Selman Keles/E+ via Getty Images

Investment Thesis

Human space travel has mostly focused on manned low-Earth orbit missions and unmanned scientific research until now. However, high levels of private investment, technological advancements, and increased public-sector interest are reviving the demand to go to space.

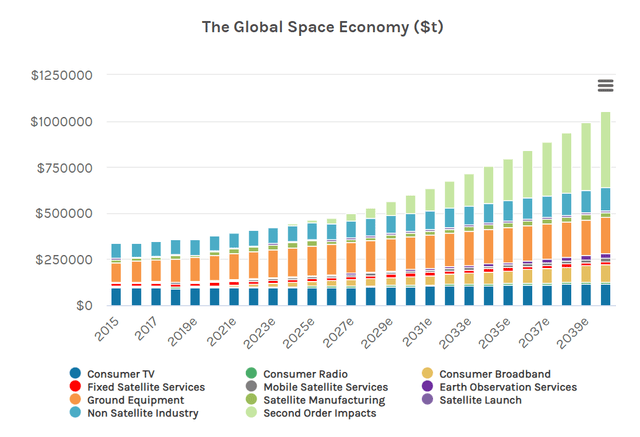

In the short term, space as an investment subject is anticipated to have an influence on a variety of industries other than Aerospace & Defense, not accounting for potential spillovers. According to Morgan Stanley, the global space sector might produce more than $1 trillion in sales by 2040, up from $350 billion today, growing at more than 6% per year. Satellite broadband will account for half of the predicted increase in the global space industry by 2040 and as much as 70% in the most optimistic scenario. In this article, I will review the ARK Space Exploration & Innovation ETF (BATS:ARKX), which provides exposure to a basket of global stocks involved in the space industry.

Strategy Details

The ARK Space Exploration & Innovation ETF is an actively managed fund that seeks long-term capital growth by investing in companies that are engaged in the space industry. According to Ark Invest, these firms are benefiting from technologically enabled goods and services that occur beyond the Earth’s surface.

If you want to learn more about the fund’s strategy, please click here.

Portfolio Composition

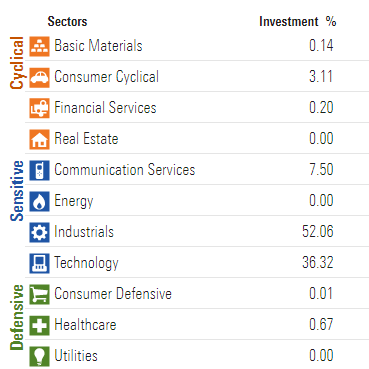

From the sector allocation chart below, we can see the index places a high weight on Industrials (representing around ~52% of the index), followed by the Information Technology sector (accounting for ~36% of the fund) and Communication Services (representing ~7.5% of the index). The top 3 sectors have a combined allocation of ~95.9%.

Morningstar

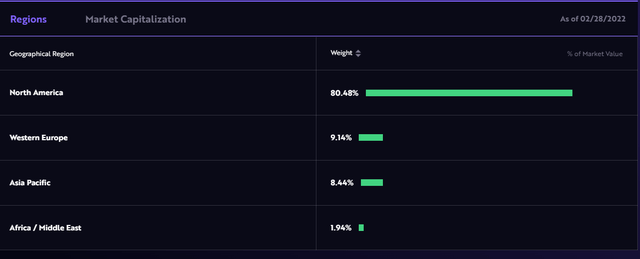

In terms of geographical allocation, ARKX invests over 80% of its assets in North America, followed by Western Europe and the Asia Pacific. Unsurprisingly, North America attracts the largest share of the funds since it is the region that spends the most on space exploration. According to Statista, the US spent ~$54.6 billion on space programs in 2021, five times more than the second country on the list (China).

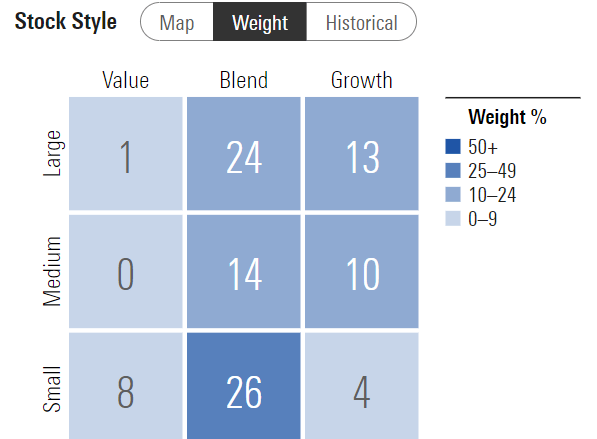

ARKX seems to be well-diversified in terms of market capitalization. The fund invests ~24% of its capital into large-cap blend issuers, characterized as large-sized companies where neither growth nor value characteristics predominate. Large-cap issuers are generally defined as companies with a market capitalization above $10 billion. The second-largest allocation is small-cap blend equities. Small-cap stocks account for ~38% of total assets. As they are generally more volatile than large and stable companies, I believe this high allocation increases the risk of the fund’s strategy.

Morningstar

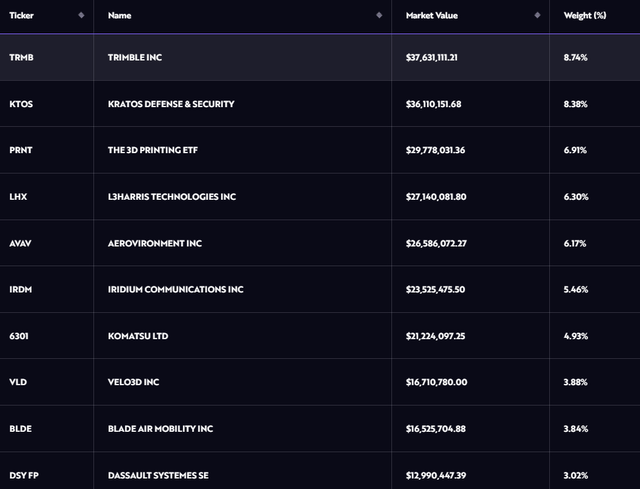

The fund is currently invested in 33 different stocks. The top 10 holdings account for ~58% of total assets, with no single stock weighting more than ~9%. All in all, I would say the fund is pretty concentrated in a few high-conviction names. I think it is important to be comfortable with such a portfolio before buying ARKX, as such concentration can remove some of the benefits of diversification and increase volatility.

Since we are dealing with equities, one important characteristic is the portfolio’s valuation. According to data from Morningstar, the fund currently trades at a price-to-book ratio of 3 and an average price-to-earnings ratio of ~26. I generally consider a company trading at a forward price-to-earnings ratio above 20 to be richly valued. Moreover, I think it is hard to justify holding stocks with a P/E above 20 when the Fed and other central banks around the world are beginning to tighten monetary policy and raise interest rates.

Is This ETF Right for Me?

I have compared below ARKX’s price performance against the Invesco QQQ ETF (NYSEARCA:QQQ) and the Procure Space ETF (UFO) over the last year to assess which one was a better investment. Over that period, QQQ outperformed both space strategies by over ~24 percentage points. To put ARKX’s performance into perspective, a $100 investment a year ago in this ETF would now be worth ~$90.25, which is a poor absolute return.

It is interesting to see that over that period, both space strategies delivered negative results, which I believe is very frustrating for long-term investors given the fantastic bull market that we had in the NASDAQ 100 and the S&P 500. If we look at UFO’s performance since its inception back in April 2019, the strategy generated only a 2% return, which is a mediocre result, to say the least.

I personally think space is one of the most exciting sectors of the future based on the growth opportunities. That said, I think we are only at the beginning of this journey and many market participants are overvaluing the few companies that give exposure to this industry. At the same time, there are a number of private companies, such as SpaceX, that will probably come to the market in the next couple of years. This will greatly increase the supply of publicly listed space companies, which could be detrimental for the leaders of today who have attracted a large chunk of capital.

Key Takeaways

ARKX provides exposure to a basket of leaders in the space industry, who can displace or create new markets and deliver exponential returns. Based on the potential prospects, I believe space is one of the most fascinating industries of the future.

That said, I believe valuations are stretched across the industry. Most of these businesses are trading at more than 25x earnings which adds a lot of risk in my opinion in the current market environment given the fact that we are at an inflection point in monetary policy and inflation is running hot. Historically, high inflation has a negative impact on P/Es, and richly valued stocks tend to suffer the most. All in all, I expect ARKX to continue to underperform the market going forward.

Be the first to comment