Pgiam/iStock via Getty Images

Investment summary

We continue our extensive research on companies that provide medical breakthroughs in complex disease segments in FY23′. Of late, we’ve concentrated on names building momentum in developing treatments for various autoimmune disorders. With this in mind, I’m back here today to present our appraisal of argenx SE (NASDAQ:ARGX) after extensively reviewing all of the moving parts in the investment debate. Make no mistake, ARGX was a tremendously strong performer in FY22′, against a bearish market. Investors showed strong demand for the stock in a decent rally across the year. The question now rests on the level of demand looking forward, based on its Vyvgart growth curve, and ability to convert the remainder of its pipeline. Problem is, there’s a lack of organic growth propensity to achieve this right now. Alas, whilst there’s several positive talking points, the lack of profitability and early-stage within the growth cycle are negating factors that go against our core investment principles. Net-net, we rate ARGX a hold.

Myasthenia Gravis treatment Vyvgart a potential long-term compounder

In our opinion, the investment opportunity in ARGX lies in its myasthenia gravis (“MG”) pipeline. MG is an autoimmune disorder that affects the neuromuscular junction – the site of nerve impulse transmission to the muscles resulting in muscle contraction. The pathogenesis originates as patients develop auto-antibodies to the acetylcholine (“ACH”) receptor. These antibodies bind to the postsynaptic membrane at the surface of the neuromuscular junction and blockade neuromuscular synaptic activity.

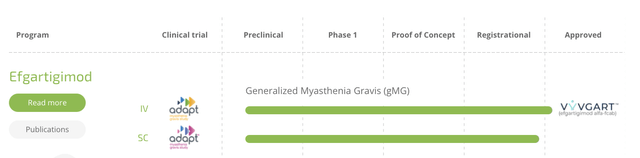

ARGX MG Pipeline

Data: ARGX Website, see: “Pipeline”

The classic clinical presentation of MG manifests as episodic muscle weakness and easy fatiguability. The ocular [eye] muscles are the first impacted in 85% of patients, accompanies by weakness/fatigue in the neck and proximal limb musculature. Many patients also present with symptoms of bulbar palsy, other words difficulty swallowing, altered voice, feeling of choking. Consequently MG has significant impact on mobility and functionality. The underlying cause of this peculiar autoimmune response is not fully understood, but causes are understood to be multivariate and potentially of genetic origin.

The market for MG treatments is a niche, concentrated, portion of the broader healthcare sector. That’s because MG is quite rare – epidemiological studies in FY21′ showed an incidence of 2.1 to 30 cases per million person years, with a prevalence of 150-200 cases per million [0.015-0.02%]. Market research points to an expected market growth of CAGR 6.5% into FY28′, after being valued at $1.22Bn in FY21′. Contrary findings here and also here suggest a 7.5% into FY30′, corroborating a reasonable period of growth, reaching $2-$3Bn over this time. New demand for MG treatments should underline the MG market’s growth over this range.

The company’s Efgartigimod label [sold under brand name “Vyvgart”] formed a new class of medical treatment for MG after its approval in August FY21′. Following this, AstraZeneca’s (AZN) Ultomiris was approved for MG in April last year, creating a new label in the MG market that ARGX must now compete against [note: Ultomiris is also approved for several other disease segments]. What is promising for ARGX, is that it printed $175mm in quarterly Vyvgart sales in Q4, leading to $402mm in Vyvgart revenues for the full-year in FY22′, according to its earnings pre-announcement. At this pace, the company has ~33% of the treatment market share.

Vyvgart’s mechanism of action is actually an innovative hypothesis, seeing that is does not directly target the underlying cause of the disease, instead, it modulates the activity of the MG antibodies. It is a recombinant, human IgG1 Fc fragment that binds to and modulates the activity of Immunoglobulin G (“IgG”) antibodies. It interacts with the Fc receptor-mediated pathway, an evolutionarily conserved mechanism for the clearance of circulating IgG antibodies. By mimicking the Fc region of human IgG, it binds to Fc receptors, which are expressed on cells such as macrophages, dendritic cells and some other cells. This binding leads to the internalization and degradation of the antibodies via the effect of lysosomes, that effectively break-down the metabolites. As a result, the drug is able to stop the pathogenesis of MG from continuing or advancing.

ARGX deeper look at fundamentals

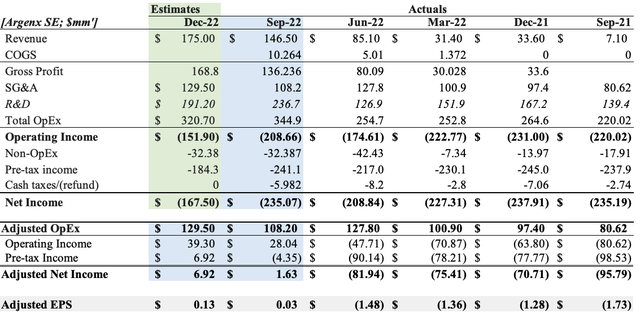

Given the fact ARGX is still investing the bulk of cash flows into R&D, it’s earnings profile is messy and requires some minor adjustments. Primarily, we need to reconcile the GAAP accounting treatment of R&D, which recognizes it as an expense. In our opinion, for ARGX, it’s R&D spend is actually an investment, given its lengthy pipeline that it continues to invest heavily in. In fact, looking at a traditional calculus of [quarterly] invested capital, it is negligible, therefore it’s clear the bulk of investment is in R&D for the company. I’ll address this later, but for those observing Exhibit 1, you’ll note that, by capitalizing R&D [and including an amortization expense], this results in net income for $1.6mm of $146mm of sales in Q3 FY22′. Using the known $175mm in revenue for Q4 provided from management, our estimates for Q4 FY22′ are shown below as well. We see a potential uplift of $0.10 in EPS after the adjustments.

Exhibit 1. Capitalizing R&D as an intangible investment leading to cleaner picture of operating income

Note: Q4 FY22′ revenue provided by management in pre-announcement, all other ledgers are internal estimates. GAAP accounting treats R&D as an expense, yet IFRS accounting capitalizes R&D. (Data: Author, ARGX SEC Filings)

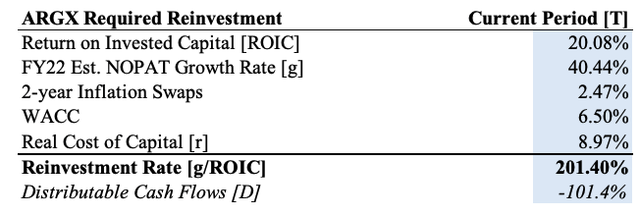

This has important implications to the ARGX investment debate. With the above reconciliations for R&D, we’ve calculated its adjusted NOPAT at $38.4mm. Treating the R&D investment as the invested capital last quarter, ARGX recognized a 20.1% ROIC for the period, up from 11% in Q3. Looking at the return on incremental invested capital (“RIIC”), we note it pulled in to 4.67%. This is important, as its WACC hurdle is 6.5%, and so it may now be generating a ROIC/WACC spread of ~13.6 percentage points. Where this becomes relevant, is identifying how much of this ‘profitability’ is required to be reinvested to fund ARGX’s future growth, an important factor in growing corporate value [for more on this, see: here]. The issue for equity holders right now, is that ARGX requires a reinvestment rate of 201% of its tax-adjusted operating income to achieve the forecasted NOPAT growth of Q4 FY22′. This isn’t surprising, considering the heavy R&D spend, however there’ll be no leftover cash to add shareholder value for now.

Exhibit 2. Utilizing the above adjustments, we calculate ARBX’s NOPAT, and show it requires heavy reinvestment of all operating income to sustain growth

Note: The reinvestment rate captures what percentage of NOPAT, or earnings [in this case, NOPAT], needs to be reinvested to facilitate forward growth. This is an integral component in gauging a firm’s valuation. For more on this, see: Blieberg & Priest (2019): “The P/E Ratio: A User’s Manual”, Epoch Investment Partners; and also: Mauboussin & Callahan (2014): “What Does a Price-Earnings Multiple Mean? An Analytical Bridge between P/Es and Solid Economics”, Credit Suisse Global Financial Strategies (Data: Author, ARBX SEC Filings)

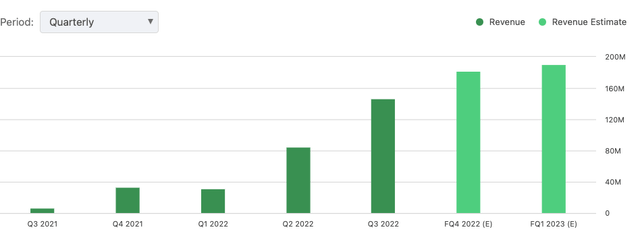

On a positive note, consensus has the company to print $181mm in Q4 revenues, lifting to $190mm by the end of the current period [Exhibit 3]. Should this trend in revenue continue, there’s good scope for the company to generate economic profit above the cost of capital.

Exhibit 3. AGRX Q4 FY22′ and Q1 FY23′ revenue estimates

Data: AGRX, Seeking Alpha, see: “Revenues”

ARGX technical analysis

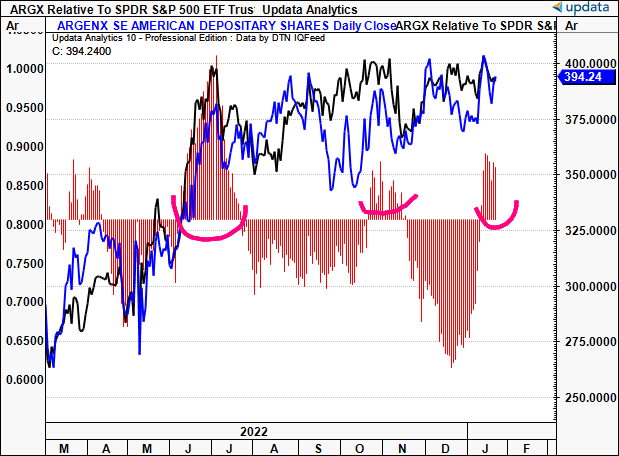

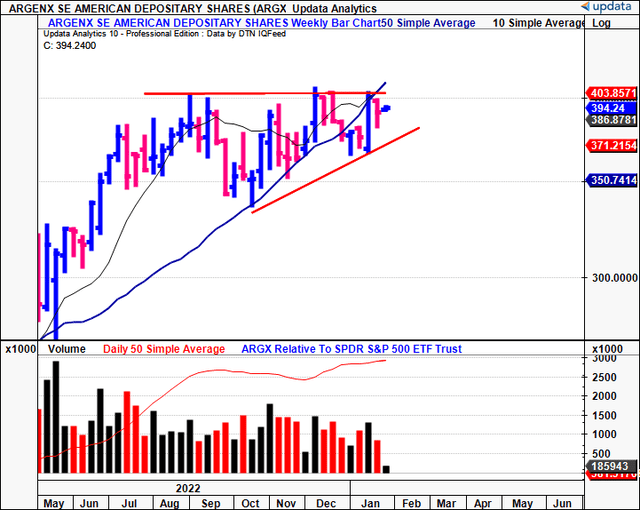

It’s essential to have a grasp on what’s happening within the marketplace for ARGX to round out the picture. You’ll see below the stock has tested and been rejected 3x at the ~$403 mark since August last year. An ascending triangle can be seen with higher-lows after each attempt, but the volume trend has been consistently flat, with no indication of large entrants opening or adding to positions.

Exhibit 4. Ascending triangle after testing 3x at ~$403 with no success

Money flows have been equally as weak to the upside and have followed a period of heavy daily outflows since November to mid-January. Investors are buying at these prices although at weak levels, nothing like the rally in June last year.

Exhibit 5. Money flows weak to the upside, bottom-heavy with large outflows from November to mid-Jan

Data: Updata

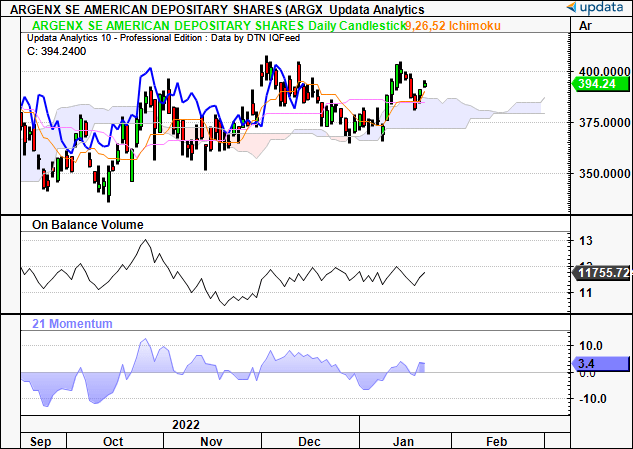

At the same time, shares have just bounced from the top of the cloud, whereas the lagging line is still above the cloud. This is a bullish confirmation and advocates against an all-out sell, by estimation. On-balance volume has flatlined, in-line with the findings of money flows from above, again suggesting a lack of long-term demand or supply at these levels.

Exhibit 6. Testing and bouncing from cloud support, yet lack of demand/supply over last few months

Data: Updata

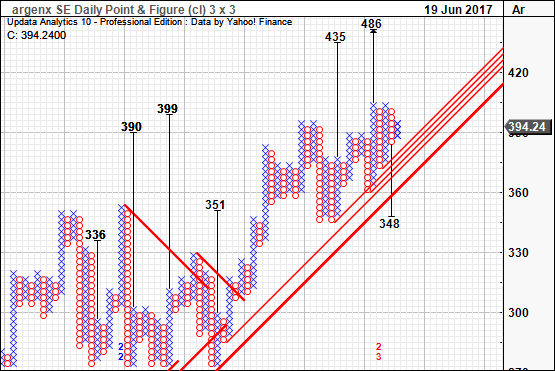

Consequently, we have a downside target to $348, in the presence of two previous upside targets to $486, and this has us neutral on the price action looking forward. In the absence of tangible earnings, these price targets are extremely valuable in guiding price visibility looking ahead.

Exhibit 7. Downside targets to $348

Data: Updata

In short

There’s plenty to like about ARGX, given its novel Vyvgart hypothesis and sales growth exhibited over the last 12 months. However, we have core investment tenets that we must abide by, and there just isn’t the profitability or aggressive price action to suggest the stock is a buy right now. Its FY22′ earnings in March is set to be a key inflection point, so we’ll be watching closely at the numbers there. However, in our estimation, after a strong rally last year, ARGX is one best watched from the sidelines for now. Nevertheless, we are trigger ready should the signs appear. Rate hold.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment