Dr_Microbe/iStock via Getty Images

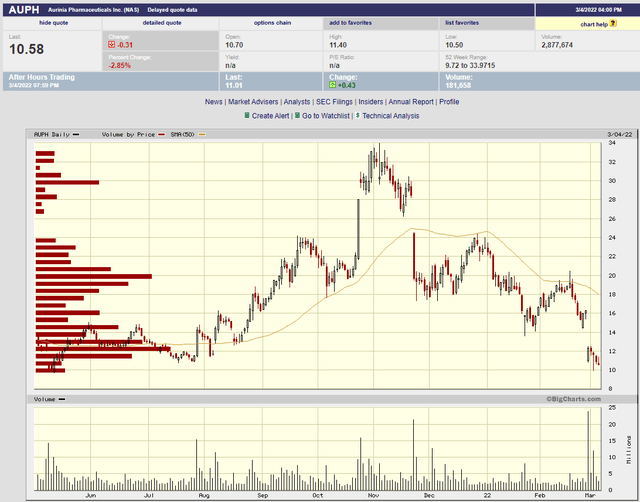

I’ve analyzed Aurinia Pharmaceuticals (AUPH) on a number of occasions, most recently on May 30, 2021 where I presented a revamped sales model which I used to establish a discounted cash flow analysis and stock target price. Since that time the stock has had a wild ride, first trading up to nearly $34 on takeover speculation, and now plunging to $10 on investor disappointment for 2022 guidance.

bigcharts

(source)

In today’s article, I’d like to review the reasons for the recent stock weakness and then update/compare my model to actual sales and cash flow data. For readers new to the stock, I highly recommend reading my earlier articles to better understand the company and the merits and safety profile of its voclosporin drug (brand name LUPKYNIS) which was approved for sale by the FDA early last year.

Why AUPH Stock is Down

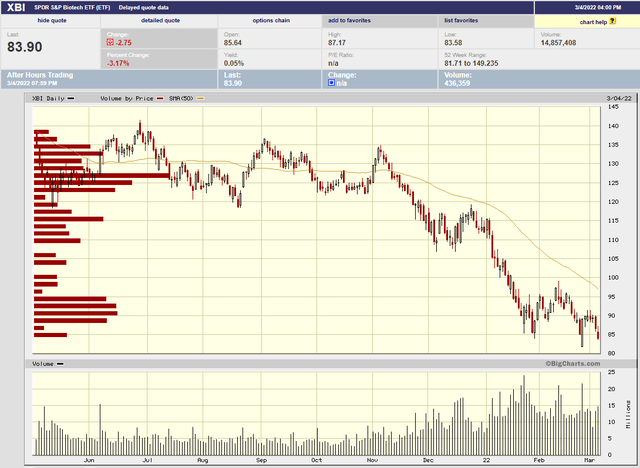

First and foremost, I think the stock is down because biotech stocks in general have been hammered over the past 4 months or so. Here’s the S&P Biotech index (XBI) over the same period as the AUPH graph above. It doesn’t have the spike up that AUPH did, but round trip it’s about the same outcome.

bigcharts

(source)

Particular to AUPH itself are two factors to explain its recent descent. First is guidance and second is concerns about compliance and patent strength. Let’s quickly look at each of these.

Aurinia CEO Pronouncements and Actual Guidance

AUPH set itself up for disappointment when, 12 days before earnings, its CEO, Peter Greenleaf, while presenting at the Annual Leerink SVB Global Healthcare Conference, said the market could expect “aggressive numbers” for its guidance in the forthcoming earnings call. At the time, according to the Globe and Mail, “Wall Street, for its part, was expecting the midway point of the company’s 2022 revenue forecast to come in at around $178 million”.

The actual guidance provided by AUPH in its earnings release on Feb 28, fell way short of that Wall St number:

“For fiscal year 2022, the Company is providing net revenue guidance of $115 to $135 million from sales of LUPKYNIS. This range is based on assumptions regarding the impact of COVID-19 on the current business environment and represents an increase of more than 150 to 200% in net revenue from sales of LUPKYNIS compared to fiscal year 2021.”

Talk about NOT managing expectations!

Patient Adherence and Persistence

The second issue is that there has been some patients who have either started taking LUPKYNIS and stopped or who have been prescribed LUPKYNIS but have never filled their prescription. This was mentioned several times on the recent earnings call and it was discomfiting for analysts and investors. Here is a flavor of this type of talk (with my emphasis):

Of course, and unfortunately, as more patients begin treatment with LUPKYNIS, we can expect to see some more patients discontinuations. While it’s still too early to see statistically significant trends in overall drop-off rates, thus far, discontinuations are aligned with what we tracked in our clinical trials, which is about 25% to 30%.

When we look at patient adherence with LUPKYNIS, here, too, it is too early to cite emerging trends. Remember, the emerging LUPKYNIS patients on drug started treatment in mid-Q3 and Q4 of 2021. Obviously, in most cases, these patients have only been on treatment between three to six months, so we will need more time to understand overall adherence rates.

[…]

So on discontinuations and adherence, I would tell you that the reasons are across the Board. What I would underscore is, they’re not payer related. It’s not like we’re getting PSFs that come in and then the payer is not paying for the drug. That’s not been one of the ones we’ve seen. But to try to range in on a host — from a host of different reasons as to why patients might be discontinuing their product, it’s kind of across the board right now.

Everything from tolerability to patients just not picking up prescriptions, which we are trying to flesh out more. Remember, we’re dealing with primarily a patient population that’s an African-American, Hispanic and Asian female population in the U.S., and we can look to other disease states as analogs to understand that adherence and longer-term compliance are a challenge with that population in general.

As we will see below, my model was more conservative than Wall Street’s in general, and so all of these issues were already baked into my DCF, hence what is disappointing to some, isn’t to me.

Patents

There was also a question about patents raised in the 10-K and earnings call. I believe this is just an exploratory move, so I’m currently happy with the explanation that AUPH gave on the call:

We did receive notice of an inter partes review, or IPR, petition being filed on February 24 with respect to our patent that has claims directed at LUPKYNIS dosing protocol for lupus nephritis used in our clinical trials.

As you all recall, that patent has a term extending out to December of 2037. At this stage, it’s really too preliminary to give a full assessment of this IPR as a position — a petition that was filed from Sun Pharmaceuticals who you all may recall, if you’ve been reading our Ks, we are suing for patent infringement in a separate matter, which I’ll talk about in a second, was really just received.

So we’re looking at it, but we’re confident in our process to prosecute all our patents. This patent in particular, had significant review, as we’ve mentioned previously at the U.S. Patent and Trade Office before being approved as being actual valid patent by that office.

I think that summarizes why the stock is trading as low as it is. Now let’s turn to the bigger picture which is what will sales look like over the life of the drug and what is that worth?

Initial Comparison of Sales and Cash Flow to Model

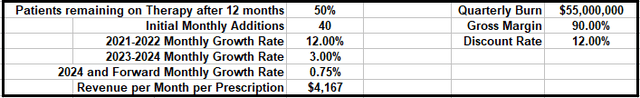

As I mentioned, I presented my full model in an earlier article, so for new readers, I’d suggest reviewing that to get into the nitty gritty of my assumptions. But as a quick recap, here are the basic model parameters, followed by the first two years of predicted revenues and cash flows:

Author

(source: Author’s model)

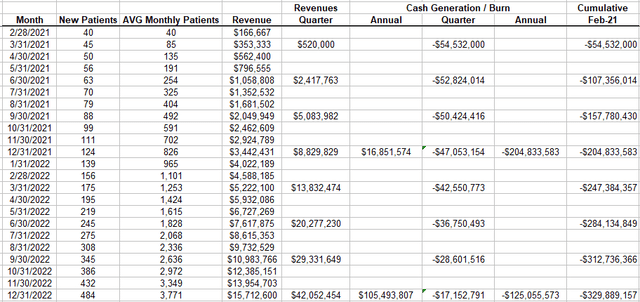

Author

(source: Author’s model)

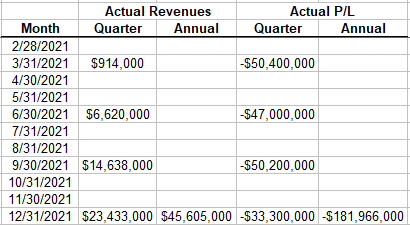

Actual Data

We now have a year of actual revenues and cash flows to compare. To be conservative, I’m using P/L instead of cash flows because the company does use stock-based compensation and I don’t want that to make the model look better than it is.

author

(source: Author’s compilation of earnings data)

The initial data suggests that my model is very conservative; i.e. it overestimates cash burn in the first year by $20M and underestimates revenues by $29M. Or another way to put it, so far actual revenues are tracking ahead of predicted revenue by about 6 months.

Going forward, I predict revenues of $105M in 2022 and cash burn of about $125M. Both of this are likely very conservative, particularly given the company’s revenue guidance of $115M to $135M cited above. For 2023 I predict revenues of $333M and positive cash flows of $80M. Given that the company currently has $466M on hand (as of Dec 31, 2021) it should have no need to raise cash going forward. Indeed, as mentioned in the earnings release:

[AUPH] [f]urther stabilized balance sheet through the utilization of an at the market offering (ATM), raising net proceeds of $196.7 million through December 31, 2021, at an average price of $19.91 and at an average discount of 2.63%. The Company has terminated the ATM sales agreement with no further sales to occur under the ATM.“

As a couple of validation points for my model, consider that

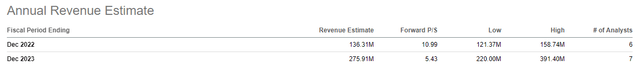

(1) analysts estimates for 2023 revenues currently range from $275 to $391M which puts me in the range but still conservative.

seeking alpha

(source)

(2) That the number of SLE patients diagnosed with LN is estimated to range between 80,000 and 120,000 (see for example 10). My model doesn’t have AUPH treating half of the low end of the range (i.e. 40,000 patients) until March of 2028, by which time the number of diagnosed patients will almost certainly be substantially higher than current estimates (in no small part because effective treatment will encourage more accurate diagnoses).

Finally, as another conservative aspect of my model, there currently is no accounting for any royalties or milestones from international sales, despite the fact that Otsuka appears to be making solid progress in Europe.

Conclusion

As a result of this exercise, I’m more convinced of the value of my model. Factoring in one less year of negative cash flows counterbalanced by a higher fully diluted share count gives me the same price target I had previously, viz. $75 with a 5 year horizon to get there. Given that the stock is now trading below $11, I’m adding to my position at today’s prices.

Be the first to comment