piola666/E+ via Getty Images

Quick Dividend Update

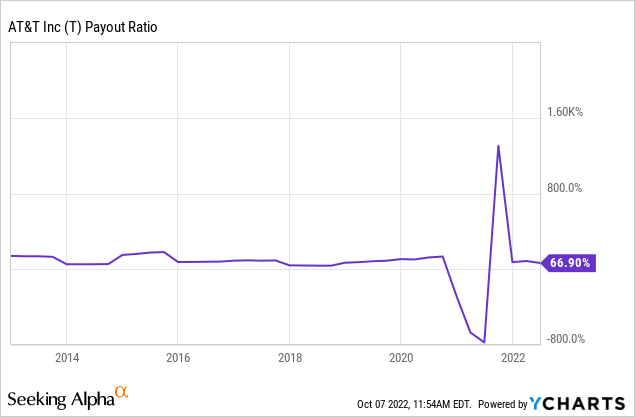

One month ago I explained why AT&T (NYSE:T) was a buy. I specifically discussed how T’s cash flow was down but the dividend was up. And, despite the lower cash flow, the dividend was still quite safe. Now, while this is a rather gross oversimplification, you can see the dividend payout ratio for yourself:

The Warner Bros. Discovery (WBD) spinoff ruins the picture with that weird “heartbeat” but otherwise, you can see that T is roughly in line with its historical payout ratio. Sure, it’s up around 67% and “high” but this is really nothing new at all.

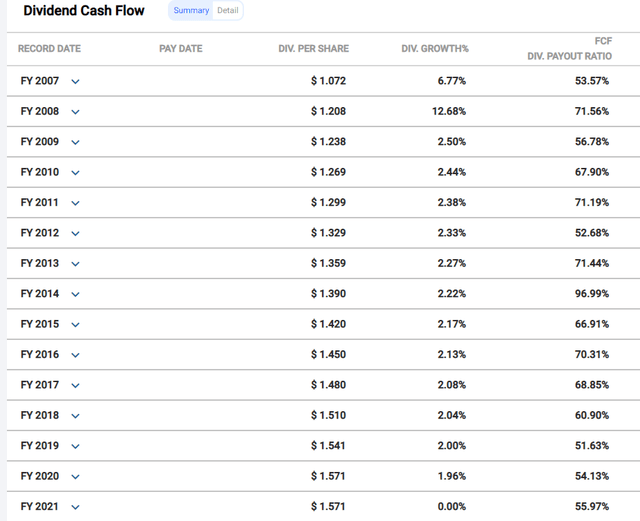

I believe you might like the picture below a little bit better. I know that I like it better because it’s entirely based on Free Cash Flow.

T Dividend Cash Flow Analysis (FASTgraphs)

Instead of the current traditional payout ratio of 67% per YCharts above we’re seeing a more modest 56% via FCF in 2021.

As I said as part of a forward looking view:

The dividend isn’t threatened. The dividend is $1.11 which will likely land somewhere between 58-62% of the anticipated free cash flows per share in 2022. Perhaps my range isn’t quite big enough, but the point is that T’s dividend is safe, and the yield is close to 6.5% if you’re looking to collect.

Really, it doesn’t matter too much if we’re using EPS or FCF. The story is that, in large part, T is in line with history regarding the payout ratio.

Of course, this doesn’t tell us much at all about T’s debt load, the WBD spinoff train wreck, the price collapse or anything like that. Instead, it’s just to say the T’s dividend is mostly stable based on a simple historical measure.

In a sense, we can say that income investors and dividend investors shouldn’t be any less or any more worried than in the past. Nothing fundamental has changed there.

Total Return Failure

One month ago, it looked like T was nearing a low and a reasonable entry point, especially for income and dividend investors. And, I did say this:

T is a reasonable Buy at this price for income investors.

No table pounding. No screaming buy. No generational buy. I didn’t think that one month ago and I still don’t think T is strong enough while simultaneously cheap enough to warrant a strong buy. But, I do believe it’s a Buy for investors who want to roughly match inflation right now, although the paltry dividend increases won’t satisfy much going into the future. Keep that in mind if you’re expecting to beat inflation. With T, you won’t.

In the larger picture but still in a short period of time, T isn’t looking great. What I mean is that since I wrote about T’s cash flow and dividend, the stock price is down more than 12%. Sadly, the price was already low, and yet we’re down even more. Worse still, the S&P 500 (SPY) is “only” down about 7%. So, T’s not beating in that regard either.

The only good news about price drop and total return fizzle is that you can get more shares and more income if you’re adding T right now. Likewise, you’re getting a chance to lower your cost basis. This is hardly even a reasonable consolation price, but it’s still something for long-term investors.

The Nasty Twist

On September 12th, T presented at the Goldman Sachs Communacopia + Technology Conference. Cutting to the chase, I was not impressed. I didn’t spiral into some depression but some of the news was bad, and direct.

Here’s the first smack across the face:

We understand that we’ve got to sustain a consistent level of investment to make that happen. And we’re probably a little over 18 months into that cycle that typically in our business, given the capital intensity and the significance of what you need to do to move infrastructure, it takes about a three-year process to get the flywheel moving in the right direction.

My interpretation is that T is only halfway through their transition, to reposition the company. Obviously, the first half has been ugly for at least two reasons. First, the WBD spinoff has destroyed investor capital. Or, perhaps more fairly, investors have seen the price of WBD get crushed thereby providing almost no benefit. We have seen no value unlocked in WBD. Second, T’s dividend might be “safe” but T’s price action has been extremely poor, with a serious decline. I don’t think any serious investor believes that T price action has been stable. It’s downhill. And we have 18 more months of this?

Next, CEO John Stankey does flag inflation as an issue. He also indicates that political and monetary actions are taken to rectify the situation, outside of what T itself is doing. But, here’s the worry:

As a result of that, the best thing that we can do is that we continue to work really aggressively on the cost side of the equation. The economy from a volumes perspective and our customers’ willingness to use our products and services still remains really strong. However, we are seeing input rising — cost of inputs rising literally at every portion of the business and having to work really aggressively to carry that through.

Remember that T was already getting aggressive about costs before nasty inflation and economic issues really hit the fan. Therefore, there’s the threat here that T starts to get “too cute” and they keep cutting and slashing. They could easily cut away not just fat, but the muscle and bone needed for growth going forward into 2023, 2024, and beyond.

Recall that we’re only halfway through the transition. T isn’t the most creative company so I can easily imagine the bean counters turning into butchers. Let me be very precise, using Stankey’s own words here:

So we had a real aggressive approach on costs in place before. We’re working even harder now looking for other opportunities…

The upside of the transitional activities is that T has added something like three million postpaid to the business. Also, around 300K fiber customers are being added per month. There is growth. It’s not all cutting.

I could continue to add good news and bad news here. But, that wouldn’t change the fundamental picture much, if at all. The problem is that there’s very little that makes me think T is going to strengthen significantly, or grow with any new speed. I do believe, however, that T’s dividend will remain safe.

Wrap Up

The very short summary is that T’s price continues to collapse while at the same time the business is strong enough to support the dividend. In the short term this is likely just fine for income-hungry dividend investors. That’s fine. In the longer run, however, T isn’t likely to produce any meaningful total return. It’s a slow old dog, perhaps with fleas. There are far better total return opportunities, such as Big Tech right now, like Alphabet (GOOGL) (GOOG), Meta (META) and Amazon (AMZN). You won’t get the dividends but you will almost certainly beat T overall if you’re patient.

And, all of that said, I’ll say again that T is a Buy but only for a select group of investors who know the exact value proposition, as I’ve laid out above.

Be the first to comment