BlackSalmon

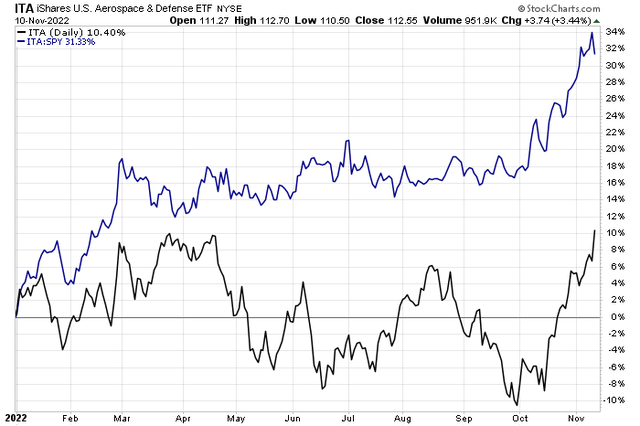

Aerospace & defense stocks have surged since late September. The iShares U.S. Aerospace & Defense ETF (ITA) is up more than 20% in that time, moving from a 2022 total return loss of -10% to a gain of more than 10%.

Moreover, the group sports impressive relative strength against the S&P 500 year-to-date. One small-cap in the space recently reported a weak quarterly profit report, but I see an opportunity for a trade.

Aerospace & Defense: Strong in 2022

According to Bank of America Global Research, Astra Space (NASDAQ:ASTR) is a launch service provider focused on meeting the demands of small satellite manufacturers with payloads less than 600 kg. ASTR offers access to space via low-cost rockets that are built in-house, intending to expand into satellite manufacturing and in-orbit servicing.

The Alameda, California-based Aerospace & Defense industry company within the Industrials sector has negative GAAP earnings over the past 12 months and does not pay a dividend, according to The Wall Street Journal.

There’s upside growth potential, at least that’s the bulls’ hope, in shares of ASTR. The company successfully launched into orbit a year ago, but bears will say much must be proved to demonstrate a long-term launch schedule to become a decent provider. After many failed tries at monthly launches this year, the company is mired in losses. The firm has paused launches for now. The good news is that ASTR won a Maxar Low Earth Orbit contract last month.

Downside risks include more losses from it being just a concept stock. More scrapped launches and delays will likely hurt shares, but much of that risk is likely baked into the stock price. Litigation and reputational risks are also apparent. Upside potential comes from effectively cutting costs and margin expansion from new modular spacecraft platforms and services.

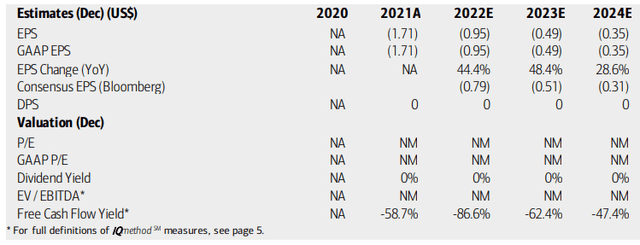

On valuation, analysts at BofA see earnings continuing to be in the red through 2024. The Bloomberg consensus forecast shows the same red trend. Astra Space is not expected to pay a dividend any time soon, given its steeply negative free cash flow. Moreover, Seeking Alpha rates the stocks with extremely poor readings on Growth, Profitability, Momentum, and Revisions. On valuation, though, it’s rated with a deceiving A given a low price-to-book ratio. In my view, the valuation remains sketchy at best with such poor net losses and negative free cash flow. Just recently, the company missed its Q3 earnings consensus forecast by reporting a per-share loss of $0.75, though it barely topped revenue estimates. I would avoid the stock on valuation here.

ASTR: Earnings, Valuation, Free Cash Flow Forecasts

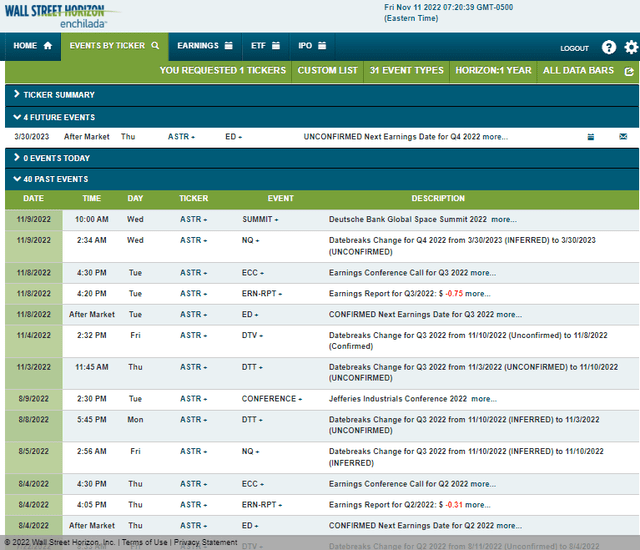

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q4 earnings date of March 30 after market close. The calendar is quiet aside from that, though.

Corporate Event Calendar

The Technical Take

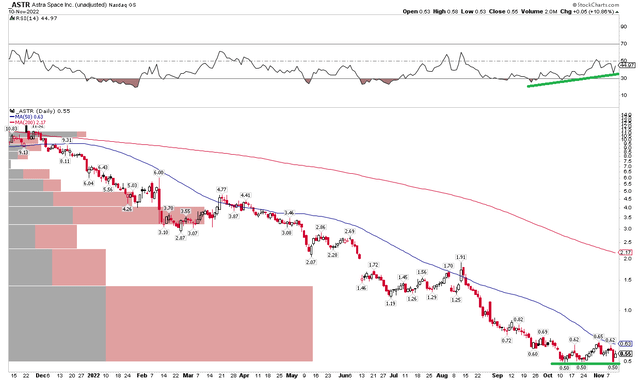

I was bearish on ASTR back in August, and that proved to be a good call. Of course, any negative view on the stock in the last year has looked good.

Fast-forward to today, and I actually see a bullish trade in the works. Notice in the chart below that the stock has held the $0.50 level on a few tests. While that is not exactly a scream to buy, it’s buttressed by improving RSI (the indicator up top). That’s a bullish divergence in that the stock is not making higher lows, but momentum is. It is thought that momentum turns before price.

Therefore, for a trade, I am bullish on ASTR here. Perhaps a move up toward what I had last laid out as a key level – $1.20 – could be in play. A sell stop below $0.50 is prudent, though.

ASTR: Shares Find Support at $0.50 with an Improving RSI

The Bottom Line

I am tactically bullish on ASTR here. While the company has negative EPS and free cash flow, there are some technical signs of hope for the bulls. I would avoid the stock as a long-term investment, though.

Be the first to comment