Galeanu Mihai/iStock via Getty Images

Ares Capital (ARCC) is one of the leading blue-chip BDCs. It boasts a long track record of sustaining or raising its dividend, prudently allocating shareholder capital that has enabled it to consistently compound net asset value per share, and ultimately generating market-beating performance. In fact, management announced during their latest earnings call that:

Through the quarter ended September 30, 2021, which is the latest full reporting quarter for BDCs, Ares Capital has delivered the highest regular base dividend per share growth rate and the highest NAV per share growth rate over the past 5 and 10-year time periods, among any externally managed BDC with a market cap of over $700 million.

If there has been any negative point on ARCC, it has been that the company has lagged some of its peers in terms of quarterly dividend growth in the past few years. However, the company nixed that criticism when it resumed dividend growth last year in H2 and has kept it going early in 2022 with a 9% year-over-year/3.9% sequential hike in Q1. However, we do not think that ARCC is done quite yet with dividend growth. In this article, we give 3 reasons why we think dividend growth is set to continue moving forward.

#1. Strong Dividend Coverage

Perhaps the most challenging and most important reason for a BDC to be poised to hike its dividend is dividend coverage. The reason we say this is the most challenging reason is because BDCs are required to distribute 90% of taxable income to keep their BDC status, so it is difficult to achieve strong dividend coverage for very long.

However, ARCC has managed to achieve just that. This past quarter, ARCC paid out $0.4044 per share in dividends, but managed to cover that very easily (1.43x) with $0.58 per share in adjusted earnings.

This year, analysts expect the company to generate $1.89 in normalized earnings per share, while the current annualized dividend rate is just $1.68. That translates to an 88.9% payout ratio which, while not low, still leaves substantial flexibility for further dividends. Management has addressed this expected shortfall by announcing additional dividends totaling $0.12 per share for 2022, to be distributed in four consecutive quarterly payments of $0.03 per share per quarter.

Most importantly, ARCC’s dividend coverage is also enhanced by its large amount of spillover income. On the earnings call, management stated:

Given our strong earnings for the year, we once again outearned the dividends we paid, resulting in an increase in our undistributed taxable income, sometimes referred to as our spillover. We currently estimate that our spillover income from 2021 after considering the shares issued in our January equity raise, reached $1.30 per share, an increase of $0.24 per share from 2020’s level.

The expansion of our spillover was an important consideration in our decision to pay additional quarterly dividends totaling $0.12 per share during 2022. The first additional dividend of $0.03 per share is also payable on March 31, 2022, to stockholders of record on March 15, 2022. We will continue to monitor our undistributed earnings and balance sheet levels against prudent capital management considerations. Overall, we believe having a strong and meaningful undistributed spillover supports our goal of maintaining a steady dividend through varying market conditions and sets us apart from many other BDCs without our level of spillover.

Between the solid coverage of the quarterly dividend and the ongoing large spillover income level, it is highly likely that ARCC will continue to raise its quarterly dividend in the years to come.

#2. Strong Investment Grade Balance Sheet

ARCC has a healthy investment grade balance sheet, earning a BBB- credit rating from S&P and an equivalent Baa3 from Moody’s, while Fitch gives it a BBB rating. As a result, the company is able to access plenty of inexpensive debt on very favorable terms (weighted average interest rate of 2.013% and the weighted average unsecured debt interest rate of 3.429%).

With most of its debt maturing in 2025 or later, ARCC’s liquidity and financial positioning looks very solid. When combined with its robust investment pipeline and common stock price that currently trades at a healthy premium to NAV, ARCC should be able to continue generating very accretive growth for shareholders, further increasing the earnings per share that will translate directly to dividend per share growth.

#3. Healthy & Well-Diversified Portfolio

Last, but not least, we are confident in ARCC’s ability to keep raising its dividend over time because it has a very well diversified portfolio that is also performing well.

Only 0.5% of its portfolio at fair value (0.8% at amortized cost) is on non-accrual status . This is down substantially from 1.0% and 1.7% respectively in the previous quarter and down from 2.0% and 3.3% year-over-year.

Meanwhile, the investment portfolio is diversified across 387 different borrowers with an average hold size of only 0.3% at fair value. Outside of investments in highly diversified funds, no single investment accounts for more than 1.5% of ARCC’s portfolio at fair value, and its top 10 largest investments totaled just 10.9% of the portfolio at fair value as of the end of Q4. Furthermore, the loan to value in the debt portfolio is pretty conservative at ~45%.

Given the health and diversification of the portfolio, we believe that ARCC is well positioned to weather market turmoil without taking on huge permanent losses to NAV per share.

Investor Takeaway

Dividend growth is considered by many to be the holy grail of investing. In fact, investing in securities that pay dividends – especially growing dividends – has been proven over time to be a superior strategy to investing in non-dividend paying securities.

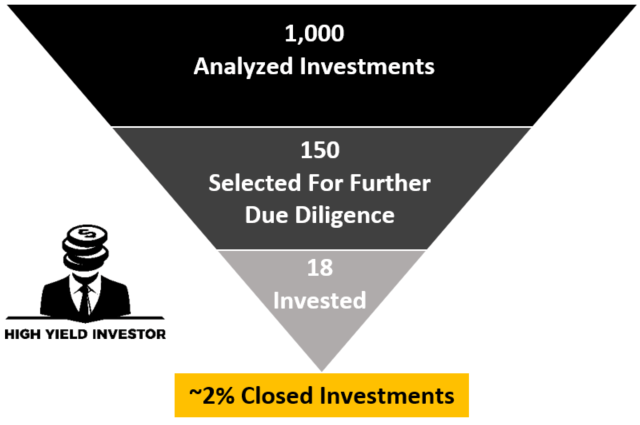

HYI Investing Process (HYI)

At High Yield Investor, we target an attractive combination of quality, dividend growth, and a high current yield, so that the compounding effect is optimized. One of the top stocks to fit this profile is Ares Capital Corp.

This is what enables us to generate outsized weighted average income yields (5%-6%) relative to the broader market while still generating substantial outperformance:

| HYI Core Portfolio | 54.8% |

| S&P 500 (SPY) | 21.7% |

We believe that holding ARCC in our Retirement Portfolio enables us to sleep well at night while also reaping the rewards of a far current yield (8%+) that is also highly likely to continue growing for years to come for the three reasons stated in this article.

Be the first to comment