Dzmitry Dzemidovich

ARMOUR Residential REIT Inc. (NYSE:ARR) is a mortgage based real estate investment trust (mREIT) that invests in long-term, fixed-rate agency-backed residential mortgage-backed securities (“RMBS”). This Maryland based entity was incorporated in 2008, and has been paying monthly dividends since 2011. For the past 10 years, its average yield has ranged between 10 to 20 percent. The company has recorded a yield of 17 percent in the trailing twelve months (“TTM”). The price performance, though, has been extremely disappointing. The company also has a very low price to book (P/B) value of 0.78, whereas the peers are trading at an average P/B of 3.36.

ARMOUR Residential’s Ownership Structure

ARMOUR Residential REIT is managed by ARMOUR Capital Management LP, an investment advisor registered with the Securities and Exchange Commission (SEC). ARMOUR Capital Management LP is the majority owner of BUCKLER Securities, a FINRA registered broker-dealer. 52 percent of ARMOUR Residential REIT is owned by institutional investors, while 47 percent is owned by the common public. Almost a quarter of the company’s ownership lies with five investment management firms, namely Vanguard Group Inc., Mirae Asset Global Investments (Korea) Co., Ltd., Amvescap PLC, State Street Corporation, and Geode Capital Management, LLC.

ARMOUR Residential’s Investment Portfolio

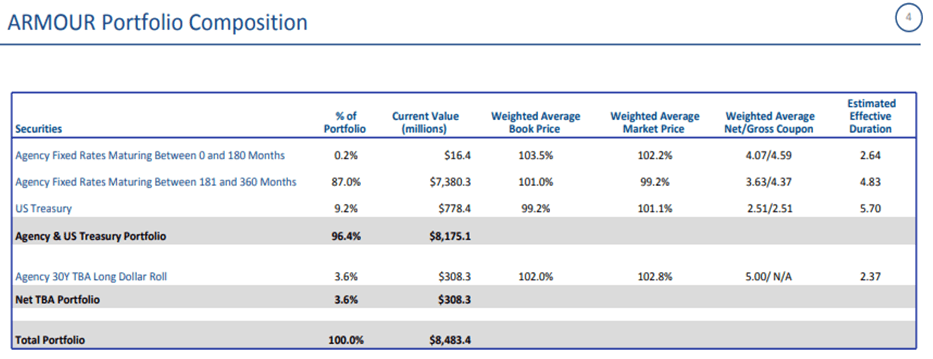

ARMOUR Residential REIT’s investment portfolio is composed of fixed-rate mortgage-backed securities, adjustable-rate mortgage securities, and multifamily mortgage-backed securities. As a result of dealing mostly in mortgage-backed securities, this mREIT generates its revenue as interest income from its investments. Agency-backed RMBS are issued or guaranteed by the U.S. government sponsored enterprises, such as Federal National Mortgage Association (Fannie Mae), the Federal Home Loan Mortgage Corporation (Freddie Mac) or the Government National Mortgage Administration (Ginnie Mae).

A substantial portion of the company’s holdings are guaranteed by Fannie Mae. Agency Securities consist primarily of fixed rate loans. The remaining investments are backed either by hybrid adjustable rate or by adjustable-rate loans. The company also invests in interest-only securities, U.S. Treasury Securities and money market instruments. It also invests in other securities backed by residential mortgages for which the payment of principal and interest is not guaranteed by a GSE or government agency.

ARR Portfolio composition (ARR website)

ARR’s Market Price Failed to Recover Post Pandemic

Prior to the covid-19 pandemic, ARMOUR Residential REIT’s shares were traded in the range of $20 to $30. However, the price came down to below $10 during the pandemic, and has traded within a range of $7 to $12. At the current price, the stock looks attractive enough. Investors generally prefer to buy such stocks when they are trading at a historical low price. But it also raises some questions: why such poor price performance despite the attractive yield?

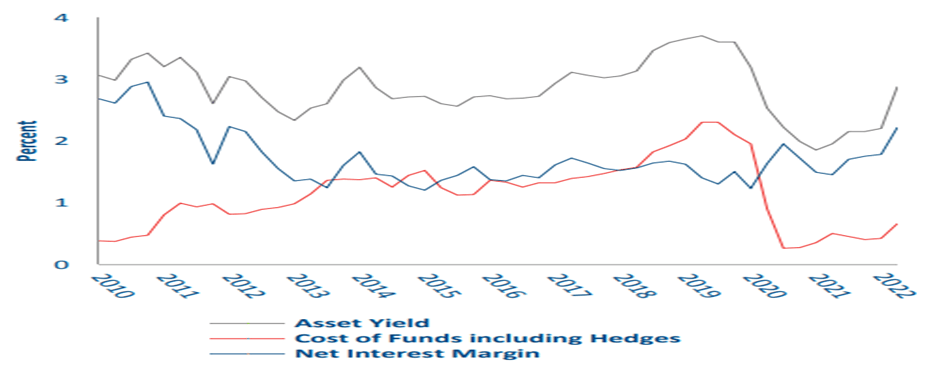

A probable reason might be the adverse changes in net interest income. Since 2017, the interest income is on a declining trend, while interest expenses keep on increasing. On top of that, the interest rate hikes by the Federal Reserve will amplify its pain. The Fed has increased the base rate twice, and they are expected to go for further rate hikes. As ARR’s primary source of income is based on long-term, fixed-rate agency-backed RMBS, there is a risk of losing out substantial interest income, as the company will not be able to hike its interest rates on the existing loans. However, it has to borrow from the market at a higher rate than it was borrowing before.

Impact of interest rate hike (ARR website)

ARMOUR Residential’s Share Buyback

ARMOUR Residential REIT returned $271 million to common shareholders through share repurchase program during the past 10 years. This amount is considerable considering its market capitalisation of $809 million. Thus, almost one-third of current value of this mREIT has been returned to its shareholders in the form of buyback. This buyback program was specifically targeted at enhancing the value of its outstanding common shares. Despite such massive buyback, management has failed to boost up the market price.

Investment Thesis

In order to control inflation, the Federal Reserve squeezes the liquidity in the financial system and increases the borrowing rates for long-dated assets. The Fed will also reduce renewals or replacement of maturing securities. This may lead to lower supply of RMBS over the next year or two. The demand side has also been affected by the rising property rates and simultaneous increase in mortgage interest rates. All these factors combined have led to slower mortgage applications and shrinking levels of both supply and demand for RMBS. This will have a severe adverse impact on ARMOUR Residential REIT’s investment portfolio.

The stock is currently available at a deep discount, when compared with its peers. ARMOUR Residential REIT is currently trading 0.78 to its book value. The 17 percent TTM dividend yield is also quite attractive. Still the risks involved with ARR’s portfolio are considerable. ARR’s portfolio is not looking solid in the current scenario of high inflation and rising interest rates. The price performance has been extremely disappointing with no sign of short-term recovery. Thus, despite the attractive-looking yield, ARR does not convince.

About the TPT service

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

Be the first to comment