Solskin

The Investment Thesis

Aveanna Healthcare Holdings Inc. (NASDAQ:AVAH) is a company operating in the United States as a diversified home care company. They have a number of different focuses for their business, but some niches are nutrition services, private home nursing and adult home health. They offer customers the ability to utilize their platform to help avoid using high-cost care facilities like hospitals. I think their edge is that with this mindset they will be able to secure customers who prefer the comfort of someone coming home to them and caring, and not have it carry a large bill.

Aveanna offers a unique product and something that the market and investors might see potential in. Right now they are trading too high for me to make an investment, but I believe in the company in the long-term if they manage to grow at the pace I’m hoping for. Until then I think holding on to shares is best and then potentially adding if the price drops.

Last Earnings Report Highlights

In the latest earnings report the results were mixed and came with some disappointing comments from the management. Looking at the way the revenues increased they didn’t see as much of an increase as the company probably would have liked. YoY they increased by 7.7% to $443 million in the latest quarter. The increase in revenue came primarily from the Private Duty Services (‘PDS’) segment of the company, where $28.5 million more in revenues were generated.

Earnings Highlights (Q3 Earnings Report)

Looking at the gross margins they saw a disappointing decrease of 3.7% YoY. This was much contributed by the very tough current labor market. Something the management of the company also commented on. The CEO Tony Strange can be quoted saying “We continue to manage through a very difficult labor environment, and our results clearly do not meet our expectations’ ‘.

Looking at the bottom line they had a net income of $24.7 million, a large increase from a year ago when it was only $2.1 million. The reason being a $43.5 million increase in the value for the interest rate derivatives the company holds.

Looking at 2022 so far however, the company is losing a lot of money and is far from profitable. As for the 9 months they have recorded a net loss of $423 million. The primary reason being a goodwill impairment of $470 million during the second quarter of 2022.

The management seems slightly optimistic however on some of the segments they have in the business. The CEO said “I am encouraged by signs of progress within our Private Duty and MS Business”.

Sector Outlook

The healthcare sector is massive and there will probably always be demand for the products and services within it. The question instead becomes of how the companies operating in it will be able to handle higher costs and translate that into not losing margins.

The healthcare services sector is expected by 2026 to reach $10414 billion in value, this would be a CAGR of 8.4% from current levels. With growth like that there will be a lot of companies who will be able to strengthen their market share and continue providing investors with value.

Market Outlook (Report Mines)

As it becomes more and more expensive for people to go to the hospital, a company like Aveanna could provide a valuable service where they help customers navigate through the many healthcare options out there and in the end get the best possible option for them.

But the difficulty will become securing a large enough customer base so that they eventually can start seeing a snowball effect. Until then there is still the possibility of larger company disruption.

Competition

The healthcare industry is filled with a number of different companies all fighting for their market share. There aren’t that many companies out there that provide what Aveanna does, a private home nursing service and a platform to freely choose between several healthcare options.

One of the larger companies that does similar things to Aveanna would be Enhabit (EHAB). They also offer a form of home health service where patient wellness is of course heavily prioritized.

Where Aveanna might beat their competition in terms of looking for an investment option is that they are growing revenues faster. EHAB has seen plateauing revenues over the last few years, whilst Aveanna has seen a 9% CAGR since 2018. Being that Enhabit is a more established company they have a positive bottom line at least. Something I find vital when first making an investment. Unless there is profitability, you aren’t investing based on fundamentals in my opinion.

The Balance Sheet

When it comes to the balance sheet there are a number of things I like to look at. Firstly, the relation between cash and debt for a company. The growth of assets and liabilities is also an important one. But I like to include both cash flow and the risk for share dilution as well in a segment like this.

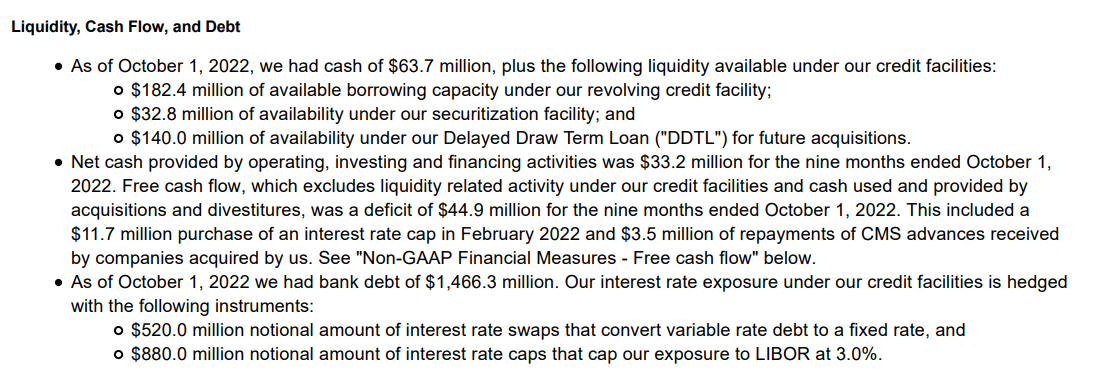

Balance Sheet (Q3 Earnings Report)

The cash position for Aveanna has been a little bit all over the place in the last few years, but in their latest report they had $63.7 million in cash compared to $140 million in short-term borrowings and $9 million in current debt. On paper this really doesn’t look good as they will need to raise capital in order to pay off their obligations.

The assets that the company is holding has seen a fall since 2021. Much thanks to a large goodwill impairment that we mentioned before. This has meant the assets and liabilities are much more closely aligned, with a ratio of 1.13 currently. This has meant that the book value is right now $1.24 per share, which is pretty much exactly where the company is trading right now.

Free Cash Flow (Seeking Alpha)

Moving over to cash flow. I mentioned before that the company has had a negative bottom line so far in 2022. But they have maintained a positive free cash flow so far in 2022, at around $40 million. Not a substantial amount when they generate around $1.7 billion in revenues.

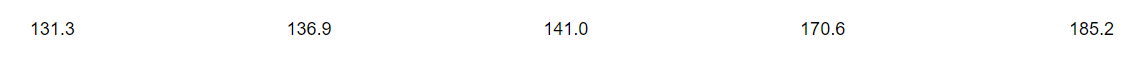

Outstanding Shares (Seeking Alpha)

Share dilution has been common practice in the last few years for the company. Going from 131 million in 2018 to 185 million in 2022. I think that given their high amount of current liabilities the risk for dilution remains high as the company will need to raise capital somehow.

Valuing The Company

Valuing Aveanna based on their previous performance is difficult as they have been a bit too up and down with profitability. Instead I have quite optimistic outlooks for the company based on the potential for the market they are in.

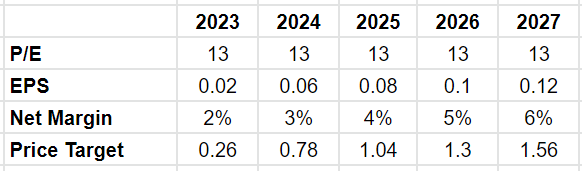

Future Valuation (Author’s Own Calculations)

Right now the company is trading a bit higher than what I have as future estimates. Limiting your downside risk is very important as in the long-term it usually is a good habit to have. Right now I wouldn’t buy the company as they are far from my targets. But that is not to say it wouldn’t be a good investment eventually.

I think a conservative p/e of 13 is justified as the company is quite new and has not yet proven to be a stable and incredibly well run and smooth business. That comes with time.

In the next few years I believe the company could manage to take more and more market share and that’s why I have the EPS growing the way it does. During this time I am confident that shares will continue to be diluted. All in all I think that the best course of action would be to just hold onto any shares until a better buy price presents itself.

Conclusion

Aveanna is a diversified company that is operating in many different niches within the healthcare sector. They have seen increased revenues and had in the latest earnings report twice their market cap in revenues. Despite this the investing sentiment has been tarnished, likely as shares have continuously been diluted the last few years.

The industry they are in is expected to continue to grow at a good annual rate. With this continued inflow of capital I expect that Aveanna should be able to capitalize somewhat from the trends.

Right now however the price is too high for my liking, but I have faith they will eventually stabilize and justify its price. I want to see a positive bottom line and good free cash flow before thinking about investing. If you have shares in the company I don’t think it does any harm to hold those shares and buy more when the price drops.

Be the first to comment