Michael Vi

Earlier this week, ASML Holding N.V. (NASDAQ:ASML) presented its Q3 2022 earnings report and topped both top and bottom-line expectations once again. This is a strong signal from ASML that it is not being hit as significantly by the semiconductor slowdown and continues to see strength across the board. Revenues saw strong growth YoY, margins expanded, and order intake reached record highs.

ASML is the most crucial part of the whole semiconductor industry, since ASML is the only company able to build EUV machines for semiconductor manufacturing. It has a true monopoly in this business, and there is no other company in the world able to build these high-end machines. The story is very simple: without the technology of ASML, we would not be able to build the most high-tech semiconductors used in all our newest and most advanced technologies.

During 3Q22, ASML delivered great results and projected even more growth for 4Q22. ASML booked revenue of €5.8 billion and outperformed its own previous outlook of €5.4 billion. ASML recorded a record order intake of €8.9 billion, which shows demand for its products remains high. Margins stood at 51.8% and outperformed expectations. Net profit came in at €1.7 billion and EPS of €4.29.

ASML recorded an incredibly strong quarter in sales. In addition to this, ASML gave a strong outlook for the fourth quarter. ASML expects revenue to come in between €6.1 and €6.6 billion with margins of around 49%. This does also increase the FY22 outlook for ASML from 10% growth YoY to 13% growth YoY coming in at over €21 billion now.

ASML purchased around €1 billion worth of shares under its current share buyback program during the last quarter.

I did expect ASML to report revenue in line with its outlook, but ASML put down an incredible performance during Q3 by outperforming despite an economic slowdown, loss of sales for many semiconductor companies such as AMD (AMD), Nvidia (NVDA), and Micron (MU), and supply chain difficulties. This outperformance of ASML shows the resiliency of their products and the strong remaining demand, shown by record order intake. The backlog now stands at €33 billion.

This quarter once again shows exactly why ASML is such a strong investment. I will show you why I think ASML will keep reporting strong results and why you should buy shares right away.

ASML

ASML is a Dutch multinational with its headquarters in Veldhoven. ASML originated from a partnership between electronics manufacturer Philips (PHG) and ASM International (OTCQX:ASMIY). These companies saw the future of semiconductors and figured there needed to be more advanced technologies to satisfy our needs. And so, ASML was founded. I do not think they could have ever predicted ASML to become one of the most crucial companies in the world and grow to a market cap of $160 billion. ASML has a total of 32,016 employees from 122 different nationalities working in over 60 countries.

ASML builds two very important machines and has a very strong market position in both. It builds DUV lithography machines and competes with the likes of Nikon (OTCPK:NINOY, OTCPK:NINOF) and Canon (CAJ, OTCPK:CAJFF), but has by far the largest market share.

EUV is the crown jewel of ASML. This is a technology they completely developed themselves, and this makes them the only ones with the knowledge of how to make EUV lithography machines. EUV machines are giant machines and ASML needs multiple sea containers or planes to get all the parts to the customer. One EUV machine exists of over 100,000 different components and ASML is only able to make a certain amount per year because of the sheer work it takes to build these machines. The waiting time is over 2 years now.

EUV stands for extreme ultraviolet and is using a wavelength of just 13.5 nm. EUV is the driver of Moore’s law and supports novel transistor designs and chip architectures. This is what ASML says about EUV:

Using a wavelength of 13.5 nm, our EUV systems pattern the finest lines on microchips. They are used in high-volume manufacturing to create the highly complex foundation layers of the most advanced microchips (7 nm, 5 nm and 3 nm nodes).

ASML invested €6 billion in over 17 years of R&D to develop EUV technology. Now, this technology, as mentioned above, can manufacture up to 3nm nodes. But we always want to keep developing and going smaller. ASML is working on High-NA systems, the next generation of EUV, and these should be able to create 2nm nodes. ASML expects these machines to be ready by 2025 and already has taken in the first orders from the likes of Intel (INTC) and Taiwan Semiconductor Manufacturing Company Limited (TSM).

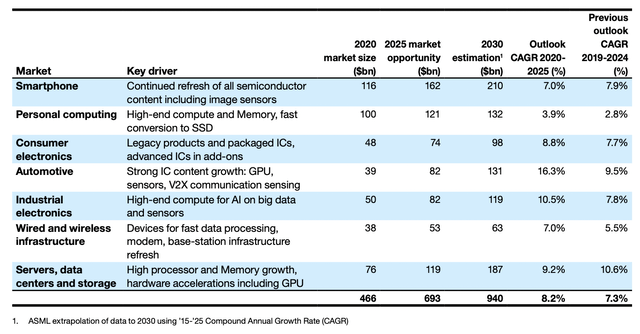

What we can take away from this is that ASML will be the driver of keeping up with Moore’s law and its machines will be able to provide us with the most advanced chips. Semiconductors are seen as the oil of the future, the drive behind everything. ASML plays a crucial role in this future, and this will support company growth. With the digital transformation still well underway, we can expect total demand for semiconductors to keep increasing at a strong pace. According to McKinsey, the total semiconductor market today stands at a market cap of $600 billion. It is expected to grow by 6% to 8% annually to reach $1 trillion by the end of the decade. Semiconductors will be increasingly important for all our daily tasks. As the graph below shows us, the use of semiconductors is everywhere and will only increase over the years ahead.

ASML sees a lot of opportunities to grow over the coming years. With the demand for semiconductors increasing, the demand for machines to make the most high-end semiconductors will be even stronger. We should not forget that within the global digital transition and growth of the semiconductor industry, high-end chips will be the fastest growing because of higher data and performance demand. This will give an extra boost to the need for EUV machines, as they are the only way to produce these high-end semiconductors.

So, growth for ASML seems baked in. Yet, the current economic downturn and the threat of a recession are pushing down on ASML stock, although I believe this is mostly unjustified. Demand for the machines of ASML will remain. Semiconductor manufacturers such as Samsung (OTCPK:SSNLF, OTCPK:SSNNF), TSM, and Intel all see the need for these machines, and since the waiting list takes over two years, there is simply no time to wait. This explains the strong backlog for ASML, which recorded record growth during the most recent quarter. There is also no risk of cancellations since part of the machine has already been paid in advance and this would mean you would have to go back in line if you need the machine in two years’ time and you would lose your payment. ASML backlog remains strong and is big enough to support strong growth over the next 2 years. Once ASML figures out how to improve its supply capabilities, it will be heading for even stronger growth.

Balance sheet and valuation

ASML has total cash of $4.6 billion on the balance sheet. Total debt was also $4.6 billion. The company has a solid balance sheet with its debt well covered by its cash and free cash flow. The company has a solid balance sheet and plenty of cash to spend.

The company also pays a dividend. The dividend yield is 0.7%, which is not very high, and therefore receives a D rating from Seeking Alpha Quant. The company did recently change its dividend structure to quarterly payouts and the company made clear that it wants to keep growing its dividend in the future. Dividend growth has been strong for ASML in the last few years, with growth of over 41% over the last 5 years. This is incredible growth, and it is expected to keep rising at a strong pace, as ASML keeps growing its business and margins. The dividend is also well-covered by its cash flows, and the payout ratio currently stands at a safe 24.58%. Dividend safety receives a Quant rating of B-.

Valuation is a riskier point for ASML. The company is currently valued at a forward P/E ratio of 30.39, which is lower than its 5-year average of 36.66. Yet, it is also 79% higher than the sector average, although I do not really see any peers for ASML thanks to its monopoly. ASML is a difficult company to value, because of its monopoly in EUV technology. This gives the company a great moat that protects it against downfalls. I think the company deserves a high valuation, because of this monopoly and the strong growth the company shows. Thanks to its strong backlog, cash flows are fairly predictable and there is no slowdown on the horizon. I believe ASML is a strong growing value play in a cyclical sector. That cyclical sector is taking this stock down way too far, and I believe ASML is fairly valued but could see an upside to a P/E of 35 again.

Risks

Thanks to its monopoly in the fast-growing and important EUV market, the company does not come with a lot of risks in my opinion. An economic slowdown would not be helping ASML, but I do believe its products, backlog, and importance for the semiconductor sector will keep growth alive. ASML is growing at a very safe 10-13% this year and the record-high backlog will support this growth for a further 2 years.

This growth would be at risk in the case of China invading Taiwan. TSM is the biggest customer of ASML, and so losing TSM would have a huge impact on revenue. Although an invasion from China would probably have an impact on everyone around the world.

The last risk to be discussed is a setback in new technologies. The creation of its High-NA is going very well, but if ASML would run into problems and delays with this new technology, which is already a part of its backlog, then this could have an impact on income after 2025 and could be a drag on the stock price. So far, ASML has been very strong at staying true to its promises, so I believe ASML will have plenty of margin for failure until that deadline in 2025.

We do have to add to this that ASML stated during its latest earnings call that its business is not impacted by the restrictions laid on the export of high-end semiconductor machines to China by the U.S. This is a very important detail as there was a lot of talk about ASML losing revenue because of this. The impact on ASML is fairly limited until 2023 for sure, according to management. Even if it would cause problems for ASML, China is only 15% of ASML’s revenue, so still manageable.

Conclusion

With no real short-term risks to be found, a solid backlog, and growth continuing to be strong, I remain of the opinion that ASML is one of the best buys on the market. The stock price dropped too far this year, and so did its valuations. Yet, the company still is not cheap, but I do believe this is justified. ASML has a predictable revenue stream thanks to its strong backlog. Demand remains higher than supply, something ASML is working on intensively. We hope to receive an update on its expansion plans during its Investor Day on 11th of November.

Recent quarterly results remained very strong and came in above expectations. The company also guided for another strong Q4 and increased FY22 expectations to over €21 billion. I believe ASML will continue to grow as it expands its business and shipments as demand for EUV will only grow and demand for DUV will remain high. ASML does not seem exposed to the general semiconductor slowdown for now. Of course, this is something to keep monitoring over the next couple of quarters. The news of management saying that China restrictions do not pose a significant threat is comforting.

I rate ASML a buy on strong business fundamentals, resilient growth, and a fair valuation.

Be the first to comment