Liudmila Chernetska/iStock via Getty Images

Introduction

Associated British Foods (OTCPK:ASBFY) is a packaged food and retail business. The company is based in the UK and has strong brands in its portfolio such as Twinings, Ovaltine, Patak’s, Primark (aka Penneys, not the bankrupt JCPenney). Brits are known for their strong appetite for tea, and Twinings is their favorite brand. Twinings was first introduced in 1706 and is still a favorite with the British.

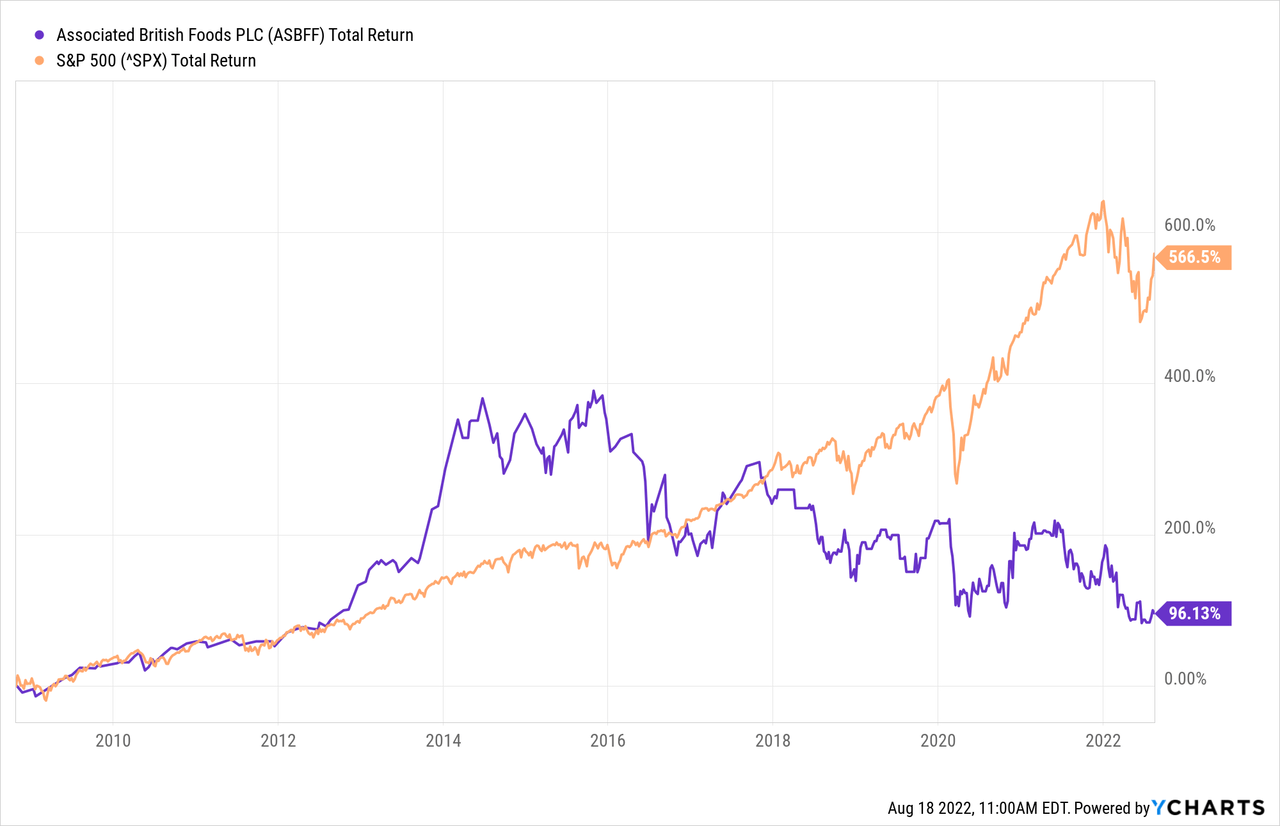

The stock grew strongly until 2016, after which it started its downward trend and has since lagged the S&P 500. Revenue increased annually until 2014, after which revenue decreased slightly and has remained stable since then.

Associated British Foods has strong management, and the company has remained quite profitable during both the 2007-2008 financial crisis and the corona crisis. The corona crisis has forced retail chain Primark (aka Penneys) to temporarily close, but Associated British Foods has remained profitable. Primark recently started offering click-and-collect where people can shop online and pick up from a Primark warehouse. Primark can operate well in an upcoming corona shutdown. Is Associated British Foods recession-proof?

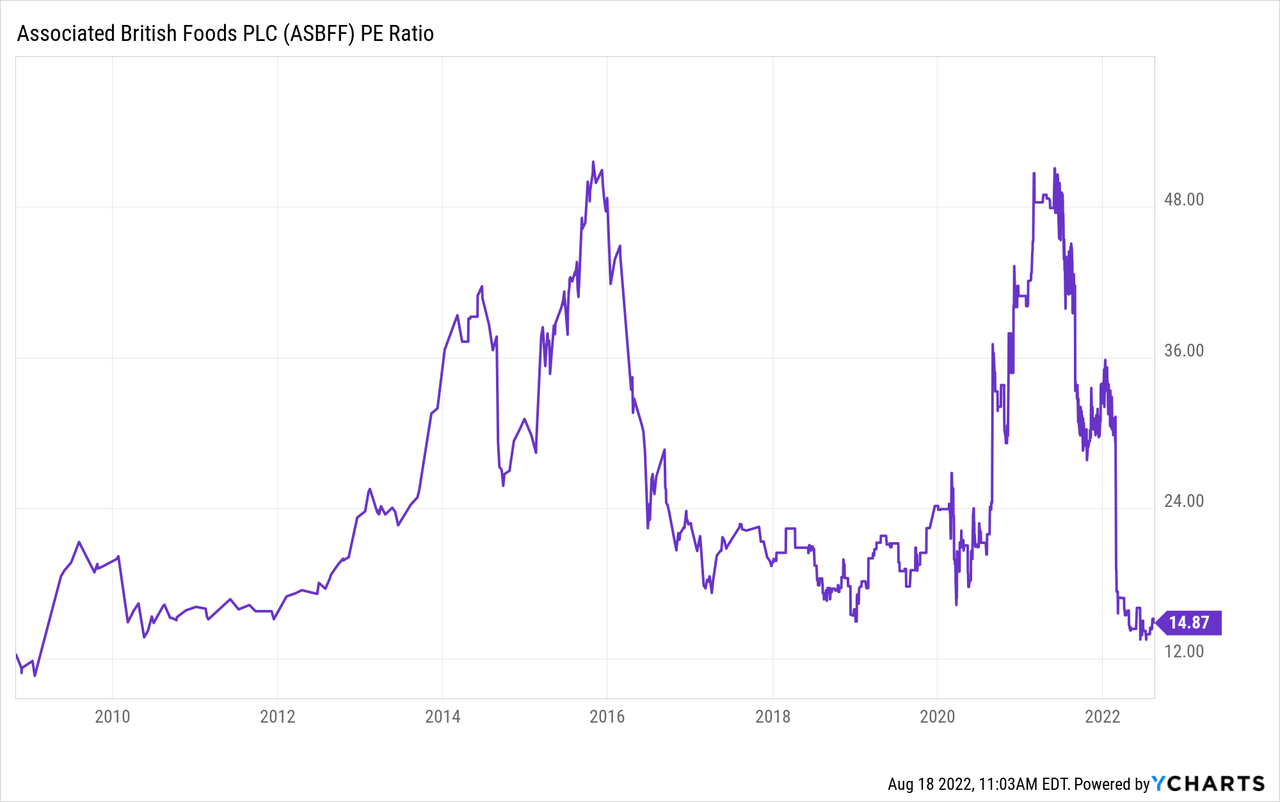

The stock is valued cheaply compared to its historical P/E ratio, management is strong at preserving earnings, but the outlook is mixed. Growth catalysts are high inflation and the expansion of Primark. Risks are the recession in the UK and the future of Primark. The stock is a hold, when there is no recession in sight in the UK, the stock is a buy.

Earnings And Balance Sheet Are Strong

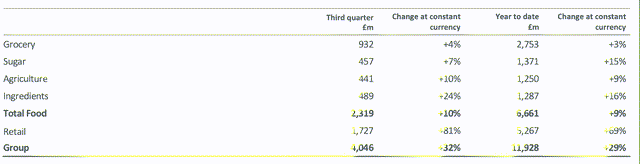

Third quarter results (March 6, 2022 to May 28, 2022) came in nicely with 32% YoY sales growth at constant exchange rates. Primark’s sales increased by 81% due to the opening of all Primark stores in contrast to last year. Sales in food segment increased by 10% due to higher volumes and higher prices due to higher input costs.

3Q Trading update announcement (Associated British Foods Investor Relations)

The financial strength of Associated British Foods’ balance sheet looks good. The financial leverage (net debt/adjusted EBITDA) is only 0.7 and the company has sufficient cash to cover possible financial losses for the coming years.

Business Outlook Is Mixed

Associated British Foods expects growth in all business segments. Their outlook and growth drivers are:

- Food: margin recovery expected next financial year and continue to expect full year earnings improvement for sugar.

- Primark: accelerating space expansion in key growth markets, and growth opportunities for digital assets (click-and-collect). Which will lead to sales improvement and adjusted operating profit growth.

- Group: expected growth in adjusted operating profit in second half, and significant progress in adjusted operating income and adjusted earnings per share for the full year.

I have two reasons to expect a more conservative picture for the next 2-3 years.

- I expect moderate growth in sales and profits in their essential business segments due to the passing on of inflation, the UK’s beloved brands and the defensive nature of the essential products. The essential business segments concern approximately 55% of sales (groceries, sugar, agriculture, and ingredients). The remaining 45% comes from the retail branch Primark.

- The Bank of England warned of a possible recession at the end of this year. UK sales make up a solid 37% of sales. This poses a major risk in the short term.

1) High inflation and high commodity prices must be passed on to remain profitable. This will benefit Associated British Foods’ essential businesses in the grocery, sugar, agriculture, and ingredients segments. This group accounts for about 55% of the sales.

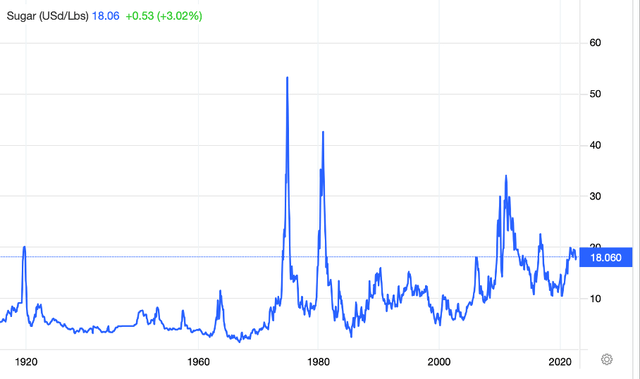

Associated British Foods can pass on the higher input prices, increasing sales and profits. However, I expect high volatility in sugar prices. The sugar prices are extremely volatile; in times of high inflation, they are traded at very high prices as was the case in the 1970s.

World sugar prices (Trading Economics)

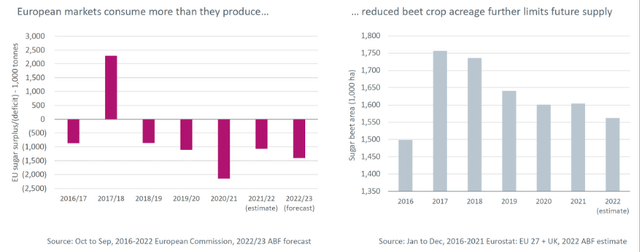

Associated British Foods expects sugar prices to rise due to sugar shortages. European consumers consume more sugar than is produced, and reduced bite crop acreage will further increase scarcity. The high prices are favorable for the essential business segments of Associated British Foods.

FY 2022 Analyst Presentation (Associated British Foods Investor Relations)

2) Primark, on the other hand, will experience more volatility in sales and earnings during a recession.

Now, inflation in the UK is 40-year high at 10.1%. Bank of England warns that the UK will slip into recession this year. UK GDP growth was negative in the first quarter of 2022. Retail sales volume declined as consumer confidence bottomed, and Deloitte wrote that spending on non-essentials is declining. Essential spending is down 2% and discretionary spending is down 8% compared to 1Q 2022.

That’s a lot of negative news. What I’m concerned about is Primark’s sales in the UK. Primark stores in the UK are 191 out of a total of 402 Primark stores, so they are a major contributor to Associated British Foods’ revenue. Primark focuses primarily on low- to middle-income families, and low-income families will cut back on non-essential spending during a recession. During recessions, discounters that offer essential items will survive. But Primark doesn’t offer essential items, so I expect a lot of volatility in earnings here.

Now, I like Associated British Foods but without Primark. When the economy is booming, I like Primark. That’s just not the case now. In terms of risk/return, Primark is not a good fit for the more defensive Associated British Foods.

Valuation

Given the risks and rewards, the valuation should be attractive enough to convince me to buy the stock. Historically, Associated British Foods’ P/E ratio is approaching an all-time low. This should be a good time to buy the stock. But the rewards don’t outweigh the risks of buying the stock with a P/E ratio of 14.9. There are other companies in the market that can steadily grow profits without the risks, and at the same valuation.

The poor outlook for the UK economy could hit Associated British Foods hard. That’s why I prefer to wait until the economy is doing well before buying the stock. I also prefer Primark to go public or be sold to private equity because the non-essential products which Primark sells don’t match the essential products the rest of the company sells.

Conclusion

Associated British Foods has well-known (British) brands in its portfolio such as Twinings, Ovaltine, Patak’s and Primark (also known as Penneys). Twinings tea was first introduced in 1706 and is still a British favorite.

The recent figures were strong, partly because all Primark stores were open in contrast to last year. The financial strength of the balance sheet also looks strong. Associated British Foods’ management was able to maintain profitability during the 2007-2008 financial crisis and the corona crisis.

Management is positive for the coming periods, but I expect a more conservative view of the future. Their core businesses (groceries, sugar, agriculture, and ingredients) will generate more sales and profits during high inflation. But 45% of sales come from retail (Primark and Penneys). A recession is coming in the UK. Primark targets low- to middle-income families, and they are more likely to cut back on non-essentials. This poses a major risk for the coming years.

Associated British Foods’ stock valuation looks attractive, with the P/E ratio hovering around all-time lows. The P/E ratio of 14.9 is still quite high considering the potential risks mentioned in my article. There are better stocks in the market that carry less risk at the same valuation. This makes the stock a hold.

Be the first to comment