wdstock

Finally Seeing Results

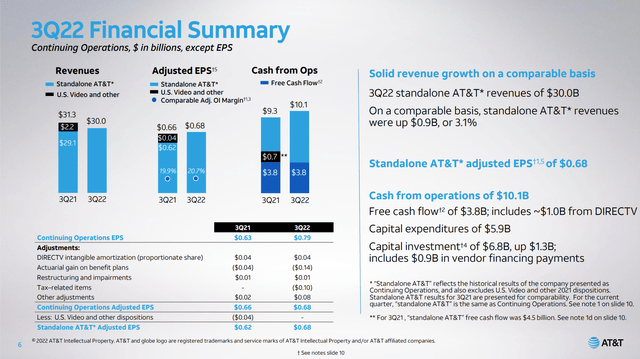

AT&T (NYSE:T) is now seeing turnaround efforts pay off in their financial results, justifying their disciplined marketing strategy to grow the customer base. The company earned $0.68 per share (non-GAAP), beating expectations by $0.07. They also raised full year guidance to “$2.50 or higher”, which is still conservative as $2.50 for the full year would require only $0.54 in 4Q. Free cash flow was $3.8 billion for the quarter and $8 billion YTD, both of which cover dividends paid. The good news is that the company maintained its full year FCF forecast of $14 billion. This implies $6 billion FCF in 4Q which is achievable considering that planned capex is slowing down as AT&T spent heavily on its 5G and fiber strategy already this year.

AT&T continues to have strong subscriber growth in Mobility while in Consumer Wireline, growth in fiber customers continues to offset the decline in older technology voice and data subscribers. Revenue per user is growing in these segments, leading to operating margins that are higher compared to 3Q 2021 as well as the 2022 YTD average.

The company is sticking with its strategy of giving everyone the best deals, meaning limited use of promotional pricing to draw in new customers at the risk of losing them when the promotional period ends. As a result, customers are staying with the company despite the macroeconomic concerns over inflation and possible slowdown. Concerns over customers taking longer to pay their bills, which first arose last quarter, have not gotten any worse. Churn and days of sales outstanding are up slightly from the government stimulus-heavy period of 2021 but have normalized to similar levels as at the start of 2020.

With AT&T now showing results, it is not surprising for the stock to be up about 8% by the end of the earnings call. Still, at $16.82 it is valued at only 6.6 times 2022 earnings compared to Verizon (VZ), which is now at about 7.2 times. This gap has narrowed considerably since the start of the year even as both companies have gotten cheaper. AT&T is still about 8% cheaper despite its improving balance sheet, higher dividend yield, and similar growth prospects. AT&T remains the better buy on a relative basis, but the improving business makes it a good buy on an absolute basis as well.

Adding Higher Value Subscribers

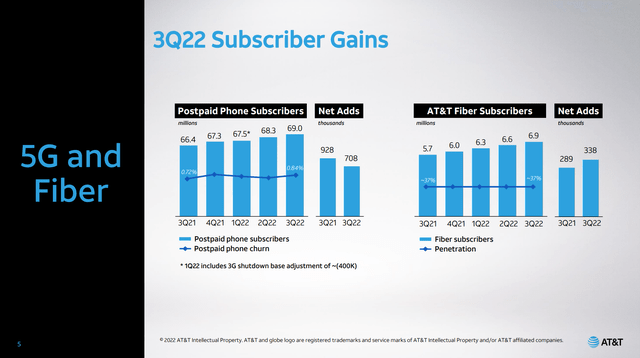

AT&T continues to benefit from their marketing strategy of “everyone gets the best deals” instead of offering discount prices to new customers only to raise them after the promotional period. In wireless, the company added 816,000 phone subscribers in 3Q, 708k of which are high-paying postpaid subscribers. These customers are now paying more, with postpaid phone ARPU up 2.4% from last year to $55.67. AT&T also has a huge base of almost 102 million non-phone “connected devices”, an increase of 12.1% from a year ago. This lower margin but fast-growing category has the automotive business as its main growth source as cars become more connected. There is still a long runway ahead for this business to grow, although management also mention manufacturing and medical devices as the next growth verticals for the future.

On the fiber side, AT&T continues to gain customers, offsetting losses in legacy copper wire voice and DSL services. This overall flatness in the consumer wireline subscriber count is expected to last for the foreseeable future, but the fiber customers are higher paying with an ARPU of $62.62 and new customers coming on in the $65 to $70 range. The company remains committed to its fiber strategy rather than using fixed 5G wireless for home data services. This is in contrast to competitors Verizon and T-Mobile (TMUS). Although fiber takes longer to build out the network resulting in slower initial customer growth, the company believes that it is more scalable to higher data usage rates that customers will have in the future. The company would not comment on rumors of a joint venture to finance quicker expansion of the fiber business however it did sound like this strategy, if employed, would be in areas outside its core footprint.

The one segment still in decline is Business Wireline. Traditional company-managed networks required more and higher-margin services from AT&T than the newer cloud and software-defined networks, even though data transmission rates are higher for the newer technologies. The best I can say about this segment is that the decline does appear to be slowing down, and it’s now a small part of the company with about 11% of overall revenue this quarter compared to 15% a year ago. On the bright side, the Latin America segment is showing good subscriber growth while margins continue to improve. EBITDA of this segment is now over $100 million this quarter after first turning positive in late 2020.

Outlook

AT&T has some seasonality to their results with the fourth quarter typically showing strong revenue and cash flow, but below-average EPS as non-cash expenses are recognized. For that reason, the pre-earnings call analyst consensus of $2.55 EPS for the year looks achievable as it implies 4Q EPS of $0.59. Recall that free cash flow guidance for the year was revised down from $16 billion to $14 billion earlier this year but was unchanged this quarter. That implies $6 billion of FCF in 4Q. While that is higher than any quarter this year, it does not require any heroic operating results, just a planned drop-off in capex from the high YTD levels.

Looking forward to 2023, management declined to give any specific guidance on the earnings call, saving that for next quarter. Generally speaking, the company will continue its marketing strategy in Wireless and expanding its fiber network to more locations. Recession is a risk for 2023 but based on consumer behavior so far, customers consider AT&T’s services “essential” and are keeping them despite other challenges to their budget. On the business side, AT&T is more focused on large enterprises, which can weather downturns better than small businesses. Large businesses are also more likely to forge ahead with IT projects in a downturn to achieve efficiency benefits.

The company noted the $20 billion free cash flow forecast for 2023 while reminding analysts that there would be no change to it until next quarter. There is a risk the company could lower it because of macro concerns, but they did commit on the earnings call to at least growing the number compared to the 2022 forecast of $14 billion. The mobility business should continue to grow from customer adds and higher ARPU while consumer wireline will grow as legacy customers switch to fiber and pay more each month. Business wireline decline is expected to slow and capex as well as interest expense will be lower as the company has paid off some debt. On the negative side, the company expects higher cash taxes and lower dividends from DirecTV.

Capital Management And Valuation

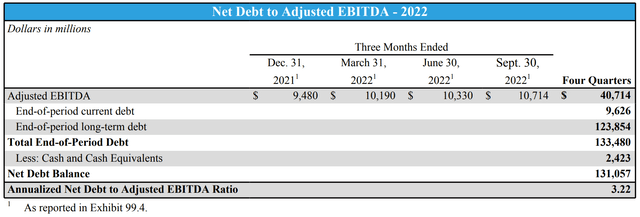

Free cash flow of $14 billion in 2022 covers the $9.8 billion of dividends to be paid out this year ($0.52/share in 1Q and $0.2775 in 2Q-4Q). However, FCF does not subtract the ~$10B paid in auctions for spectrum this year. Nevertheless, the company received cash in the WarnerMedia spinoff and has reduced net debt so far this year. Compared to last quarter, net debt is down just under $1 billion to $131 billion.

Looking ahead to the end of 2022, AT&T should generate $6 billion of FCF in 4Q as noted above, or $4 billion FCF after dividends. FY EBITDA should come in around $42 billion which would bring Net Debt/EBITDA down to $127/$42 = 3.02.

For 2023, there is a risk that macro concerns could cause the company to start out with a lower FCF forecast than the $20 billion previously stated. If they only earn $18 billion, that still leaves the $8 billion of dividends well-covered, assuming the $0.2775 per quarter is not increased. Assuming EBITDA of $44 billion in 2023 (4.7% growth), that would result in net debt/EBITDA of $117/$44 = 2.66. This is slightly above the previously stated target of 2.5 but still below my estimate of Verizon’s net debt/EBITDA of 3.3.

It’s hard to forecast what AT&T will do with the dividend following the cut earlier this year. My suspicion is that they will wait to raise it until they hit their stated leverage target of 2.5 which I now expect to be in 2024. The company’s earlier stated long term targets had an incremental $4 billion of free cash flow growth from 2023 to 2024. That would be enough to raise the dividend by $0.56 per year or $0.14 per quarter to $0.4175. That would represent a dividend yield of 9.9% based on current prices. Alternatively, that would imply a price target of $23.39 if the dividend yield stays similar to current levels.

Conclusion

AT&T’s efforts to increase subscribers and grow margins are now paying off in income and EBITDA growth. Free cash flow growth will follow next quarter as the company ramps down its capex plan. Macro concerns are a risk for 2023 but the consumer has so far been resilient and willing to keep paying for service.

The company can easily cover the annual dividend rate of $1.11 per share in 2023, which is about 40% of the previously stated free cash flow plan, or 44% of my more conservative $18 billion estimate. FCF should improve by another $4 billion in 2024 as the capex plan slows down further. This gives the company flexibility to resume buybacks, do more growth projects, or increase the dividend.

AT&T’s leverage as measured by net debt/EBITDA would reach 2.66 in 2023 based on my conservative FCF estimate. Once leverage hits the target of 2.5 in early 2024, I expect the company will be more generous with dividend increases. The incremental $4 billion of 2024 FCF if applied to the dividend would result in a payout of $1.67 per year, and a share price of $23.39 assuming a yield similar to the current value.

Be the first to comment