turk_stock_photographer

Quality dividend growers don’t stay down for long, as temporary weakness only gives savvy investors an opportunity to double down on the cheap. This appears to be the case for Ares Management (NYSE:ARES), whose share price has nicely recovered from the trough that it saw in the June through July timeframe.

While ARES is no longer a value stock, I still find it to be a growth stock trading at a reasonable price. In this article, I highlight what makes ARES a quality buy at the current valuation, so let’s get started.

Why ARES?

Ares Management is a worldwide asset manager that’s been in business for 25 years, with over 2,300 employees spread across over 45 offices around the globe. Its three main lines of business include Credit, Private Equity, and Real Estate, and is the external manager for well-regarded investment companies such as commercial mortgage REIT Ares Commercial Real Estate (ACRE) and the largest BDC by asset size, Ares Capital (ARCC).

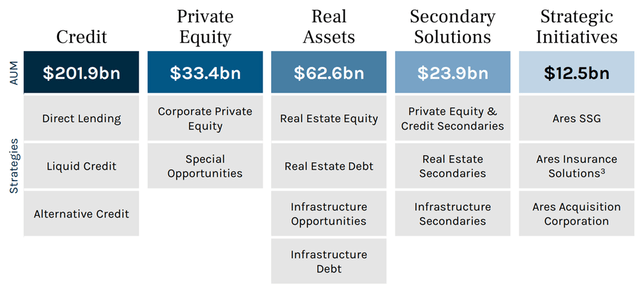

While ARCC and ACRE are both higher yielding, ARES makes up for it with steady fee income that it generates from managing these and other investment funds. At present, ARES has $334 billion in assets under management, spread across the asset classes below.

ARES Investment Mix (Investor Presentation)

One of ARES key advantages as an asset manager is its long-lived locked up capital, which unlike stock mutual funds, which are not subject to daily market swings and investor redemptions that often occur at inopportune times, when the market is down.

ARES continues to grow at an impressive pace, raising $16.4 billion in new gross commitments during the second quarter. This resulted in AUM growth of 35% YoY to $334 billion. Also encouraging, ARES is seeing the benefits of positive operating leverage through its scale, as management fees grew at a faster clip at 41% YoY, and fee-related earnings grew by 50%.

Moreover, while some may be inclined to lump ARES into the broader economically sensitive financial services segment, ARES appears to be rather resilient compared to this general asset class, as it saw compounded annual growth rate of more than 25% during both the global financial crisis of 2007 through 2009 and COVID pandemic from 2019 to 2021.

This is driven in part by the nature of ARES’ investments, of which 64% are in credit investments. This asset class provides protection from losses with more stability in valuation during economic adversity, since they sit in the top half of the capital structure (above the equity layer) in its portfolio investments. Moreover, ARES’ direct lending platform gives it more influence and a closer relationship with portfolio companies, as opposed to truly passive investments such as high-yield bonds and syndicated bank loans.

Looking forward, ARES’ investment vehicles are poised to continue to benefit from a high interest rate environment, as 90% of credit investments are of floating rate nature. Management sees a meaningful positive impact to earnings for its BDC, Ares Capital, on a going forward basis due to the recently elevated rates, while also having significant dry powder to grow its stable investment base, as noted during the recent conference call:

In fact, ARCC reported that a full run rate earnings impact from the recent increase in base interest rates through the end of the second quarter, could have increased its second quarter core earnings by about 11%, and add an additional 100 basis point increase in base rates from June 30, could add a 17% increase from second quarter core earnings all else being equal.

I would also note that the structure of our AUM and long-dated and perpetual vehicles also provides insulation. About 88% of our AUM and 95% of our management fees are from either long-dated funds or perpetual capital vehicles.

Due to the long-term nature of this capital, we have not experienced significant redemption issues during volatile periods. This has enabled us to be patient investors and utilize the capabilities of our experienced teams to support portfolio companies during challenging times.

Having significant dry powder and access to capital is also critical to success. At quarter end, we’re well-positioned with over $90 billion of available capital of which $52.7 billion is not yet generating management fees, and available to support further FRE growth when deployed.

Meanwhile, ARES maintains a strong BBB+ rated balance sheet and pays a well-covered 3.3% dividend yield with a 75.5% payout ratio and has a robust 19.4% 5-year dividend CAGR.

While ARES doesn’t scream cheap at the current price of $74.94 with a forward PE of 23x, I see the valuation as being justified considering ARES’ growth track record and forward prospects, especially with elevated interest rates.

Analysts estimate 25% – 27% annual EPS growth through 2024 and have a consensus Buy rating with an average price target of $85.18, translating to a potential one-year 17% total return including dividends.

Investor Takeaway

ARES appears to have strong growth prospects while being more resilient and less cyclical than the broader financial services sector. The company is well-positioned to benefit from rising interest rates, with a high proportion of its investments in floating rate credit instruments. With analysts seeing robust forward EPS growth and a reasonable valuation, I believe ARES represents a solid choice for dividend growth investors.

Be the first to comment