Marco Bello

Thesis

ARK Innovation ETF (NYSEARCA:ARKK) rebounded sharply after the October CPI print turned out softer than feared. In fact, the 13% surge on Thursday 10th marked ARKK’s best one day performance ever.

However, it might be too early to call a bottom for tech/growth stocks, as inflation is still far from the Fed’s 2% target and one data point (October CPI) is surely not sufficient to make a structural judgment about whether inflation is easing. Moreover, I remain cautious on Cathie’s stock picking and trading capabilities, as the fund must still prove being able to capture risk-adjusted alpha.

Has ARKK Bottomed?

Amidst a rising interest rate environment, long-duration assets such as Cathie Wood’s Ark Innovation ETF have strongly underperformed the broad market in 2022. For reference, ARKK is down about 58% YTD, versus a loss of approximately 17% for the S&P 500 (SPY).

Looking at such a sharp sell-off, bargain hunters might be tempted to see a bottom – especially after the softer than expected October CPI print sparked a buying party for tech/growth assets.

The argument in favor of ARKK goes as follows: If inflation would indeed be cooling down, then the federal reserve might be open to slowing, or even stopping, hiking interest rates. This would take valuation pressure from long-dated cash flows, given that the ‘lower’ discount rate makes investing in the future less expensive.

But I remain cautious on trading the thesis. First of all, one single data point – the October CPI print – is not enough to justify a bet on easing inflation. Second, even if inflation is indeed cooling, there is no reason to assume that central banks will go back to ultra-loose monetary conditions anytime soon – if ever. Arguably, the pain the current inflationary episode caused, and is still causing, has fundamentally altered the mindset of policy makers. Third, investors should consider that inflation might be cooling due to a sharply slowing economy. In that case, even if interest rates (cost of capital) becomes a valuation tailwind, a recession-driven earnings contraction provokes an equally strong headwind.

Investing With Cathie?

I understand the attractiveness of selectively buying high-quality growth assets – personally I am buying Twilio (TWLO), Roblox (RBLX) and Block (SQ).

But personally, I am very cautious trusting Cathie Wood to do the stock-picking for me, because her track-record of identifying structural trends and positioning investments accordingly has not been the most stellar. For example:

- in early 2020 Cathie predicted oil prices are going back to $12 a barrel. The WTI benchmark now trades at $85m, about seven times the value Cathie identified as reasonable.

- Shortly before the Crypto crash, Cathie put a $500,000 price target on Bitcoin.

- In early 2022, Cathie said that value stocks – not growth stocks – would be in a bubble.

Even assuming Cathie’s macro strategy of investing in ‘disruptive technologies’ is correct, her ARKK fund still underperformed the Nasdaq 100 benchmark since inception. Since November 2014, ARKK has returned only 100.6% versus a gain of 183.8% for the NDX. In other words, the ARK Innovation fund underperformed by a factor of almost x2. So why not invest in the Nasdaq 100 and save the 75 basis points management fee?

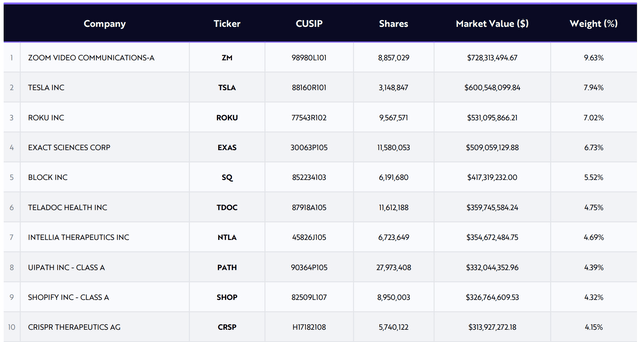

Moreover, I struggle to understand the ‘disruptive’ value proposition of Zoom (ZM) and Roku (ROKU), which are ARKK’s largest and third largest holdings respectively. Here are the fund’s 10 largest holdings.

Still Vulnerable To Higher Rates

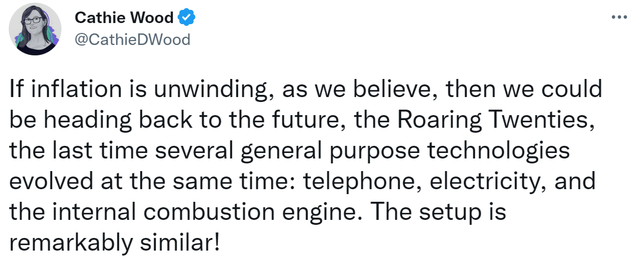

On Saturday 12th, Cathie Wood once again cheered for her investing strategy – saying that she believes inflation is easing and the macro set-up for an economic and technological boom similar to the roaring twenties could be building.

But Cathie also added that if the Fed does not support the economy with lower interest rates, then an environment similar to the ‘Great Depression’ could also be possible.

While I ascribe little value to Cathie’s macro predictions (see previous sections), I think the truth is somewhere in the middle. In my opinion, is very likely that higher interest rates (+2% Fed funds rate) will stay with investors for longer.

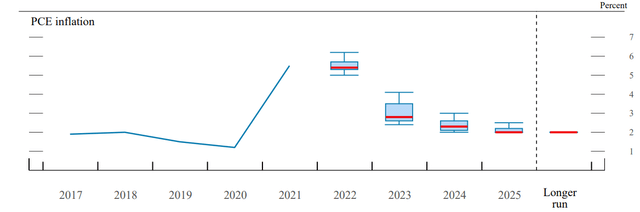

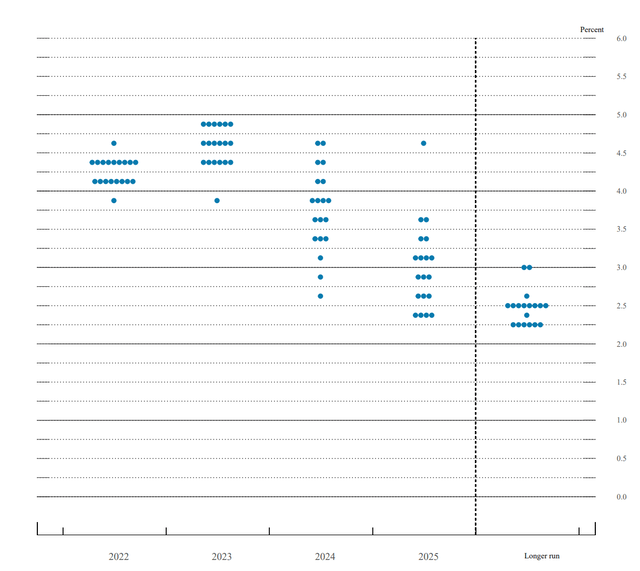

Investors should consider that although the Fed is assuming inflation will trend down to 2% by 2025…

…policy makers are still estimating a +2% Fed funds rate. Thus, I deem it highly unlikely that ultra-loose monetary conditions will return anytime soon.

Investor Takeaway

ARKK is down about 5% since I last covered the ETF and assigned a ‘Sell’ rating, versus a gain of approximately 3% for the S&P 500 (SPX). Although I acknowledge the attractive valuation for many growth assets, I continue to be bearish on ARKK.

In my opinion, ARKK’s stellar performance in 2020/ 2021 was more a function of ultra-loose monetary conditions than a function of Cathie’s stock-picking abilities. And reflecting on commentary from Fed officials, I doubt that ultra-loose monetary conditions will return anytime soon – if ever. Accordingly, I expect ARKK to remain under pressure.

Be the first to comment