JHVEPhoto

Autodesk (NASDAQ:ADSK): The Google of Construction and Design

Website: Autodesk.com

Current stock price: $197.83

Shares outstanding: 215.9 million

52-week high: $335.48

All-time high: $344.39

52-week low: $163.20

Market cap: $42.7 billion

Net cash: -$1.47 billion

Enterprise value: $44.2 billion

Headquarters: San Rafael, California

Number of employees: 12,000+

Average price target from analysts: $252.00 (~27.4% upside from current price)

Introduction:

I’ve been a big fan of companies like ADSK and Adobe (ADBE) for many years, but I’ve never owned the stocks because they always seemed too expensive (I try to avoid companies with PEG ratios above 1.5x because there’s too much risk in that multiple contracting). With that said, if you’re looking for high-quality, profitable software companies with strong management teams and incredible margins (gross/net), then these are two companies worth a look. ADBE recently announced a $20 billion acquisition of Figma, so I’d stay away from that one right now until we have more clarity on the future financial impact of the deal which means we’re going to focus on ADSK for this mini writeup.

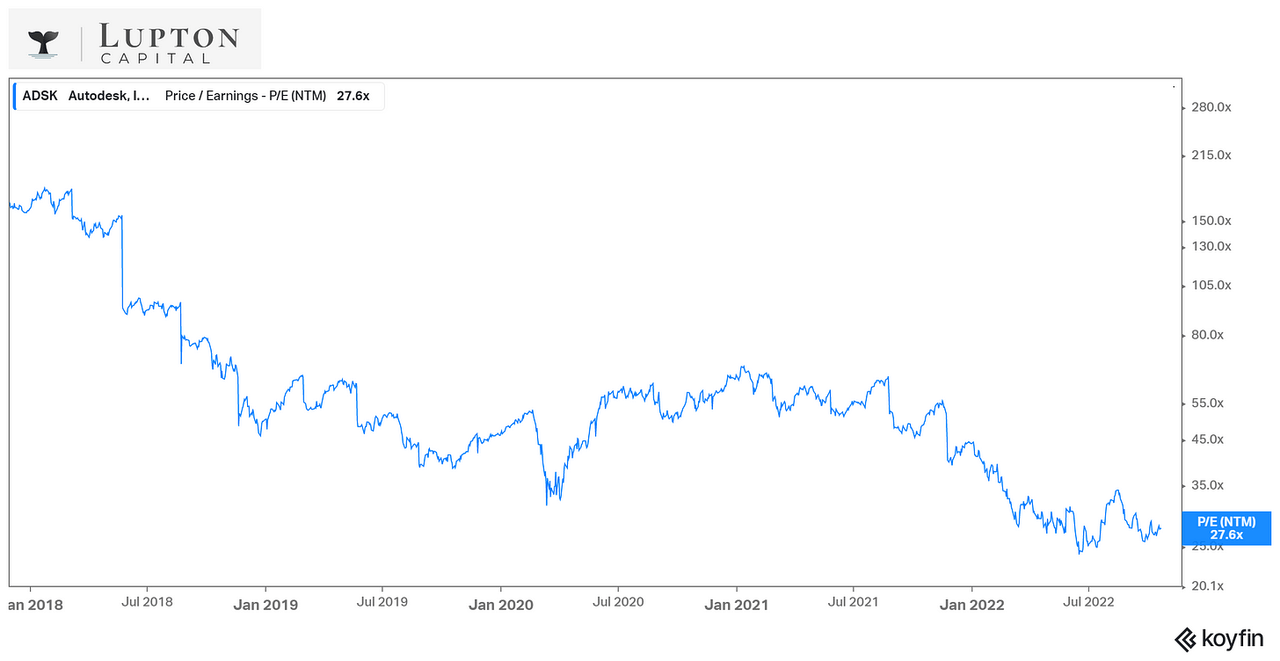

koyfin

As you can see above, ADSK is trading near its all-time-low NTM P/E multiple, even below the March 2020 levels. My concern is that ADSK’s P/E multiple might continue to contract over the next few years which is the main reason why I don’t own it. If I thought we’d see some multiple expansion, then I’d be more inclined to own the stock. Nevertheless, ADSK is a great company with a strong track record that operates in a massive market, so I thought this mini writeup was still warranted even though I don’t have a position.

For what it’s worth, ADSK stock is up 192% over the last 6 years, so it’s been a quality performer for shareholders. I believe this is the type of stock that will perform in-line with the Nasdaq (QQQ) unless they can find a way to accelerate their revenues and/or expand their margins faster than the current estimates.

Based on my own investment models, I just don’t see enough upside over the next few years to justify a position “yet”.

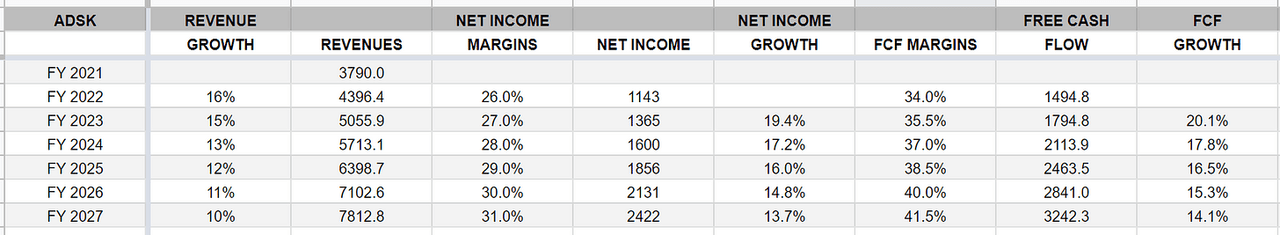

Lupton Capital investment models

Lupton Capital investment models

ADSK is the type of company (along with others like CrowdStrike (CRWD), Datadog (DDOG), Amazon (AMZN), Uber (UBER), etc.) where you should value them based on free cash flow (FCF) more so than net income or earnings. This is why I tried to come up with potential price targets based on net income as well as free cash flow.

Summary:

-

Autodesk is the “go-to” software for architecture, engineering, and construction, with its business model being a 100% SaaS provider. The company engages in design and software services across various industries, including automotive, manufacturing, animation, and construction.

-

Healthy growth in a challenging environment; 16-20% CAGR, equating to revenues of $5B and FCF of $2B in FY23.

-

The current macro-environment presents a significant tailwind from the $1.2T infrastructure bill and $135T in infrastructure spending globally through 2050 (International Energy Agency). Focus on upgrading old infrastructure with new as we push toward a more “green” world.

-

Outlook is continued innovation internally, whether that’s building out M&A as they are the leader in AEC (architecture, engineering, construction), or a long-term digitalization trend and Metaverse play.

Thesis – Pure Play ESG Name With A Long Runway to Build:

Autodesk is a technology company that successfully implements a SaaS model both domestically and internationally. Margins speak for themselves, as management and CEO, Andrew Anagnost, consistently report strong growth and demand for their services. The transition to digitalization gives Autodesk a competitive advantage being already the leader in the construction space. Furthermore, the push toward cleaner and more efficient energy allows them to assist in building out greener infrastructure (smart cities & smart buildings).

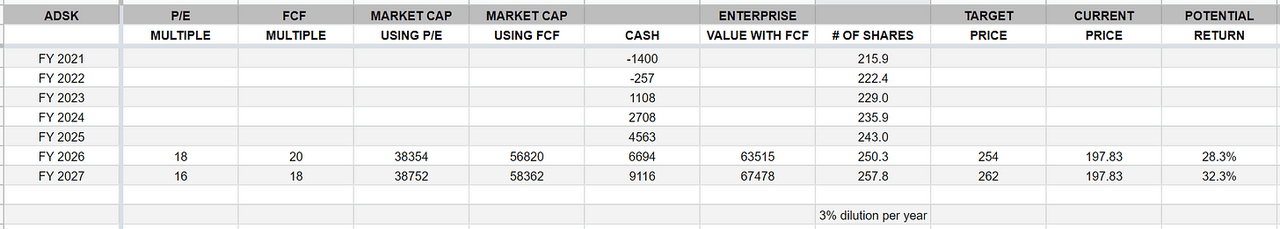

Lupton Capital models

The Main Theme: Consistency

Autodesk continues to deliver strong metrics YoY, firing on all cylinders. In the last quarter, the company produced record Q2’23 revenue, Non-GAAP operating margins, and FCF, which offset geopolitical uncertainty. Total revenue of $1.2B (+17%) and FCF of $246mm (+32%) YoY. AutoCAD, which is their largest software product since the inception of their business, grew +13%, AEC +18%, and Manufacturing +16%. Billings increased by +17% to $1.2B for the quarter, demonstrating the resiliency of their business model, despite global headwinds in Europe and Asia. Geographically, strong growth in the U.S. (+22%), healthy growth in Europe (+15%) despite a recession, and robust growth in the APAC countries (+10%), if you take China out of the equation.

FX headwinds still remain to be a factor next year, as the question for them remains whether the Euro has bottomed. Fortunately, with the diversification the company has geographically, they are able to offset this underlying risk. The company’s robust balance sheet allowed them to accelerate their share repurchasing during the quarter of 1.4 million shares for $257mm at an average price of $182 per share. Finally, they have used strong liquidity to repurchase 3.5 million shares in the first half of this year. In regard to demand, Kimberly-Horn (a leading design consulting firm in the U.S.) expanded its executive business agreement (EBA) with Autodesk, demonstrating a backlog of business both companies have.

Looking Ahead:

Guidance from management remains unchanged at the midpoint across all metrics, with the underlying momentum of the business offsetting FX headwinds. Despite the economic slowdown in the U.S. and globally, Autodesk continues to maintain its FY23 revenue range to be between $4.99 and 5.04B Vs. FactSet’s estimate of $5.01B. Continue to expect non-GAAP operating margin to be approximately 36% and FCF between $2B and 2.08B Vs. FactSet’s estimate of $1.98B. Finally, the expected adjusted EPS of $6.52-6.71 Vs. FactSet’s $6.54.

Evidently, North America remains a stronghold, while healthy growth is in Europe and Asia. The renewal business continues to be a highlight and is key going forward to acquiring new customers and those continuing to pay for their service. Ultimately, strong demand and robust competitive performance delivered exceptional results in their latest quarter. Investors can expect consistency going forward regardless of the challenging environment.

Valuation:

Revenue CAGR of ~15% and earnings CAGR of 20-25% over the next 4-5 years is the baseline expectations. However, given some of the tailwinds we discussed above, it’s possible these numbers are conservative. It’s also possible that ADSK makes some strategic acquisitions that also accelerates revenues and earnings over the next few years.

Even if ADSK continues to grow revenues at a consistent pace, the stock price will still be volatile because it’s the multiple that will change much faster based on macro, yields, etc.

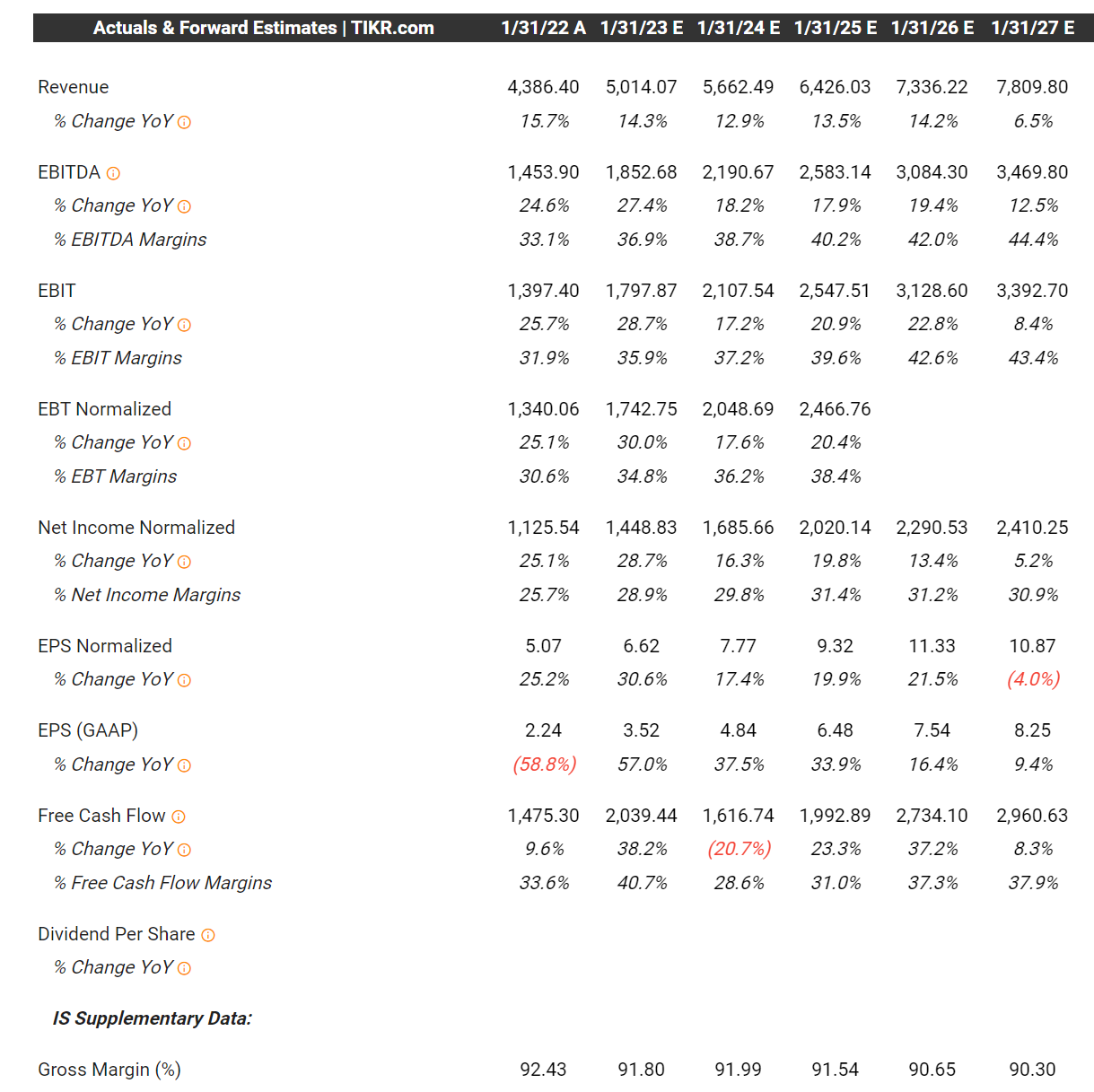

Right now ADSK is trading at 29.7x FY2023 non-GAAP EPS estimates which is certainly a premium to the S&P 500 but in-line with their historical P/E multiple. Given their current EPS growth rates (as seen below), I think the multiple is fair but certainly not cheap.

Where ADSK looks more compelling as we discussed above is when you look at FCF. Right now ADSK is trading at less than 22x FY2023 EV/FCF which does seem on the low end. Looking at the estimates below, my big question is, why do the analysts expect FCF to fall 20% next year? And if this is the case, then perhaps the current FCF multiple is fair.

tikr.com

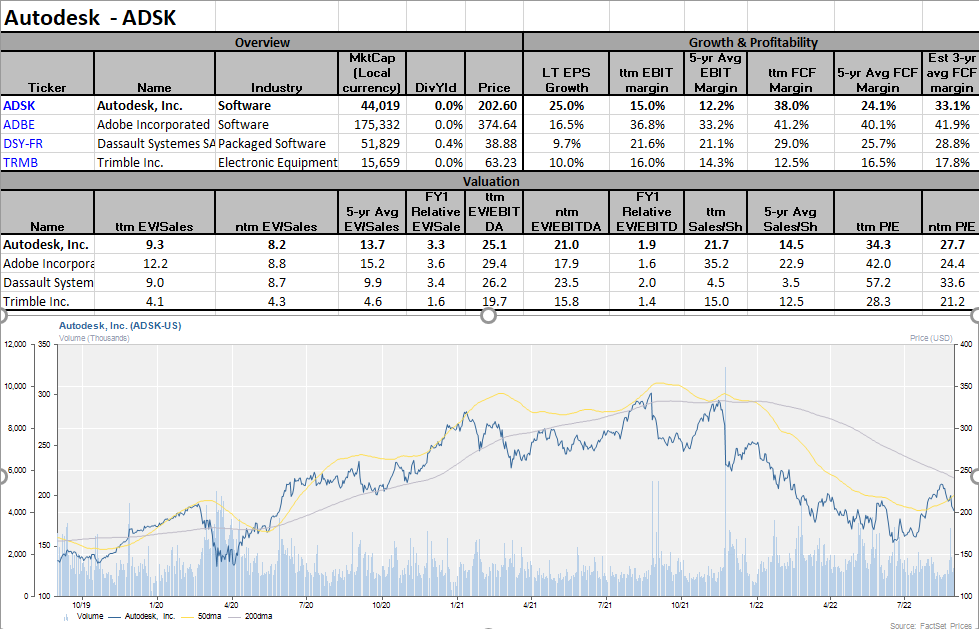

Technicals:

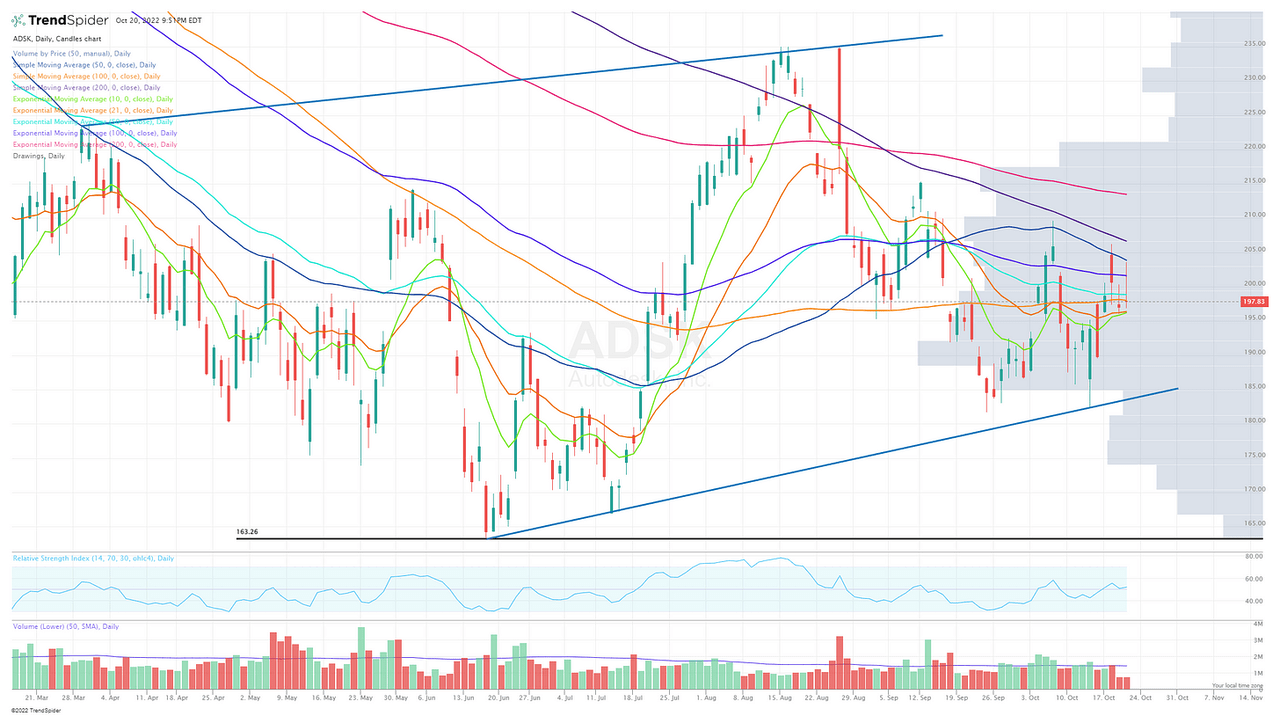

Looking at ADSK on a 6-month daily chart, you can see the stock is currently sitting right above the 21d EMA and 10d EMA. If you were looking to start a position based on the technicals, you can probably start one here, but I’d have a stop loss under the 21d EMA because there’s no technical support below that level until you get down to the trendline in the mid $180s. If you’re an investor focused on fundamentals and valuations, then your strategy might be very different.

TrendSpider

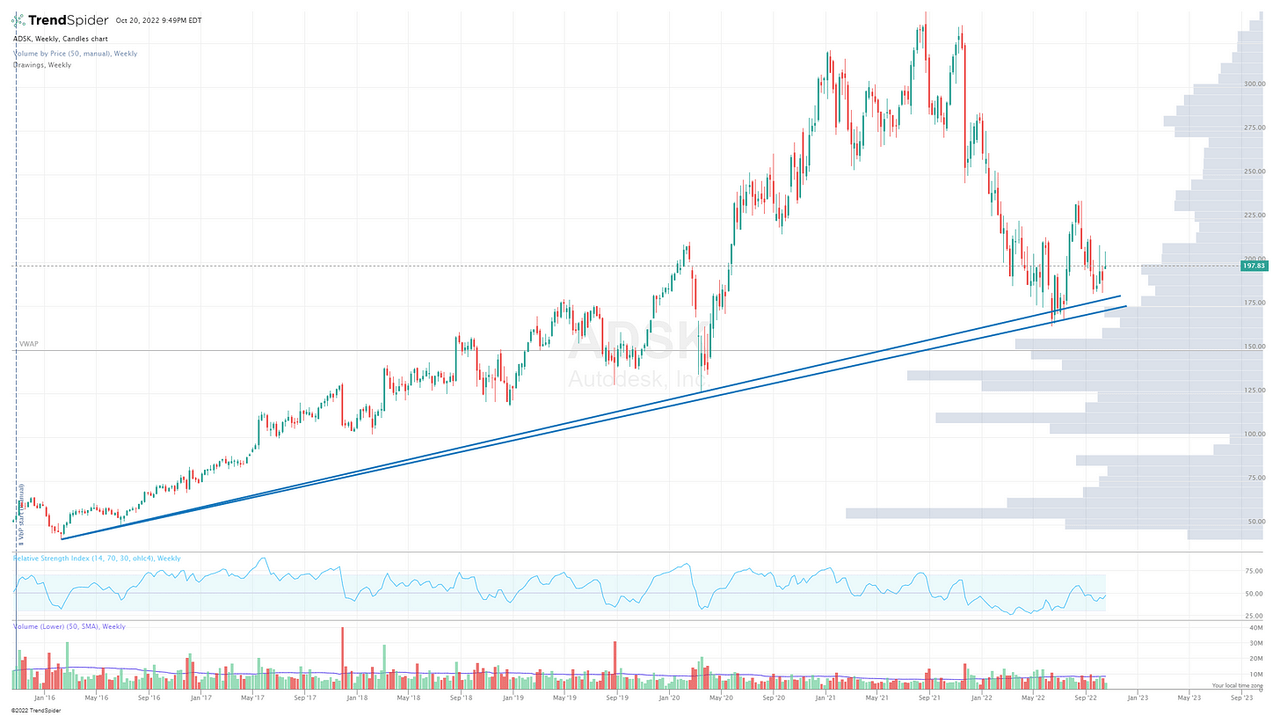

Looking at ADSK on the 6-year weekly chart, you can see this long-term trendline with the middle of that support range being in the mid-$170s. This is where I’d feel more comfortable buying the stock if I was a long-term investor; however, the big volume shelf doesn’t really provide support until you’re down in the $150s. ADSK is currently below the 200w SMA and 200w EMA, both of which are up in the $220s. Sometimes I’d say that it’s better to wait until those moving averages are reclaimed; however, in the case of ADSK, if you waited to buy the stock after it got back to the $220s, I’d contest that upside over the next 3-4 years is significantly lowered.

TrendSpider

Conclusion:

If you decide to buy a stock like ADSK, you are getting a company with a very strong management team and a proven track record. I don’t love the current valuation, although this is one of the premier software companies so they do deserve to trade at a premium to their peers and the broad market. I’d say the same thing about companies like ADBE, CRM, GOOG, AAPL, etc. — given that ADSK is down close to 45% from the highs, the risk/reward is certainly more attractive now than it was last October.

The secular trends for Autodesk continue to be winning the digital transformation in AEC, allowing them to further their competitive advantage. Furthermore, the macro tailwind in this industry is the $1.2T infrastructure bill, which Andrew Anagnost (CEO) has noted money is now slowly trickling into this space. Autodesk is a pure ESG play in an equity name that believes in designing and building sustainable infrastructure, which will act as an additional tailwind transitioning to an energy-efficient country. Ultimately, this is a technology company that successfully implements a SaaS model both domestically and internationally. The transition to digitalization gives Autodesk a competitive advantage as it’s already the leader in construction and at the forefront of sustainability and progress around climate change.

Be the first to comment