sankai

One of the best sectors for income-seeking investors is infrastructure. There are a few reasons for this, including the fact that these companies tend to enjoy relatively stable cash flows regardless of conditions in the broader economy. In addition, most infrastructure companies do not have particularly high growth rates so they will often pay out a high percentage of their incomes to investors. Unfortunately, it can be difficult to put together a diversified portfolio of these companies, particularly if one does not have access to a considerable amount of capital.

One way around this problem is to invest in a closed-end fund (“CEF”) that specializes in the infrastructure as these funds provide easy access to a professionally-managed portfolio that is able to use a variety of strategies that can generate a much higher yield than any of the underlying companies possess.

In this article, we will look at the Aberdeen Standard Global Infrastructure Income Fund (NYSE:ASGI), which is one such fund. This CEF currently boasts an attractive 8.29% distribution yield and, like many Aberdeen funds, it can be a way to diversify a portfolio internationally. This global diversification can be a rare trait in the infrastructure sector so it is certainly something that is nice to see. Therefore, let us investigate and see if this fund could be right for your portfolio.

About The Fund

According to the fund’s webpage, the Aberdeen Standard Global Infrastructure Income Fund has the stated objective of providing investors with a high level of total return. This is not exactly surprising for an equity fund as most of them focus specifically on providing investors with as high a total return as they can. After all, equities are at their core a total return instrument since most people that invest in equities are seeking both capital appreciation and dividend income. This fund does specifically state that it is emphasizing current income as a way to provide this total return to investors. This is likewise unsurprising for an infrastructure fund considering that most infrastructure firms boast relatively high yields due to paying out a sizable proportion of their cash flow to investors.

Interestingly, the fund does not specifically state if it invests only in common equities or if it may include preferred securities and other fixed-income investments in the portfolio as well. If it is the latter, it could prove advantageous to income-focused investors. This is because preferred equity usually has a higher yield than common equity issued by the same company. In addition, preferred equity’s price does not typically vary as much during difficult markets because its distributions are not linked to the performance of the issuing company. However, preferred equity does not have the same potential for capital gains as common equity so their inclusion might limit the fund’s upside in strong markets.

As my regular readers likely know, I have devoted a considerable amount of time and effort over the years to discussing various infrastructure companies here at Seeking Alpha, particularly in the midstream and utility sectors. As such, some of the largest positions in the fund will likely be familiar to many readers. Here there are:

CEF Connect

We see three of the largest midstream companies in North America on this list. These three firms are Kinder Morgan (KMI), The Williams Companies (WMB), and Enbridge (ENB). All three of these companies are among the most well-known firms in the sector and all three have considerably strong forward growth prospects. This is because the global demand for natural gas is expected to grow over the coming years, which I discussed in various previous articles (such as this one). Many of the rest of the companies on this list are likely to be somewhat unfamiliar to most. This is because they are all foreign companies.

Overall, though, we see electric utilities, telecommunications firms, toll road operators, and similar companies that provide many of the things that we all take for granted but are necessary for society to function. In aggregate though, the majority of the companies in the portfolio are either utilities or companies that construct infrastructure, such as toll roads:

CEF Connect

This is an unusual configuration for an infrastructure fund. In particular, we do not usually see such a high concentration of industrials, which in this case are mostly toll road operators. The heavy weighting toward utilities is quite common, though. It is also appreciated since utilities tend to be highly resistant to economic problems such as recessions. After all, most people consider things such as electric and natural gas services to be essential for modern life so they typically prioritize paying their utility bills over discretionary things.

The same is not entirely true for toll roads though since people do frequently cut down on their driving and travel during recessions. In addition, the quantity of goods moved by trucks tends to decline, which has a negative effect on the financial performance of toll roads. With that said, toll roads do hold up better than many other sectors during such an environment, however.

As my long-time readers on closed-end funds are likely well aware, I do not generally like to see any position in a fund account for more than 5% of the fund’s assets. This is because that is approximately the point at which an asset begins to expose the fund to idiosyncratic risk. Idiosyncratic, or company-specific, risk is that risk that any asset possesses that is independent of the market as a whole. This is the risk that we aim to eliminate through diversification but if the asset accounts for too much of the fund then this risk will not be completely diversified away.

Thus, the concern is that some event may occur that causes a given asset to decline when the market as a whole does not and if that asset accounts for too much of the fund’s portfolio then it could drag the entire fund down with it. As we can see above though, there are no assets that have such a high weighting in this fund. In fact, the fund’s largest position is actually another fund, and even that only accounts for 3.76% of the portfolio. Overall then, we can clearly see that the fund should be diversified enough to protect us against the poor performance of any individual stock.

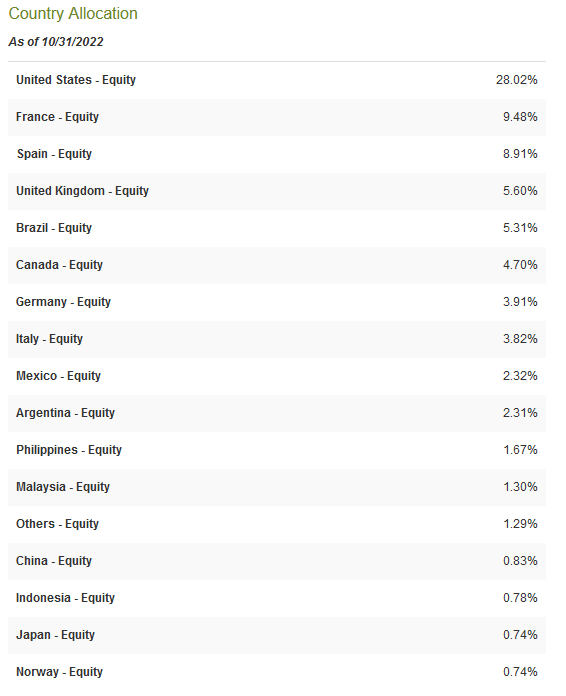

As there are only two American companies in the fund’s largest positions list, we may assume that the fund is primarily invested in foreign companies. In fact, this is the case as only 28.02% of the fund’s assets are invested in the United States:

CEF Connect

This is the lowest weighting toward America that I have ever seen in a global fund. It is also somewhat in line with the country’s actual representation in the global economy. After all, the United States only accounts for a little under a quarter of the global gross domestic product. The relatively high international diversification that we see here is quite nice because of the protection that it provides us against regime risk.

Regime risk is the risk that some government or other authority will take some action that has an adverse impact on a company that we are invested in. We saw an excellent example of this back in 2021 when the incoming Biden Administration unilaterally canceled the permits for the construction of the Keystone XL pipeline and caused all the money that was invested by TC Energy (TRP) into the project to be wasted.

The only real way to protect ourselves against this risk is to ensure that only a relatively small proportion of our assets are invested in any individual nation. As we can clearly see, the Aberdeen Standard Global Infrastructure Income Fund is certainly doing this. We could use that to our advantage by putting it into a portfolio that contains other global funds that have a much higher weight to the United States. This will allow us to reduce our exposure to that nation and thus reduce our overall risk.

Distribution Analysis

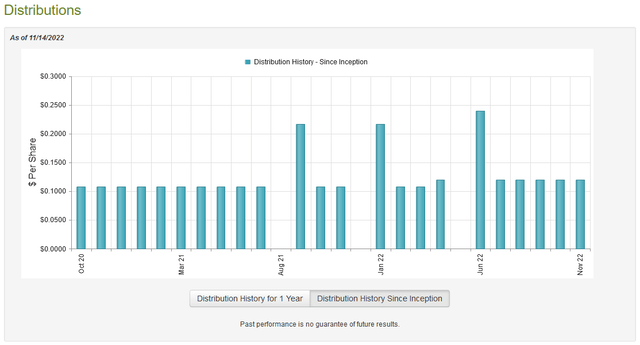

As stated earlier in the article, one of the characteristics of infrastructure companies is that they generally pay out a fairly high dividend yield. This is because these companies tend to have fairly low growth rates and stable cash flows, which lend themselves well to paying out a high proportion of their income to investors. As such, we might assume that the Aberdeen Standard Global Infrastructure Income Fund also has a high yield. This is indeed the case as the fund currently pays out a monthly distribution of $0.12 per share ($1.44 per share annually), which gives it an 8.29% yield at the current price. The fund has been remarkably consistent about this payout over its history as it has never cut the distribution, although it did increase it earlier this year:

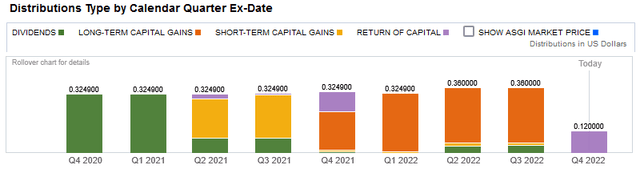

This overall consistency seems quite likely to appeal to many investors, particularly those that are seeking a safe and secure income with which to pay their bills. Another thing that might be appealing is that these distributions are overwhelmingly classified as dividend or capital gains income, although the latest quarter was entirely comprised of return of capital:

The reason that this is likely to be comforting is that many people do not like to see much return of capital in distributions. This is because a return of capital distribution can be a sign that the fund is returning the investors’ own money back to them. This is obviously not sustainable over any sort of extended period. There are, of course, other things that can cause a distribution to be classified in this way, such as the distribution of unrealized capital gains. We seemingly do not have to worry too much about that here, though. However, as I have pointed out in the past, it is possible for these distributions to be classified incorrectly. Therefore, it is important for us to look at the fund’s finances in order to determine exactly how it is financing its distributions and how sustainable they are likely to be.

Unfortunately, we do not have a recent financial report to consult for this task. The fund’s most recent financial report corresponds to the six-month period ending March 31, 2022. As such, this report will not give us very much insight into how well the fund performed over the past several months. This could be an issue because the past half-year has shown us a very volatile market, although many infrastructure companies did hold up better than other sectors. This is especially true for energy infrastructure companies, which have generally delivered positive returns this year when their dividends are considered. The report will, however, show us how the fund performed in the early stages of the bear market.

During the six-month period, the Aberdeen Standard Global Infrastructure Income Fund received a total of $1,683,414 in dividends and another $189 in interest from the investments in its portfolio. This gives it a total income of $1,683,603 in income. This was not enough income to cover the fund’s expenses and it had a net investment loss of $41,053 during the period. Obviously, this alone is not sufficient to pay out any distribution but the fund still paid out $5,753,979 during the period. This is likely concerning at first glance.

However, the fund does have other methods through which it can obtain the money that is needed to cover the distribution. The most significant of these is capital gains. Fortunately, the fund was quite successful at this during the period. It had net realized gains of $7,333,605 and another $6,436,964 net unrealized gains in the time period. This was more than sufficient to cover the distribution with a great deal of money left over.

Overall, the fund’s assets increased by $7,975,537 over the period after accounting for all inflows and outflows. This gives us a great deal of confidence in the fund’s ability to maintain this distribution as it can cover an entire half-year of distributions with this increase even if the fund’s portfolio remains completely flat. As long as it can continue to produce decent results, this distribution is likely to be sustainable and reliable.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the Aberdeen Standard Global Infrastructure Income Fund, the usual way to value it is by looking at the net asset value. The net asset value of a fund is the total current market value of all the fund’s assets minus any outstanding value. It is therefore the amount that the investors would receive if the fund were immediately shut down and liquidated.

Ideally, we want to buy shares of a fund when we can acquire them at a price that is less than the net asset value. That is because such a scenario implies that we are purchasing the fund’s assets for less than they are actually worth. That is currently the case with this fund. As of November 14, 2022 (the most recent date for which data is currently available), the Aberdeen Standard Global Infrastructure Income Fund had a net asset value of $20.51 per share but it only trades for $17.26 per share. This gives the shares a 15.85% discount to the net asset value. This is slightly better than the 15.40% discount that the shares have had on average over the past month and it is still an incredibly large discount. Thus, overall, the price seems to be reasonable for purchase here.

Conclusion

In conclusion, the Aberdeen Standard Global Infrastructure Income Fund appears to be a reasonable way to generate income today. The fund’s investments in infrastructure companies are nice due to the inherent stability and high yields of infrastructure companies through any economic environment. As the United States appears likely to enter a recession in the near future, this sort of stability is certainly attractive. The fund also boasts an internationally diversified portfolio and an attractive valuation, which both help to reduce investment risk. Overall, the ASGI fund might be worth considering for investment.

Be the first to comment