Sjo/iStock Unreleased via Getty Images

Last time, we concluded that ‘Aston Martin was A No Go‘ (OTCPK:AMGDF), providing a full note on the company’s valuation and finding it hard to justify an overweight target. Despite the fact that the EV/EBITDA multiple was extremely low, we were forecasting a 75% discount, in detail, the company was issuing new stocks “at 103 pence each with a ratio of 1 new share for every 4 existing”. Here at the Lab, we believe that Wall Street analysts were not pricing in the full information disclosure, and we are not surprised to see Aston Martin’s stock price development signing a minus 68% compared to our last publication reference price.

Source: Mare Evidence Lab’s previous publication

Financials and capital injection

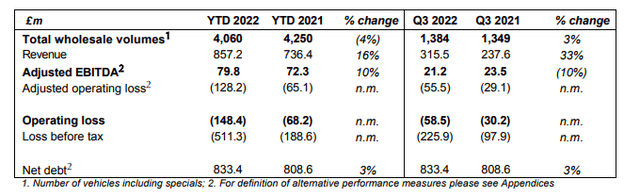

Very briefly on the Q3 results, the British luxury carmaker almost doubled its operating loss, which rose to £58.5 million from £30.2 million compared to the same period in 2021. Looking at the nine-month aggregate, we can see a similar situation, in detail, Aston Martin recorded a loss of £148.4 million more than double the £68.2 million achieved in January-September 2021. On the volume side, the third quarter achieved a growth of 3% arriving at 1,384 cars sold, but in the nine months, the company volume declined by 4%. This was due to the supply chain challenges and logistical interruptions which; however, do not affect revenues for the July-September quarter. Here the growth was at 33% and Aston Martin’s turnover reached £315.5 million from £237.6 million in the same quarter of 2021. This was supported by strong price increases and favorable foreign exchange. Going down to the company’s P&L, its adjusted EBITDA result was at -10% in the third quarter (from £23.5 million in July-September 2021 to £21.2 million in 2022).

Another key concern in the investor community was the company’s financial debt. In this case, despite the capital increase, debt in percentage increased by +3%, with deterioration from -£808.6 million in 2021 to -£833.4 million in 2022. In detail, the figure also included the $245 million impact of non-monetary currency appreciation of US dollar-denominated debt, as the pound significantly weakened against the dollar. This also included the successful capital increase of £654 million. On the other hand, the chief executive officer of the car manufacturer, Amedeo Felisa, positively commented the Q3 results: “we have continued to see very impressive demand across our product range, and the underlying fundamentals are very strong”. Here, we continue to see many promises but a continuous lack in performance (even compared to similar companies within our universe coverage).

Aston Martin Q3 financials in a snap

Source: Aston Martin Q3 press release

Conclusion and Valuation

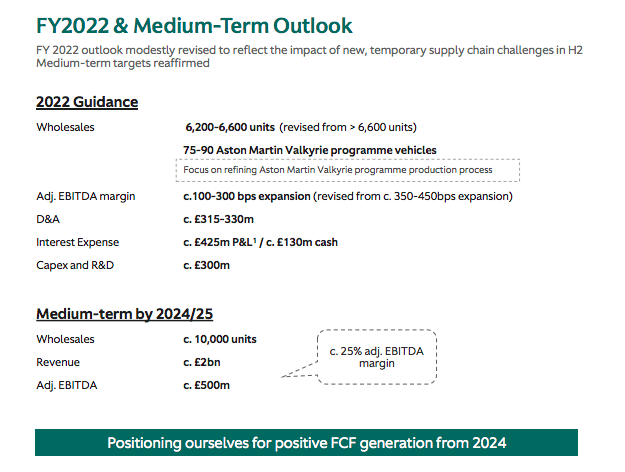

To sum up, last time, the company was forecasting a volume of 10,000 cars sold with an expected turnover and EBITDA of £2 billion and £500 million respectively (and a cash-positive position) in 2024. In the Q&A call, we understood that the British house has revised wholesale sales estimates in a range between 6,200 and 6,600 (previously it expected car volumes above 6,600 units). So, again, another cut in their previous guidance (this was justified with logistic constraints which are definitely not a new topic in 2022 development). We believe that this revision can be explained; however, this continued lack of investor confidence will hurt Aston Martin’s stock price development even because rising incremental costs will also hurt margins. As already mentioned, many hopes were placed on its most powerful SUV and we should note that DBX 707 orders are up by more than 40% on a yearly basis. On our numbers, the cash injection will also be used to reduce Aston Martin’s debt, thanks to the company’s disclosure, they expect to save in interest rate approximately £20 million per year. This was in line with our internal estimates. Therefore, our neutral rating target is left unchanged. In Mare Evidence Lab auto coverage, we prefer:

- Ferrari (RACE) is a top pick

- Porsche Automobil Holding SE (OTCPK:POAHY): Our Buy Rating Target Is Confirmed backed by our Volkswagen (OTCPK:VWAGY) analysis called: the company is Really Undervalued

Aston Martin guidance

Source: Aston Martin Q3 results presentation

Be the first to comment