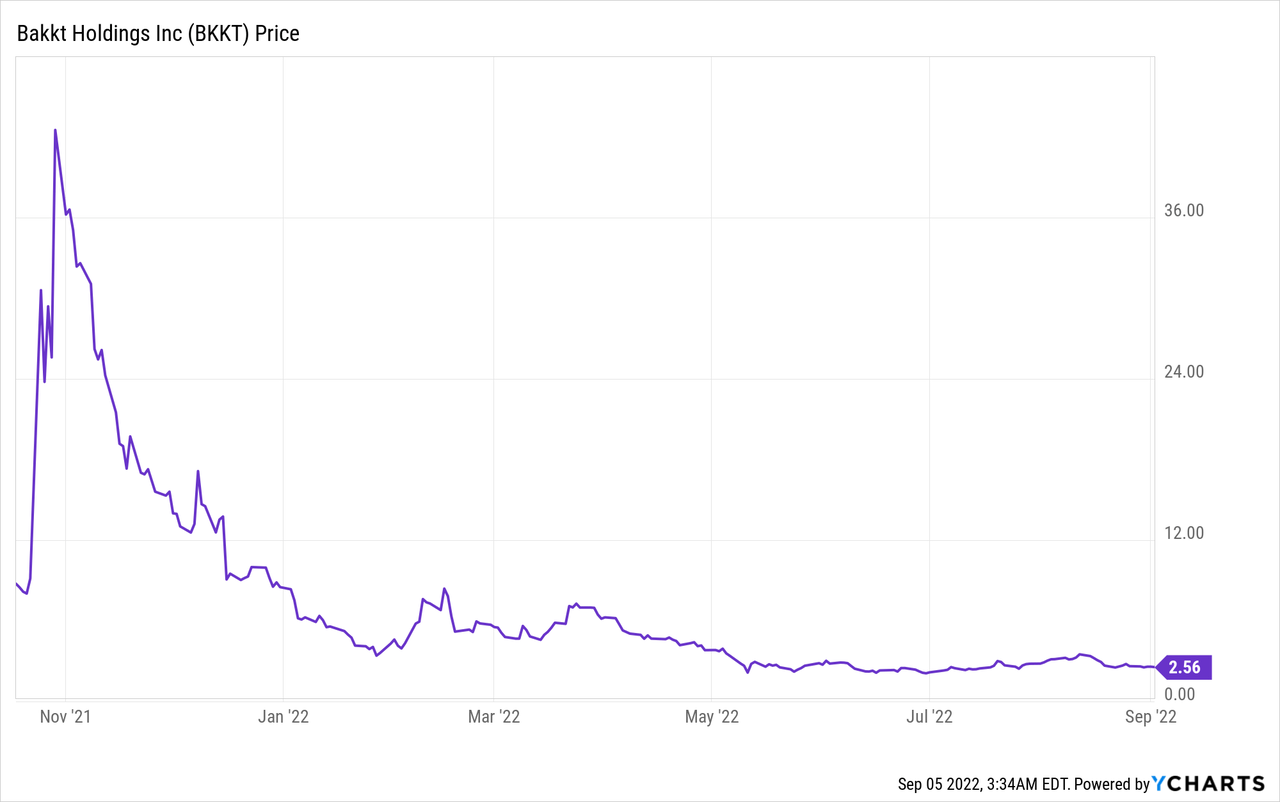

Bakkt (NYSE:BKKT) has seen its valuation fall precipitously since going public in the autumn of 2021. The malaise faced by the Intercontinental Exchange (ICE) spinout mirrors that of many fintechs from the now-dead SPAC boom. The golden era of unfettered investor enthusiasm has given way as inflation continues to surge and a hawkish Fed scrambles to taper it. Market liquidity has been declining on the back of increasingly aggressive rate hikes as an inverting yield curve provides ominous cues for a possible recession.

The current seemingly perennial collapse is not due to operational issues with the crypto infrastructure business, but the unfortunate fate of going public just as a crypto winter and stock market collapse went into full swing. The company is now down nearly 95% from all-time highs.

Bakkt is trusted by several financial services firms to deliver crypto capabilities to their customers. Indeed, the company has signed a strategic alliance with Visa (V) to provide crypto solutions to Visa’s network, recently launched in Fiserv (FISV) AppMarket, and has signed a partnership with Missouri-based Sullivan Bank. Bakkt Crypto Connect, a service that offers financial institutions tools to provide crypto access to their customers, should see Fiserv marketplace users and Sullivan’s customers gain access to the ability to trade Bitcoin and Ethereum. The company’s B2B model is firing on its cylinders and the partnerships keep on stacking up with a collaboration with the Mayor of Miami also announced to help build a crypto ecosystem in the city. The most near-term services will likely be through the Bakkt Crypto Payout, which allows workers to receive a portion of their wages in Bitcoin.

New Partnerships Are Driving Revenue Growth

At the core of the bullish thesis is that crypto has value beyond financial speculation. Hence, Bakkt’s services should be able to see customer adoption even during periods of extreme crypto volatility. This is not the first crypto crash, with the last crypto winter lasting from January 2018 to December 2020.

Taking examples from around the world to assess the probability of crypto adoption in the United States is important. El Salvador’s large experiment with Bitcoin has been assessed to be faltering. After more than a year since Bitcoin was adopted as legal tender, adoption has practically been non-existent in the Central American country.

In my opinion, what’s clear from the collapse of crypto is the inescapable fact that crypto utility is tethered at the hips to its price movement from financial speculation. This places Bakkt’s business fully under constant struggle between the bulls and bears for domination. Against this, Bakkt might be able to sign new partnerships with institutions but might face stiff resistance in adoption by American households.

The company last reported earnings for its fiscal 2022 second quarter, which saw revenue come in at $13.6 million, a 60% increase from the year-ago quarter but a miss of $300,000 on consensus estimates. For some context, when Bakkt went public it guided for fiscal 2022 revenues of $224 million on the back of 18 million active users. Total half-year revenue for fiscal 2022 currently sits at $26.1 million. The company has revised fiscal 2022 revenue guidance downwards to between $57 million and $62 million.

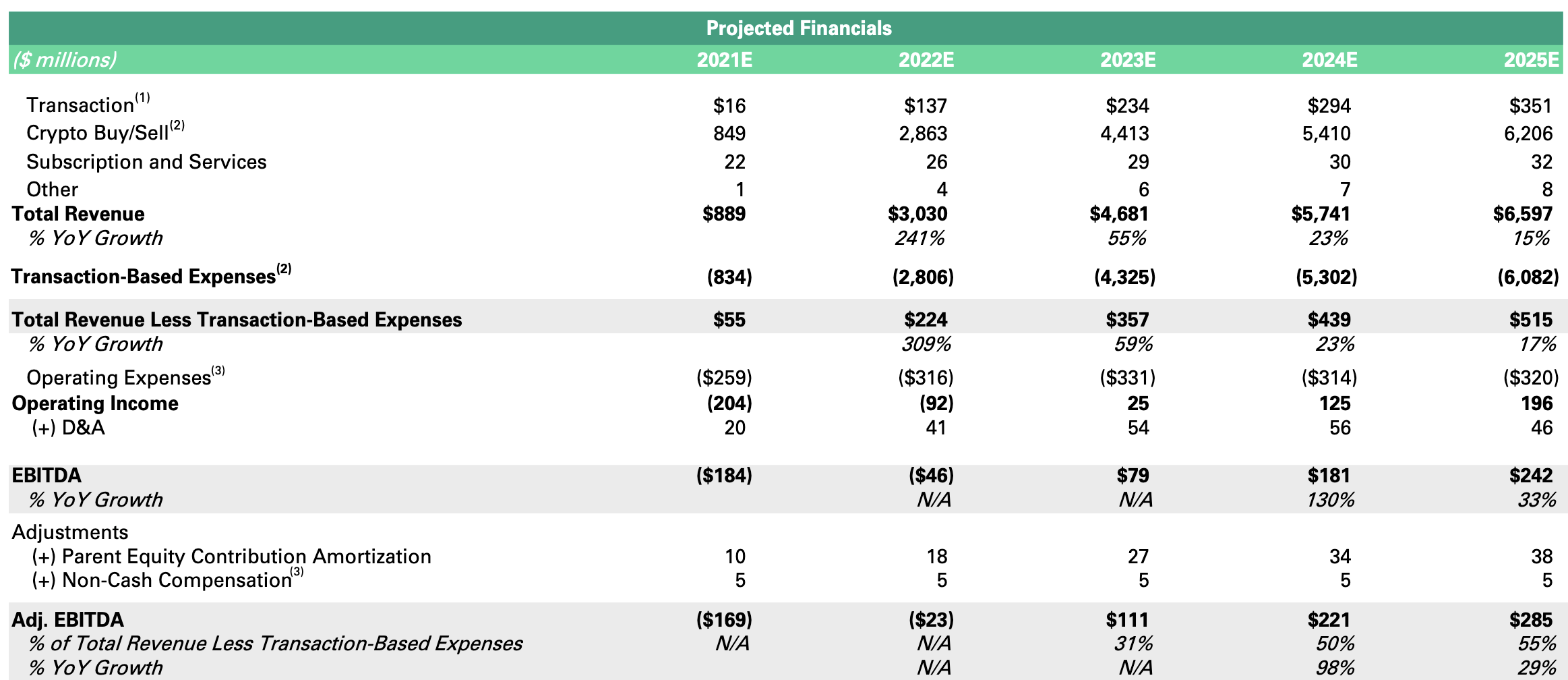

Bakkt SPAC Presentation

At the time, Bakkt described its estimates as conservative, bullish rhetoric, which combined with the widely outlandish growth expectations to drive the valuation to stratospheric highs.

Further, the company expects total cash burn for the year to be not less than $135 million, with cash burn during the most recent quarter at $39 million. This was up nearly 78% from the year-ago quarter. Cost-cutting has been implemented to reduce this from earlier guidance of cash burn between $150 million to $170 million. Hence, assuming its cash burn remains the same, the company has a runway well into fiscal 2024.

With shares currently trading hands at $2.56, Bakkt’s market cap stands at $675 million. This places the price to forward revenue multiple at 10.88x, a high premium to pay when its crypto peer and industry leader Coinbase (COIN) is trading at a 4.33x price to forward sales multiple.

Building Crypto Infrastructure For Financial Services

Bakkt’s business model is built on there being tangible value for bitcoin outside of financial speculation. The fickle nature of the materially leveraged trading of crypto is not a sound basis to build a long-term value-creating business. This opens a paradigm, why invest in Bakkt at all when you directly speculate on crypto prices by buying Bitcoin or Ethereum?

Whilst renewed investor enthusiasm for Bitcoin would help lift shares back up, the business model is unequivocally joined at the hip to crypto’s animal spirits. This places the boom and bust cycles influenced by sentiment, hype, and fear as the main determinants of Bakkt’s future performance.

Be the first to comment