vm

Intro

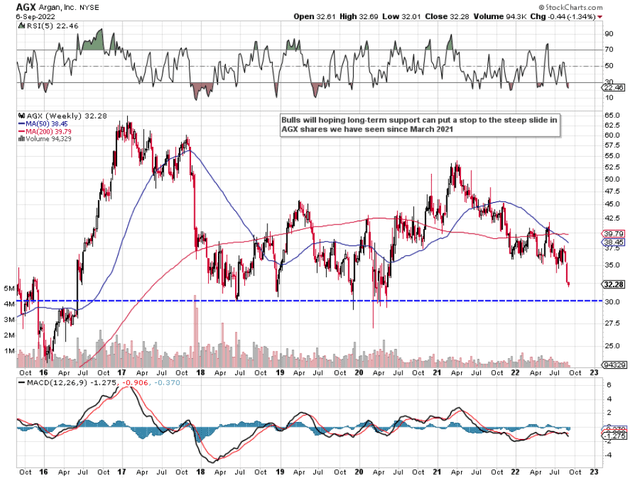

If we pull up a chart of Argan, Inc. (NYSE:AGX) (Engineering & Construction Player), we can see that shares now look likely that they will test underside support in this latest downswing. Momentum remains clearly to the downside with shares continuing to trade well below their 200-day moving average ($37.80). Suffice it to say, the first quarter earnings and revenue beats that were announced in June of this year did little to stem the tide in this play. The big calling cards in Argan are its valuation and the projects it has coming down the track specifically. For example, the company’s Non-GAAP forward earnings multiple comes in at an ultra-low 12.02. This multiple looks particularly attractive compared to Argan’s 5-year average of 26.20 for example. Furthermore, if we go out to the fiscal year ending in January 2024, the forward price-to-earnings ratio comes in even lower close to the 9 mark. Suffice it to say, consensus is pricing in plenty of growth in Argan which if realized should undoubtedly lift the share price over time.

Argan Shares Continue To Slide (Stockcharts.com)

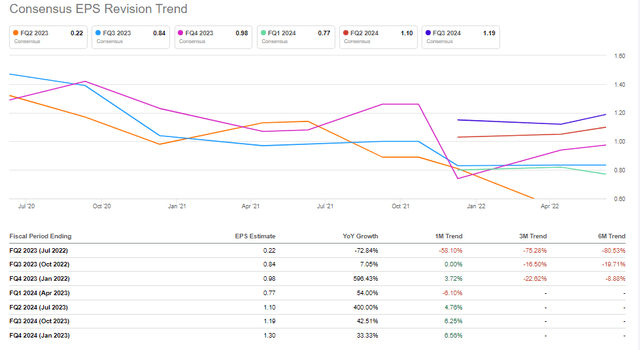

We must remember that forward-looking numbers are estimates and could easily miss the mark by quite some margin. We state this because bottom-line near-term quarterly estimates (which are much easier to predict) have been falling sharply, so if this trend persists, those annual earnings multiples could increase much faster than many presently expect.

Furthermore, there is another problem that investors should focus on: Argan’s cash flow. Although Argan may look very attractive from its cash position ($367 million of cash & short-term investments where the market cap present is only a mere $455 million), the company has not been generating cash flow for a while. This presents a problem for the following reason.

Argan Quarterly Earnings Estimates (Seeking Alpha)

Negative Cash-Flow

Argan’s trailing net profit number of $35 million may demonstrate that the company remains healthily profitable but $35 million of net profit over the past four quarters does not mean that this amount was available to shareholders in the form of buybacks or dividends. This is an important distinction in that the income statement is an accounting document whereas the company’s cash-flow statement illustrates the actual movement of cash in and out of the business over a specified period.

Suffice it to say, if we go to Argan’s cash-flow statement, we see a negative operating cash flow of $28 million (Another way of valuing the stock) which means the company is not profitable on a cash basis. Balance sheet cash was reduced by over $200 million (Mostly investments) and shareholder equity lost roughly $29 million in this timeframe.

Although bulls will point to the underlying strength of Argan’s balance sheet ($302.8 million of equity versus total liabilities of $190.8 million) and really encouraging forward-looking expectations concerning multiple profitable projects, long-term investors who look for stability invariably focus on cash-flow growth. The reason being is that solid cash-flow generation invariably leads to increased assets and revenues. Suffice it to say, when there is a lack of free cash flow over a sustained period, the company needs to rely on its balance sheet and organic growth to resume growth. This reduces the opportunity to grow and you can bet the market has been pricing this into the prevailing share price.

Argan’s forward dividend yield presently comes in at roughly 3% and the stated payout ratio is roughly 36%. That payout ratio is calculated off earnings and not cash, so if negative cash flow continues to be the order of the day for some time, management will have to continue to lean on its balance sheet to reward shareholders.

From a bullish standpoint, management is confident that it can invest successfully through this cycle with international expansion now coming to the fore. Suffice it to say, how long the cash-flow drain will continue is anyone’s guess. The company’s order book remains very strong but time will tell whether this work can be completed in a timely fashion. Inflation, supply chain headwinds, and ongoing covid variants still have the potential to delay operations significantly. Suffice it to say, share-price appreciation will not solely be a consequence of doing the work Argan has on its books but also the speed at which this work can be done over time.

Conclusion

Argan may not be generating cash flow at present but management’s recent behavior with respect to where it deploys its cash points firmly to its belief that better times are ahead for the stock. Let’s see what the second quarter numbers bring. We look forward to continued coverage.

Be the first to comment