DNY59/E+ via Getty Images

Buying into rapidly growing companies can be a very profitable endeavor. But at the same time, it is also fraught with risks. The most significant risk is the potential to buy into a firm that does not grow as quickly as the market would like or in the way the market wants it to. One rapidly growing company that investors should be aware of is Aspen Aerogels (NYSE:ASPN). Despite recently increasing guidance for its revenue for its 2022 fiscal year, the company also came out with a couple of developments that led to investors losing faith in management. Because of a reversal in judgment, shares are starting to recover again. But it’s clear that some damage is done, and investors would be wise to tiptoe safely. Normally, the change in guidance would have led me to increase my rating on the business from a ‘hold’ to a ‘buy’, but given a significant misunderstanding by management about how the market would react to a rather large decision, there has come to exist enough questions regarding competency at the firm to keep me from doing this.

New Guidance Is Mixed

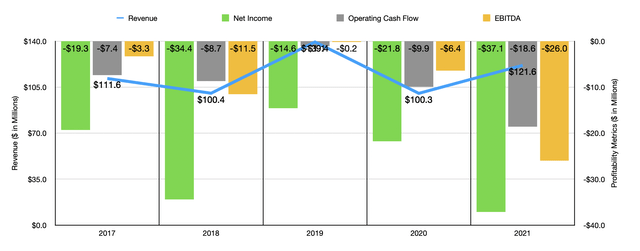

When I last wrote about Aspen Aerogels in an article published in February of this year, I found myself attracted by the company’s rapid growth and by a $150 million investment made by Koch Strategic Partners into the firm. Even though all of this looked positive, I also acknowledged that the company’s bottom line was continuing to worsen even as sales improved. This even held true for the company’s operating cash flows and EBITDA. This led me to declare the company as a highly speculative prospect but one that, in time, could become worth what it was trading for.

Fast-forward to today, and we can see that the top line picture for the company remains robust. In 2021, the company generated revenue of $121.6 million. Heading into the 2022 fiscal year, management thought that revenue growth would slow, with sales coming in at between $145 million and $155 million. But in early June of this year, the company revised this significantly higher. Increased visibility associated with order volume for both General Motors (GM) and Toyota Motor Corporation (TM) caused the company to update its revenue expectations for its thermal barrier products. Guidance was previously pegging this number at $18 million. Now, the company expects to come in at between $52 million and $62 million for the year. Robust results are also expected for the company’s energy industrial products, but this is less of a driver at this time. Ultimately, management increased guidance to between $180 million and $200 million for the year. At the midpoint, this would translate to a year-over-year improvement of 56.3%.

Although the top line expectation was positive, the company came out at the same time and said that profitability for the year would come in worse than anticipated. This has been a common theme for the company from year to year. Overall net loss for 2022 should be between $79.8 million and $86.8 million. This compares to the prior expected range of between $66.7 million and $70.7 million. The increase, management said, has been largely driven by increased material costs and increased manufacturing and operating expenses necessary to support the higher thermal barrier volumes. Meanwhile, adjusted EBITDA should also worsen, coming in at between negative $55 million and negative $62 million. Before, the expected range was from negative $42 million to negative $46 million.

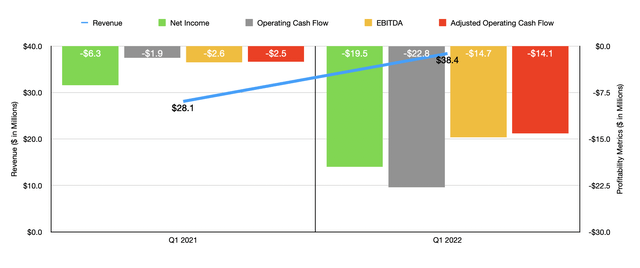

The company has already seen its financial performance come in mixed for the first quarter of the 2022 fiscal year. Even though revenue shot up from $28.1 million in the first quarter of last year to $38.4 million the same time this year, net income went from a negative $6.3 million to a negative $19.5 million. Operating cash flow plunged from negative $1.9 million to negative $22.8 million. Even if we adjust for changes in working capital, it would have gone from negative $2.5 million to negative $14.1 million. And finally, EBITDA went from a negative $2.6 million to a negative $14.7 million.

It’s great to see revenue growth come in strong. However, profitability and cash flow are ultimately what decide the value of an enterprise. Investors are used to seeing large and growing net losses and cash outflows. But it must have been jarring to see the forecast worsen. It is true that the company currently has a tremendous amount of cash on hand. As of the end of the latest quarter, this came in at $205.2 million. The company only has $100.6 million in debt on its books, but all of that debt is convertible under certain circumstances.

To make matters worse, management not only had to lower expectations when it came to profitability; They made a serious misjudgment on what the market would accept during this time. On June 28th of this year, the company announced that it was issuing $225 million in additional stock, and it was planning to receive $150 million associated with the issuance of green convertible senior notes that would come to you in 2027. Management wanted to use these funds for general operational purposes and to help cover the $250 million to $300 million in planned capital expenditures for this year, much of which would be dedicated to the Phase 1 of Plant II project on its books, as well as to the acceleration of investments for high volume thermal barrier assembly in Mexico.

The terms of these issuances were never made public because management canceled this maneuver just one day later on June 29th. This came in response to shares of the company plunging from $15.23 to $7.93, a decline of 47.9% over two days. Ignoring the convertible notes, since we could speculate ad infinitum about what those terms would entail, the issuance of common stock alone would have resulted in tremendous dilution for existing shareholders. Based on the closing price of stock on June 27th, investors in the company would have been diluted by 29.1%. And that doesn’t even take into consideration the very real probability that management was expecting its stock to drop in response to the news.

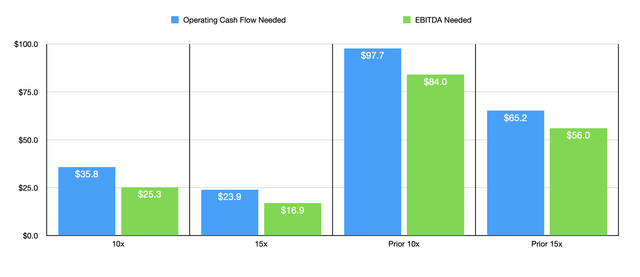

Conceptually speaking, Aspen Aerogels could very well make for an attractive opportunity for long-term investors. For instance, in order to justify its current valuation, an implied price to operating cash flow multiple on the company of 10 would necessitate operating cash flow of $35.8 million per year. At a multiple of 15, this would drop to just $23.9 million. If, instead, we use the EV to EBITDA approach, the multiple of 10 would require $25.3 million, while the multiple of 15 would require a reading of just $16.9 million. These numbers are substantially lower than the figures I gave in my prior article on the company. Given enough growth, this could definitely be achievable. But now there are obvious additional risks for investors to consider.

Takeaway

At this point in time, Aspen Aerogels continues to grow nicely on its top line. That is great to see. However, the additional pain on the bottom line is not welcome. Add on top of that management’s inability to see that a significant dilutive event would impair investor enthusiasm, and I am no longer as optimistic about the company as I once was. So even though the firm now has a lower bar that it needs to meet in order to be appropriately valued, I am deciding to keep my ‘hold’ rating on the company for now.

Be the first to comment