JHVEPhoto

Despite coming basically in-line with expectations, Autodesk (NASDAQ:ADSK) managed to disappoint investors by giving weak guidance. Some of the headwinds that Autodesk is experiencing include a slowdown in Europe and the impact of currency fluctuations.

Full-year billings guidance was again lowered, and management sounded downbeat when discussing modeling with analysts for the coming year during the earnings call. The market reacted strongly to the results, falling significantly after the numbers were released. The two main things that likely scared investors were the lower billings guidance and growth decelerating in the quarter.

In any case, we believe there is a more fundamental reason why shares have been trending down, and that is that expectations got unreasonably high and the valuation was extremely stretched. We still continue to believe that shares are overvalued, especially now that growth is decelerating, and with the company increasing stock-based compensation. Last year we warned investors that shares were expensive because non-GAAP earnings were ignoring massive amounts of stock-based compensation.

Q3 2022 Results

Total revenue increased 14% to $1,280 million, 15% growth at constant exchange rates. Billings increased 16% to $1,360 million. GAAP operating margin increased by 3 percentage points to ~20%. Net revenue retention rate was within the target range of 100% to 110%. Cash flow from operating activities was $469 million, while free cash flow was $460 million.

GAAP diluted net income per share was $0.91, compared to $0.62 in the third quarter last year, while Non-GAAP diluted EPS was much higher at $1.70, mainly because it ignores massive stock-based compensation.

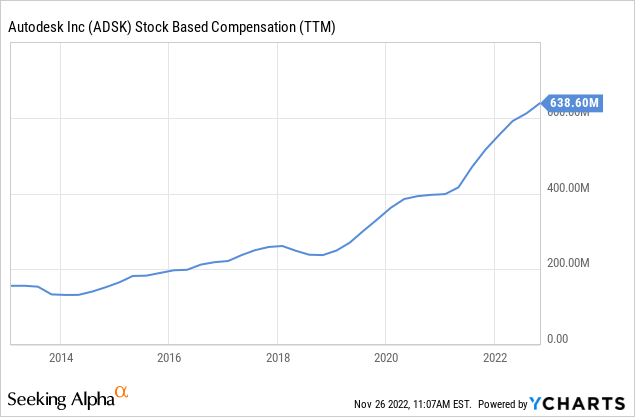

Stock-based compensation remains excessive

For a company doing ~$5 billion in annual revenue, we find that more than $600 million in trailing twelve months stock-based compensation to be excessive. Roughly speaking the equivalent of 12% of its revenue is given out as stock-based compensation. This is the main reason why for FY23 GAAP earnings per share are expected to be about half of what is expected for non-GAAP EPS. In other words, the company is giving about half of its earnings as stock-based compensation, and asking investors to ignore it. This is particularly common in the tech industry and Autodesk is not the only company doing it, not even the worst offender. Investors should, however, take it into consideration when valuing the company, as the amounts are very significant.

Growth

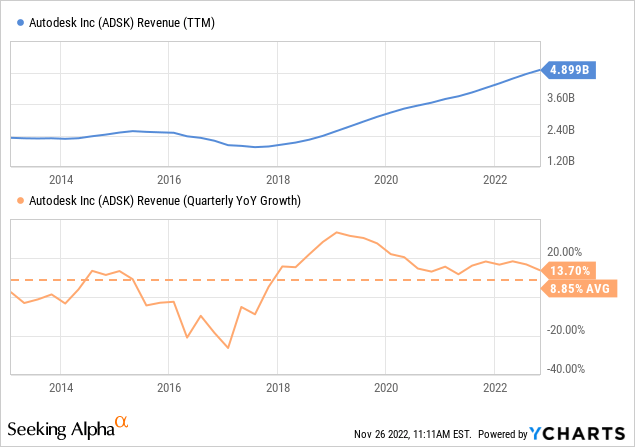

Autodesk’s transition to a subscription business model created some noise with respect to growth rates, but overall it has basically doubled its revenue in the last ten years, and it can be argued that it is now higher quality as it is mostly recurring.

As we mentioned at the start, growth is decelerating mainly due to softness in Europe and foreign exchange headwinds.

Balance Sheet

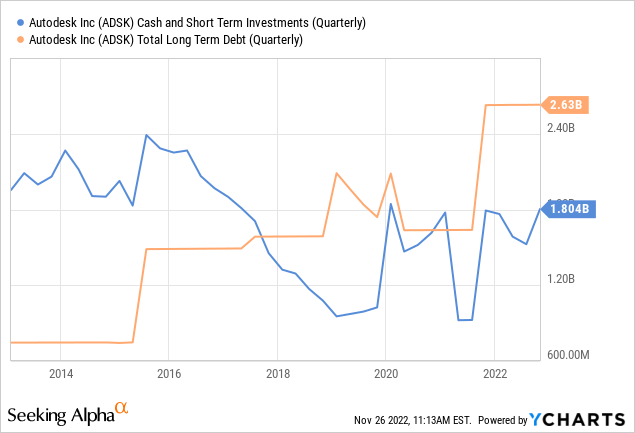

Autodesk’s balance sheet is in good shape, with plenty of liquidity in the form of cash and short-term investments. Total long-term debt has increased, but remains quite manageable for the company.

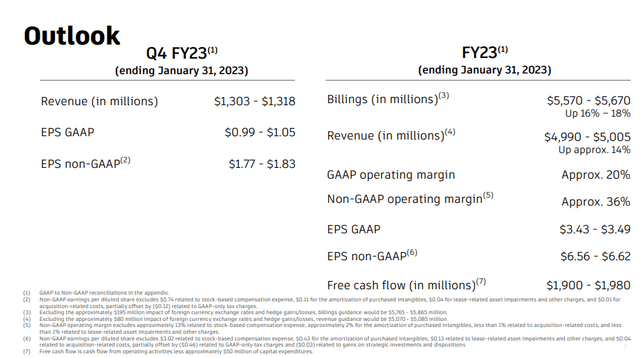

Guidance

The slide below shows the guidance shared by the company for next quarter, and for all of fiscal year 2023, which ends this coming January. While billings guidance seems to have disappointed some market participants, what we find most concerning is the massive difference between GAAP and non-GAAP earnings estimates.

Autodesk Investor Presentation

Valuation

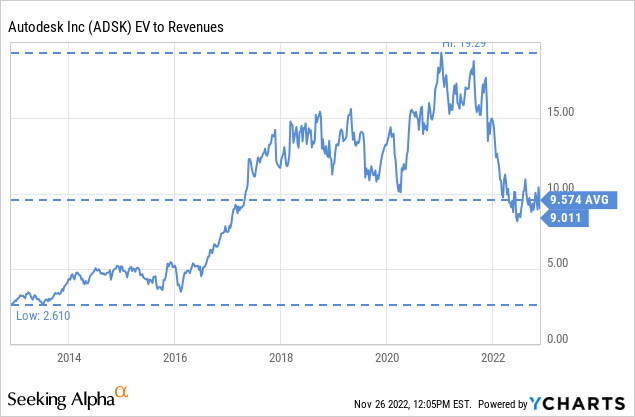

While the overvaluation has significantly moderated this year, with the EV/Revenues multiple approaching 9x after having reached more than 19x, we still consider shares to be overvalued.

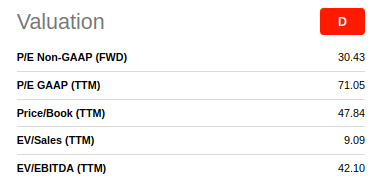

With a GAAP price/earnings ratio of ~71x, we have to agree with Seeking Alpha’s ‘D’ grade. The EV/EBITDA multiple is also quite high at ~42x.

Seeking Alpha

We like to estimate the fair value of the shares by calculating the net present value of its future earnings stream. We use GAAP earnings for our estimation, and assume earnings growth of +10.95% for FY 2024 and +17.52% for FY2025, and 15% growth thereafter until FY2033. We discount everything with a 10% rate, and use a 3% terminal growth rate. The resulting net present value that we get is ~$106 per share, which is why we believe shares continue to be considerably overvalued. Replacing earnings per share with non-GAAP numbers we get $201, very close to the current share price. In other words, the main reason we believe shares to be overvalued is due to the impact of stock-based compensation.

| EPS | Discounted @ 10% | |

| FY 23E | 3.49 | 3.17 |

| FY 24E | 3.87 | 3.20 |

| FY 25E | 4.55 | 3.42 |

| FY 26E | 5.23 | 3.57 |

| FY 27E | 6.02 | 3.74 |

| FY 28E | 6.92 | 3.91 |

| FY 29E | 7.96 | 4.08 |

| FY 30E | 9.15 | 4.27 |

| FY 31E | 10.53 | 4.46 |

| FY 32E | 12.10 | 4.67 |

| FY 33E | 13.92 | 4.88 |

| Terminal Value @ 3% terminal growth | 198.86 | 63.36 |

| NPV | $106.74 |

Risks

We are not too worried about Autodesk the business, which has a decent balance sheet and a significant recurring revenue stream. The biggest risk we see for investors is the high valuation, especially when valuing the company using GAAP numbers. We continue to believe that stock-based compensation at Autodesk is excessive, and that it is an expense that should not be ignored.

Conclusion

Autodesk delivered an in-line quarter but disappointed with weak guidance, decelerating growth, and sounding downbeat during the earnings call. Still, we continue to believe that the biggest issue Autodesk investors are facing is the massive amount of stock-based compensation at the company. This is the main reason why there is a huge gap between GAAP earnings and non-GAAP earnings, and it is why we believe shares to be significantly overvalued. While we like the company and believe that it has some of the best simulation and CAD products, we cannot justify buying the shares at current prices.

Be the first to comment