Justin Sullivan

I warned about growing dividend risks for AT&T Inc. (NYSE:T) two months ago, citing bill collection issues and increased risks to free cash flow.

Furthermore, AT&T did not cover its dividend with free cash flow in the second quarter, and the company lowered its free cash flow forecast for the full year due to customers deferring bill payments.

With that said, AT&T’s valuation has now fallen to the point where a dividend cut is fully priced in, in my opinion.

Because AT&T’s earnings multiple is so low, I dipped my toe in the water and purchased AT&T’s stock price weakness. AT&T could rise to $20 per share, representing a 33% increase in value.

AT&T Doesn’t Cover Its Dividend

AT&T generated only $1.4 billion in free cash flow in 2Q-22, which was insufficient to cover the approximately $2.0 billion cost of financing the company’s quarterly dividend pay-out.

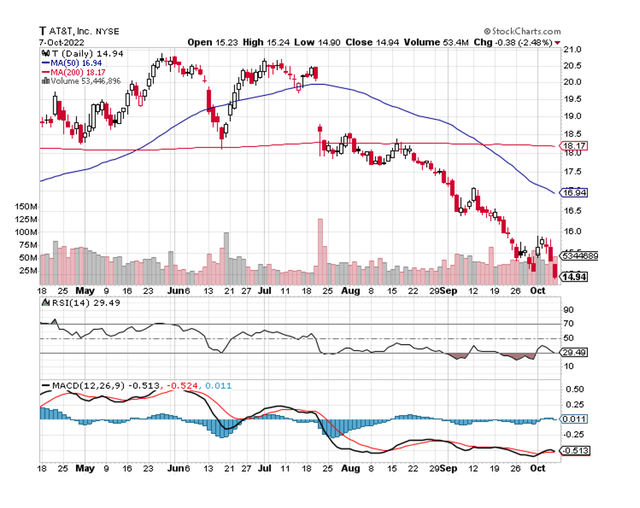

Furthermore, AT&T reduced its free cash flow forecast by $2.0 billion to $14.0 billion in the most recent quarter, contributing to a significant selloff from which the stock has not recovered. In fact, the selloff has worsened since the company issued its free cash flow update, and AT&T’s stock recently hit a new 52-week low.

The bottom half of the chart above shows that investor sentiment has deteriorated significantly, with the Relative Strength Index (RSI), now showing a value of only 29.49. A drop below 30 is considered a contrarian indicator, indicating overly bearish sentiment and pointing to a potential stock reversal.

What Is Going On Here?

The market is likely expecting the telecommunications company to cut its dividend in 2023 due to poor free cash flow and uncertain capital allocation decisions. Remember that AT&T recently spun off its media business, which was then merged with Discovery.

The new AT&T, which focuses on 5G and the expansion of its fiber business, has reset its dividend to $1.11 per share per year, paid in equal installments of $0.2775 per share per quarter. The dividend yield is currently 7.4%.

How Much Could AT&T Slash Its Dividend?

To be honest, a 50% dividend cut would not surprise me because it would save the telecommunications company approximately $4.0 billion per year or $1.0 billion per quarter in free cash flow that could be put to better use, such as expanding its fiber business or paying down debt.

Even though my 50% dividend cut assumption is speculative, a dividend adjustment would almost certainly have to be significant in order to relieve pressure on AT&T’s free cash flow, especially if bill collection issues persist.

Comical P/E-ratio

Aside from being oversold according to the Relative Strength Index, AT&T’s P/E-ratio valuation is borderline comical, even when considering that the company may cut its dividend payout in half.

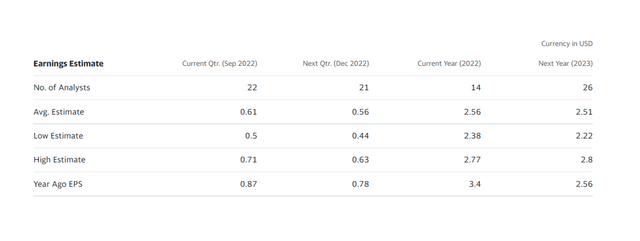

Earnings per share are expected to be $2.51 in 2023, resulting in a 6.0x earnings multiple. Even a 50% dividend is fully priced in at this P/E ratio, and the stock has significant upside potential.

Earnings Estimate (Yahoo Finance)

Fair Value Closer to $20

I believe AT&T has a fair value that is approximately 33% higher than the current price of $15. A $20 price target would imply a P/E ratio of 8.0x, which is closer to the company’s long-term (five-year) average P/E ratio of 9.0x.

Why AT&T Might See A Lower/Higher Valuation

Sentiment strongly speaks against AT&T, but it can also be interpreted as a contrarian indicator. If AT&T follows through on a dividend cut, the stock price may fall even further in the short term.

Having said that, the market appears to have fully priced in a dividend cut, so the downside is likely to be quite limited at this point.

A dividend cut could be beneficial to the stock in the long run, as AT&T could prioritize debt repayment and create value for shareholders by pushing for aggressive fiber network expansion.

My Conclusion

I purchased an initial tester position in AT&T because I believe the market has fully priced in the risk of a dividend cut following the company’s separation from WarnerMedia.

AT&T not only trades at a very low earnings multiple based on 2023 earnings, but it is also oversold according to the Relative Strength Index. A drop below an RSI of 30 is usually interpreted as a contrarian buy signal.

Given that the valuation ratio has also contracted significantly in 2022, I believe AT&T’s P/E-ratio reflects a very high margin of safety, even if the company decides to reduce its dividend payout.

Be the first to comment