phototechno

A recession has arrived, making it more important than ever for dividend investors to invest in business development companies that have a long track record of successfully managing investors’ money.

Ares Capital (NASDAQ:ARCC) is a highly regarded business development firm with a long history of achieving high returns on equity. The BDC also has a conservative asset allocation and strong net investment income, which allows it to cover its growing dividend payout. Even when trading at a premium to net asset value, ARCC is a buy.

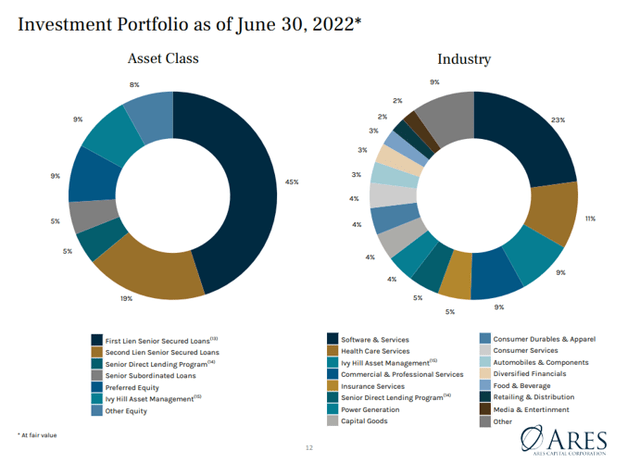

Unchanged Portfolio Structure

Ares Capital’s investment portfolio did not change much in 2Q-22: the business development firm had an uneventful quarter in terms of portfolio composition, with only minor changes in the investment structure.

As of June 30, 2022, first lien senior secured loans accounted for 45% of Ares Capital’s portfolio, while second lien senior secured loans accounted for 19% of loan investments.

Second Liens’ weighting decreased by 2 percentage points from the previous quarter, while the BDC’s investment allocation to investment manager Ivy Hill Asset Management increased by 2 percentage points. As of June 30, 2022, the total value of Ares Capital’s investments was $21.7 billion.

Investment Portfolio (Ares Capital Corp)

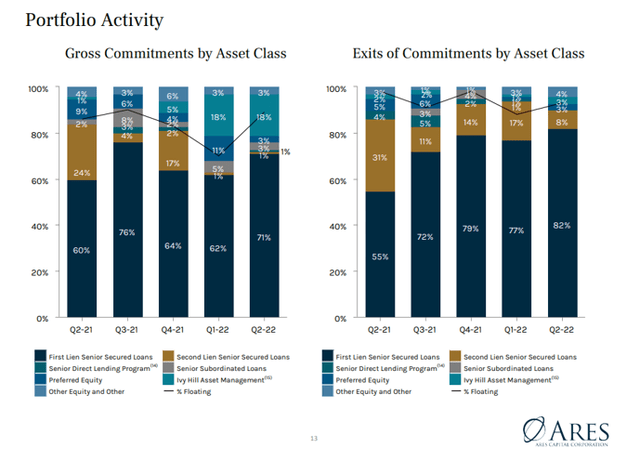

Ares Capital’s new investments made during the second quarter are more interesting than the company’s little changed portfolio structure. Ares Capital made new commitments primarily to First Lien Senior Secured Notes, with this category accounting for 71% of new investments.

Following Ivy Hill Asset Management, Ares Capital has equity and subordinated loan investments. Ares Capital’s largest investment, accounting for 8.5% of investments, is Ivy Hill Asset Management, which received 18% of new commitments.

Because of its size and equity nature, the investment has the potential to generate excess returns for Ares Capital. Ares Capital’s other investments, primarily Senior Loans, received the remaining 11% of new commitments.

Portfolio Activity (Ares Capital Corp)

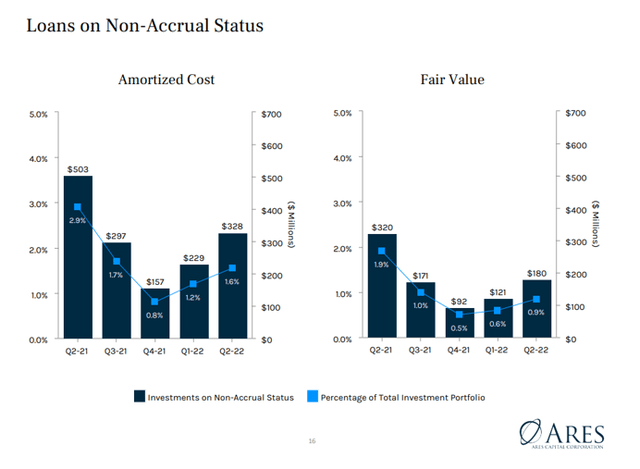

Asset Quality Remained High

In 2Q-22, Ares Capital’s balance sheet quality remained strong. In 2Q-22, the BDC’s total non-accrual ratio based on fair value was 0.9%, a 0.3% increase QoQ. The non-accrual ratio calculates the total dollar value of loans, in this case $180 million, that are at risk because they were made to stressed borrowers. Ares Capital has a stellar underwriting track record and has historically had first lien loss rates of less than 0.1%.

I consider a non-accrual ratio of less than 1.0% to be pretty solid, and despite a slight increase in non-accruals in 2Q-22, Ares Capital’s ratio remained below this threshold.

Loans On Non-Accrual Status (Ares Capital Corp)

LTM Pay-Out Ratio Now 90%

Ares Capital had a strong 2Q-22, with the portfolio continuing to perform well, as evidenced by the company’s net investment income. Second-quarter NII increased by 50% YoY to $257 million, owing to a broad recovery in asset values and improved economic prospects following Covid-19.

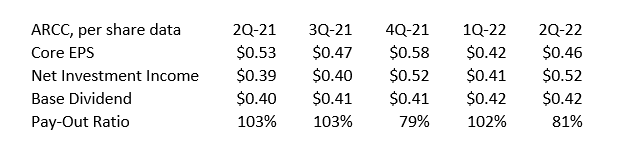

Ares Capital earned $0.52 in net investment income per share, for a 2Q-22 pay-out ratio of 81%. Ares Capital paid out only 90% of its net investment income over the last twelve months, so the dividend was easily covered.

Pay-Out Ratio (Author Created Table Using BDC Information)

Management recently increased the dividend by $0.01 per share, or 2.4%, bringing the regular dividend to $0.43 per share. Ares Capital previously declared a $0.03 per share special dividend, which will be paid in addition to the regular base dividend on September 30, 2022.

To receive the dividend, investors must purchase before the ex-date, which is September 14, 2022. ARCC stock currently pays an 8.9% yield based solely on the regular dividend and assuming that the dividend will be maintained at $0.43 per share. When two special dividends of $0.03 per share are added in September and December, the yield rises to 9.2%.

Slight Premium To Net Asset Value

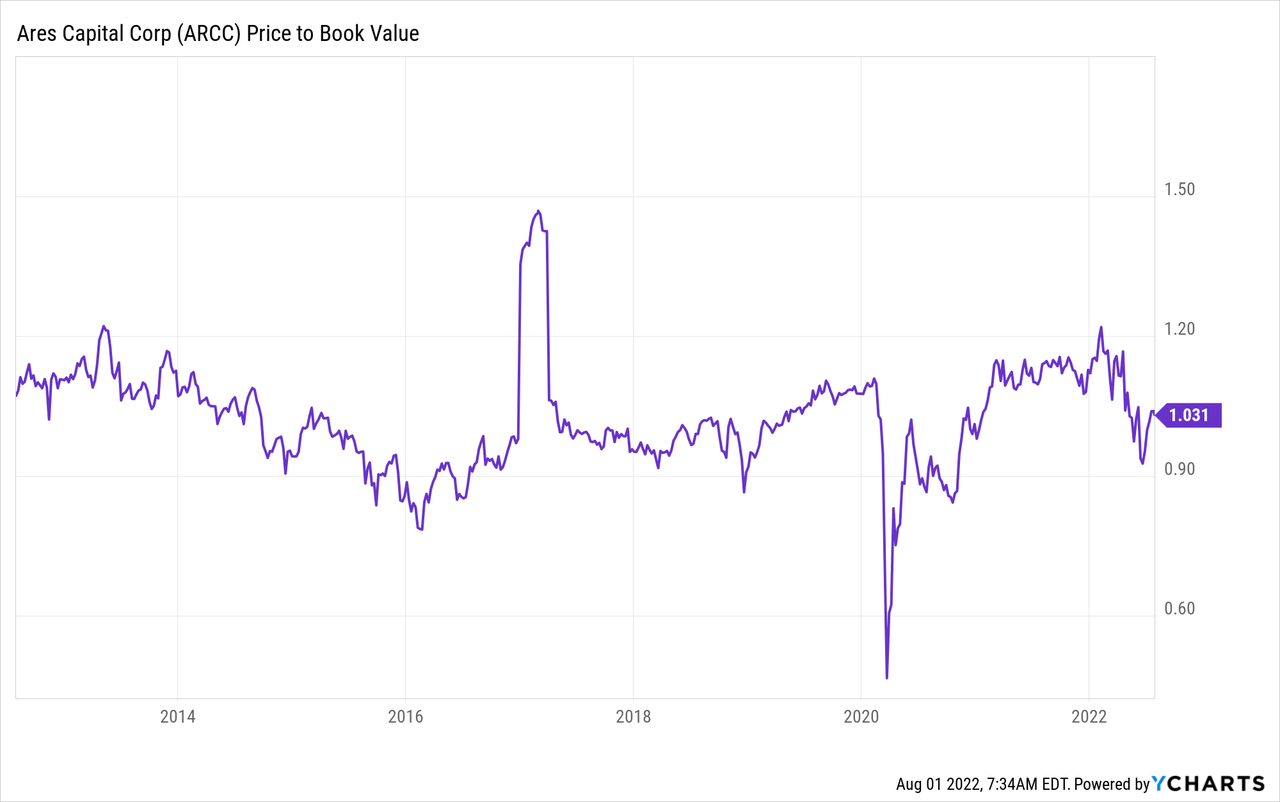

Ares Capital appears to be fairly valued to me, as the stock trades near net asset value. Ares Capital’s net asset value per share at the end of the second quarter was $18.81. The BDC’s net asset value fell $0.22 per share, or 1.2%, due to net unrealized losses in the portfolio.

Ares Capital has a P/NAV-ratio of 1.03x, reflecting a 3% premium, based on a new net asset value of $18.81. Ares Capital has historically traded at higher P/NAV ratios and higher NAV premiums, but I believe paying around book value for the BDC is reasonable given the company’s track record of successfully managing investor capital.

Why Ares Capital Could See A Lower Stock Price And Valuation

As long as Ares Capital’s non-accrual ratio remains as low as it is now, there is no significant credit quality issue in the BDC’s loan portfolio to worry about.

This also means that the company’s net asset value and ability to cover dividend payments with net investment income are not at risk. However, the game changes if more borrowers experience stress and loan losses rise.

I’m buying the BDC for the dividend because Ares Capital has a long track record of selecting strong credit quality (low loan losses).

My Conclusion

Ares Capital had a strong second quarter: The portfolio has continued to perform well, there are no major portfolio issues, and the conservative asset allocation suggests that ARCC can weather a recession.

On an LTM basis, the pay-out ratio is only 90% due to the strong YoY rebound in net investment income. In addition, management increased the dividend by 2.4% and covered it with net investment income.

Since management has a high level of confidence in its portfolio potential, or it would not have increased the dividend, you can as well.

Be the first to comment