The Australian dollar has fallen precipitously in recent weeks. The monthly candlestick chart below illustrates the extent of the decline, which has seen AUD fall by over 27% against the U.S. dollar. That is, if we compare the recent low of about 0.5506 to the monthly opening price in January 2020 of about 0.7016.

(Chart created by the author using TradingView. The same applies to all subsequent candlestick charts presented hereafter.)

I have also drawn attention to the 0.5500 level in the chart above, per the horizontal line. Notice that this is a key level which roughly matches the low of AUD/USD in August 1998. Indeed, in August 1998, AUD/USD found support and bounced over the subsequent months; this is something we should keep in mind going forward.

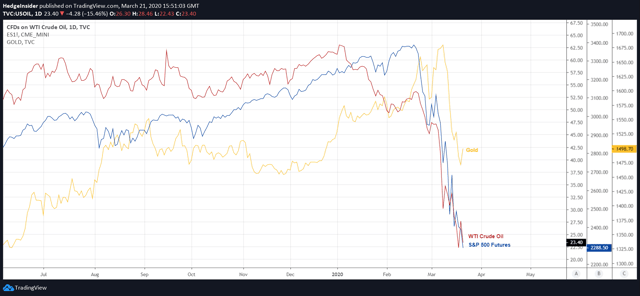

Nevertheless, the recent drop in AUD has been based on an aversion to risk-taking, as U.S. equities continue their rapid decline amidst the COVID-19 pandemic. Oil prices have also collapsed. In fact, due to the market’s increased demand for cash, even so-called safe-haven assets like gold have quickly dropped in value (see below).

Indeed, equities, oil and gold (among other assets) have sold off in tandem. In effect, markets have been so averse to risk that they have shunned not only risk assets but also traditional safe havens like gold. Perhaps one of the largest benefactors of this ‘flight to cash’ has been the U.S. dollar (or USD), the world’s reserve currency. This has resulted in practically all other currencies (besides USD) finding downside pressure.

Indeed, equities, oil and gold (among other assets) have sold off in tandem. In effect, markets have been so averse to risk that they have shunned not only risk assets but also traditional safe havens like gold. Perhaps one of the largest benefactors of this ‘flight to cash’ has been the U.S. dollar (or USD), the world’s reserve currency. This has resulted in practically all other currencies (besides USD) finding downside pressure.

It is worth noting that Australia is a key exporter of commodities whose demand is typically positively correlated with world economic growth, and by virtue of that, risk-taking. Top Australia exports include mineral fuels (including oil), ores, precious metals, meat, inorganic chemicals, and machinery (including computers). Since even gold, also a key export of Australia’s, has dropped too, the pressure on AUD has truly mounted.

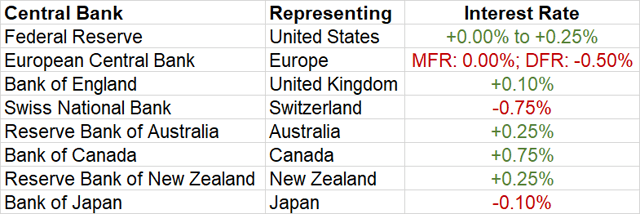

The Reserve Bank of Australia recently cut its interest rate to +0.25% too, in order to help support the economy amidst the COVID-19 pandemic. The table below offers a snapshot of the current interest rates of the world’s major central banks.

(For a more complete list, see global-rates.com.)

(For a more complete list, see global-rates.com.)

Note that interest rates have fallen to almost zero across the board, at least in many major economies. The U.S. Federal Reserve has a target rate of between zero and +0.25%; a similar rate to Australia’s. The European Central Bank (or ECB) has a short-term rate of zero on its main refinancing operations, however its more comparable rate is negative at -0.50% (the deposit facility rate, i.e. the interest that banks receive for depositing money with the ECB overnight). The Swiss National Bank (or SNB) is even more negative, at -0.75%, while New Zealand is now matches Australia with a rate of just +0.25%.

This overview is important, because it signals the “death of carry”, so to speak. Regardless of prevailing risk sentiment, it is no longer attractive to borrow one cheap currency in order to purchase a higher-yielding alternative. One of the classic carry trades was AUD/JPY; borrowing Japanese yen (with Japan’s official rate being negative) to purchase Australian dollars (with positive rates). This kind of trade enabled one to book interest income, and this phenomenon also typically provided support in FX spot prices (lifting popular carry-trade pairs like AUD/JPY).

We are now likely to see far less bias in the FX market with respect to interest rates. In the immediate term too, the COVID-19 pandemic has placed great strain on any pro-risk narrative. AUD has naturally dropped quickly. It could drop further, as it did in 2008. However, gold will be an important commodity to watch as uncertainty persists, and the current market drive for cash liquidity begins to correct.

The chart above shows the price of gold (per the yellow line), versus AUD/USD spot. While not perfectly correlated, the positive correlation is fairly apparent. The fact that gold dropped recently, just as everybody would typically expect it to rise (i.e., in light of reduced economic growth, increased monetary stimulus, increased uncertainty, etc.), is again indicative of a run for cash liquidity. Given that much, or all, of this initial shock is likely over, regardless of where U.S. equities now travel, gold is now likely to witness a small resurgence.

The chart above shows the price of gold (per the yellow line), versus AUD/USD spot. While not perfectly correlated, the positive correlation is fairly apparent. The fact that gold dropped recently, just as everybody would typically expect it to rise (i.e., in light of reduced economic growth, increased monetary stimulus, increased uncertainty, etc.), is again indicative of a run for cash liquidity. Given that much, or all, of this initial shock is likely over, regardless of where U.S. equities now travel, gold is now likely to witness a small resurgence.

By virtue of this (at least minor) resurgence, AUD is also likely to find some support at current prices. At the very least, we should expect the currency to sustain levels above the 0.5500 level in the near term, and more likely above 0.5700. However, as we move into quarter end, it is probable that we will see further pressure on many asset classes (particularly risk assets, to include U.S. equities) as asset managers continue to liquidate their positions.

It is important to note that many funds, especially hedge funds, operate with redemption notice periods. This means that an investor in one of these funds may have to give a certain number of days’ notice (anywhere from 30 to 90 days, possibly even longer in some cases) before they can pull their capital out of the fund in question. The recent sharp sell-off would likely have caused many investors to make fund redemption requests. As the recent equity decline only began about 30 days ago, the coming quarter-end could see another wave of liquidation.

Nevertheless, since the most leveraged players are likely to have already been liquidated (due to the sheer level of volatility recently witnessed in equities), it is likely that the downside pressure will now begin to slow (if not cease). Meanwhile, despite the drop in gold prices, the precious metal’s underlying safe-haven allure is likely still intact, as it usually attracts more committed investors with longer-term mindsets. Gold investors often purchase gold to protect against inflation and the devaluation of fiat currencies.

Even if we see further volatility, gold is likely to ‘catch a bid’ and find some support from these levels (above $1,500/oz). In turn, AUD should at least consolidate around current levels. While AUD does not present an attractive long opportunity at this juncture, it is no longer such an attractive short either.

The Australian dollar, together with the New Zealand dollar (or NZD) and the Canadian dollar (or CAD), will be important to monitor as the COVID-19 pandemic remains the top news story. Significant global development in combating the virus (through containment, mitigation and/or vaccine development, etc.) could send AUD, NZD and CAD (collectively, the commodity currencies du jour) significantly higher as the current risk premium built into these currencies unwinds.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment