RiverNorthPhotography/iStock Unreleased via Getty Images

We tempered our bullishness on AT&T Inc. (NYSE:T) the last time we wrote on it. Despite being raging inflation bulls, we were astounded by the extent and impact of it on the earnings of all companies in sight, T included. We concluded our piece with:

Even as massive inflation bulls for the last two years, we have been flabbergasted at the extent of its impact on earnings. From Walmart Inc. (WMT) to Target Corporation (TGT) and everything in between, there is a very serious headwind from inflation. AT&T looks insulated in the very short term, but we would not underestimate the potential here to tighten the noose around free cash flow. We still rate this a buy, and expect that the exceptional valuation and modest pricing power gets AT&T through the day. However, due to the forces mentioned above, our price target is just $24-$25 or 9X-10X potential 2023 free cash flow.

Source: AT&T: Inflation Threats Are Real

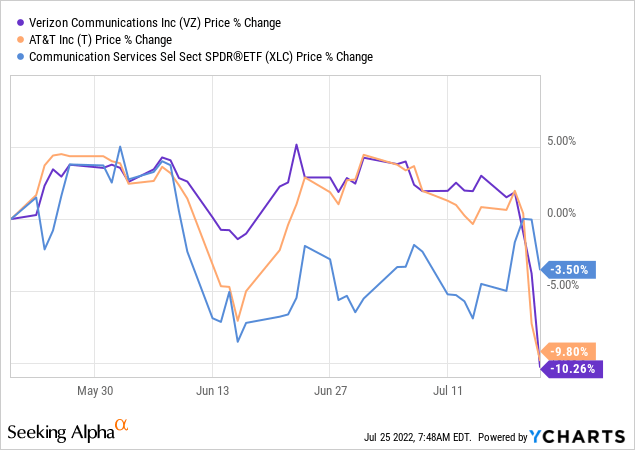

Last week, AT&T revised its free cash flow estimation for 2022 lower and was punished by the now inflation weary market. All of the price movement since our last piece happened today and for the exact reason we warned about in the conclusion stated above. Verizon Communications Inc. (VZ) also matched this decline almost exactly and made some similar comments.

We are long AT&T and have participated in the one way ride since the spin-off. What are our current thoughts and next steps? We discuss that next.

Q2-2022, What Worked & What Did Not

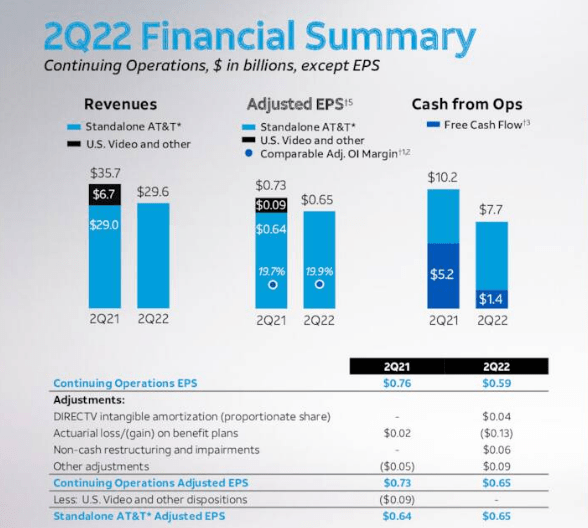

The big picture numbers for the quarter were good. Revenues and adjusted EPS were up year over year, albeit modestly. This was after adjusting for the impact of the Warner Bros. Discovery Inc. (WBD) spin-off.

AT&T Q2-2022 Presentation

Free cash flow was solidly lower, and came in even under expectations. For all the trauma AT&T received from investors about the large debt laden acquisition of Time Warner, you can clearly see that the powerhouse was adding to results.

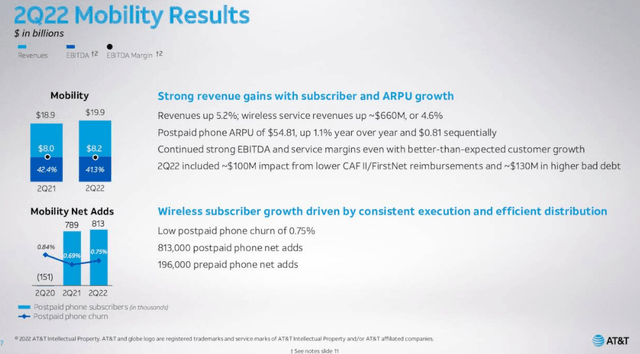

On a segment basis, mobility was strong in terms of net adds and revenues, but weaker in terms of EBITDA margins.

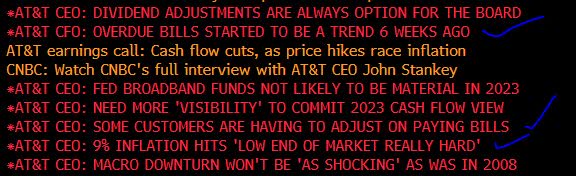

While we cannot speak for what everyone was thinking when they saw this, we believe the bad debt expense, so early in the slowdown, probably spooked a few investors. On this note, the headlines that came out, summarizing the CEO’s comments, probably added fuel to the fire.

Bloomberg Via John M. Spallanzani

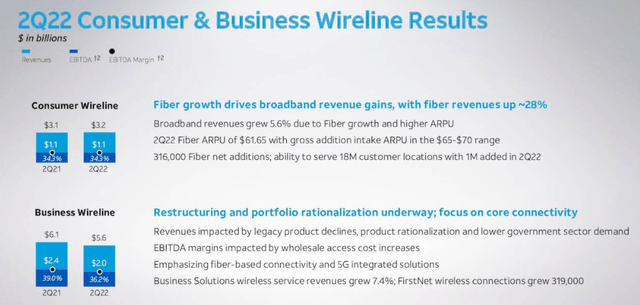

The other segment, of consumer and business wireline, was also weaker year over year with the business side of things taking a sharp EBITDA dive.

This part was expected and in line with previous guidance.

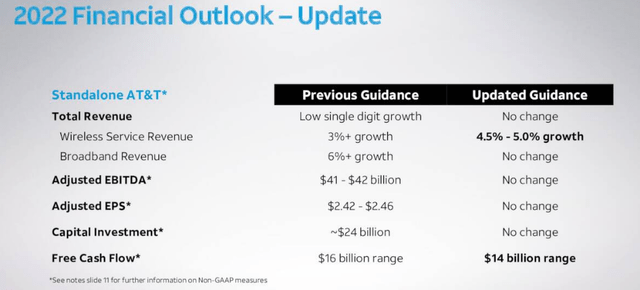

AT&T interestingly enough, only lowered its free cash flow outlook, while maintaining EBITDA, adjusted EPS and capex numbers.

Outlook

Management addressed the Free cash flow on the conference all and we show the relevant quotes below.

I’d also like to touch on free cash flow directly. While free cash did come in lower than we expected this quarter, there were several notable factors that drove this. The first is the timing of higher success-based investments on the back of our robust customer growth. Additionally, we front-end loaded our capital investment plans in order to kick-start our growth initiatives. We expect these plans to seasonally moderate through the course of the year, as we achieve our $24 billion in capital investment plan.

…..Moving to free cash flow. Given the combination of elevated success-based investment, the potential for further extension of payments by our customers, inflation and the more challenging environment facing our Business Wireline unit, we consider it prudent to take a more conservative outlook to free cash flow for the year. Given these factors, we anticipate pressure of about $2 billion to our free cash flow guidance from our prior $16 billion range for the year.

Source: AT&T Q2-2022 Conference Call Transcript

As we noted above, it is unusual for free cash flow guidance to move lower by so much, when EBITDA and capex are remaining steady. Yes, working capital movements do impact things and that is what A&T management is referring to, but the amount seems rather large, all things considered. We think that capex line is being held, but inflation is making it less effective. In other words AT&T is getting less bang for its capex buck and that is translating into lower cash flow. There is also a possibility that management had under promised in Q1-2022 and expected to come in and raise guidance. Things turned out worse than expected and they figured they could still hit the older EBITDA numbers, but free cash flow targets were not feasible any more.

Verdict

The probability of a recession has risen quite substantially since we last covered this stock. Yes, people are not going to give up their 5G phones but spending can dial back at the margins and AT&T itself will have to deal with more inflation pressures in the next 6 months.

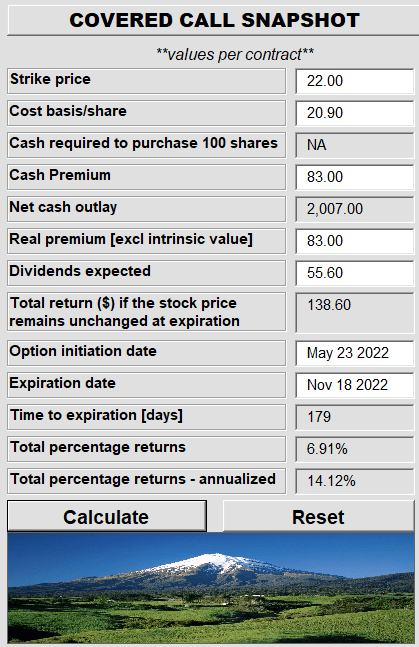

Working for the company is the fact that interest rates have likely put in at least an intermediate top and T’s yield looks rather compelling. On our existing position, we sold the November 2022, covered calls.

Author’s App

That “enhanced” the yield and with the way things stand, we will capture the premium. With perfect hindsight, we should have gone a strike or two lower, but that will now be a consideration for the next set of calls. We remain bullish here for the intermediate term. Our last target on this was extremely conservative and we aimed for AT&T equity to be worth just 10X free cash flow. That 10X free cash flow now gets us to about $20/share, not too far from where we are now. We think T can get to higher numbers down the line, but for now, we would not expect too much in the way of fireworks.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment