Editor’s note: Seeking Alpha is proud to welcome Fahim Ali as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

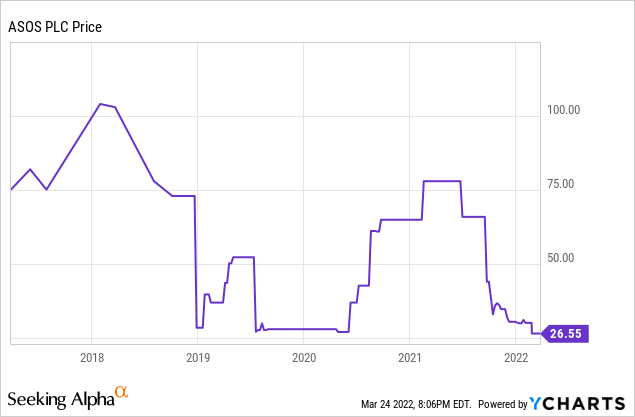

ASOS (OTCPK:ASOMF)(OTCPK:ASOMY) has positioned itself strongly in a highly competitive segment of the fashion industry. The company has achieved a 22% CAGR in revenue over the previous five years, as the share price continued to fall. Our expectation is for the fashion industry to continue to be robust with growth led by the U.S., the largest Western fashion market. With the new brands and the Nordstrom (JWN) deal, we believe that ASOS’s growth can at least be maintained in the medium term, if not exceeded. In the past four months alone there has been an 11% increase in U.S. sales, confirming the early success of the Nordstrom partnership.

Now, ASOS can begin a true expansion into the U.S., having already soft-launched but yet to show real success. If ASOS can show growth in the U.S., investor confidence will likely return as much of their total addressable market is here. Given ASOS’s track record of navigating changes in the industry and ability to understand new trends early, I believe this is very likely. Regardless of an immediate catalyst, the future cash flows of the business will reward investors with over 64% growth in share price.

Presley Ann/Getty Images Entertainment

Company background

ASOMF is a wholly online fashion and cosmetic retailer based in the UK. Their target demographic is “20-something” year olds, offering them over 90k products across their nine ASOS brands and over 880 third party brands. 40% of sales are in the UK, 30% in the EU and 30% in the ROW. ASOS recently acquired Arcadia’s brands, including Topshop, while also beginning an expansion into the U.S. market involving a strategic partnership with Nordstrom. ASOS and Nordstrom are the ninth and seventh largest e-commerce fashion brands by sales, respectively.

The fashion industry going forward, post-COVID-19

In order to continue to grow, ASOS requires the industry to remain robust as the previous dips in 2016 and 2018 were the result of waning demand and a fall in consumer confidence. McKinsey expects growth to be led by the U.S., with Europe lagging behind. This will be driven by online sales, which has seen its share of transactions increase sharply from the low teens in 2019 to 30% in 2021.

Additionally, consumers (and increasingly investors) are expected to reward those firms that place sustainability at the forefront of their strategy. ASOS has invested heavily in its sourcing and supply chain, which is reflected in the company’s absence from recent scandals plaguing the fast fashion industry. Differentiation through sustainability has served ASOS well so far and means they do not need to compete purely on price.

Therefore, we believe the market is positioned well to maintain aggressive growth. ASOS will need to convince Americans of their offering in order to achieve this.

Macroeconomic analysis

Now, more than ever, we are living in uncertain times and as such should consider the heightened market risk when assessing ASOS’s competitiveness.

ASOS is struggling with increased delivery costs, which are reflecting negatively on margins. ASOS is expecting constraints to ease in Q3 22, and we should note that ISM’s manufacturing report supports this with observations of easing labor requirements and improvements in supplier deliveries. Should this occur, our expectations would be an immediate improvement in margins.

Furthermore, inflation in the fashion industry in the UK rounded off 2021 at 9.5%, breaking a six-year record of price drops in December. Although ASOS has reluctantly increased prices, margins have been compressed nonetheless. Markets are pricing in several rate rises in the U.S. and Europe, which should help bring Inflation under control.

Consequently, ASOS has a real opportunity to impress investors with conditions available to improve margins, following several years of decline, which has irked markets.

ASOS’s strong fundamentals and forecasts

ASOS’s core financials are strong after several years of impressive revenue growth and free cash flow generation. They have the financial might to maintain growth levels inorganically into the future due to a healthy level of debt and cash.

ASOS saw revenues up 20% in 2021 while maintaining an EBITDA margin of 5%. This represents a CAGR in revenue of 22.03% over the last five years, driven predominantly by a mix of effective targeted marketing and ASOS’s strong ability to identify trends and quickly produce a superior market offering.

The balance sheet is equally strong. Despite the large transaction during the year, ASOS still has $662m in cash and a net debt position of $129m. The debt raised for the transaction, the only notable debt on the balance sheet, is a five-year convertible debenture with a coupon of only 0.75%.

Looking forward, ASOS are guiding $7bn in revenue within four years (a CAGR of 17%). With management’s “growth before all else” strategy and early signs of U.S. sales beginning to pick up steam (11% growth in the first four months of FY22), this looks quite reasonable as our model expects this to occur in early 2025.

For this reason we think ASOS’ financials are very good, the growth can continue and margins are due to improve. This should help market confidence return.

Non-financial analysis

ASOS has positioned itself perfectly to grow through innovation as the years have gone by. They have maintained a competitive advantage against established market players, while also pivoting successfully against new entrants.

ASOS’s core offering (60% of revenue) is approximately 880 brands across the spectrum from affordable, such as Bershka, to junior luxury such as Versace Couture. ASOS has achieved great success by positioning its own brands within these price points, ASOS’s competitive advantage here is multilayered. On the one hand, they can offer culturally relevant products faster than traditional brands but can also offer similar quality goods at a more affordable price. This makes ASOS a consumer’s one-stop shop. If customers are fixated on specific brands, there is a high chance ASOS have what they want. If they are looking for brand alternatives, be it affordable or specific designs, ASOS also have what they need across their many different brands.

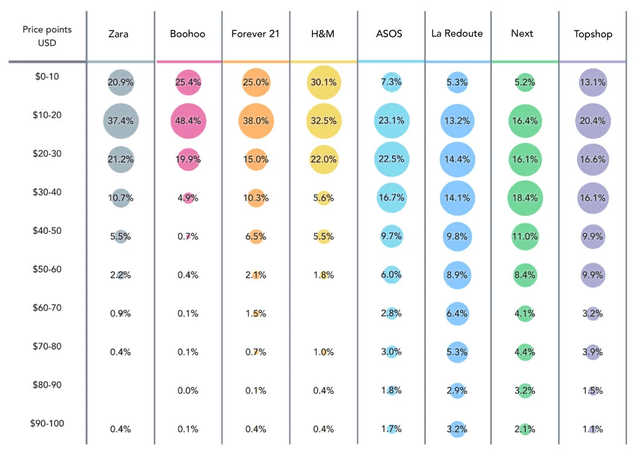

In addition to this, research has shown ASOS’s average price is higher than several of its peers. ASOS are not trying to be the cheapest but instead differentiate themselves by focusing on sustainability and “exclusive” offerings. McKinsey sees sustainability as both an opportunity but increasingly also a concern for businesses as it becomes a staple in consumer values.

Average price by select peers (Katie Smith/Edited)

The majority of ASOS’s inventory is held for three months or fewer, cementing their stellar understanding of consumer needs. ASOS is careful with understanding trends; it is not the first to market like Boohoo (OTC:BHHOF) or Zara. ASOS instead responds to new styles with a more comprehensive, well thought out, targeted suite of products. For example, pastel-colored, layered looks are trendy currently. ASOS has a dedicated page showing 176 curated products following a single theme compared to eight from Zara and 134 divergent designs from Boohoo. The result? Eight percent of ASOS’s current products were first offered one year ago, which is more than double that of Forever 21.

As part of the deal to acquire the Arcadia brands, Nordstrom took a minority stake in them as part of a joint strategic move. The partnership with Nordstrom represents ASOS’s first foray into a distribution channel as they begin to stock the Arcadia brands in the U.S. Nordstrom is a U.S. powerhouse, being the seventh biggest online retailer globally, which presents a huge opportunity to market the Arcadia brands in the U.S. In the short term this will generate greater, diversified revenue in a country expected to grow faster than Europe. In the long term this gives ASOS’s brands a true foothold in the U.S. market.

Moreover, the Arcadia Group represented the fifth largest UK fashion retailer domestically in 2016 before its collapse. Many of these brands were already being sold through ASOS which allowed management to incorporate them and begin selling within three weeks of the acquisition. This will allow ASOS to continue its strong growth and improve margins now that they are the owners. With the previously mentioned lag in European demand, inorganic growth through a staple European brand is a prudent decision by management.

Overall, ASOS has a unique offering and have been able to navigate an ever-changing industry. This is why we are not concerned about ASOS’s ability to continue growth and expand into new territories.

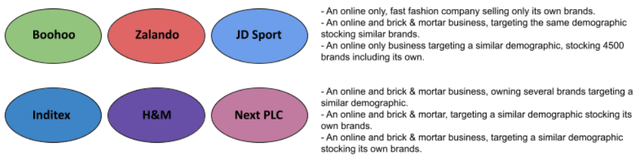

ASOS struggles to stand toe-to-toe with its competitors

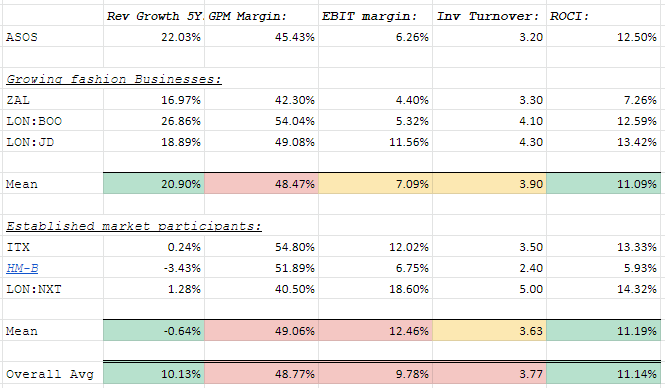

Most comparable peers (Author)

The affordable fashion landscape has changed significantly in the last few decades. We had the rise of fast fashion and now the move to more unique designs and sustainability. Zara is the dominant player in the market gaining large market share due to globalization and the social media era. In fact, alongside H&M they have struggled in recent years with growth as an increasing amount of people are rejecting fast fashion on ethical grounds. Conversely, Next Plc (OTCPK:NXGPF), which historically targeted more affluent consumers, has grown well by creating affordable clothing lines. ASOS has maintained its growth and competitiveness by anticipating consumer trends as they change. The dominant strategy remains the fast fashion model. However, due to various scandals, we are seeing real upheaval with consumers increasingly moving away from that, which could fundamentally change the industry.

As the table below shows, ASOS is underperforming in one key area, margins. Given they are generally priced higher than their competitors, it shows two things:

- ASOS is comfortable discounting products; the company regularly offers 10-20% off via their app and noticeably more often in Q4.

- Their supply chain is more costly, which is expected against the larger competitors due to scale and those brands, such as Boohoo, compromising sustainability. However, the difference from a brand such as JD is concerning. Then again, the most comparable company is Zalando (OTC:ZLDSF), which ASOS outperforms.

Comparable performance (Yahoo Finance)

Conversely, ASOS has the better revenue growth of 22% compared to 20.89%, showing the difference in strategy. However, the trade off is not to the benefit of ASOS.

Finally, it should be noted that the delta to the EBIT margin is much smaller than that to the GPM margin when compared to its growing peers. This shows the effectiveness of ASOS’s customer acquisition.

Overall, ASOS is slightly under performing its peers in key metrics which explains its market sentiment as profitability is what investors want. That said, the delta is insignificant and with the pressures we have established around the use of cheap labor and sustainability, it is not out of the question that ASOS’s peers see margins being compressed over time.

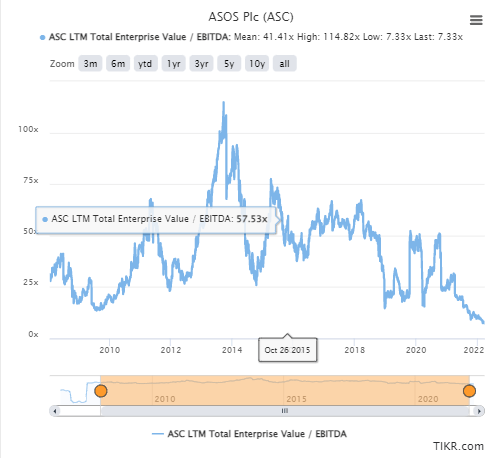

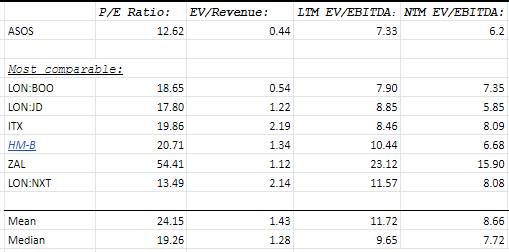

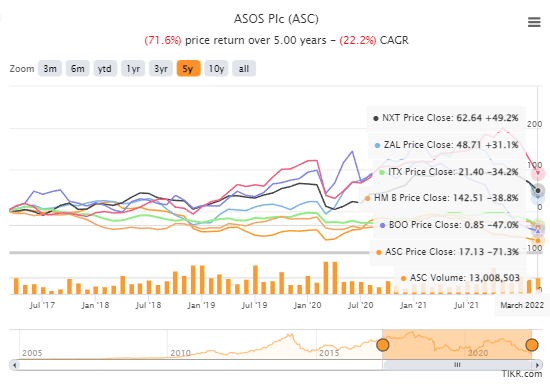

ASOS is oversold compared to its peers

We have established that ASOS is fundamentally a strong business, although it may not be performing to the levels of its competitors. Its valuation reflects a poor business that cannot compete. ASOS is currently trading at 7.33x its LTM EV/EBITDA, which is comfortably below its historic multiple (average 41x). This is partially the result of the market uncertainty, but also the market’s opinion of ASOS’s tight margins.

ASOS historic multiple (Tikr Terminal)

While the average LTM multiple of its peers is 11.72x, the difference between the companies is certainly not 4x.

ASOS’s comparable peers (Tikr Terminal) ASOS’s peers share price performance (5Y) (Tikr Terminal)

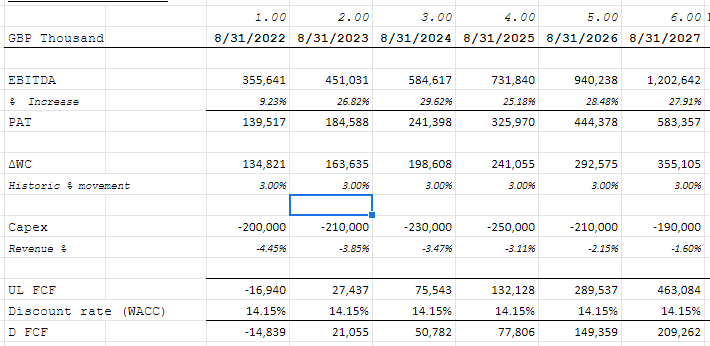

Our price target reflects a 25% weighting toward a discounted cash flow model based on continued strong growth with tightening margins. To be prudent, we have assumed any improvement in supply side constraints cannot materially change the NTM performance. Expenses will continue to increase in 2022 before falling, and as per ASOS’s recent accounts capex and marketing spend will increase substantially.

DCF calculation (Author’s calculation)

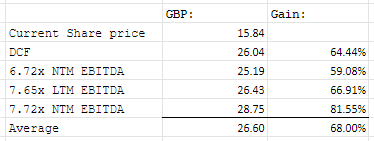

Additionally, a 75% weighting toward three separate LTM and NTM EV/EBITDA multiples from market comparables:

Valuation summary (Tikr Terminal)

- 7.65x LTM EBITDA – Due to the underperformance of margins compared to competitors historically, we have applied a 2x discount to the current year EBITDA multiple when compared with ASOS’s peers.

- 6.72x NTM EBITDA – In addition to the above, we have included a discounted multiple (1x) to future EBITDA reflecting the chance of margins continuing to remain compressed.

- 7.72x NTM EBITDA – Finally, a valuation in line with its peers and its competitive position reflecting the chance of a value reversion if margins improve.

As shown above, even at a discount to its competitors there is substantial upside at the current share price. Importantly, even on a purely perpetual cash flow basis, the return expected is greater than 60%. Importantly, it looks as though the bottom is in for ASOS and over the medium term some reversion toward its future cash flows valuation is likely.

Investment risks/price target impediments

Although ASOS is extremely attractive at its current price, markets have shown in the past that they are not fans of ASOS’s strategy. Given this there are a few key risks to acknowledge:

- Margins – ASOS’s discount to competitors is a result of its margins; given management have not wavered in their pursuit of growth, regardless of eight years of underperformance, it is unlikely this will cease.

- CEO – ASOS, currently without a CEO, is heading for a turbulent six months economically. This could cause short-term downward pressure.

- Moat – ASOS lacks a distinct tangible USP, which differentiates it noticeably from its competitors. ASOS’s competitive advantage comes from their ability to offer fashionable brands and trendy products.

Key catalysts

We note two key catalysts in the coming 12 months that could cause positive price action for ASOS:

- 2022 performance – P1 growth is in double digits in the U.S. and UK, where restrictions have been minimal compared to the EU and ROW, which were <5%. The expectations would be that growth bounces back in the EU and ROW as lockdown restrictions continue to end in Q1 2022, alongside supply side issues easing early Q3. Should this occur, we would expect guidance to be upgraded or an out performance come year end.

- FTSE 250 – ASOS has recently announced it will be joining the FTSE 250 from the AIM. This should give the stock a natural boost as a result of funds needing to hold the stock, and also greater visibility to investors.

Closing thoughts

With guidance looking bleak for 2022 and lacking a CEO, ASOS has been brutally oversold. However, if we look beyond this and acknowledge the fantastic offering they have, the healthy financials, and Nordstrom’s support, there is no reason why ASOS should not outperform.

Be the first to comment