xavierarnau

Ares Commercial Real Estate Corporation (NYSE:ACRE), a real estate investment trust (“REIT”), provides investors with an 11% dividend yield that is fully covered by the trust’s distributable earnings, income upside from rising interest rates, and a strong portfolio of high-quality senior loans.

This package deal can also currently be purchased at a significant discount to Ares Commercial Real Estate’s book value. I believe the trust’s 11% dividend yield is sustainable, and the valuation maintains a high margin of safety.

Senior Loan-Focused Loan Portfolio And Interest Rate Exposure

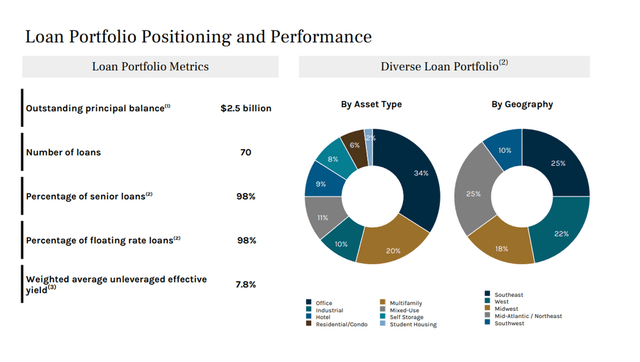

As of 30 September 2022, Ares Commercial Real Estate’s portfolio was valued at $2.5 billion and consisted of 98% high-quality, secured Senior Loans.

The trust closed $50 million in new loan commitments and received $167 million in loan repayments in the third quarter, resulting in a QoQ decrease in portfolio value of approximately $100 million.

In the third quarter, Ares Commercial Real Estate maintained a strong focus on the office and multi-family sectors, which accounted for 54% of Ares Commercial Real Estate’s loans.

Loan Portfolio Positioning And Performance (Ares Commercial Real Estate Corp)

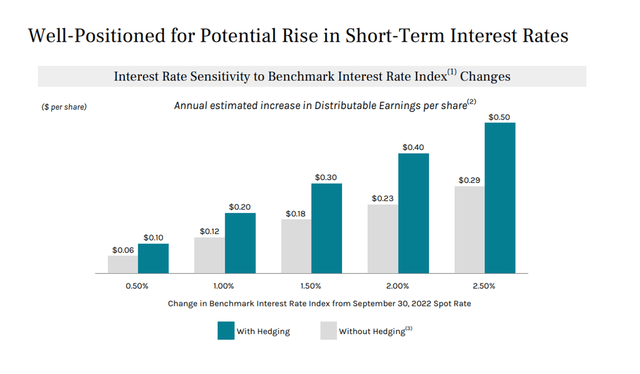

Ares Commercial Real Estate benefits from the Federal Reserve’s aggressive rate hike cycle. The central bank raised interest rates by 75 basis points earlier this month, marking the fourth consecutive 75-basis-point increase in 2022.

Because 98% of Ares Commercial Real Estate’s loans are floating rate, higher interest rates result in higher loan portfolio income.

According to Ares Commercial Real Estate’s most recent interest rate sensitivity schedule, a 100-basis-point increase in interest rates would result in a $0.20 per share increase in distributable earnings.

Interest Rate Sensitivity (Ares Commercial Real Estate Corp)

Base Dividend And Supplemental Dividends Remained Covered By Distributable Earnings in 3Q-22

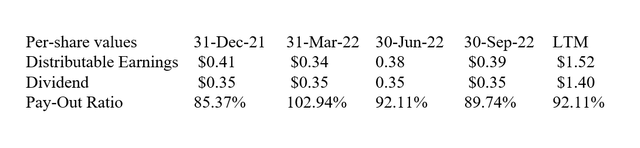

In the third quarter, Ares Commercial Real Estate covered its dividend with distributable earnings. The trust earned $0.39 per share from its loan portfolio and paid out $0.33 in regular dividends and $0.02 in supplemental dividends to shareholders, for a total payout ratio of 90%.

Ares Commercial Real Estate’s payout ratio was 92% over the last year, indicating that the trust’s dividend has been consistently covered by earnings. ACRE’s payout ratio includes the trust’s $0.02 per share supplemental dividend, which has been paid consistently over the last four quarters.

Dividend And Distributable Earnings (Author Created Table Using Trust Information)

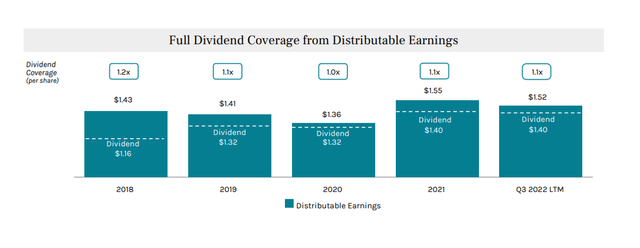

Ares Commercial Real Estate has covered its dividend with distributable earnings over a longer period of time. Since 2018, the trust’s dividend has consistently outperformed its dividend payout by a wide margin, with ACRE’s dividend coverage ratios ranging from 1.0x to 1.2x.

Dividend Coverage From Distributable Earnings (Ares Commercial Real Estate Corp)

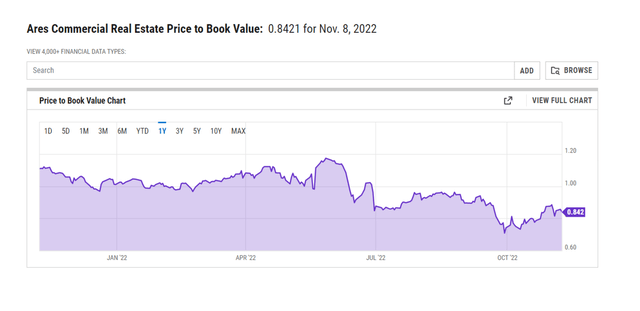

Get An 11% Yield For A 16% Discount To Book Value

Ares Commercial Real Estate’s dividend has a high margin of safety, owing to its availability at a discount to book value. The trust’s book value at the end of September was $14.09, representing a 16% discount.

Given that Ares Commercial Real Estate’s investment portfolio is largely comprised of high-quality Senior Loans with very low loss ratios, I believe investors are making a big mistake by pricing the trust’s stock at such a high discount.

Why ACRE Might See A Lower/Higher Valuation

Mortgage originations will continue to be critical to the trust’s performance in terms of distributable earnings in the future, and there are currently no signs of distress in the commercial real estate market.

Having said that, a major recession in the United States real estate market could alter the investment landscape and result in lower distributable earnings and dividend coverage.

Investors can mitigate this risk by investing a small portion of their funds (say, no more than 5% of their portfolios) in stocks such as ACRE.

My Conclusion

Ares Commercial Real Estate is a well-managed real estate investment trust whose stock trades at a 16% discount to book value and easily covered its dividend with distributable earnings in the third quarter.

The trust prioritizes safety by relying on a heavily secured, Senior Loan-based investment portfolio, and it has significant portfolio income upside because the majority of its loans (98%) are floating rate.

I believe Ares Commercial Real Estate Corporation is worth a higher valuation multiple, and the 11% dividend yield should be relatively safe in the future.

Be the first to comment