V2images/iStock Unreleased via Getty Images

Over the last month, the Chinese stocks have traded in a wild fashion due to fears the shares will be delisted from U.S. stock exchanges. The risks to Baidu (NASDAQ:BIDU) appear far over stated. My investment thesis remains very Bullish on the Chinese tech stock leading in autonomous vehicle technology, but Baidu definitely faces a volatile few years.

Source: FinViz

Irrational Delisting Fears

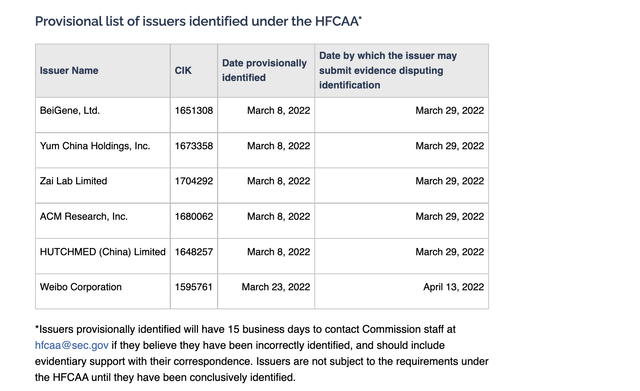

Baidu plunged mid-March as the SEC placed multiple Chinese stocks on the official list for delisting unless the company provides an official audit for inspection. At the same time, Yum China Holdings (YUMC) informed shareholders the company might be forced to delist in early 2024.

On March 10, the SEC listed 5 stocks failing to provide audits inspectable by US regulators. The related companies will be delisted after three-straight years of failing to meet the requirements giving these companies until early 2024 to meet the audit requirements with the 2021 report being the first audit failure.

Source: U.S. SEC

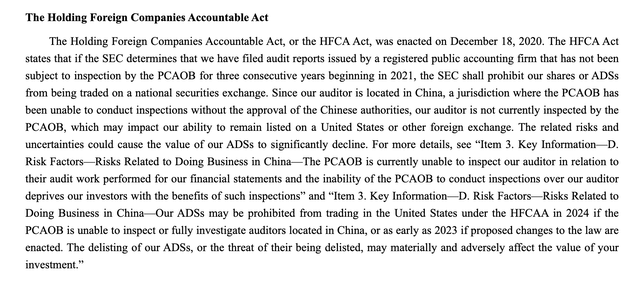

The Holding Foreign Companies Accountable Act (HFCAA) became a law on December 18, 2020 requiring foreign listed equities to have reliable accounting firms perform an audit. The requirement forces companies with a public accounting firm location in a foreign office or the Public Company Accounting Oversight Board (PCAOB) has determined a foreign jurisdiction doesn’t allow an inspection of the audit due to the position of a foreign jurisdiction such as the CCP to delist shares after the three-year period of failed audits.

The fears added up to the stock plunging to a low of $102 on March 14. J.P. Morgan analyst Alex Yao added to the fears by cutting his price target on Baidu to $90 per share from $245 in a move helping cause a panic. To be fair, the analyst made a negative call on most Chinese stocks including Alibaba (BABA), JD.com (JD) and Pinduoduo (PDD).

Oddly, the analysts call appeared more related to geopolitical risks and company specific problems, not delisting concerns. The markets saw the $90 price target and panicked on fears the influential firm knew something regarding delisting.

The reality is that Chinese leaders came out with support for companies, such as Baidu, producing more disclosures to meet the requirements of the SEC. The news was very supportive that China actually wants the tech giants to remain listed on U.S. stock exchanges. As no real surprise, China wants to be an economic power and major corporations listed in the U.S. provides a level of credibility.

Fellow technology company Weibo (WB) filed Form 20-F on Mach 10 and the company was promptly placed on the HFCAA list on March 23. The stock initially dipped on the news, but Weibo didn’t face a major selloff on the delisting worries about two years away.

Baidu just filed the annual report suggesting the company faces being added to the list in the next couple of weeks. The Chinese tech giant was clear in the report that the PCAOB is currently unable to conduct inspections over the audit.

Source: Baidu Form 20-F

The risk definitely exists that Baidu could get placed on the HFCAA list. The stock would most likely fall under such a scenario.

Some influential investors don’t see the same risk as identified by the stock collapse of mid-March. According to Gary Dvorchak of the Blueshirt Group, the Chinese and U.S. regulators are working on positions to properly audit Chinese companies to meet U.S. requirements.

The biggest risk in Chinese stocks has mostly existed in the relatively small and unknown stocks. The only major hiccup of a large Chinese stock was the DiDi Global (DIDI) IPO.

Deep Value

In the meantime, Baidu continues to struggle with a tough domestic China ad market due to COVID and the promising AV business being a few years away from major commercialization. Regardless, Baidu reported Q4’21 revenues grew 9% lead by 12% grow in Baidu Core and an impressive 63% in the non-online marketing group focused on AI-powered businesses.

For all of 2021, Baidu repurchased $1.2 billion worth of shares and $2.9 billion since approving the plan in 2020. The Chinese tech giant has a cash balance of $30.0 billion with net cash balance of $18.6 billion plus another $10.6 billion in long-term investments.

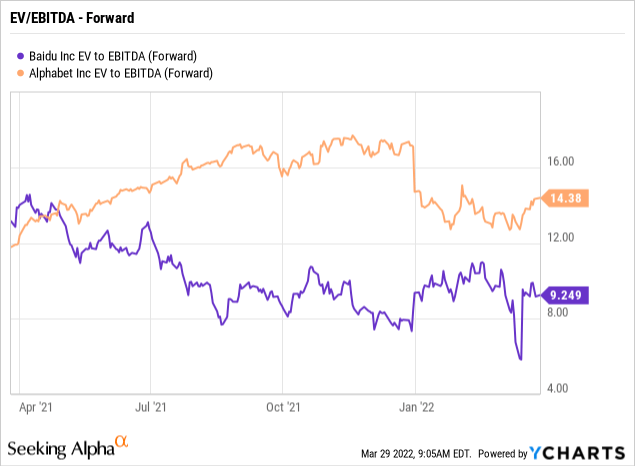

As the AI business develops in the years ahead, Baidu becomes an exceptionally cheap stock. The stock trades at only 15x 2023 earnings and naturally the EV is far lower with the nearly $20 billion cash balance. In comparison to Alphabet (GOOG, GOOGL), the Chinese company trades at a far lower forward EV/EBITDA multiple at just 9x.

Data by Ycharts

Of course, any actual issue with the stock being delisted will most likely cause Baidu to fall from these levels despite already being down nearly 50% from the all-time highs.

Takeaway

The key investor takeaway is that Baidu is a very cheap stock considering their AI business focused on the commercialization of AVs and strong cash balance. Regardless, the stock faces a very tough headwind with the potential delisting risk highlighted by the company. In our view, the delisting fears are overplayed with Baidu trading at $150.

Be the first to comment