MJ_Prototype

Canadian Pacific Railway Limited (NYSE:CP) is about to report earnings, so I thought I’d review the name to see if it makes sense to buy at current levels. In order to do this, I’m going to review traffic figures to this point in the year, compare the latest financial results to those posted last year, and look at the valuation of the stock. My thinking is that if the market is paying less per carload or less per revenue ton-mile than usual, this may be an intriguing buy.

Those who read my stuff regularly know that I’m no fan of Canadian Pacific and that I prefer its larger Canadian competitor, Canadian National (CNI). That written, I’d be very happy to buy this business with its unassailable moat at the right price, because I’d be happy to buy almost any business at the right price.

If you read my stuff regularly, you know that I’m thoughtful enough to provide readers with a “thesis statement” paragraph at the beginning of each of my articles. These thesis statements give you the gist of my thinking, and, so armed with my arguments, you can choose to continue reading or move on to something that you might consider a more enjoyable use of your time. You’re welcome.

Anyway, I don’t like the combination of CP’s flat traffic, lower revenue ton-miles, and much more expensive stock at the moment. Additionally, given the financial results we’ve seen during the first two quarters, I think the idea that the company will post great results in the back half of the year is pure fantasy. For these reasons, I am recommending people avoid this name for the moment. I also feel a need to point out that I may be “wrong” in some sense, because the market may drive shares higher from here, in spite of the fact that 2022 has not been a great year so far when compared to last year.

The company may report excellent results, and the stock may skyrocket as a result. Additionally, investors have a demonstrated capacity to apply truly baffling logic to railroads and buy at nearly any price based on the strength of the “moat” alone. If Canadian Pacific stock skyrockets after they report earnings, these gains will be fleeting, and will eventually be given up in my view. I see a company that is generating lower revenue ton-miles than they did this time last year, has had a financially troubled year so far, combined with a stock that is somewhere between 15% and 57% more expensive. In my view, this is a dangerous combination. I also feel compelled to remind investors that we are not in the business of simply making great returns. We’re in the business of trying to make great risk-adjusted returns. In my view, the risk is too great here because the market is paying more for a company that is facing significant headwinds.

Finally, I think the market’s guestimate of a 17% uptick in revenue is ludicrously high given what we’ve seen so far in 2022. Additionally, if the current forecast of 17% is post downward revisions, it makes you wonder what the earlier, more upbeat forecast was. Given these downward revisions, it seems that I’m not alone in my gloominess, but I may be more gloomy than most. I’m used to that.

Traffic: Then & Now

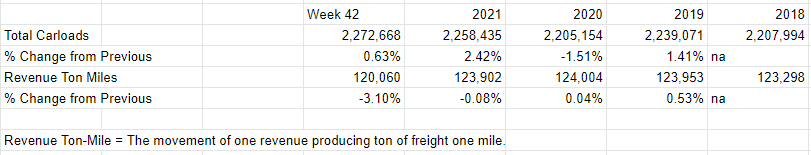

The following are the traffic figures for the period to week 42 of the year. In 2022, that period ended on October 22. In the past, the 42nd week of the year would obviously end on different calendar days. In order to accommodate these slight variances, I took an average of daily carloads between week 41 and 42 and adjusted the number of carloads to October 22 to aid comparability. I found that these adjustments didn’t make a material difference from raw results, but I feel a need to report on my methodology.

What we see in the following table is that traffic has remained basically flat from the pre-pandemic, pandemic, and now, I suppose, post-pandemic periods. The issue for me is the fact that revenue ton-miles have deteriorated fairly significantly from the same period in 2021. For those who may not be familiar with this measure, it is a metric used to calculate how much revenue a railroad makes per volume of freight transported one mile. So, the traffic figures may be relatively flat, but if the company is generating less revenue per mile, that’s a problem.

Canadian Pacific Traffic & Revenue Ton-Miles in Historical Context (Canadian Pacific investor relations)

Additionally, slowing revenue ton-miles is troublesome for me because I consider this metric to be a bit of a canary in the economic coal mine. When it starts to falter, that’s a sign that the overall economy is starting to slow.

So, I conclude from this that the company is maintaining the amount of traffic from year to year, but they’re generating less revenue on that traffic.

What Financial Expectations are Being Placed on the Back Half of the Year?

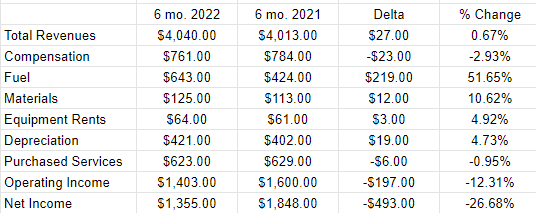

I’ve taken the liberty of reproducing the most recent financial results and comparing those results to the same period last year. For the first six months of this year, revenue was basically flat (up about .7%) while operating income was down about 12.3%, and net income was down just under 27%. Higher fuel expenses were obviously a problem, but so too were materials, and equipment rents.

In order to place a bet that 2022 will be a growth year for the company, an investor would need to assume that the back half of the year will be truly spectacular in order to make up for the first year’s slowdown. In my view, that’s theoretically possible but is a risky proposition.

Canadian Pacific Financials (Canadian Pacific investor relations)

While I think the dividend is well covered, and I like the huge moat this company enjoys, given the evidence of softness, I’d like to see the shares reflect this slowdown before I got excited about this investment.

The Stock

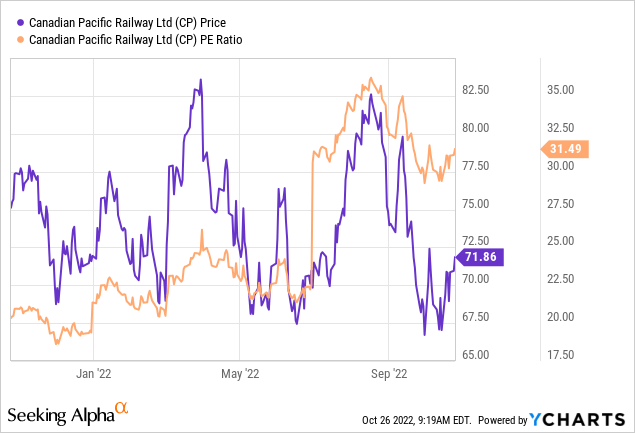

Because we’re doing a year-over-year comparison, I’ve created a valuation chart for your enjoyment and edification. We see from the following that this time last year, the shares were trading at a P/E of about 20. Today, the market is paying about 57.5% more for $1 of earnings. In case you’ve forgotten, traffic is basically flat, earnings have deteriorated significantly, and revenue ton mile is down from the same period a year ago.

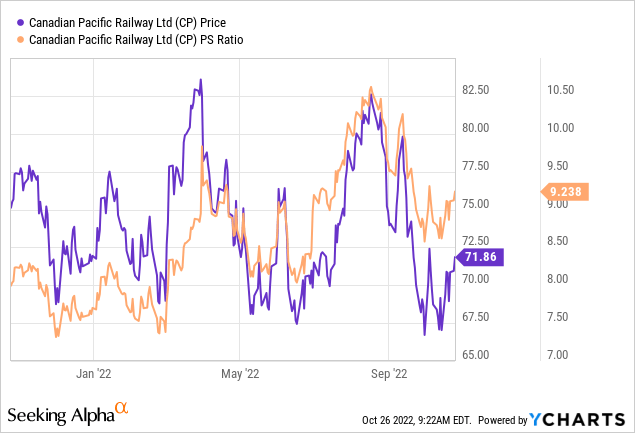

Similarly, the market is now paying about 15.5% more for $1 of sales than it did this time last year.

In addition to looking at simple ratios, my regulars know I like to try to work out what the market is “thinking” about the future for a given company. In order to do this, I turn to the work of Professor Stephen Penman and his book “Accounting for Value.” In this work, Penman walks investors through how, using the magic of high school algebra, to isolate the “g” (growth) variable in a standard finance formula. This approach takes the “known” (e.g., book value, current stock price) and infers what growth must come from the “unknown” (i.e., future profits) to justify the current known stock price. Applying this approach to Canadian Pacific at the moment suggests that the market is currently assuming a long-term (i.e., perpetual) growth rate between 11% and 12%, depending on the company’s dividend policy. I consider this to be a massively optimistic forecast, which is another data point that shows me that it’s prudent to avoid this name at the moment.

Conclusion

So, to sum up, traffic is flat, and revenue ton-miles are lower by about 3% when compared to this time last year. The financial results for the first half of the year have been poor in my estimation. Given the market’s rosy forecast, we’re expected to believe that the trends we’ve seen so far this year are about to experience a massive reversal, in spite of the slowdown in revenue ton-miles. On top of all of this, the stock is either very much, or very, very much more expensive now than it was this time last year. All of this adds up to “avoid” in my view. The shares may spike from here, but I am of the view that such gains will be short-lived.

Be the first to comment